Following yesterday’s furious quarter-end puke, which saw the S&P tumble 50 points in the last hour of trading as a massive $10 billion Market on Close sell imbalance sparked a liquidation frenzy, U.S. index futures started off the new quarter on the right foot, rising as investors weighed a drop in oil prices sparked by Biden’s unprecedented pre-midterm election draining of the petroleum reserve, ongoing developments in the Ukraine war and tightening monetary policy ahead of ISM and payrolls data. S&P500 and Nasdaq 100 futures gained around 0.5% before March payrolls figures later on Friday, after U.S. stocks ended their worst quarter since the start of the pandemic. Europe’s Stoxx 600 gained after its worst quarter since the pandemic bear market. Oil reversed an earlier decline as euro-area inflation accelerated to another all-time high and Russia’s Gazprom PJSC started telling clients how to pay for gas in rubles. Treasury yields rose and the dollar was steady as traders await the jobs report, which unless it is a total disaster, will strengthen the case for a 50bps rate hike in May. U.S. data on Friday include nonfarm payroll and ISM data while no major company is expected to report earnings.

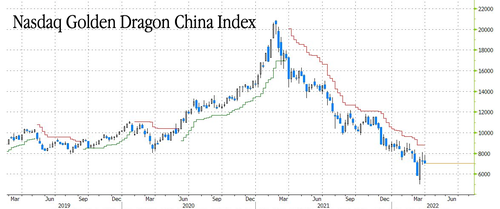

U.S.-listed Chinese stocks jumped in premarket trading after Bloomberg News reported that Chinese authorities are preparing to give U.S. regulators full access to auditing reports of the majority of the 200-plus companies listed in New York. Alibaba shares rose 5.8% in premarket trading; E-commerce peers JD.com up 4% and Pinduoduo up 7.9%. Didi Global was among the top gainers, rising more than 18%, following a 15% drop Thursday. Meanwhile, shares of Lulu’s Fashion Lounge Holdings Inc. rose 27% in U.S. premarket after better-than-expected fourth-quarter and full-year guidance. Here are some other notable premarket movers:

- Chicken Soup For The Soul Entertainment (CSSE US) shares rise 21% in U.S. premarket, rebounding from yesterday’s losses, after Guggenheim’s Michael Morris (buy) said the company posted a “solid” 4Q performance, with sales modestly below his estimates but adjusted Ebitda slightly better.

- GameStop (GME US) shares rose 15% in premarket trading and were on course to open at the highest level this year after the video-game retailer announced plans for a stock split, fueling a rally in fellow so-called meme stocks.

- Redwire (RDW US) slumps 22% in U.S. premarket trading after the space infrastructure company reported 2021 results, with Jefferies saying that while the firm’s outlook was encouraging, it was disappointing versus prior expectations.

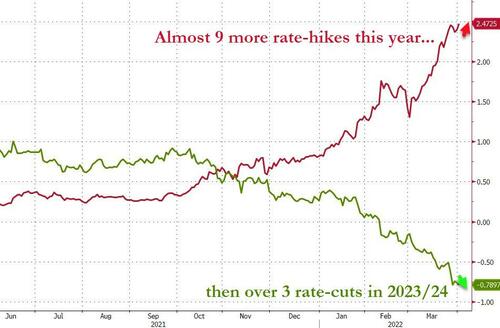

Meanwhile, the curve between two-year and 10-year Treasuries yields is flipping between positive and negative, signaling that the countdown to the next recession has begun (see “The Yield Curve Inverts: What Happens Next“).

“The market, like the Fed, has no idea how much tightening is necessary to stop a wage inflation spiral, but by upping the ante on the market with a series of 50bp rate hikes this year and a higher terminal rate, it can regain the control of the narrative and market expectations,” said Sebastien Galy, senior macro strategist at Nordea.

Investors begin a new quarter wondering if the fighting in Ukraine, the isolation of Russia and the Fed’s increasingly hawkish turn will engender still more volatility and losses for stocks and bonds. Raw materials are the only key asset class to deliver major gains so far in 2022.

Meanwhile, in Ukraine, talks between Ukraine and Russia resumed Friday via video link, following meetings earlier in the week in Turkey. Russia said two Ukrainian military helicopters made a rare strike across the border, hitting an oil tank facility in the city of Belgorod. Russian Foreign Minister Sergei Lavrov said Moscow is preparing a response to Ukraine’s proposals on ending hostilities; Lavrov also said Russia is preparing a response to Ukraine’s proposals, says there has been movement forward; he also added that Russia has seen “much more understanding” of the situation in Crimea and Donbass from the Ukrainian side. Lavrov says peace talks with Ukraine need to continue. UK reportedly urged Ukraine not to back down and is concerned US, France and Germany will push Ukraine to “settle” and make significant concessions to Russia, according to The Times citing a government source. Mayor of Ukraine’s Mariupol says Russian forces are not allowing humanitarian aid in; City is dangerous to try and exit.

