S&P futures traded in a narrow 8 point range near all-time highs as a lack of clear catalysts kept trading slow, with investors awaiting fresh cues from inflation data this week and an upcoming Federal Reserve meeting. 10Y TSY yields dropped below 1.50% for the first time since May 7 amid a plunge in odds that Biden’s reflationary infrastructure program will pass, and easing fears that tomorrow’s CPI print will smook markets. At 07:15 a.m. ET, S&P 500 E-minis were up 3.25 points, or 0.08%, Dow E-minis were down 37 points, or 0.1%, while Nasdaq 100 E-minis were up 40 points, or 0.29%. The dollar dropped against all of its G10 peers.

On Tuesday, U.S. stocks closed within a hair’s breadth of a record high and Treasuries rose as investors debated the impact of resurgent inflation on monetary policy. “Investors are likely to be in a wait-and-see mode,” said Mitsushige Akino, a senior executive officer at Ichiyoshi Asset Management. “People will want to check how market expectations over the Fed’s policies change and how yields, whose upside has been capped recently, move following the U.S. CPI data.”

Despite broadly muted overnight trading, meme stocks ContextLogic and Clover Health had double-digit gains in premarket trading, extending a huge jump on Tuesday after a discussion of a potential short squeeze. Chamath’s Clover Health has emerged as the new social media favorite, surging 17% in premarket trade after jumping 85% to a record high on Tuesday. Meanwhile, the original meme stonk, GameStop, rose 2.4% ahead of its quarterly results, due after the bell while AMC dropped 5%. Here are some of the biggest U.S. movers today:

- Cryptocurrency-exposed companies like Marathon Digital (MARA) and Riot Blockchain (RIOT) rise as Bitcoin recovers ground following recent pressure on the token.

- Ondas Holdings (ONDS) declines 15% in premarket trading after the company announced on Tuesday an offering of 6.4m shares at $7 each.

- The latest additions to the meme-stock frenzy like Clover Health, ContextLogic Inc. and Wendy’s rally in premarket trading as retail traders latched on to their latest favorites.

- UiPath (PATH) shares fall 6.4% in premarket trading despite reporting 1Q results that beat estimates, with its 2Q revenue forecast also exceeding expectations. Growth expectations had already been priced in, according to analysts.

Overnight, China spooked some markets after it reported a higher than expected PPI print which at 9.0% was the highest since the month Lehman collapsed. The surge in producer prices which China’s companies have failed to pass on, forced Beijing to roll out price controls which are sure to make the global shortage and supply-chain squeeze even worse.

Investor focus remains locked on Thursday’s release of U.S. consumer price data and a European Central Bank meeting for further clues about how soon policymakers may begin to withdraw support for Europe’s economy rolled out following the COVID-19 crisis. The Fed’s meeting next week is also expected to shed more light on the bank’s policy tapering plans. While inflation has surged in recent months, a sluggish labor market is broadly expected to keep the bank dovish.

Meanwhile, Tuesday’s JOLTs report suggested that American companies are struggling to find enough workers, according to Michael Hewson, chief market analyst at CMC Markets in London. “Employers may well have to hike salaries quite substantially,” he said. “This in turn could have significant consequences for inflation expectations, which are already elevated, especially if U.S. CPI comes in anywhere near 5%.”

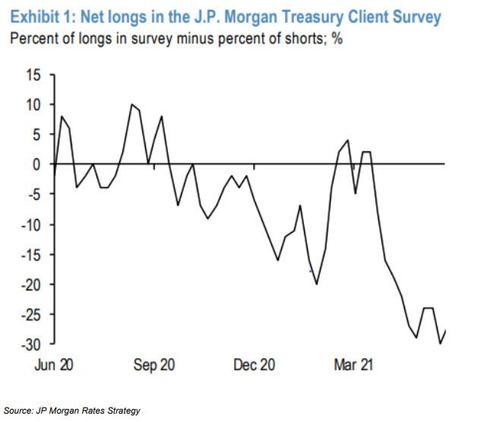

“As the recovery in the job market is contained, any discussion at the Fed on tapering is unlikely to gain momentum, even if it starts soon,” said Naokazu Koshimizu, senior rates strategist at Nomura Securities. “So those who had bet on steepening of the yield curve are unwinding their positions while some investors are also now buying to earn carry.”

