Taper To Be Discussed But Quickly Dismissed; No 2023 Hike Dots Will Be Seen As Dovish

By Steve Englander, head G10FX research and NA Macro Strategy at Standard Chartered

FOMC Preview – Taper to be discussed but quickly dismissed

Key highlights:

-

Tapering very likely to be discussed and dismissed, unlikely to be mentioned in the statement

-

UST market unlikely to see major moves; ongoing absence of 2023 hike in dots may be read as dovish

-

Soft recent data discourages a hawkish signal until the FOMC has more clarity on growth and inflation

Talk is cheap

The 16 June FOMC is unusual in that there are potentially several market drivers in both directions but no dominant one:

-

Tapering of asset purchases will likely be discussed, given the number of FOMC participants who have raised the issue, but we expect Chair Powell to stress that all (or almost all) participants see tapering action as very premature.

-

It is a close call on a 2023 hike in the June projections; on balance we think the FOMC will wait until 2024 projections are introduced in September and put the first hikes in 2024.

-

The 2021 forecast of core inflation is likely to rise, but we expect 2023 core inflation unchanged at 2.1%. The end-2021 unemployment rate projection rising from its current 4.5% would be a dovish signal.

-

We do not see rates on reverse repos (RRP) or overnight reserves (IOER) being raised at this meeting but they could well be raised in the coming months.

-

The inflation update in the statement could edit the May comment to implicitly acknowledge higher inflation but not as a policy factor:

“With inflation running persistently below this longer-run goal,The Committee will aim to achieve inflation moderately above 2 percent for some time”. -

Fed Chair Powell will likely push back against the view that the rebound has come off the rails but not spook the market by completely ignoring data softness.

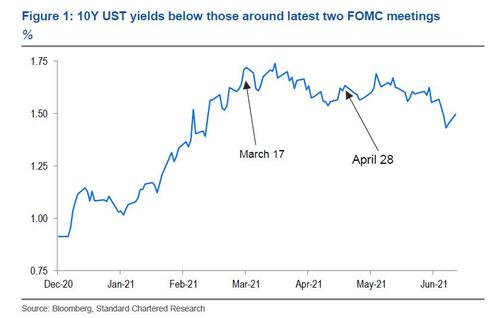

We anticipate the FOMC giving itself a few more months to assess incoming data on both inflation and growth, recognizing the potential embarrassment of another episode of premature hawkishness. FOMC comments will be in the context of sluggish economic data (including a risk of soft May retail sales data, due 15 June) and much less aggressive market pricing (Figure 1).

We see a small chance that the FOMC will indicate that it is advancing its normalization schedule, but at current yield levels such a shift would likely have a big bond market impact. The FOMC is much more likely to advocate and practise patience in assessing the underlying trends in activity and inflation, which points to very moderate signals. Yields have some downside if the FOMC sees the recovery as being more sluggish than earlier expected, but such overt pessimism would surprise us.

We, and we suspect the FOMC, expect the activity data to firm in the coming months, and the center of the FOMC may even be worrying more about inflation; but incoming data makes it risky to be overtly hawkish.

We don’t see a spike in yields unless the tapering discussion is accompanied by added inflation concerns in the out years. Many have discussed labor-market tightness, but real wages have not moved much this year, with inflation offsetting a big chunk of nominal gains. And inflation expectations in surveys such as the New York Fed’s still show increases in the coming years. So far the upward inflation move is heavily concentrated in a few small sectors. We expect the FOMC to argue that the evidence supports a transient rather than permanent inflation pick-up, but perhaps with slightly less conviction than before.

Given the decline in breakevens recently, particularly in the 2Y-3Y sector of the curve, the market may be caught off-guard if the 2023 core PCE projection rises from March’s 2.1% forecast. Markets could see such a rise as inconsistent with the Fed’s view that the inflation pick-up is transient. A 2.2% core inflation projection for 2023 could be seen as close enough to the upper end of “somewhat higher” to justify beginning policy rate normalization. We think that nine (including Powell) will push for unchanged signals, and expect a few swing participants to go with the Chair. While projections are not discussed or debated at FOMC meetings, we suspect that participants develop an understanding of which projections are potentially sensitive and reflect carefully on those projections.

Yields could also rise if Fed Chair Powell looks through recent data, conveying a message that the Fed is convinced that the current soft data patch is temporary. But given FOMC emphasis on making policy based on current data, he is likely to argue that they expect robust growth but need to see how growth plays out.

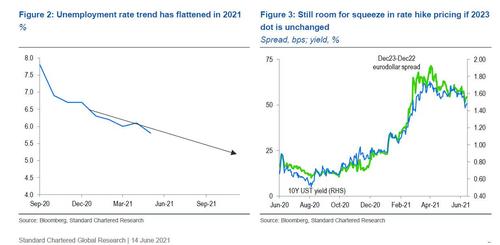

The biggest dovish risk that we see is if the unemployment rate projections rise. The unemployment trend since January does not jive with the current 4.5% median projection (Figure 2). If that rises, and especially if the increase is not made up in later years, investors may contemplate an even slower anticipated future tapering path. Powell has been at pains to stress that projections are not policy signals, but more elevated unemployment projections would be indicative of added caution on growth prospects. While Fed rate hike pricing has retreated somewhat since the March and April FOMC meetings, the market still prices in about 2½ hikes by end-2023, so there is room for further paring if the projections suggest slower normalisation (Figure 3).

There are enough FOMC participants arguing that is time to begin the tapering discussion that it would be a surprise if there were none. Too many Fed speakers have mentioned tapering for it not to be discussed; it would look as if they were avoiding mention of the elephant in the room. However, we expect the possibility of near-term tapering to be dismissed quickly without mention in the statement. Given the run of data, it is more credible for Fed Chair Powell to say that there was broad agreement that sufficient progress had not yet been made and concrete discussion was premature.

We think the bond market will react negatively initially to the mention of a tapering discussion, especially given that 10Y UST yields are well below levels prevailing immediately before and after the March and April FOMCs. The dominant market view looks to be that any mention of a tapering discussion is the first step towards normalization. We don’t think this reaction will persist and expect the dismissal of an imminent move to reassure investors. The scenario would be different if payroll gains had averaged 900,000 the past two months rather than 418,000.

Tyler Durden

Tue, 06/15/2021 – 21:25

via ZeroHedge News https://ift.tt/3xup9XT Tyler Durden