June Payrolls Preview: Hot But Not Too Hot

Labor market reading going into tomorrow’s Nonfarm Payrolls have been predominantly strong in June, but not all; as Newsquawk writes in its payrolls preview, ADP’s report was strong, but the whisper number was even higher. Challenger layoffs was an exceedingly solid print at the lowest figure since June 2000 with the report crediting record job openings and high job seeker confidence. Consumer Confidence continues to facilitate the potentially impressive NFP print, as it rose to the highest post-pandemic level, while the difference between jobs “plentiful” and jobs “hard to get” rose too. However, the jobless claims figure was poor and surprisingly rose, which may weigh, but the total number on unemployment benefits fell below 15mln for the first time since April ’20.

At the same time, business surveys, such as the ISM Manufacturing survey, painted a reasonably poorer picture with the headline figure falling alongside the employment sub-component dipping into contractionary territory, where panelists noted it remains difficult to fill vacant positions. Some of the former factors point to improving conditions and growing confidence amid the re-opening picture. However, slack still remains in the economy illustrated by the participation and unemployment rate still way off pre-COVID levels and record job openings.

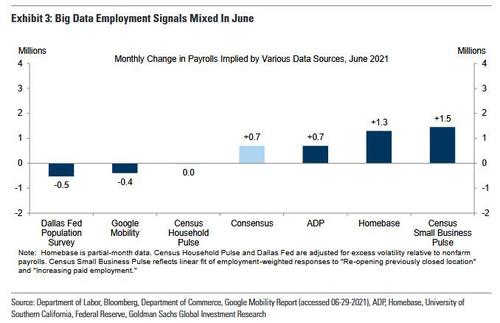

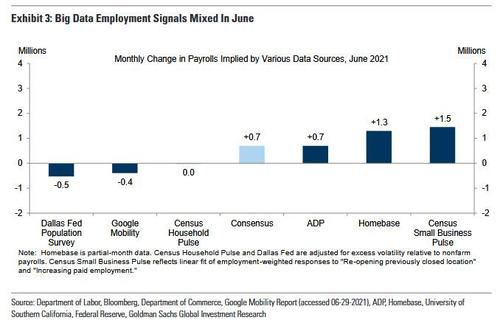

Looking at high-frequency data on the labor market shows a mixed picture for the May and June survey weeks. While two of the six measures tracked by Goldman declined outright (Dallas Fed survey, Google mobility), there were strong gains in the two datasets that explicitly track employee scheduling (Homebase, ADP). These two indicators may more effectively track inflections in reopening categories like restaurants, hotels, and other services.

On this, and while the Fed continues to state unemployment has a long way to go, it is not unanimous. For instance, Quarles does not think we need to see labor force participation return to pre-COVID levels due to baby boomer retirements, although several members have said they are looking to return to the pre-COVID employment landscape.

Therefore, as Newsquawk summarizes, a decent print is only likely to amplify the hawkish calls at the Fed amid progress on “substantial further progress”, sustaining expectations for a tapering announcement into year-end.

With that in mind this is what consensus expects from tomorrow’s payroll report:

- Non-farm Payrolls (exp. 7110k, prev. 559k);

- Private Payrolls (exp. 615k, prev. 492k);

- Manufacturing Payrolls (exp. 28k, prev. 23k);

- Government Payrolls (prev. 67k);

- Unemployment Rate (exp. 5.7%, prev. 5.8%);

- Participation Rate (prev. 61.6%);

- U6 Underemployment (prev. 10.2%);

- EPOP (prev. 58.0%, vs 61.1% in Feb 2020);

- Average Earnings M/M (exp. 0.4%, prev. 0.5%);

- Average Earnings Y/Y (exp. 3.7%, prev. 2.0%);

- Average Workweek Hours (exp. 34.9hrs, prev. 34.9hrs)

Guesses by bank, from high to low:

- Citi 860K

- BofA 800K

- Daiwa 800K

- JPM 800K

- Jefferies 800K

- NatWest 800K

- TD 800K

- GS 750K

- WF 750K

- SocGen 730K

- Nomura 720K

- UBS 711K

- CS 700K

- DB 700K

- Mizuho 700K

- Scotia 700K

- Amherst 690K

- HSBC 675K

- Barx 625K

- BNP 625K

- MS 620K

- RBC 570K

- BMO 550K

Some more details from Newsquawk

ADP PAYROLLS: Ahead of Friday’s jobs report, the ADP’s gauge of payrolls showed 692k jobs being added to the US economy in June, above the forecasted 600k, but below May’s figure which was revised lower to 886k from 978k. Pantheon Macroeconomics hoped for a greater increase, based on the Homebase employment data, suggesting the signal for Friday’s NFP release is unclear. Pantheon highlights the ADP’s measure was short of the official payroll data for most of the pandemic, but it suddenly overshot in April and May, adding that the change was likely due to ADP’s model overstating the strength of macroeconomic variables (retail sales and jobless claims) while ignoring the labor supply shortfall. As such, payrolls growth has not kept pace with demand due to the participation rate remaining lower. Looking ahead, PM writes, “if the new pattern continues for June, Friday’s print will only be about 200K, but that would be wildly at odds with the clear message from the Homebase data suggesting that increasing labor supply allowed payrolls growth to jump to about 1mln”, an expectation Pantheon is sticking with, but believes the breadth of Friday’s plausible outcomes is exceedingly broad.