MSCI’s all-country world index last stood at 716.42, after hitting an intraday high of 718.19 on Tuesday, led by gains in Europe.

In Europe, the Stoxx 600 Index retreated 0.1%, the Eurostoxx 50 slipped as much as 0.3%, as FTSE 100 and FTSE MIB underperformed peers. Declines among basic resources companies, insurers and banks outweighed gains for travel and leisure, health care and real-estate industries. Norwegian salmon producer Salmar slipped from an all-time high, falling 8.6% after its private placement of shares was priced below the market level. Here are some of the biggest European movers today:

- European airlines gain after the U.S. eased its travel warnings for dozens of countries, including France and Germany. Duty-free retailer Dufry gained as much as 6.7% as part of the rally in travel-exposed stocks.

- Smith & Nephew shares rise as much as 4.6% after Credit Suisse upgraded the medical-equipment company to outperform, saying the market is not appreciating its attractions as a short-term play on elective surgery volumes recovering.

- Clinigen shares plunge as much as 26% after the pharmaceutical services firm issued new guidance that RBC said was below consensus, driven by Covid-related weakness in oncology procedures.

- Heidelberger Druckmaschinen shares slump as much as 16% after the machinery company’s new guidance, which Baader says looks cautious.

- AB Science shares slumped as much as 32% in Paris after the French drug developer’s shares resumed trading following its decision to halt trials of its key experimental drug.

- Voestalpine shares fall as much as 3.1% with analysts saying the company’s earnings momentum may lag its peers in the steel sector.

In Asia, the MSCI’s broadest index of Asia-Pacific shares outside Japan ticked down 0.3% and Japan’s Nikkei average shed 0.4%. Asian equities slipped for a second day, weighed down by losses in technology shares, as investors monitored inflation data for signals on potential central bank actions. TSMC and Sony were the biggest drags on the MSCI Asia Pacific Index. The regional benchmark slipped 0.4%, on track for its largest decline in three weeks. Financial stocks also contributed to the loss, as U.S. Treasury yields declined. Chinese stocks edged higher after the nation’s producer prices rose more than expected, but consumer prices increased less than expected in May. Global investors anxiously awaited Thursday’s U.S. consumer-price data for clues on how long the Federal Reserve can postpone a tapering of stimulus.

The Asian stock market has been stuck in “range trade with the whole planet, seemingly treading water for the U.S. inflation data tomorrow night,” Oanda market analyst Jeffrey Halley wrote in a note. “Except for China, regional investors appear to be once again reducing exposure ahead of the inflation data.” Key equity gauges fell in South Korea, Taiwan, India and Japan. Most Southeast Asian markets rose, with the Philippine and Vietnamese benchmarks rising at least 1%.

Japanese stocks fell as investors also remained focused on Thursday’s report on U.S. consumer prices, which may affect perceptions of when the Federal Reserve is likely to start discussing tapering asset purchases. The Topix fell 0.3% to 1,957.14 in Tokyo. The move was the biggest since falling 1.3% on May 31 and follows the previous session’s increase of 0.1%. The Nikkei 225 closed at 28,860.80, down 0.4%. Sony Group contributed the most to the Topix’s decline, decreasing 2.2%. Airlines and restaurant companies gained after the U.S. State Department loosened its travel warnings for dozens of nations including Japan, spurring optimism that the pandemic is gradually being brought under control. ANA Holdings rose 3.4% and Japan Airlines advanced 3.1%, while Skylark Holdings added 5.2% and Royal Holdings climbed 4.3%. U.S. stock index futures were little changed during Asia trading.

