Gold & Basel III’s Trillion-Dollar Question

Authored by Mathew Piepenberg via GoldSwitzerland.com,

June 28th has come and gone, which means the much-anticipated Basel III “macro prudential regulation” to make so-called “safe” banks “safer” has officially kicked off in the European Union (as it will on July 1 for U.S. banks and January 1, 2022 for UK banks).

The trillion-dollar question for gold investors is now obvious: What next?

The short answer is: Gold will rise, but don’t expect a straight line or zero discomfort/volatility.

The longer answer, however, deserves a bit more context, unpacking and plain-speak; so, let’s roll up our sleeves and start from the beginning.

What is Basel III?

Basel III is essentially a long-delayed, controversial and internationally agreed-upon banking regulation which now, among other things, requires commercial banks to change their “net stable funding ratio” for gold held as a tier 1 asset on their balance sheet from 50% to 85% to make banks “stronger and more resilient in times of crisis.”

(Hidden premise: Are the BIS and its regulated banks worried about another “crisis”?)

Translated into non-banker English, for each asset a bank buys, they have to insure “stable funding” (as opposed to repo money, demand deposits or excess leverage) to buy/lever more stuff…

Translated even more simply, banks can’t use as much “maturity transformation” or “duration mismatches”—i.e., leverage and short-term money for long-term speculation (arbitrage)—to buy and sell precious metals, among other things.

Basel III, in essence, is requiring banks to engage in longer (rather than shorter-term) lending, and in a nutshell, this makes it far more expensive for banks to own “unallocated” gold, as most of the gold they owned in the past was just tier 3 paperlevered to the moon.

Getting back to more banker-speak, Basel III is an open move that requires banks to de-lever (slow down) their trade in paper gold.

This is accomplished by requiring/regulating banks to classify their actual physical gold holdings (bars or coins) as tier-1 (real/safe) assets and their paper gold holdings as tier 3 (levered, unsafe) assets, against which greater reserves will be required.

Translated once again into actual practice, Basel III means there will be a lot less banking leverage of, say a 400-ounce bar of gold (200:1 in 2016, to just 3:1 today) in the COMEX market, which market is slowly being transformed from a derivative-supported (i.e., levered) speculators’ exchange to a far more collateralized exchange.

Is Basel III Making the World Safer for Honest Banking?

Seems like a good thing, right? Less margin, less tier 3 risk, more “stable” assets, more reserves, safer banking practices, stronger bank balance sheets to protect depositors and, hey, perhaps even some actual and honest price discovery for precious metals?

Well…Yes and No.

Yes, the new regs will force greater liquidity requirements (“Net Stable Funding Ratios”) on banks, thereby preventing them from saying (falsely) that they have gold when in fact all they had was a lot of levered paper and more than one owner for the physical gold they did have.

But no, this will not lead to banks suddenly going on a forced buying spree (and skyrocketing price move) to replace all their old tier 3 paper gold with shiny new real, physical tier 1 gold to meet the new reserve requirements.

Despite this, many have made hay online claiming such an instant price rise would follow, but as we’ve said before, banks may be greedy, levered and dishonest, but they aren’t stupid, unprotected or suicidal…

That is, they’ve known these regs were coming and weren’t in any hysterical panic to nervously collect their pennies and suddenly buy more tier 1 gold and silver to meet the new reg percentages.

Not at all.

What many on the pundit-circuit and YouTube universe failed to remind their audience was that well before Basel III’s “reserve requirements” went live, those very same banks were already sitting on plenty of excess reserves thanks to prior bailouts (think 2008…).

In the U.S. banking sector, for example, the big boys were already well positioned with over $1.6T in excess reserves, yet all that is needed to meet Basel III is another $400B.

In short, banks are not even close to worrying about a forced purchase of more gold to meet Basel III reserve percentages; instead, they can simply allocate a portion of their fat excess reserves (compliments of you the tax-payer and forced bailout sponsor) to meet the new regs.

Re-Arranging (“Classifying”) the Deck Chairs on the Titanic

But what we do know from Basel III is that all that unallocated paper gold on the banks’ prior balance sheets needs to be re-considered, re-shuffled and re-classified.

In plain speak for non-bankers (i.e., the rest of us mortals), this means the banks need to make some decisions.

That is, will they set aside more money to buy physical gold to replace the paper gold, or will they simply reduce the size and scope of their old bullion business?