JOBLESS CLAIMS: The initial jobless claims data released for the period that usually coincides with the BLS Employment Situation report showed a surprise rise to 412k from 375k, against the expected fall to 359k. Continued Claims followed suit and also surprised on the upside, rising to 3.518mln from 3.517mln (revised up from 3.499mln), against the expected fall to 3.43mln. The rise in initial claims marked the first increase in more than a month, although the gains were primarily seen in California, Pennsylvania, and Kentucky. The good news from the report was that the total number of people on unemployment benefits fell below 15mln for the first time since April 2020. However, looking at the headline prints, it does not bode so well for the June BLS data.

BUSINESS SURVEYS: The ISM Manufacturing PMI fell to 60.6 (prev. 61.2), below the expected 61.0. The survey gave a fairly negative insight into the labour market, highlighted by the Employment sub-component falling to 49.9 from 50.9, into contractionary territory after six straight months of expansion, with panellists continuing to note significant difficulties in attracting and retaining labour at their companies’ and suppliers’ facilities. Alongside this, panellists reported difficulties in filling open positions, continuing to limit manufacturing-growth potential. Looking at services, heading into this month’s payrolls the ISM Services data has yet to be released, and as such the IHS Markit Services May PMI data can be used as a proxy. The Markit data stated there was a further sharp rise in employment which can be derived down to the greater business requirements. However, despite that, the rate of job creation reduced as firms reported difficulties filling vacancies as they could not find suitable candidates. Nonetheless, jobs creation still remained sharp and outpaced the long-run series average.

CHALLENGER LAYOFFS: Challenger reported that job cut announcements fell from 24,586 in May to 20,746 in June, the lowest monthly total since June 2000, and -88% Y/Y. Challenger stated that so far this year, employers announced plans to cut 212,661 jobs, the lowest January-June total since 1995, and down 87% from the 1,585,047 jobs eliminated through the same period last year. The report noted they are seeing a rubber band snap back, and companies are holding on tight to their workers during a time of record job openings and very high job seeker confidence. Also, they have not seen job cuts this low since the Dot-Com boom. However, Challenger adds, the majority of cuts were attributed to Restructuring (10,876), while 2,950 were from plant and store closings. Nonetheless, a low challenger layoffs reading

bodes well for a strong NFP print.

SLACK: Fed officials are looking past the headline unemployment rate to try and gauge the levels of slack that remain; accordingly, the U6 Underemployment metric, Participation Rate, as well as the Employment-to-Population ratio have gained in importance. Last month, U6 was 10.2% (vs 7.0% in February 2020), Participation at 61.6% (vs 63.3% in February 2020), and the Employment-Population Ratio at 58.0% (vs 61.1% in February 2020), all three indicating there is still a long way to go, and recovering the lost ground is not going to happen in the immediate short-term. Moreover, Fed officials continue to state that unemployment has a long way to go, although it is not unanimous, as Quarles noted he does not think we need to see labour force participation return to pre-COVID levels due to baby boomer retirements.

SENTIMENT: Consumer Confidence rose to the highest figure since February last year which indicates confidence has recuperated a large part of the COVID hit. Moreover, the view of the labour market has also drastically improved, as the “jobs hard to get” index fell to just below the pre-COVID level. Further signalling the positive outlook, the difference between jobs “plentiful” and jobs “hard to get” rose. Nonetheless, the future remains highly uncertain, as the level of people expecting business conditions to worsen has stopped falling. As such, the positive consumer confidence may filter through into a solid NFP figure.

SEASONAL ADJUSTMENT: Recall that April and May disappointed in no small part due to seasonal adjustments that mistook a highly unusual reopening for a regular expansion. In June the seasonal adjustment is still negative (-200k), but less than in May (-400k) and April (- 800k). But In July the US economy normally lays off 1,000k workers meaning that if the reopening economy continues to add about 1mn jobs monthly (seasonally unadjusted) Nonfarm payrolls could be around +2mn on a seasonally adjusted basis. Clearly that implies a rapidly improving labor market, inflation, much higher interest rates and wider credit spreads.

Arguing for a better-than-expected report:

- Reopening. The further decline in infection rates and looser restrictions on businesses and mask usage has supported job growth in virus-sensitive industries. For example, restaurant seatings on OpenTable rebounded to 90% of their 2019 levels during the June survey week, compared to 83% in the May survey week.

