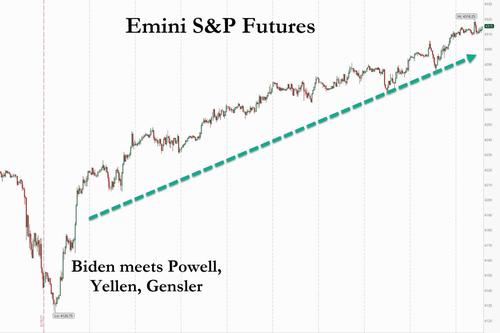

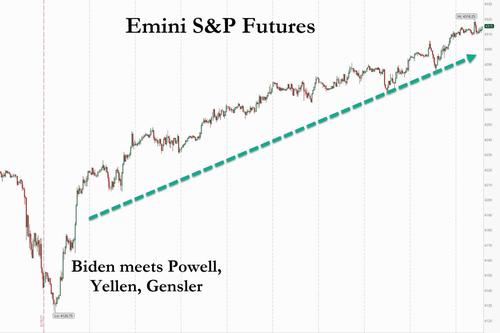

Another day, another record high for US stocks which have not hit a new all time high virtually every single day since the post-FOMC mini tantrum when Biden met with Yellen and Powell. At 7:30 a.m. ET, Dow e-minis were up 15.50 points, or 0.05%, S&P 500 e-minis were up 4.50 points or 0.1% to a new record high of 4,315, and now above Goldman’s year end price target of 4,300 and Nasdaq 100 e-minis were up 29.5 points, or 0.2%.

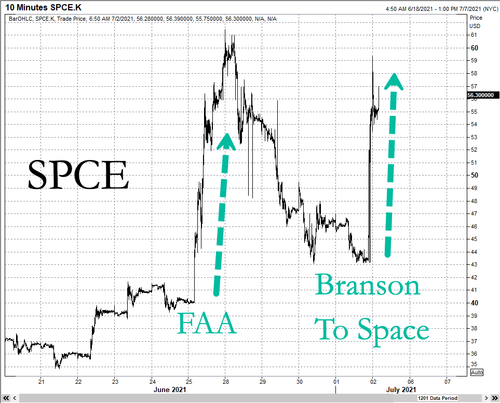

Sure enough, on Friday futures tracking the S&P 500 hovered at a new record high as investors awaited key employment data amid promising developments on the vaccine front for more clarity on the U.S. jobs market and the fate of easy monetary policy. News that Johnson & Johnson’s vaccine neutralizes the fast-spreading delta variant helped boost sentiment. Virgin Galactic Holdings jumped 27% after the space tourism firm said billionaire entrepreneur Richard Branson would travel to the edge of space on the company’s test flight on July 11, beating out fellow aspiring billionaire astronaut Jeff Bezos. Here are some of the other notable premarket movers:

- Iterum Therapeutics (ITRM) drops 28% in premarket trading after receiving a letter from the FDA saying deficiencies were found during its review of the New Drug Application (NDA) for a urinary tract infection treatment.

- Pop Culture Group (CPOP) shares surge 37% in premarket trading, with the Chinese hip-hop promoter set for a third day of straight gains since going public on Wednesday.

- Several stocks favored among retail traders on social media platforms like Reddit fall in premarket trading. Powerbridge (PBTS) slips 5.4% and Borqs Technologies (BRQS) declines 2.7%, while Verb Technology (VERB) drops 4.2%.

- Virgin Galactic (SPCE) shares jump 26% on news that founder Richard Branson will be aboard the next rocket-powered test flight of its SpaceShipTwo Unity.