Take a wild guess…

As noted above, if you were expecting banks like Citi Group and Morgan (JP or Stanley) to suddenly convert all their tier 3 paper gold into tier 1 physical gold to make the 85% quota, think again.

Instead, they’ll be dumping a lot of the paper gold rather than spark some immediate price surge in the physical market.

In other words, banks will be reducing the size and scope of the precious metal trade, which adds to the cost of lending to every player in the gold and silver space–from coin shops to mining co’s.

Trading will tighten and clearing costs will rise to match the wider bid-ask spreads as gold and silver becomes less liquid, which could make institutional investors less interested in precious metals for no other reason than liquidity will be harder and spreads wider.

Suffice it to say, banks will always follow the path that is best for themselves and more onerous for gold in general and the rest of us little guys (i.e., anyone who isn’t a bank) in particular.

In short, expect a lot less bullion clearing services and hence much higher trading costs from the primary dealer banks.

But what does that have to do with the Trillion-dollar question—namely the future direction of gold and silver pricing?

Good question.

Basel III and Precious Metal Pricing

A. The Bearish/Cynical Take

As the traders say, buy the rumor and sell the news.

For the last three months, as Basel III rumors spread, gold saw a great deal of short covering and price upticks.

But once the so-called Basel III “news” approached the June 28 deadline, the selling kicked in on que and gold saw expected falls, which should be classic dip-buying signals for far-sighted investors.

Near-term, the fact that banks are reducing their bullion trades (or re-arranging their unallocated/tier 3 gold and allocated tier 1 gold) is not exactly a bullish signal for gold.

In the UK, for example, the very perturbed LBMA banks live and breathe primarily in the clearing and settling of unallocated, “paper” gold and silver—i.e., the very tier 3 assets most impacted by Basel III.

As indicated above, the UK’s regulatory clock starts ticking in January, so we can expect some serious stress (i.e., lower volume) in the soon-to-be beleaguered LBMA market in 2022.

For true cynics, it’s tempting to simply see Basel III as a clever way for the BIS and their central and commercial bank minions (think Deutsche Bank) to create a tightened gold trade designed to stifle gold market activity/lending and hence shield their otherwise worthless fiat currencies, as nothing scares broke sovereigns and fake currencies more than rising gold prices.

Furthermore, Basel III creates a convenient setting to push gold down and thus allow banks to front run the dip and buy more of the same at lower prices. Such cheating is nothing new from the big banks…

Fair point—from a cynic like myself.

But let’s stick to what we know in real time.

In particular, we can assert that the smaller players and traders in the gold space are about to feel a tight and painful pinch in everything from liquidity to loan terms.

Thus, for smaller enterprises in the gold sector (miners, mints, jewelers and refiners for example) who rely upon inexpensive and readily available liquidity (or loan terms), many will, as always, get priced out by the big players or loan-averse banks as more consolidation in this otherwise shrinking trading/lending universe takes place.

And as for gold traders hoping to go long to actual delivery on futures contracts with tight spreads, they’ll quickly discover that thanks to Basel III, they won’t be able to afford/use leverage to take physical delivery, but will instead have to keep rolling their contracts at a much higher price and wider spread.

Why?

Because unlike banks, whose cost of capital is zero, normal traders won’t be given a margin account from those same (and newly regulated) banks to pay for actual delivery.

That’s why the big banks banks are natural gold shorts: They know most traders can’t go long to full delivery.

In other words, the cost (as well as widening bid-ask spreads) of clearing and settling precious metal trades, as well as the cost of borrowing (and hedging) for miners and refiners in this sector will rise considerably as banks push the rising costs down the food chain while making profits on what is effectively their own “insiders arbitrage.”

Such shrinkage in bank “precious metal departments” could make gold less attractive to certain parties (expect far less players in the LBMA pitch), and hence push precious metals downward.

B. Some Volatility & Bullish Inevitability

On the bullish side, however, a smaller precious metals market combined with more demand and higher transactional costs can send prices higher, not lower.

Furthermore, the fact that Basel III reclassifies physical, or allocated, gold as a tier 1, zero-risk asset, means more banks (commercial and central) are likely to increase their vaulted positions of gold and silver.

That’s bullish.

But as already noted, be it forward contracts in London or futures contracts on COMEX, banks will clearly be less encouraged or voluminous in the precious metal trade.

