‘We Spent Like Never Before’ – US Saw Record Drop In Poverty Last Year As 7 Million Jobs Disappeared

President Joe Biden and the Democrats in Congress are pushing for another one-month extension of the federal eviction moratorium. It’s unlikely to pass, and while Democrats are essentially using the whole setup to bash Republicans for being standing by while thousands are evicted, they probably won’t say much about the billions of dollars in rental assistance approved by Congress that hasn’t been spent, even in deep blue states like New York (one of the slowest states to start doling out the aid).

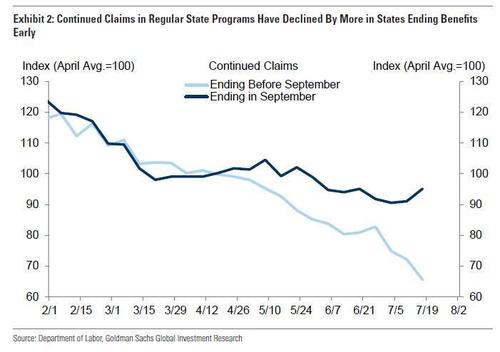

With restaurants, retailers and other small businesses struggling to find workers to fill lower-paying jobs, a gap is already opening between red states (which have curtailed some of the expanded federal unemployment assistance) and blue states (which are keeping the money taps open).

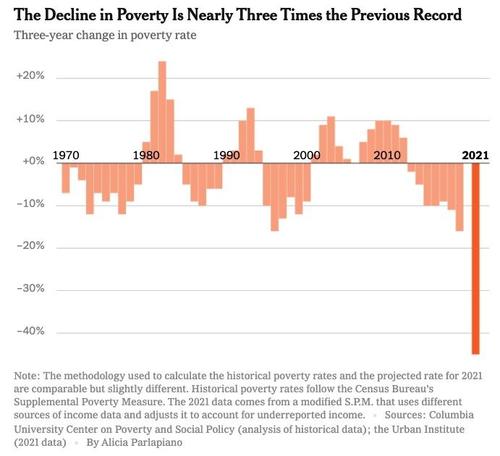

As Democrats argue for even more federal spending and aid, it’s important for people to take a step back and consider how much assistance has already been doled out by the government. As the NYT claimed in a report published earlier this week using data compiled by some left-wing think tank, the trillions of dollars spent on handouts to families and individuals, and loans and grants to businesses, has led to the biggest reduction in poverty in American history.

Per the report, the number of poor Americans has fallen by nearly 20MM since 2018, a decline of almost 45%.

The Urban Institute’s projections show poverty falling to 7.7 percent this year from 13.9 percent in 2018. That decline, 45 percent, is nearly three times the previous three-year record, according to historical estimates by researchers at Columbia University. The projected drop in child poverty, to 5.6 from 14.2 percent, amounts to a decline of 61 percent. That exceeds the previous 50 years combined, the Columbia figures show.

(Source: NYT)

What’s even more remarkable is that the US managed to achieve this even as 7MM jobs evaporated last year during the early months of the pandemic. It’s likely that these gains will prove ephemeral, since without more emergency measures, many families will see their total income decline as programs like increased food stamps and expanded unemployment insurance have either already ended, or soon will.

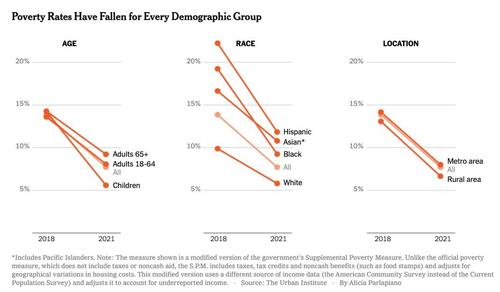

The decline in poverty has been steady across race and age and practically every demographic group.

(Source: NYT)

But while plenty of the aid helped keep families afloat, many spent their money on luxuries like new TVs, or worse, indulgences like illegal narcotics. Perhaps unwittingly, the NYT beautifully illustrated this point with an anecdote: the case of Kathryn Goodwin, a single mother of five from St. Charles, Missouri.

Before the pandemic, she managed a group of ptrailer parks which paid her $33K per year. When she was working, she received food stamps, tax credits and aid fro a disabled child which raised her total income per year to $52K. For context, the local poverty line is $34K. Without the expanded assistance, Goodwin would have seen her income drop to just $29K, but instead, her income exploded.

Instead, her income rose above its prepandemic level, though she has not worked for a year. She received about $25,000 in unemployment benefits (about three times what she would have received before the pandemic) and $12,000 in stimulus checks. With increased food stamp benefits and other help, her income grew to $67,000 — almost 30 percent more than when she had a job.

“Without that help, I literally don’t know how I would have survived,” she said. “We would have been homeless.”

Still, Ms. Goodwin, 29, has mixed feelings about large payments with no stipulations.

While hers is an example where the money spent helped keep a familiy in its home, even Goodwin has mixed feelings, since she knows plenty of people who squandered the money.

Still, Ms. Goodwin, 29, has mixed feelings about large payments with no stipulations. “In my case, yes, it was very beneficial,” she said. But she said that other people she knew bought big TVs and her former boyfriend bought drugs. “All this free money enabled him to be a worse addict than he already was,” she said. “Why should taxpayers pay for that?”

This is just one example of how the federal money wasn’t always spent in the most responsible way. Critics, including economists from the University of Chicago, believe the government should have been more discerning with how it distributed the money.

Critics said the aid was poorly devised, noting that many people received more from unemployment benefits than they had earned on the job.

“We spent like we’ve never spent before and we reduced hardship for most people quite dramatically,” said Bruce D. Meyer, an economist at the University of Chicago. “But this came at a very high and unnecessary cost.”

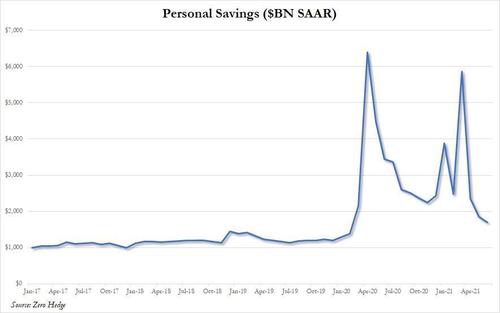

Dems are already fighting for more spending via Biden’s infrastructure package and $3.5 trillion budget. Unfortunately for those who perhaps didn’t save as much money as they should have, it looks like Americans have already burned through the savings they accumulated during the pandemic, according to the latest data on ‘excess savings’ from the BEA.

Tyler Durden

Sat, 07/31/2021 – 11:45

via ZeroHedge News https://ift.tt/3if4P87 Tyler Durden