Treasury gained, with the 10Y yield dropping below 1.50% for the first time since May 7 ahead of today’s 10Y auction. Treasuries were richer by nearly 3bp across long-end of the curve, flattening 2s10s, 5s30s by ~2bp and ~1bp on the day; 10-year yields around 1.495%, outperforming bunds and gilts by 1bp and 1.5bp Treasuries extended a bull-flattening move, helped by a long-end futures block buyer in early European session. Trend may ease with 10-year note and 30-year bond auctions over next two sessions, starting with $38b 10-year reopening at 1pm ET Wednesday.

Japanese bonds were led higher by longer maturities, with 10-year yields falling to the lowest level in six weeks. Australia’s bond yields fell for a third day as futures’ roll positioning dominated ahead of U.S. CPI data; European yields also fell, led by Italy. European bonds rally, supported by several block trades.

Germany’s 10-year Bund yield extended Tuesday’s drop to fall to -0.240%, the lowest since May 7 as euro area investors continued to price in a dovish outcome to the ECB policy meeting on Thursday. German curve bull steepens, Italy outperforms peers with 10y yield back to the lowest since April. Gilts and Treasuries bull flatten. With European bond markets calm, Greece followed Italy with a bond sale, opening books on Wednesday for a 10-year issue.

In FX, the greenback weakened against all of its nine G-10 peers while the Bloomberg Dollar Spot Index inched lower in muted trading; the J.P. Morgan Global FX Volatility Index extended its slide to the lowest since February last year. The pound rose as Bank of England Chief Economist Andy Haldane said the economy is going “gangbusters” and the central bank may need to start turning off the monetary policy tap; focus is turning to a meeting between the U.K. and European Union on the Northern Ireland protocol later on Wednesday. The yen traded in a narrow range against the dollar. The Chinese yuan, whose rally to a three-year high last week was propelled in part by speculation Beijing may want a stronger yuan to tame inflationary pressure, ticked up slightly to 6.3945 per dollar.

Deutsche Bank’s Currency Volatility Index hit its lowest level since February 2020 on Tuesday, and sank even further on Wednesday.

In commodities, oil prices held firm after U.S. Secretary of State Antony Blinken said that even if the United States were to reach a nuclear deal with Iran, hundreds of U.S. sanctions on Tehran would remain in place. U.S. crude futures closed above $70 per barrel for the first time since Oct 2018 on Tuesday and last stood at $70.40, up 0.5%. Brent futures rose 0.5% to $72.56, having earlier touched their highest since May 20, 2019. Bitcoin added 3%, trading above $34,500.

Looking ahead, Thursday’s U.S. consumer price data is expected to show the overall annual inflation rate rose to 4.7% and core inflation increased to 3.4%. While those readings will be well above the Fed’s inflation target of 2%, many economists expect the inflation rate to ease in coming months, allowing the Fed to wait before taking any tapering measures.

Yet some investors remain wary. “Nothing that we see in tomorrow’s report can prove or disprove any of the theories around the future path for inflation but I suspect that the market isn’t entirely believing of the Fed’s on-hold forever message,” said James Athey, investment director at Aberdeen Standard Investments. “I therefore see potential for a higher print to push real yields and shorter dated yields higher thus flattening the curve and boosting the dollar. This might not be a great environment for risky assets.”

To the day ahead now, and the highlights include a monetary policy decision from the Bank of Canada. Otherwise, data releases include the German trade balance for April, and the final reading of April’s wholesale inventories in the US.

Market Snapshot

- S&P 500 futures little changed at 4,227.00

- STOXX Europe 600 down 0.23% at 452.96

- MXAP down 0.4% to 209.13

- MXAPJ down 0.4% to 700.66

- Nikkei down 0.4% to 28,860.80

- Topix down 0.3% to 1,957.14

- Hang Seng Index down 0.1% to 28,742.63

- Shanghai Composite up 0.3% to 3,591.40

- Sensex down 0.4% to 52,062.35

- Australia S&P/ASX 200 down 0.3% to 7,270.20

- Kospi down 1.0% to 3,216.18

- Brent Futures up 0.25% to $72.40/bbl

- Gold spot down 0.24% to $1,888.29

- U.S. Dollar Index little changed at 90.02

- German 10Y yield fell 1.2 bps to -0.236%

- Euro up 0.1% to $1.2186

Top Overnight News from Bloomberg

- Global bond traders appear to be readying for a slow summer regardless of how this week’s key U.S. inflation data comes in, as markets show a willingness to look through short-term releases