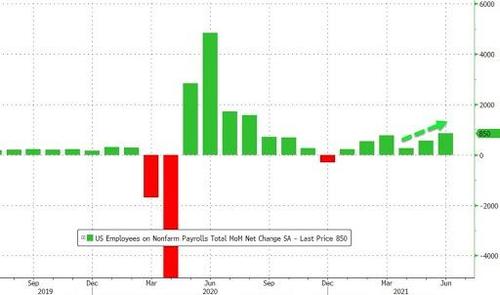

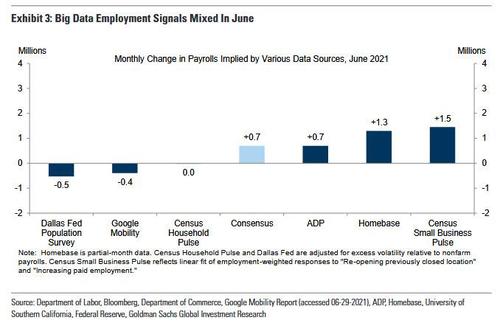

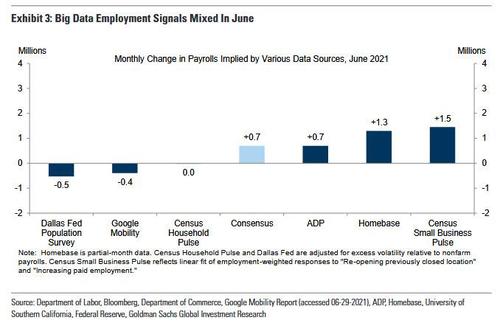

The June jobs report (preview here) is expected to show U.S. job growth accelerated in June – but remain well below the Fed’s implicit taper-unlocking bogey of 1 million new jobs per month – as companies boosted perks for workers amid booming demand, following reopening. Still, widespread labor shortages and significant seasonal adjustments will make any gains above 700K challenging.

“The market clearly needs a strong figure to hold on to its upbeat mood, as a surprise weakness in jobs figures wouldn’t get the Fed to do more, when inflation is hovering around a worryingly high 5% and it’s not even sure that it’s a peak,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank adding that “strong jobs data should keep the U.S. equities and the dollar upbeat.”

Still, after a strong end to the first half of the year, the S&P 500 began the second half with its sixth consecutive all-time closing high in the previous session amid a broad-based rally led by so-called economy-linked “value” stocks. Focus now also shifts towards the second-quarter earnings season and progress on President Joe Biden’s infrastructure bill that could help the equity market keep the momentum.

In Europe, the Stoxx 600 Index gained 0.4%, led by miners and travel firms. Eurostoxx 50 trades flat, fading modest opening gains. DAX and FTSE 100 outperform at the margin. Travel, miners and tech are the strongest sectors, banks, retail names lag. Here are some of the biggest European movers today:

- Bellway shares gained as much as 3.6% after Jefferies upgraded the company and Barratt Developments to bring all U.K. house builders under its coverage to buy ratings, and reiterating positive stance on sector.

- EQT AB shares gained as much as 2.9% on reports the company and Goldman Sachs Group are in advanced talks to buy Parexel International Corp. for nearly $9 billion including debt.

- Mediaset shares rose as much as 3.7% to highest level in over three years, after Il Sole reports that co. could revive talks with U.S. media firm Discovery.

- Solutions 30 shares jumped as much as 15% to an eight-week high after shareholders approved the Luxembourg-based company’s uncertified 2020 accounts earlier this week.

- Shares in Delivery Hero, Deliveroo and Just Eat Takeaway all rose as JPMorgan tweaked their price targets before earnings updates.

- Ambu shares fell as much as 16% in Copenhagen after the company lowered its full-year financial forecast. Morgan Stanley says the new guidance implies a 15% cut to Ebit consensus, but that drivers for downgrade are temporary in nature

- Valmet shares slumped as much as 6.1%, the worst in nine months, after the company agreed to buy Neles in a $2.5 billion deal. Neles shares surged as much as 13% to a record high, while still below implied value of offer.

- Evonik Industries shares fell as much as 2.9% after the stock was cut to sell at Goldman Sachs saying the company has less compelling organic opportunity heading into a recovery versus its peers.