European equities also drifted higher after a slow start. Euro Stoxx 50 rises 0.7%. IBEX outperforms, adding 0.9%, FTSE 100 lags. Retailers, banks and miners are the strongest performing sectors. Euro-zone inflation accelerated to another all-time high as Russia’s invasion roiled global supply chains and provided a fresh driver for already-soaring energy costs. Euro-zone March consumer prices surged 7.5% from a year ago, up from 5.9% in February and far higher than the 6.7% median estimate in a Bloomberg survey.

The Stoxx Europe 600 Index however, was on the rise, led by retail and banking stocks. Here are some of the biggest European movers today:

- Santander shares rise as much as 3.2% after reiterating its financial targets for the year and saying its business remained resilient in the first quarter. The statement provides reassurance of recent trends, Barclays writes.

- Vestas Wind Systems gains as much as 5.4% after announcing orders totaling 2,179 MW in 1Q, with Handelsbanken saying the order intake is “promising” and well-above estimates.

- Bridgepoint Group jumps as much as 7.8% after the private-equity firm was upgraded to buy from neutral at Citi following a drop in the shares since the broker’s initiation in August 2021.

- Assicurazioni Generali rises as much as 3.8%, climbing for a third session, amid speculation the Italian insurer may get involved in industry M&A going forward.

- Greggs gains as much as 2.9% after Berenberg reiterates its buy recommendation, saying there is a “rare opportunity” to invest in the U.K. bakery chain at a “reasonable multiple.”

- Yara climbs as much as 1.8% after the company said it pre-ordered 15 floating bunkering terminals from Azane Fuel Solutions to establish a carbon-free ammonia fuel bunker network in Scandinavia.

- Stratec rises as much as 21% after a Bloomberg report that EQT and KKR are among several private equity firms weighing bids for the German health-care technology provider.

- Energiekontor jumps as much as 6.8%, extending its record high, after Warburg raised its price target to a Street- high, saying there is an “appetite for more” following Thursday’s FY results.

- Sodexo shares fall as much as 10% after the French caterer said the environment “remains uncertain” due to intermittent local outbreaks of Covid-19 and the war in Ukraine.

Russian stocks gained for a third day, the longest winning streak since trading resumed on March 24. Talks between Ukraine and Russia will resume Friday via video link, following meetings earlier in the week in Turkey. Russian Foreign Minister Sergei Lavrov said Moscow is preparing a response to Ukraine’s proposals on ending hostilities.

The manufacturing resurgence in Europe and Asia softened in March as factories saw worsening supply shortages and soaring costs after Russia’s invasion. Friday’s data follow inflation overshoots this week from Spain and Germany that prompted investors to bring forward bets on when the European Central Bank will end almost eight years of negative interest rates.

Earlier in the session, Asian stock retreated for a second day amid concerns about the extent the war in Ukraine will hurt global growth and as Chinese tech shares extended a selloff. The MSCI Asia-Pacific Index slid as much as 1.1% before paring about two-thirds of that loss. The benchmark still remained on pace to finish the week up 0.3%, extending its winning streak to a third week. Tech shares including Taiwan Semiconductor Manufacturing and Alibaba were major drags on Friday as traders assessed economic data and continued to eye possible U.S. delistings of Chinese firms. Equities in Japan underperformed the region while China’s consumer shares boosted the mainland benchmark. Investors are watching the impact of soaring inflation and higher interest rates on global growth as the war in Europe continues. Asia’s manufacturing resurgence softened in March as factories saw worsening supply shortages and surging costs after Russia’s invasion of Ukraine. Data on Friday showed Japan’s business mood weakened while South Korean imports jumped on rising costs. Also on investors’ radars are the trading halts of dozens of firms in Hong Kong from today after they missed a deadline to report annual results, increasing uncertainty in the market. “We are in the middle of a war between two globally vital suppliers of energy and food,” said Justin Tang, the head of Asian research at United First Partners. “The ramifications are plenty and as long as there is no cease fire, we will continue to experience ebbs and flows in volatility.” Asian stocks finished their worst quarter since early 2020 on Thursday with a drop of nearly 7%. Still, the measure has bounced back from the quarter-low touched in mid-March.