- China’s efforts to control raw materials costs could include price limits on its runaway coal market, underscoring the government’s tough stance on taming inflation

- Surging costs of imported commodities drove China’s factory-gate inflation to its highest level since 2008, raising the odds that exporters will begin passing on higher prices and boost inflationary pressures in the global economy

- The European Parliament approved the introduction of mutually recognizable certificates that will allow quarantine- free travel within the blocSoon after Nomura Holdings Inc. got burned on the collapse of Archegos Capital Management, its executives vowed to revamp its prime brokerage. Insiders and hedge funds are starting to grasp what that means for those operations in the U.S. and Europe: There won’t be much left

- Russian Foreign Minister Sergei Lavrov said his country doesn’t have “excessive expectations or illusions” about a possible breakthrough at the upcoming summit between President Vladimir Putin and U.S. counterpart Joe Biden

- Hungary’s inflation rate stayed outside of the central bank’s tolerance range for a second month, reinforcing policy makers’ plan to be among the first in the bloc to tighten monetary policy this year

Quick look at global markets courtesy of Newsquawk

Asian equities traded mixed with price action confined to within relatively tight ranges as the tentative mood in global markets persisted heading closer to this week’s risk events, with sentiment also clouded by lingering China-related frictions and following a breakdown of US infrastructure talks. ASX 200 (-0.2%) lacked conviction with upside in mining names and tech offset by underperformance in consumer staples and financials. In addition, Consumer Confidence data in Australia continued to dwindle and the confirmation that Melbourne lockdown measures will be eased on Thursday evening did little to spur the index. Nikkei 225 (-0.3%) was subdued after meeting resistance just shy of the 29k level although downside was limited and participants continued to await the reopen of Eisai shares which remained untraded for a 2nd consecutive day amid heavy buy order, while the KOSPI (-0.2%) remained uninspired despite the upward revisions to South Korea’s final Q1 GDP data. Hang Seng (Unch.) and Shanghai Comp. (+0.4%) were indecisive after mixed Chinese inflation data in which CPI missed forecasts, but PPI continued to surge and registered the fastest pace of increase in factory gate prices since 2008. Risk appetite for the region was also hampered by ongoing frictions after the US Senate voted to pass the sweeping China competition bill and with the US to launch a “strike force” targeting trade abuses including from China, while the US Commerce Department was reportedly considering a Section 232 investigation on the national security impact of neodymium magnets which are largely imported from China. Finally, 10yr JGBs marginally extended on yesterday’s advances which were in tandem with the global bond rally, to test resistance at 151.50 and with upside helped by the BoJ’s presence in the market for more than JPY 1.4tln of JGBs heavily concentrated in 1yr-10yr maturities.

Top Asian News

- China Investigates Bad-Debt Industry Veteran for Corruption

- Huarong, Evergrande Bond Slump Tests Too-Big-to-Fail Belief

- Online Broker Webull Is Said to Consider $400 Million U.S. IPO

- Day Traders in Duel With Short-Sellers Over Korea Meme Stock

Another mixed and directionless session thus far in Europe (Euro Stoxx 50 -0.1%) as the tentative tone reverberated from APAC, with catalysts light and powder kept dry ahead of tomorrow’s ECB and US CPI. US equity futures are similarly contained around the flat mark. Sectors in Europe vary with no overarching theme nor bias. Basic Resources underperform amid jitters seen across base metals following the firm Chinese PPI print and subsequent jawboning from the Chinese government. The banking sector also lags and financials are dented by the slide in yields. Meanwhile, Travel & Leisure resides at the top of the pile as the EU parliament approves the COVID-19 Vaccine Passport legislation. Healthcare outperforms amid gains across some heavyweights including Roche (+1.3%), Novartis (+0.6%), and AstraZeneca (+0.9%), whilst Smith & Nephew (+3%) is supported by a positive broker move at Credit Suisse. In terms of individual movers, Aviva (-1.8%) is lower following reports that new investor Cevian Capital is pushing for a seat at the board alongside the return to shareholders GBP 5bln in excess capital it gained from selling eight non-core businesses. Stellantis (-0.8%) meanwhile is pressured as the Co’s Brazilian plant has reached a “production ceiling” below pre-pandemic levels due to the chip shortage – an issue experienced across the global Auto sector.