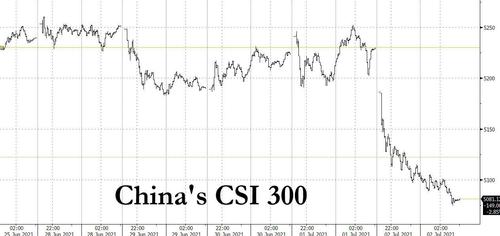

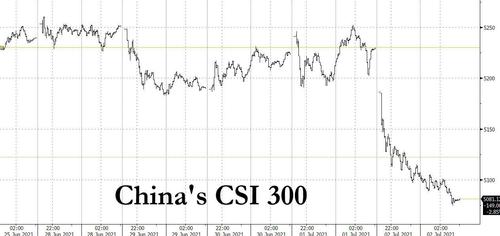

Earlier in the session, Asian equities fell, led by a slump in Chinese stocks following the Communist Party’s 100th anniversary celebrations. Alibaba, Meituan and Tencent were the largest drags on the MSCI Asia Pacific Index. China’s CSI 300 Index slid as much as 3%, the most since March 19, amid signs of profit-taking following gains in the run-up to the event.

Hong Kong’s Hang Seng Index dropped as much as 2.1% as trading resumed after Thursday’s holiday. The slide in China and Hong Kong offset an advance in Japanese stocks after strong U.S. economic data took Wall Street to another record. In other positive news for economic reopenings, Johnson & Johnson said that its coronavirus vaccine neutralizes the fast-spreading delta variant. The CSI 300 climbed 3.5% in the quarter ended June, beating the Asian benchmark’s 2.2% advance. The key Chinese equity gauge closed up 0.1% Thursday, erasing an earlier loss as President Xi Jinping in a speech said “the Chinese people will never allow any foreign forces to bully, coerce and enslave us.” “Foreign policy circle interpretation is that this is yet another strong warning to the U.S. to stay in its own lane,” Rabobank strategists wrote in a note. “Either somebody blinks –who? — or underlying fat tail risks will continue to grow. Regardless, Wall Street went up to a new high again yesterday, having either not noticed the speech, or having translated it as ‘Buy stocks!’”

Japanese stocks rose, with the Topix halting a three-day losing streak, after strong economic data took Wall Street to another record. The Topix rose 0.9% to 1,956.31 in Tokyo and the Nikkei 225 closed at 28,783.28, up 0.3%. Sony Group Corp. contributed the most to the Topix’s gain, increasing 3.7%. Today, 1,770 of 2,187 shares rose, while 345 fell; 31 of 33 sectors were higher, led by electric appliances stocks. U.S. index futures were little changed during Asia trading hours. On Thursday, the S&P 500 advanced for a sixth straight day, the longest winning streak since February, after another batch of strong economic reports added fuel to the rotation into stocks that stand to benefit the most from a U.S. reopening. “While U.S. indices are renewing highs, Japan’s Nikkei 225 has been stuck at around the 29,000 level due to infection cases in the country,” said Nobuhiko Kuramochi, a market strategist at Mizuho Securities. “Investors may be in a wait-and-see mode with the employment data coming up, and with the Fourth of July holiday approaching in the U.S.” Japan’s government is planning to extend strong virus measures that are in place in Tokyo and its three neighboring prefectures by about a month, covering the entire duration of the Olympic games scheduled to end Aug. 8, the Sankei newspaper reported, without attribution.

Australia’s S&P/ASX 200 index added 0.6% to close at 7,308.60, led by energy stocks after oil held overnight gains. The benchmark ended the week flat. IDP Education was the top performer on Friday after it agreed to buy the British Council’s Indian IELTS operations. IPH was the biggest laggard after Goldman cut its rating to neutral. In New Zealand, the S&P/NZX 50 index rose 0.2% to 12,711.84, finishing a fifth consecutive week higher

In rates, Treasuries beyond the 5-year are higher after advancing during European morning, paced by bunds, which lead by 1.5bp in 10-year sector. 10- year yield declined as much as 2.2bp to 1.436%, lowest level since June 21, and is 8bp lower on the week; it shed nearly 5bp on Monday following its biggest weekly increase since March, amid focus on positive supply dynamics including blank coupon auction calendar until July 12. Asia session was uneventful, with low futures volume. Activity remains light ahead of U.S. June employment report during a shortened session. S&P 500 futures made new all-time highs amid gains in European stocks. Yields are richer by 1bp-2bp from the 7-year to the 30-year with shorter maturities little changed, flattening 2s10s and 5s30s spreads; German 2s10s curve is flatter by 3bp with 10-year sector richer by 3.7bp on the day, outperforming Treasuries. Sifma has recommend a 2pm close ahead of July 4 weekend, and historically, jobs reports coinciding with a pre-holiday early close have seen added volatility and lower market depth.

