This Is How “Over-Positioning” Tips Over – Nomura Eyes “Gamma Hammer” As Fed Tightening’s Pulled Forward

VIX tumbled to a 14 handle this morning after the “goldilocks” jobs data as stocks spiked…

And, despite increasing evidence of a very strong “inflation pipeline,” Treasury yields continue to slide and we the power “bull-flattening” of the past month accelerates.

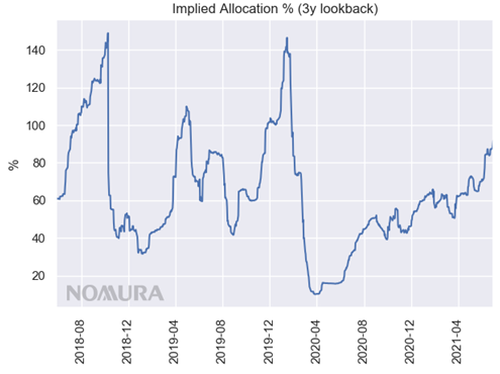

But, as Nomura’s Charlie McElligott points out in a brief note today, the rapid accumulating “short vol” positioning out there (and the subsequent col compression) has significant implications on very significant risk-sizing across the entire markiet universe.

Pretty remarkable to see extension of the bull-flattening in bonds (WN earlier making new recovering highs and 5s30s cash testing 9 month lows, although steeping a bit post data) despite the following observations…which to me yet-again shows that the market psyche remains absolutely fixated on the growth-slowing implications of “financial conditions” risk from strong data = “pulling forward” timing of central bank tightening, and / or more aggressive approach (hikes faster OR hikes more in same window).

The market seemingly being concerned about an upside surprise into today’s NFP which then realized into a “beat” (following the Claims print yday…although the “real” acceleration in the “return to workforce” dynamic of the unemployment benefits run-off should come in the next 3 monthly reports), simply because it hastens the tapering timeline (see comments from Fed’s Waller yday), into what is already a likely accelerated hiking timeline.

More evidence of inflation overshoot earlier out of Europe, where EZ PPI YoY surged to a record high of 9.6% in May (back just 6 months prior, Dec EZ PPI was -1.1% YoY)—noting specifically energy prices jumping to 25.1% in May and prices for intermediate goods also v strong +9.2%; note, this comes as EZ Manu PMIs suggest more input cost increases due to supply-side constraints, while data also shows output prices rising higher too as corporates are forced to pass through higher costs.

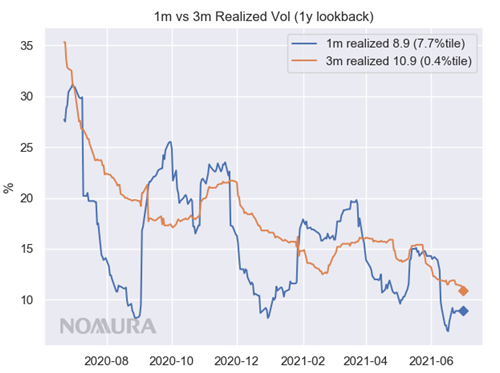

Turning to US Equities Vol, we have spoken on repeat for a long-while on the absolute defenestration of Vols which initially spiked following the initial “Fed tightening tantrum” which followed the release of the shock +++ April Core CPI data data, as “inflation scare” became a thing due to Fed “pull forward” concerns—thereafter, those “rich vols” were sold into submission from both systematic- and discretionary- investors full-throttle.

SPX 1m realized vol is now 8.9 (7.7%ile), while even more eye-watering is 3m SPX realized at 10.9—a remarkable 0.4%ile rank—as such, we estimate that the Vol Control universe has accumulated +$74.5B of fresh US Equities exposure over the following 3m, and +$10.5B over the past 2d alone (90.2%ile).

VIX ETN Net Vega has been a one-way purge since early 2021, as the aggregate “long” position which peaked post COVID shock in late 2020 has now been reduced almost in half, down to now just 119.1mm, 47.3%ile since 2011 / 15.9%ile since 2018.

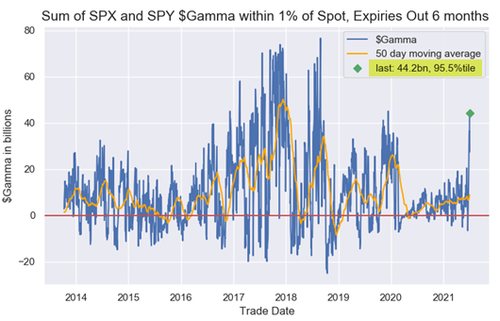

All the vol selling / overwriting (strangle selling “Gamma Hammer” flows, while picking-up again in single-names too, desk seeing it in HAL and IBM yday) is certainly pushing into “extreme” territory, as the nearly indiscriminate options selling has led to some pretty epic “Long Gamma” for Dealers:

-

SPX $Gamma $44.2B / 95.5%ile

-

QQQ $Gamma $730.9mm / 97.1%ile

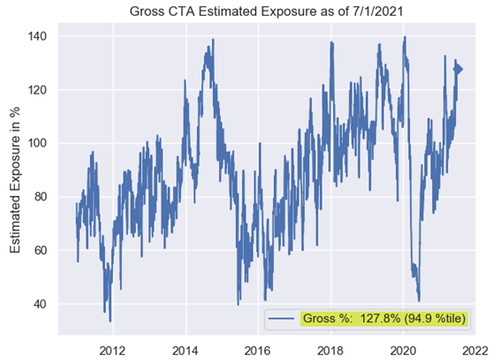

Not surprisingly then in light of this insanely compressed volatility and price- / trend- stability, our CTA model estimates the aggregate portfolio gross-exposure at 94.9%

Ultimately, this is how “overpositioning” (via leverage accumulation) “tips over” – because “volatility is your exposure toggle” in the post GFC “negative convexity” market structure…but that said, you need a macro shock catalyst, and it feels like the market darn-well gets the joke on growing potential for a Fed acceleration if / when the Jobs picture accelerates.

Until then, market behavior is showing us that “short vol” / “carry” / “roll” remain the order of the day, until “new” Fed guidance comes off the back of additional economic data releases.

Tyler Durden

Fri, 07/02/2021 – 10:40

via ZeroHedge News https://ift.tt/2TxKRM5 Tyler Durden