- Seasonality. In April and May, reopening effects likely overlapped with normal seasonal hiring patterns, resulting in less-impressive job gains on a seasonally-adjusted basis.1 The June seasonal hurdle is sequentially easier in June however: the BLS adjustment factors generally assume 200k-400k of net hiring in June (mom nsa), compared to +414k in May 2021 and +823k in April 2021.Additionally, the end of the school year should result in fewer than normal education layoffs, given the 1.1mn staffers still not working because of pandemic.

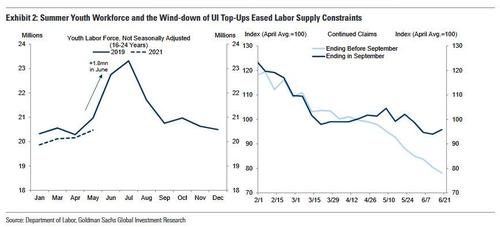

- Labor supply constraints. We also expect less of a drag from labor supply constraints in tomorrow’s report, due to the arrival of the youth summer labor force and the wind-down of federal unemployment top-ups in some states. As shown inthe left panel of Exhibit 2, 1.8mn 16-24-year-olds join the labor force in a typical June as the school year ends. This may have boosted overall payroll growth if a higher proportion successfully found jobs due to strong demand for labor in lower-skilled occupations. For example, if net hiring occurs at the 2019 pace (82% of the nsa change), we estimate it would boost headline job growth by approximately +325k relative to a typical June (66%).

- The right panel indicates that state-level changes to unemployment insurance availability and generosity are also boosting labor supply. Benefits were curtailed in half of US states (representing 29% of the outstanding job losses since the start of the pandemic) in June and early July. Encouragingly, continuing claims declined more quickly in these states (by roughly 200k relative to the trend in all other states).

- ADP. Private sector employment in the ADP report increased by 692k in June, above consensus expectations for a 600k gain. Additionally, the large reported gain in leisure and hospitality jobs (+332k) is consistent with our view that labor supply constraints eased sequentially.

- Job availability. The Conference Board labor differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—surged to +43.5 in June (from +36.9 in May) and is now at its highest level since 2000.

Arguing for a weaker-than-expected report:

- Employer surveys. The employment component of our manufacturing survey tracker was unchanged (-at 58.4), while the employment component of our services survey tracker decreased (-1.6pt to 54.9), but both remain around early-2019 levels.Encouragingly, the employment component of the GSAI increased substantially (+7.3pt to 68.4).

- Job cuts. Announced layoffs reported by Challenger, Gray & Christmas rose by 18%nin June after declining by 33% in May (mom, SA by GS). Layoffs were at the lowest level since 1993.

Neutral/mixed factors:

- Big Data. High-frequency data on the labor market were mixed between the May and June survey weeks (see Exhibit 3). While two of the six measures we track declined outright (Dallas Fed survey, Google mobility), we note strong gains in thetwo datasets that explicitly track employee scheduling (Homebase, ADP). These two indicators may more effectively track inflections in reopening categories like restaurants, hotels, and other services.

- Jobless claims. Initial jobless claims declined during the June payroll month, averaging 396k per week vs. 505k in May. Across all employee programs including emergency benefits, continuing claims remained roughly unchanged between the payroll survey weeks.

FWIW, Goldman estimates nonfarm payrolls rose 750k in June (above the 711k consensus) after rising 559k in May and 278k in April. Labor demand remains very strong due to the reopening and the stimulus, and the arrival of the youth summer labor force and the wind-down of federal unemployment top-ups in some states eased the labor supply constraints that held down job growth in May and April. GS thinks pPrivate payrolls rose 675k, above consensus of +620k.

Goldman also estimates a two-tenths drop in the unemployment rate to 5.6% (in line with consensus of 5.6%), reflecting a strong household employment gain but a further rise in the participation rate. Goldman sees scope for the household measure to outperform relative to headline payrolls, as the former should better reflect the impact of reopening establishments. At the same time, in addition to a vaccine- and reopening-driven rise in labor force participation, the easing of labor supply constraints discussed earlier may have also boosted it as well. This would absorb some of the impact of strong job growth from the perspective of the jobless rate. Goldman also will pay close attention to the number of unemployed workers on temporary layoff, which spiked to a record-high 18.1mn last April but fell to 1.8mn in the May 2021 report. The smaller number of workers left on temporary layoff reduces the scope for the rapid pace of gains seen last summer, but it remains a positive factor relative to the pre-coronavirus pace of job gains.

Finally, Goldman estimates a 0.4% rise in average hourly earnings (above consensus of +0.3%), reflecting continued labor shortages partially offset by negative calendar effects. Coupled with last spring’s waning composition effects, this would result in a further rise in the year-on-year rate from +2.0% to +3.8% (consensus is +3.6%). Wage growth continues to be resilient in the wake of the crisis, reflecting strong labor demand per unemployed worker and pandemic-related delays in job searches. Wages for lower-paid workers have risen sharply in recent months amidst widespread reports of worker shortages, and this imbalance led to further wage hikes in June as well.

Tyler Durden

Thu, 07/01/2021 – 21:59

via ZeroHedge News https://ift.tt/2V0n487 Tyler Durden