In FX, the Bloomberg Dollar Spot Index was steady even as the greenback gained versus most of its Group-of-10 peers. Risk sensitive Scandinavian and Antipodean currencies led declines; the euro also traded heavy and fell to an almost three-month low of $1.1822 as the European session commenced; German government bonds advanced, led by the long end, outperforming Treasuries. The Aussie fell to this year’s lowest level versus the greenback as iron ore and Chinese stocks decline; Australia’s 10-year bonds rise as lockdowns across the nation boost demand for haven assets. The yen was little changed after touching a new 15-month low versus the dollar; Japanese bonds were mostly higher as the nation’s uncertain economic outlook and slow pace of vaccination rollout increased demand for haven assets.

In commodities, front-month Brent slips 0.5% near $75.50, WTI crude oil traded around $75 a barrel, near the highest since 2018, after OPEC+ infighting cast doubt on an agreement that could ease a surge in prices. Spot gold pushes back into the green, trading up around best levels for the week near $1,782/oz. Most base metals are in the red with LME zinc lagging; copper and aluminum post small gains.

Attention today will be on the 830am job report and the Durable goods report at 10am ET. Focus then also shifts towards the second-quarter earnings season and progress on President Joe Biden’s infrastructure bill that could help the equity market keep the momentum.

Market Snapshot

- S&P 500 futures little changed at 4,311.25

- STOXX Europe 600 up 0.15% to 456.85

- MXAP down 0.4% to 205.95

- MXAPJ down 1.0% to 690.24

- Nikkei up 0.3% to 28,783.28

- Topix up 0.9% to 1,956.31

- Hang Seng Index down 1.8% to 28,310.42

- Shanghai Composite down 2.0% to 3,518.76

- Sensex little changed at 52,318.70

- Australia S&P/ASX 200 up 0.6% to 7,308.55

- Kospi little changed at 3,281.78

- Brent Futures little changed at $75.79/bbl

- Gold spot up 0.4% to $1,783.48

- U.S. Dollar Index little changed at 92.61

- German 10Y yield fell 2.23 bps to -0.22%

- Euro down 0.1% to $1.1833

Top Overnight News from Bloomberg

- “Prices need to increase in a gradual, stable and sustainable manner. For that we need a sustainable economic recovery. But we are not there yet,” European Central Bank President Christine Lagarde says in interview with La Provence

- Japan’s Government Pension Investment Fund booked a gain on its investments of 25%, or $339 billion, in the 12 months ended March, the most since the fund started managing the nation’s pension reserves in 2001. Overseas debt gained 7.1%, while Japanese debt lost 0.7%

- The OPEC+ alliance descended into bitter infighting after a key member blocked a deal at the last minute, forcing the group to postpone its meeting and casting doubt on an agreement that could ease a surge in oil prices

- A key gauge of funding conditions in Europe suggests money markets are pricing in an eventual end to the region’s unprecedented liquidity glut

- Johnson & Johnson said that its single-shot coronavirus vaccine neutralizes the fast-spreading delta variant and provides durable protection against infection more broadly

