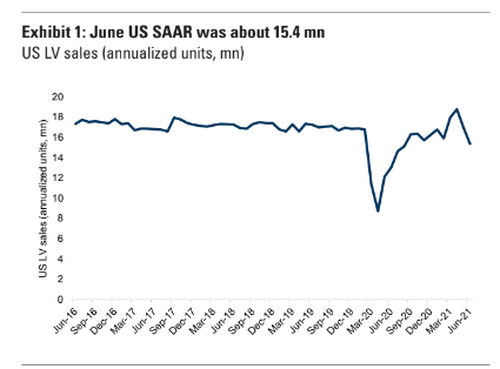

June Auto Sales Plunge To SAAR Of 15.4 Million Due To Falling Dealer Inventory

June’s US seasonally adjusted annualized rate for light vehicle sales collapsed sequentially from May to June, falling to 15.4 million as low inventory levels at dealers constrained sales.

Despite the sequential drop from May, where the SAAR was about 17 million, June’s number still marks a high teens percentage gain year-over-year, thanks to easy comps due to Covid.

Yes, June auto sales tumbled to a 15.4MM SAAR from 17MM

No, this is not due to lower demand (prices are soaring) but due to a collapse in dealer inventory

— zerohedge (@zerohedge) July 2, 2021

Goldman Sachs said in a note out this week that June’s SAAR was below their estimates of 15.5 million to 16 million. The number also fell below Bloomberg’s 16.5 million estimate and StreetAccount’s estimate of 16.1 million.

Vehicle sales were up 22% year over year in June, Goldman noted, while pickup and SUV sales were up about 16% and 15%, respectively. Analyst Mark Delaney told clients that “pickups and SUVs as a percent of total units remained at a similar mix from the year prior at 19% and 53%, respectively” and that Goldman believed “consumer demand for SUVs and pickups remains strong, and Ford and GM are prioritizing production of larger vehicles.”

EV sales in June were up about 148% year over year and hybrid sales were up about 56%.

Delaney attributed the growth in EV sales to “the increasing popularity of electric and hybrid powertrains, as well as a soft yoy compare as some states where EVs are more popular had stringent shelter-in-place restrictions in June 2020.”

Even as sales rose, incentive spending for vehicle was down 33% year over year and 11% sequentially, indicating that pricing could remain firm in coming months, leaving dealerships and automakers levers to pull to spur demand, if necessary.

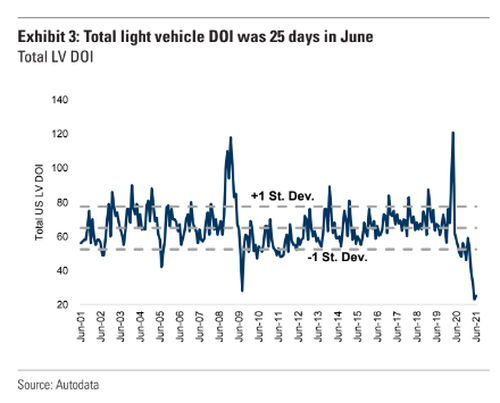

Most notably, inventory on a unit basis fell to 1.3 million in June from 1.4 million in May, Goldman noted. That number stood at 2.6 million in June 2020.

“Inventories remain at historically low levels, and we continue to believe it will take time for inventory at dealers to return to normalized levels given the strong demand for vehicles coupled with ongoing supply chain challenges (particularly with semiconductor chip shortages, but also due to shipping constraints),” Delaney concluded.

Tyler Durden

Fri, 07/02/2021 – 12:40

via ZeroHedge News https://ift.tt/368Q6Vj Tyler Durden