“It’s Too Late To Save Christmas”: Retailers Brace For Unprecedented Shortages Of Everything

With global container shipping rates hitting never before seen levels amid a historic global scramble to secure good and inventory…

… suppliers to Walmart, Target, Amazon.com and other major retailers told Reuters they are placing holiday orders for Chinese-made merchandise weeks much earlier this year, as a global shipping backlog threatens to leave many gift buyers empty-handed this Christmas shopping season.

Reuters surveyed nearly a dozen suppliers and retailers of everything from toys to computer equipment in the United States and Europe. All expect weeks-long delays in holiday inventory due to shipping bottlenecks, including a global container shortage and the recent COVID-related closure of the southern Chinese port of Yantian, which serves manufacturers near Shenzhen.

The risk for retailers is a rash of out-of-stock items just as shoppers are ready to open their wallets to splurge on toys, clothing and other merchandise.

“It’s going to be a major, major mess,” said Isaac Larian, chief executive of Los Angeles-based MGA Entertainment Inc, which sells LOL Surprise, Bratz, Little Tikes and other toy brands to Amazon, Walmart and Target. His company has toys stuck in hundreds of containers at the Yantian port. If he can’t get enough inventory for his retail clients, “it’s going to hurt the Christmas sales big time,” Larian said.

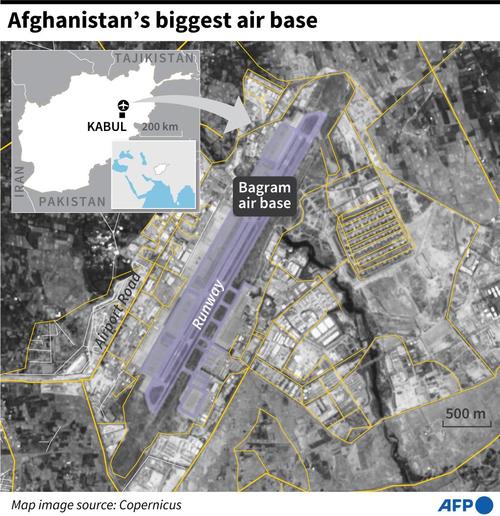

The shipping logjams are due to more than just the backlog in Yantian, which is considered Amazon’s No. 1 Chinese seaport – accounting for 32.4% of shipments handled by the e-commerce company in the three months to May 31, according to S&P Global Market Intelligence’s trade data firm Panjiva.

While Yantian port reopened on June 24, a shortage of containers was still constraining full activity, globally cargo ships are overbooked, containers are stranded in the wrong places, and ports are congested. As a result, products are piling up on factory floors, in warehouse parking lots, on seaport docks and at rail yards – threatening more backups than last year’s holiday “shipageddon,” when many items arrived after Christmas.

Retailers generally are selling goods as fast as they can bring them in, said Jason Miller, associate professor of supply chain management at Michigan State University’s Eli Broad College of Business.

“Their sales are so high right now that they’re unable to build inventory levels up substantially,” said Miller.

If that torrid clip continues, retailers would have to add about $65.1 billion in inventories to be in the same pre-holiday inventory-to-sales position they were in 2019, he said.

Andy Bond, chief executive of Pepco Group, which owns British discount retailer Poundland, told Reuters separately, “it’s definitely a day-to-day challenge and a headache that we are facing.”

Clothing sellers are looking at air freight as an option – including PVH Corp, which owns the Tommy Hilfiger and Calvin Klein brands.

Christmas-themed inventory “might be here for Thanksgiving weekend – and it might not be,” said Balsam Hill CEO Mac Harman, who sells high-end artificial Christmas trees and other holiday décor. Some of his orders from China may not arrive in time for his July sales kickoff – or even by Christmas, he said.

“We’re hundreds of containers behind where we should be at this point,” he said, with at least 10% fewer products in stock.

Michael Shah, CEO of British-based Easy Equipment, which supplies catering equipment across the United Kingdom, is racing to bring goods in early after already contending with containers held up in China.

“We are already starting to order more stock now knowing that by September-October, we have to be prepared,” Shah said. “It gets busy in the run-up to Christmas with the restaurant trade, and we are having to bite the bullet and try and rush in stock.”

Carly McGinnis, head of production, sales and logistics at Exploding Kittens, wants to make sure major retailers such as Walmart and Target don’t run out of its games. The Los Angeles-based company is making more games this year and began shipping holiday orders in March, about four months earlier than in 2020.

She also gives Walmart and Target the option to import some of their own orders. Because the two retailers are among the top U.S. importers of containerized goods, they may get priority access to containers and space on cargo ships.

“I’ve told our investors, and my internal team, something will be out of stock – there will be an issue. I don’t know when and I don’t know what it will be, but it’s certainly going to happen,” McGinnis said.

Meanwhile, Bernie Thompson, founder of Washington-based Plugable Technologies, said he has abandoned hope for a holiday restock of laptop docking stations and some other computer equipment he sells via Amazon and other retailers. That’s because it can take more than 12 months to get some of his top-selling products, which rely on hard-to-find computer chips.

A respondent in today’s ISM Manufacturing survey confirmed as much, saying that “electronic components by far the biggest challenge, with lead times going from 16 weeks to 52-plus weeks.” This means that an order today will arrive some time in the summer of 2022.

“It’s too late for Christmas,” said Thompson pointing out the obvious.

Tyler Durden

Fri, 07/02/2021 – 12:20

via ZeroHedge News https://ift.tt/3jGReYb Tyler Durden