Quick snapshot of global markets courtesy of Newsquawk

Asian equity markets were mixed as the initial tailwinds from the mild gains on Wall St, where the S&P 500 eked a fresh record high and the energy sector led the gains as focus centred on OPEC deliberations, were offset by weakness in China and with the key risk NFP jobs data on the horizon. ASX 200 (+0.6%) was kept afloat amid the removal of lockdown restrictions for parts of Queensland and following PM Morrison’s announcement the Cabinet agreed to a new pathway out of COVID-19 through a four-phase plan, while the energy sector outperformed after oil prices gained, although some of the advances for oil were retraced and the OPEC+ meeting was postponed to Friday amid disagreements on baseline production levels from the UAE. Nikkei 225 (+0.3%) was underpinned by recent currency weakness and with automakers boosted by sales updates including Mazda which notched a 28.7% jump in North American sales last month, although upside for the local benchmark was limited as Japan was said to consider an extension to the quasi-state of emergency in Tokyo by a month. Hang Seng (-1.8%) and Shanghai Comp. (-2.0%) were pressured despite a lack of significant catalysts for the declines which was led by firm losses in tech, consumer stocks and blue chips, while there was also further criticism from the US State Department regarding China’s nuclear build-up, as well as its actions concerning Xinjiang, Tibet and Hong Kong. Finally, 10yr JGBs were flat after prices recently stalled just shy of the 152.00 level and amid mild gains in Japanese stocks, while the BoJ’s Rinban announcement also showed a reduction in buying of 1-3yr and 10-25yr maturities which the central bank had previously flagged for Q3.

Top Asian News

- Fashion Brands Investigated Over Alleged Uyghur Forced Labor

- Funds Flee Southeast Asia Stocks as Vaccine Push Gets Urgent

- China Includes Online Platforms in Revised Rules on Pricing

- Prosecutors Seek Over Two Years Jail for Ghosn Accomplices

The tone across the equity space remains tentative heading into the US labour market report, with European equities choppy within relatively tight ranges after a lukewarm cash open. European cash and futures saw a bought of buying in the first half-hour of cash trade, although this dissipated thereafter. US equity futures have been mimicking the direction of the price action of peers across the pond, but to a lesser degree, with the ES (Unch), NQ (+0.1%), YM (Unch), and RTY (-0.1%) all flat intraday heading into the main event of the week. Ahead of the US jobs report, SGH Macro’s Tim Duy reminds us that today’s release will be the first of three reports before the September FOMC (the earliest date a tapering announcement can be telegraphed – barring the Jackson Hole Symposium), suggesting that this report is important, “but it’s unlikely that any one of those reports alone will decide the timing of tapering.” Back to Europe, cash is currently mixed with some mild outperformance in the FTSE 100 (+0.3%) amid gains in mining names. Sectors are mostly firmer and portray no firm risk nor cyclical/defensive bias – with Basic Resources leading the gains as base metal prices stabilise, whilst Anglo American (+2.4%) also experiences tailwind from a broker upgrade at Bernstein. Travel & Leisure cheer reports that Germany is set to relax restrictions on British travelers entering the nation ahead of a meeting between German Chancellor Merkel and UK PM Johnson. Tech resides as a top performer following yesterday’s underperformance and the pullback in yields. Subsequently, banks trade at the bottom of the bunch, closely followed by Retail and Oil & Gas. In terms of individual movers, Mediobanca (-0.1%) succumbs to the broader weakness in financials despite shareholder Del Vecchio upping his stake in the Co. to 18.9% from 15.4%, whilst Ambu (-12%) plumbs the depths after cutting guidance due to an increased impact from COVID.

Top European News

- Wise Shareholders to Sell at Least 2.4% Stake in Direct Listing

- Fashion Brands Investigated Over Alleged Uyghur Forced Labor

- DWS’s Long-Delayed London Sale Shows Office Deals Return

- H&M Downgraded at Citi, Goldman on Muted Upside Prospects

In FX, the Dollar looks reset and almost literally recharged after losing some impetus intermittently yesterday when crude oil was gushing, as it continues to rally and pick off more technical or psychological levels in index and Usd/other currency pair terms. The DXY has now been up to 92.699, leaving just a high from early April guarding the next big figure (92.790 from the 6th of the month to be specific) before attention turns to NFP in earnest and then the latest CFTC spec positioning updates that are odds-on to reveal another short squeeze and paring of Greenback shorts. Moreover, Monday is a US market holiday to mark Independence Day and this could prompt more Buck buying bar a really bad BLS report (check out the Research Suite for a preview of the event).