For this reason, I, and many others, expect greater price volatility in gold and silver, but ultimately far better price discovery when the myriad other gold tailwinds of which we’ve written (i.e., rising inflation, negative real rates, central bank loan guarantees, expanding money supply and a falling dollar) outside of Basel III send gold demand (and hence gold prices) naturally higher.

With the Basel III regs in place in such a macro tailwind environment for gold, there will be far less big-bank paper-shorts impacting silver and gold’s natural price rises going forward.

This means actual price discovery as opposed to artificial price fixing by the COMEX’s big banks.

Thus, if the BIS was hoping to discourage gold via Basel III, they may want to be careful what they ask for, as their plan is likely to backfire as the rest of the world’s currencies are already on fire and burning to ash.

Putting It Together

In sum, there is a wide arc of opinions and possibilities as to the near-term and longer-term impact of Basel III on gold and silver pricing.

As stated above, we can expect increased price volatility, and even further declines in precious metals, but longer term, the arc of history, improved price discovery and the good ol’ natural laws of supply and demand make gold an undeniably critical asset going forward.

At Matterhorn Asset Management, we serve sophisticated precious metal investors and wealth preservation clients, not speculators, pattern traders or trend followers.

As such, near-term price moves on the backs of headline-making regulations never detract us, or our clients, from the blunt recognition that the global financial system in general, and global currencies in particular, are heading nowhere but downward.

Gold is insurance against a system already on fire.

Ironically, the very fact that the Basel III regs are making noise today is just further evidence of this ultimate direction.

That is, the fear (as well as unspoken realization) that the very financial system which the BIS and others have mis-managed for years is now at risk-levels never seen before in history precisely explains what prompted Basel III’s arrival today after so many false starts yesterday.

In other words, the very architects of the global financial crisis (an unprecedented global debt disaster coupled with a risk-asset mega bubble) are worried about the catastrophe they alone created and which they can no longer pin on the COVID (fiasco).

Unlike those “banking experts,” we in Zurich have always played the long game not the putting green.

Regardless of whether Basel III brings near-term mayhem or calm to the gold markets, we have zero doubts that the only assets to bring individual calm to such global mayhem in this broken financial setting are the very same assets the big boys are currently doing their best to “regulate,” namely: Gold and silver.

Ironically, and despite even Basel III’s attempt to make allocated gold a risk-free priority over unallocated paper gold on their own balance sheets, we also know, and have know for decades, that even the “allocated” gold held by their bank customers is not in fact owned by the customers, but by the banks themselves.

That’s why we store our clients’ fully-insured precious metals outside of this fractured and band-aid regulated banking system in secured vaults where the gold is held and marked in client names, not ours.

Alas: Zero counter-party risk, 100% ownership.

Stated otherwise, we’ve been thinking way ahead of the bankers and their regulators for years.

Amidst all this noise are simple guideposts.

We knew physical gold was a “safe asset” long before Basel III made it tier 1 official; we also knew, like many other sophisticated investors, that “non-yielding” physical gold was a far superior asset than negative yielding sovereign bonds (i.e., “return-free risk”)…

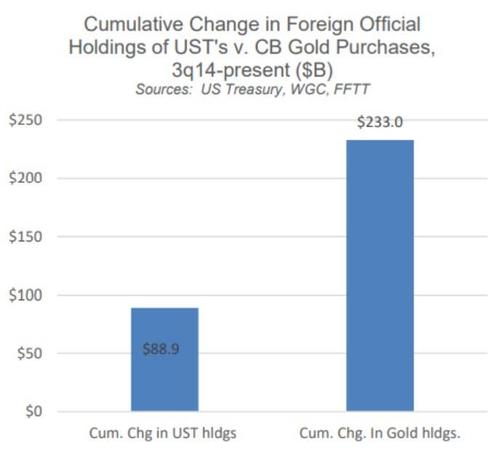

Heck, even the central banks themselves can’t deny this, which is why they’ve been purchasing more gold than Treasuries.

In short, what banks do and what they say are very different things. Basel III is just another attempt to make the unsafe appear safe, whereas we’ve been safe (and more prepared) all along.

For serious precious metal investors seeking genuine wealth preservation and currency insurance managed by the global leader in premier gold and silver stored in the world’s most secure vault, we are a far better choice than the banks.

Visit us here and see why.

Tyler Durden

Fri, 07/02/2021 – 06:30

via ZeroHedge News https://ift.tt/2UesCeK Tyler Durden