Top European News

- Ferrari Hires Little-Known Tech Leader Vigna to Be New CEO

- VW Battery Maker Northvolt Raises $2.75 Billion in Financing

- U.K., EU Hold Brexit Talks as Sausage Spat Spills Into G-7

- British Airways, Ryanair Face U.K. Probe Over Denied Refunds

In FX, the main movers of the morning and both on the back of hawkish rhetoric from their respective central banks. Cable gained impetus as outgoing Chief economist Haldane sang from his hawkish hymn sheet – suggesting the BoE could start tightening the tap on QE and could ultimately start to turn QE around. The remarks bolstered GBP/USD to a 1.4181 high (vs 1.4148 intraday base) with the pair now probing 1.4200 at the time of writing. However, it is worth bearing in mind that Haldane has recently been the hawkish outlier and is set to leave the MPC after the June 24th meeting. The focus is on whether any remaining MPC members come round to his viewpoint – which does not seem evident yet. Similarly, the Forint was spurred by central banker Virag noting it’s time to normalise policy and that ultraloose policy will end. EUR/HUF dipped below 347.50 from its 348.30 high.

- DXY – A combination of a slide in yields and persisting Sterling strength has pressured the Dollar index back below its 21 DMA (90.083) and under the 90.00 mark from its 90.139 best – with another empty State-side docket until the 10yr Note auction later today as the US 10yr cash yield threatened to breach 1.50% to the downside.

- EUR, NZD, AUD, CAD, JPY – All experiencing broad-based gains (ex-JPY) as a function of the Buck. EUR/USD now eyes 1.2200 to the upside (vs low 1.2172), but with upside hampered by EUR/GBP holding sub-0.86 and with a host of sizeable OpEx for today’s NY cut, including EUR 2.2bln between 1.2135-55, EUR 1bln at strike 1.2165 and EUR 1.8bln between 1.2200-15. NZD/USD meanders near the 0.7200 mark whilst AUD/USD trades on either side of 0.7750 – both within narrow intraday parameters. The Loonie meanwhile resides around session lows amid tailwinds from the Greenback and crude prices after WTI futures topped USD 70/bbl for the first time since 2018 – and heading into the BoC policy announcement, which is expected to be a holding meeting and statement-only affair with a small risk of some allusion to a taper signal (full preview available in the Newsquawk Research Suite). USD/JPY meanwhile remains in a holding pattern around the 109.50 marks and the middle of a 20-pip range awaiting fresh catalysts.

In commodities, WTI and Brent front month futures hold onto a bulk of their recent gains with the former around the USD 70.50/bbl mark (vs low 69.95/bbl) and the latter inching towards USD 73/bbl (vs low 72.12/bbl) at the time of writing. Fresh catalysts have remained light throughout the European morning but yesterday saw the release of a somewhat mixed Private Inventory data whilst the EIA STEO incrementally revised lower its 2021 and 2022 demand growth forecast ahead of the OPEC’s and IEA’s takes due on Thursday and Friday respectively. Meanwhile, JCPOA talks seem to be hitting a bump with Iran stating that oil sanctions are not resolved in discussions whilst WSJ’s Norman suggested that the next round of Iranian nuclear talks are unlikely to start before Saturday – six days before Iran’s presidential elections. It’s also worth keeping in mind that Libya’s Waha output has fallen to 130k BPD vs full capacity of 350k BPD due to a pipeline leak. In terms of commentary, ING acknowledges the recent narrowing of the WTI/Brent spread with the discount at its narrowest since November 2020 – “A further narrowing in the spread could see crude oil exports from the US come under pressure”, the Dutch bank suggests. Elsewhere, spot gold and silver have been drifting lower unorthodox price action against the dip in the Buck and yields. The yellow metal remains sub- USD 1,900/oz heading into tomorrow’s CPI, although volatility in the yellow metal cannot be discounted as US participants enter the fray and take stock of the environment. Turning to base metals, LME copper pared overnight gains after briefly reclaiming USD 10k/t as high factory gate prices in China raised concerns of price curbs by the government. Subsequently, China’s State Planner said China will step up monitoring of commodity prices and commodity market supervision. Dalian iron ore futures gained around 5% with some citing supply woes as inventories at Chinese ports slumped to the lowest since February.