Sri Lanka’s stock market stopped trading on Friday and the rupee extended its loss after protests against surging living costs and daily power cuts amid dwindling foreign-exchange reserves. Trading in 33 Hong Kong-listed stocks was halted after a number of firms missed a deadline to report annual results

Japanese stocks fell in Tokyo fell for a third day after U.S. peers declined and the Tankan survey showed a gloomier view of business conditions among Japan’s biggest manufacturers. The yen slipped 0.5% against the dollar during the trading day, helping stocks trim earlier losses. Still, both major gauges capped their first weekly losses in three, shedding more than 1.7% each since March 25. Electronics and auto makers were the biggest drags as the Topix fell 0.1% Friday, paring an earlier slide of as much as 1.3%. Tokyo Electron and Fast Retailing were the largest contributors to a 0.6% loss in the Nikkei 225. The Tankan index of sentiment dropped to 14 from a revised 17 in the previous quarter, the first deterioration since June 2020, according to the central bank’s quarterly report Friday. The business mood among large non-manufacturers slipped to 9 from a revised 10 in the December report

India’s benchmark stocks index completed its third weekly gain in four weeks, as local buying helped steady war-induced volatility in equities. The S&P BSE Sensex rose 1.2% to 59,276.69 in Mumbai, taking it weekly advance to 3.3%. The key gauge completed its best monthly climb since August in the previous session. The NSE Nifty 50 Index rose 1.2% to 17,670.45 on Friday. HDFC Bank Ltd. surged 2.4% to its highest in more than a month and was the biggest boost to the Sensex, which saw 25 of the 30 shares trading higher. All 19 sectoral sub-indexes compiled by BSE Ltd. rose, led by a measure of utilities. Funds in India bought $5.2 billion worth of shares in March, while foreign investors extended their selling to a sixth consecutive month. The new fiscal year and quarter have started with concerns about the war in Ukraine, a hawkish U.S. Federal Reserve and the impact of higher commodity costs on company earnings. “We expect FY23 to witness continued volatility in equity markets, especially in the first half of the year with rising interest rates globally and high inflation, which is expected to persist,” Nishit Master, portfolio manager at Axis Securities Ltd., wrote in a note. The brokerage expects the Nifty index to rise to 20,200 by year-end and is positive on metals, hospitals, oil refining and capital goods.

In FX, the Bloomberg Dollar index inched up as the greenback traded mixed against its Group-of-10 peers; commodity currencies and the Swedish krona led gains while the yen was the worst performer. The euro fell and European bonds came off lows after euro-zone March consumer prices surged 7.5% from a year ago, up from 5.9% in February and more than the 6.7% median estimate in a Bloomberg survey. The pound consolidated against the euro, after rebounding from its weakest level since December on Thursday; the yen slid for the first time in four days. Japanese government bond yield curve resumed its steepening even as the Bank of Japan raised the amounts it plans to buy through regular market operations this quarter. Australia’s yield curve bear flattened, following a similar move in Treasuries. New Zealand dollar weakened; a gauge of consumer confidence dropped to an all-time low last month, according to ANZ data.

In rates, Treasuries dropped across the curve Friday as investors positioned before U.S. jobs data forecast to show average hourly earnings accelerated in March, backing the case for a faster pace of Federal Reserve interest-rate hikes. Treasury futures traded off session lows in early U.S. trading, although yields remain cheaper by 4bp to 7bp across the curve after Thursday’s late month-end selling was extended in early Asia. Fixed income weakness is Treasuries centric, with both bunds and gilts outperforming on the day. 10-year yields trade around 2.40% after peaking at 2.437% in early European session – bunds and gilts outperform by 4bp and 2bp in the sector. Long-end led losses steepens 5s30s spread by 1.4bp and 2s10s by 2bp on the day; March jobs report is due at 8:30am with headline change in payrolls expected at 490k vs. 678k prior — whisper number is higher than estimate at 529k. In Europe, the German curve bear steepened, cheapening up 2-3bps across the back end but broadly brushing off a hot Eurozone inflation print . Peripheral spreads mostly widen to core with long end Spain underperforming. Cash USTs maintain Asia’s bear flatten bias ahead of today’s payrolls release; the belly cheaper by ~6bps.

In commodities, crude futures recoup Asia’s weakness. WTI returns to little changed, regaining a $100-handle after a brief dip in late Asia. Base metals are mixed; LME zinc rises 1.4%, outperforming peers. LME copper lags. Spot gold falls roughly $2 to trade near $1,935/oz.

