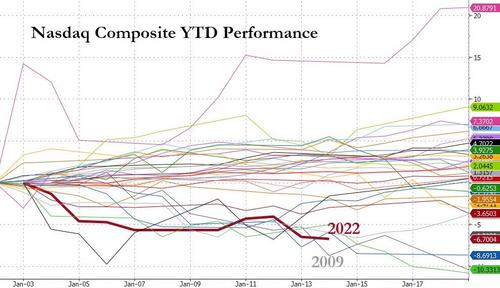

Nasdaq Extends Worst Start To A Year Since 2009 As Fed Sends Rate-Hike Odds Soaring

All major US equity indices are now lower on the year with the Nasdaq Composite the worst-performer (and The Dow the least bad horse in the glue factory)…

In the last 30 years, only 2009 saw a worst start to the year for the Nasdaq Composite…

Source: Bloomberg

On the week, Nasdaq ripped higher today to get back to even on the week, Small Caps and The Dow were the week’s laggards…

Today’s squeeze bounce came off Monday’s lows for the “most shorted” stocks…

Source: Bloomberg

Nasdaq bounce today was AGAIN perfectly off the 200DMA (and The Dow fell back below its 50DMA)…

Banks were battered today – after their big run-up this year – with JPM suffering its biggest post-earnings decline in at least 20 years and Goldman, JPMorgan, and Morgan Stanley all dropping into the red for the year. Meanwhile, WFC is up almost 20% YTD!…

Source: Bloomberg

The longest-duration, hyper-growth and non-profitable tech companies crashed further this week, now down a shocking 49% from its record highs in Feb 2021 (down 7 of the last 9 weeks)…

Source: Bloomberg

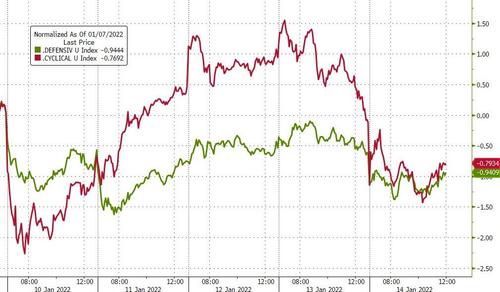

Defensives and Cyclicals both ended down just short of 1% on the week with Cyclicals playing the high vol ride…

Source: Bloomberg

Growth underperformed on the week, but Value stocks were also lower by the close…

Source: Bloomberg

Yields were mixed this week with the long-end outperforming (managing to end the week very, very marginally lower), while the short-end was smashed 10bps higher…

Source: Bloomberg

Today saw a pretty good puke across the whole curve with 30Y Yields up 8bps, back to unch on the week…

Source: Bloomberg

The yield curve tumbled further this week, now flatter on the year

Source: Bloomberg

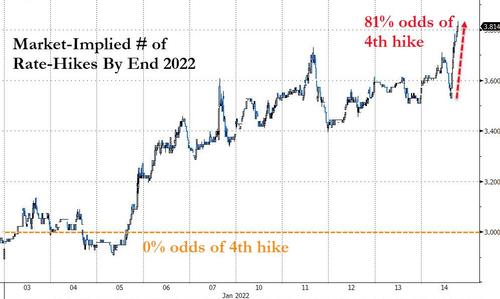

Rate-hike odds surged today (despite the bad news is good news narrative) after Jamie Dimon suggested – with no supporting evidence that The Fed could hike 6 or 7 times this year – with the market now implying a 75% chance of a 4th rate-hike by the end of the year…

Source: Bloomberg

This is what it looks like when doves die…

Despite a decent bounce today, the dollar dropped this week – now its worst start to a year since 2018…

Source: Bloomberg

Cryptos had another choppy week but ended higher with BTC and ETH up around 3% on the week…

Source: Bloomberg

Bitcoin is about to “suffer” a ‘death cross’ (the 50DMA crossing below the 200DMA). While very scary for some, we note that the last ‘death cross’ marked the lows in June 2021…

Source: Bloomberg

Gold is up for the 4th week of the last 5 and had its biggest week in 2 months…

Oil prices surged this week with WTI topping $84 – back to October highs. Oil is up 5 of the last 6 weeks…

NatGas pumped and dumped this week…

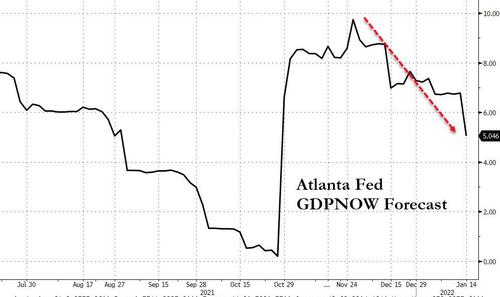

Finally, US Macro Surprise data tumbled into the red today after ugly retail sales and industrial production data (and UMich sentiment)…

Source: Bloomberg

And in turn that dragged down Q4 GDP expectations…

Source: Bloomberg

And all of that is happening as The Fed jawbones 4, 5, 6 , 7 rate-hikes and QT this year.

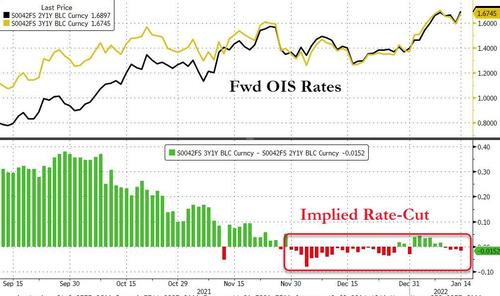

And the market is not expecting The Fed to go all the way here, implying rate-trajectory-inflection between 2 and 3 years (this spread was +75bps in March 2021 – implying 3 rate-hikes in 2024)…

Source: Bloomberg

A Fed faux-pas is coming…

Tyler Durden

Fri, 01/14/2022 – 16:01

via ZeroHedge News https://ift.tt/33llHVR Tyler Durden