Crypto Rebounds As El Salvador Passes Bill To Make Bitcoin Legal Tender

After a tempestuous day where once again the death of crypto was heralded by many, this morning has seen buyers return amid an upsized MSTR bond deal (amid very heavy demand) and El Salvador passing a bill (which we previewed here) to become the first nation to make bitcoin legal tender.

The president of El Salvador’s bill to make Bitcoin legal tender in El Salvador passed congress with a supermajority just before 6 am UTC.

As CoinTelegraph’s Brian Quarmby reports, in a Twitter Spaces conversation that began just after 5 am UTC with 22,000 listeners, President Nayib Bukele said he would sign off on the historic law later tonight or first thing tomorrow.

“It goes into effect immediately,” he said, clarifying the government would allow 90 days for the infrastructure to be put into place.

The #BitcoinLaw has been approved by a supermajority in the Salvadoran Congress.

62 out of 84 votes!

History! #Btc🇸🇻

— Nayib Bukele 🇸🇻 (@nayibbukele) June 9, 2021

He said that accepting Bitcoin would be mandatory for all businesses.

“They have to take it by law,” he said of merchants in the country.

“If you go to Mexico they have to take your pesos.”

“In the case of El Salvador Bitcoin is going to be legal tender just as the US Dollar.”

He revealed that he will be meeting with the International Monetary Fund on Thursday.

The government will also be releasing an official Bitcoin wallet (however, this will not be mandatory).

The government intends to hold $150 million equivalent of Bitcoin in a trust fund in its development bank to assume the risks of merchants.

Permanent residency will be available for those who invest 3 BTC in El Salvador.

And having bounced off $31,000, Bitcoin is now back above $35,000 – having erased all of yesterday’s losses…

Source: Bloomberg

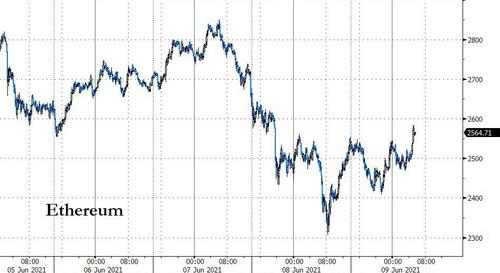

Ethereum is rallying but notably less than bitcoin…

Source: Bloomberg

The other positive catalyst was a significantly upsized MSTR bond deal ($500 million) which will be used to acquire more bitcoin…

MicroStrategy announces pricing of $500 Million of 6.125% Senior Secured Notes due 2028 to acquire additional #bitcoin. $MSTRhttps://t.co/qEhHtJS69Q

— Michael Saylor (@michael_saylor) June 8, 2021

Most importantly, and perhaps reflecting on the institutional interest in ‘buying the dip’, is the fact that MSTR saw $1.6 billion in offers for the deal.

Finally, we note that amid all the talk of regulatory crackdowns, the SEC’s Hester Pierce has once again urged regulators to take a step back from attempting to overregulate the crypto space.

Speaking to Financial Times, Peirce, affectionately dubbed “Crypto Mom” due to her positive stance on cryptocurrencies, argued against the need for strict regulatory policies.

According to Peirce, regulators by nature often have a knee-jerk reaction to emerging market spaces, often at the expense of innovation.

The SEC commissioner warned that pursuing stricter regulatory policies eliminates the ability of market participants to carry out peer-to-peer transactions. Rather than emphasizing government regulations, Peirce advocates for industry-led regulatory activities.

Tyler Durden

Wed, 06/09/2021 – 08:55

via ZeroHedge News https://ift.tt/2TdUiQm Tyler Durden