The US will also have the March ISM manufacturing reading, while global manufacturing PMIs are due. Otherwise, central bank speakers include the ECB’s Centeno, De Cos, Makhlouf, Schnabel and Knot, as well as the Fed’s Evans.

Market Snapshot

- S&P 500 futures up 0.4% to 4,548.50

- STOXX Europe 600 up 0.3% to 457.37

- MXAP down 0.4% to 179.71

- MXAPJ little changed at 590.96

- Nikkei down 0.6% to 27,665.98

- Topix down 0.1% to 1,944.27

- Hang Seng Index up 0.2% to 22,039.55

- Shanghai Composite up 0.9% to 3,282.72

- Sensex up 0.7% to 58,980.92

- Australia S&P/ASX 200 little changed at 7,493.80

- Kospi down 0.6% to 2,739.85

- German 10Y yield little changed at 0.58%

- Euro little changed at $1.1065

- Brent Futures down 1.0% to $103.69/bbl

- Gold spot down 0.3% to $1,931.84

- U.S. Dollar Index up 0.16% to 98.47

Top Overnight News from Bloomberg

- China’s factory activity fell to its worst level since the pandemic’s onset two years ago and a housing slump showed no sign of easing, darkening the outlook for the world’s second- largest economy

- Bundesbank President Joachim Nagel urged the European Central Bank to respond to quickly accelerating price pressures.

- Australia named Michele Bullock as the Reserve Bank’s first female deputy governor, propelling her to the front of the queue to succeed Philip Lowe in the top job

- At the U.S. Commerce Department, Secretary Gina Raimondo’s teams are working on ways to further undermine Putin’s ability to wage war

- For all the hardships visited on consumers at home and the financial chokehold put on the government from abroad, Bloomberg Economics expects Russia will earn nearly $321 billion from energy exports this year, an increase of more than a third from 2021.

- Iron ore futures in Asia gained with investors anticipating a strong recovery following the lifting of virus-related restrictions, even as news of Chinese housing giants missing earnings-report deadlines emerged

- Prime Minister Fumio Kishida’s government signed off on the reappointment of one of the Bank of Japan’s key policy architects in a move that suggests the central bank is looking for policy continuity after Governor Haruhiko Kuroda steps down next April

A more detailed look at global markets courtesy of Newsquawk:

Asia-Pac stocks were cautious following the uninspiring lead from Wall St, where the major indices closed off their worst quarterly performance in two years and as the region digested weak data releases. ASX 200 traded rangebound as pressure from losses in tech, industrials and financials was counterbalanced by resilience in the commodity-related sectors and upgrade to Australian PMI data. Nikkei 225 was subdued after mixed Tankan data in which the headline Large Manufacturing Index topped estimates, but Large Manufacturers and Non-Manufacturers’ sentiment worsened for the first time in 7 quarters. Hang Seng and were mixed with sentiment clouded after the PBoC drained liquidity andShanghai Comp. Chinese Caixin Manufacturing PMI slipped into contraction territory, although the mainland recovered amid the partial lifting of the lockdown in Shanghai and as Chinese press continued to advocate monetary easing

Top Asian News

- Shanghai Shifts Lockdown; Singapore Border: Virus Update

- Quarantine Eased for Hong Kong Flight Crew in Boost for Cathay

- China Chipmaker’s Buyer Said to Miss $9 Billion Payment Deadline

- Kasikornbank Said to Weigh Sale of $2 Billion Asset Manager Unit

European equities (Stoxx 600 +0.6%) opened marginally firmer before extending on gains after positive commentary from Russian Foreign Minister Lavrov. The Stoxx 600 set to close the week out with marginal gains of around 0.6% in what has been a choppy week for indices. Sectors in Europe are higher across the board with Retail, Banks and Autos top of the leaderboard.

Top European News

- London IPO Market Hasn’t Been This Bad in More Than a Decade

- Tiber Crossing Left in Limbo After War Sends Steel Surging

- Global Manufacturing Rebound Falters as War Takes Its Toll

- EU to Warn China It Will Hurt Global Role by Helping Russia

In FX, the Yen has relented as yields rebound and repatriation demand dries up – Usd/Jpy bounced further from recent lows beyond near term resistance through to circa 122.75. Greenback has regrouped in advance of NFP with the DXY straddling 98.500. Aussie outperforms as risk appetite picks up and 0.7500 continues to prove pivotal. Euro finds a base after marked month end reversal as hot inflation offset lukewarm manufacturing PMIs – Eur/USD holding around 1.1050 after soaking up stops on a minor and brief half round number break.Yuan weaker after sub-50 Caixin Chinese manufacturing print, softer PBoC Cny midpoint fix and 7-day liquidity drain – USDCNH above 6.3650.