US Event Calendar

- 7am: June MBA Mortgage Applications, prior -4.0%

- 10am: April Wholesale Trade Sales MoM, prior 4.6%

- 10am: April Wholesale Inventories MoM, est. 0.8%, prior 0.8%

Government

- President Joe Biden is headed to the U.K., where he will give a speech. He is set to meet with Prime Minister Boris Johnson on Thursday.

- The Senate Finance Committee is scheduled to vote on advancing nominees for the Treasury Department, including Nellie Liang for undersecretary for domestic finance and Lily Batchelder for assistant secretary for tax policy

DB’s Jim Reid concludes the overnight wrap

As the countdown clock ticks ever louder ahead of tomorrow’s blockbuster US CPI release, a further subsiding of inflation fears yesterday led to a major rally in sovereign bonds as global equities held steady around their all-time highs. By the close of trade, yields on 10yr US Treasuries had fallen -3.6bps to 1.533%, their lowest level in almost 3 months, with the move almost entirely driven by lower inflation breakevens (-3.0bps) rather than real rates (-0.5bps). Indeed, the 10yr breakeven closed at a 6-week low of 2.37% yesterday, so beneath where it was at the time of the last CPI release in April, in spite of the fact that report surprised strongly to the upside. It was much the same story in Europe too, with yields on 10yr bunds (-2.6bps), OATs (-3.1bps) and gilts (-3.6bps) moving lower.

Just ahead of tomorrow’s all important US CPI we have seen China’s May CPI and PPI overnight with the PPI printing as high as +9.0% yoy (vs. +8.5% yoy expected and +6.8% yoy last month) while the CPI came in below expectations at +1.3% yoy (vs. +1.6% yoy expected and +0.9% yoy last month). This suggests that so far there has been a limited pass through of increases in PPI to CPI but nonetheless the trajectory of PPI, which is now at the highest levels since September 2008, remains concerning. Also, before mid-2008 such high prints were seen only in the period before 1996. Dong Lijuan, an economist with the China’s statistics bureau, said in a statement that of the 9% year-on-year growth, base effects contributed 3 percentage points and new price hikes contributed 6 percentage points. So it’s hard to say it’s all transitory. As a consequence, China’s economic planning agency, the NDRC has issued a statement on price controls on its website. It said that Corn, wheat, edible oil, pork and vegetables are top items in China’s consumer price control list and added that China will also control commodities market and strengthen supervision. So there is obviously concern about these heavy pipeline price pressures.

We’ll have to wait and see what the state of play is after tomorrow’s release, but in contrast to China’s PPI, the continued easing of concerns over inflation helped global equities to remain around their record levels, with the S&P 500 posting only a marginal +0.02% increase, whilst the STOXX 600 rose +0.10% to a fresh record. The S&P 500 is now just over 5pts away from its record closing high after its smallest daily move in either direction in nearly 8 months and the 4th daily move of less than 0.1% in either direction in the last 7 sessions. The S&P has not moved 1% in either direction since May 20 – 13 sessions ago – which is the longest such period since a 69 session run from October 2019-January 2020.

Small-cap stocks outperformed, with the Russell 2000 up +1.06%. Earlier in the session, we had wondered if the outage of a number of important websites would be the catalyst to send stocks lower, but after a brief reaction from equity futures to the downside (S&P futures were down -0.5% from overnight highs), they swiftly bounced back again as the outage was fixed.