- EUR/CHF/AUD/NZD – By no means the only major casualties, but weaker than their G10 peers on the day and the Euro down to a new w-t-d base below a key Fib at 1.1837 (76.4% retracement of the rebound from 2021 trough in March at 1.1704 to 1.2266 May peak), leaving option expiry interest as the only real remaining source of support into 1.1800. On that note, 1.8 bn resides between 1.1825-20, but by the same token Eur/Usd seems capped, if not trapped on any upturn given 2.7 bn from 1.1850-55, 1 bn at 1.1865 and 2.36 bn at 1.1890-1.1900, not to mention more big expiries up to 1.1950 all rolling off at the NY cut. Meanwhile, the Franc is still trying to contain losses beneath 0.9250, the Aussie hold above 0.7450 and Kiwi keep afloat of 0.6950 as Aud/Nzd hovers in the low 1.0700s after just maintaining round number+ status.

- JPY/GBP/CAD – The Yen is pivoting 111.50 and also in the midst of hefty option expiries that could keep Usd/Jpy contained before and even after the US labour update, with 2 bn down at the 111.00 strike, 1.78 bn between 111.40-50 and 1.9 bn at 111.75. Elsewhere, Sterling continues to straddle 1.3750 and tussle to stay within sight of 0.8600 vs the Euro and the Loonie is back under 1.2400 alongside a deeper pull-back in WTI awaiting the delayed OPEC+ meeting, Canadian trade data and manufacturing PMI in the interim.

In commodities, WTI and Brent front-month futures trade sideways as the JMMC and OPEC+ meetings are poised to resume today at 14:00BST/09:00EDT and 15:30BST/10:30EDT respectively after ministers failed to reach an accord yesterday. In terms of where things stand, it was reported that it appears differences between UAE and Saudi Arabia at the JMMC meeting heated up and that the UAE, Iraq, and Kazakhstan have asked for a new baseline. The UAE is reportedly looking to raise the OPEC baseline to about 3.8mln BPD and would allow UAE to pump an extra 700k BPD. As a reminder, October 2018 production levels were used as baselines for producers apart from Saudi and Russia – who were both given baselines of 11mln BPD each (Click here for a full recap of yesterday’s event). Nonetheless, participants will keep their eyes peeled for source reports through the session, whilst the crude complex also keeps the US jobs report on the radar for sentiment-induced volatility. WTI Aug trades around the USD 75/bbl mark (74.94-75.54 range), whilst Brent Sep remains north of USD 75.50/bbl (75.47-76.13 range). Elsewhere, spot gold and silver eke mild gains after finding support at USD 1,774/oz and USD 26/oz respectively – with little new to mention on this front ahead of the jobs report. Over to base metals, LME copper is firmer on the day, but in the grand scheme, the contract remains near recent lows. Dalian iron ore overnight also nursed some losses but overall closed lower on the week, with traders citing the Chinese crackdown as a persisting mood-dampener in the complex. On that note, next week’s Chinese inflation metrics will be of interest as they will encapsulate China’s crackdown on the rise in base metal prices amid Beijing’s concerns over PPI spilling over to CPI.

US Event Calendar

- 8:30am: June Change in Nonfarm Payrolls, est. 720,000, prior 559,000

- June Change in Private Payrolls, est. 610,000, prior 492,000

- June Average Weekly Hours All Emplo, est. 34.9, prior 34.9

- June Average Hourly Earnings YoY, est. 3.6%, prior 2.0%

- June Average Hourly Earnings MoM, est. 0.3%, prior 0.5%

- June Unemployment Rate, est. 5.6%, prior 5.8%

- June Underemployment Rate, prior 10.2%

- May Trade Balance, est. -$71.3b, prior -$68.9b

- 10am: May Durable Goods Orders, est. 2.3%, prior 2.3%; -Less Transportation, est. 0.3%, prior 0.3%

- 10am: May Cap Goods Ship Nondef Ex Air, prior 0.9%; Cap Goods Orders Nondef Ex Air, est. -0.1%, prior -0.1%

- 10am: May Factory Orders, est. 1.6%, prior -0.6%; Ex Trans, prior 0.5%;