In terms of the details on that, the affected sites included multiple media outlets such as the FT and the New York Times, as well as the UK government’s website, Reddit and Amazon Web Services. The websites in question were offline for around an hour, and the issue was caused by Fastly, who are a content-delivery network based in Silicon Valley, who said that a configuration error was to blame. In a move that might surprise some, their share price was actually up +10.85% yesterday, but the broader implication of the outage is that questions will be raised as to how vulnerable a lot of our key infrastructure is. And this actually came on the same day that Punchbowl News reported that a ransomware attack had hit a tech vendor called iConstituent, which provides constituent outreach services to nearly 60 House offices on Capitol Hill. So a tail risk that we could well hear more about moving forward.

Asian markets are mostly trading lower outside of China’s bourses – the Shanghai Comp (+0.20%), CSI (+0.21%) and Shenzhen Comp (+0.38%) – which are up. The Nikkei (-0.32%), Hang Seng (-0.07%) and Kospi (-0.40%) are all down. Futures on the S&P and the Stoxx 50 are trading broadly flat. Meanwhile, commodity prices are trading firm with DCE iron ore futures up +5.31% and SHF rebar steel futures up +2.56%. Crude oil prices are also up c.+0.60% this morning. In other overnight news, the US Senate voted 68-32 in favour of a legislation to invest almost $250bn in bolstering US manufacturing and technology to meet the economic and strategic challenge from China.

Elsewhere, yesterday saw another slump in Bitcoin (-2.40% overnight), which fell over 10% yesterday to $31,036 at one point before bouncing back to recover half its losses to finish just above $33,600. That was the lowest closing level since January and is now around half of its all-time intraday high seen back in April of $64,870. The moves came as the IRS chief asked Congress for the authority to regulate crypto, with other assets including Litecoin (-4.22%) and Ethereum (-4.51%) both seeing similar price action. Meanwhile Coinbase, which first became public back in April, fell -4.66% to end the day at its lowest close yet and down -35.48% from its peak.

In the UK, there are still some concerning signs on the pandemic ahead of the important decision next week on whether to fully relax restrictions in England, as more than 6,000 daily cases were reported for the second time in the last 5 days. Cases are now up +61% over the last week, albeit still at comparatively low levels relative to the winter months. Dr Fauci cited the rapid rise of cases in the heavily-inoculated UK, driven by the India/delta variant, as a reason for continued vigilance as vaccination rates in the US continues to slow. Also in the US, the State Department eased travel restrictions to many European countries including France and Germany – dropping them from level 4 (“do not travel”) to 3 (“reconsider”). Meanwhile in Singapore, Covid-19 sequencing has shown that the delta variant first detected in India has become the major strain of the virus locally. And on the vaccines, the Pfizer study on children under 12 is moving from a Phase 1 study to the Phase 2/3 stage, which will see up to 4,500 children enrolled in multiple countries.

Yesterday’s data proved illuminating ahead of the inflation release tomorrow, as the number of job openings in the US rose to a record 9.286m in April, which just demonstrates the extent to which firms have struggled to hire recently. Furthermore, the quits rate rose to a record 2.7%, which shows the number of voluntary departures, so again a sign that worker bargaining power seems to be increasing and they’re feeling confident in their prospects. Staying on the inflation theme, the NFIB’s small business optimism index fell slightly to 99.6 (vs. 101.0 expected), but the proportion of firms reporting higher selling prices stood at 40%, which is the highest since April 1981.

Otherwise on the data front, the US trade deficit narrowed to $68.9bn in April (vs. $68.7bn expected). Meanwhile in Europe, German industrial production unexpectedly fell -1.0% in April (vs. +0.4% expected), and the German ZEW survey’s expectations measure fell to 79.8 (vs. 86.0 expected). Separately, we also saw the Q1 economic contraction in the Euro Area revised to show a smaller -0.3% decline (vs. -0.6% previously).

To the day ahead now, and the highlights include a monetary policy decision from the Bank of Canada. Otherwise, data releases include the German trade balance for April, and the final reading of April’s wholesale inventories in the US.