In commodities, WTI (+0.6%) and Brent (+0.8%) kicked the session off on the backfoot following yesterday’s SPR announcement by the Biden administration with WTI breaching it’s weekly low printed on Tuesday at USD 98.44 with Brent so far unable to take out its weekly low of USD 102.19. Since then, crude benchmarks have attempted to claw back lost ground and sit in minor positive territory. White House Press Secretary Psaki said a gas tax holiday is not off the table, according to Reuters. US House Majority Leader Hoyer said oil companies should either produce on leases and drill wells or pay a fee for unused leases and idled wells, according to EIN News. Russian oil and gas condensate production slipped to 11.01mln BPD in March vs. 11.08mln BPD in February, according to Reuters sources Gazprom says refilling storage ahead of winter will be a challenge for the EU. Gazprom says it has begun sending requests of gas-for-rouble payment switch to clients today; sats it remains a responsible partner and continues to secure gas supplies

US Event Calendar

- 08:30: March Change in Nonfarm Payrolls, est. 490,000, prior 678,000

- Change in Private Payrolls, est. 495,000, prior 654,000

- Change in Manufact. Payrolls, est. 32,000, prior 36,000

- March Unemployment Rate, est. 3.7%, prior 3.8%

- Underemployment Rate, prior 7.2%

- Labor Force Participation Rate, est. 62.4%, prior 62.3%

- Average Hourly Earnings YoY, est. 5.5%, prior 5.1%; MoM, est. 0.4%, prior 0%

- Average Weekly Hours All Emplo, est. 34.7, prior 34.7

- 09:45: March S&P Global US Manufacturing PM, est. 58.5, prior 58.5

- 10:00: March ISM Employment, est. 53.1, prior 52.9

- ISM Prices Paid, est. 80.0, prior 75.6

- ISM New Orders, est. 58.5, prior 61.7

- ISM Manufacturing, est. 59.0, prior 58.6

- 10:00: Feb. Construction Spending MoM, est. 1.0%, prior 1.3%

DB’s Jim Reid concludes the overnight wrap

Filling in while Jim is on holiday, my quick scan for sports-related injuries for this introduction yielded nothing. Meanwhile, a scan of quarter end markets showed sovereign bonds again yielding less than nothing, as 2yr bund yields (-7.8bps) fell back below 0 to -0.09% while the 2s10s Treasury curve closed below zero for the first time since 2019. Yields farther out the curve followed oil and transatlantic equity prices lower as well. No rest for the weary, though, as today’s US employment data kickstarts the new quarter.

Before diving into markets, a couple of research plugs.

*** Jim’s latest chartbook, “The yield curve inverts … what happens next?”, is out. We looked at all things inversion, including recession risks, asset price performance, the Fed’s viewpoint, our economists’ latest recession models and also how yield curve inversions have been explained away in previous cycles. You can take a look here ***

Staying in advertising mode, with Q2 starting, we will publish our Q1 performance review shortly. Q1 was a dramatic time in financial markets, with Russia’s invasion of Ukraine, accelerating inflation, the Fed hiking rates, and the yield curve closing the quarter inverted. As a result, it was a pretty bad month for most assets, with losses across equities, credit, and sovereign bonds. The big exception were commodities as energy, metals and agricultural goods realized large gains. See the full report out shortly for more.

Turning back to yesterday’s markets, Brent and WTI crude futures fell -4.88% and -6.99%, respectively, following the US’s plan to release 1m barrels per day from its Strategic Petroleum Reserve for the next six months to combat eye-watering energy prices, the largest such SPR release on record. In an address to the nation, President Biden also announced measures to pressure domestic producers to increase their supply to the market along with easing regulations that currently restrict oil transport between American ports to American vessels. The President will also invoke the Defense Production Act to compel manufactures to prioritize the production of minerals used for large capacity batteries.

While the UK is considering whether to join the reserve-releasing effort, OPEC+ production will be steady as she goes, with the cartel ratifying the plan to increase production only gradually by 432k barrels a day, in line with expectations. Even without a material increase in OPEC+ production, reports overnight that the US was strategically aligned with allies on Iran inched us closer to a nuclear deal that would open up Iranian supply. Crude oil futures are down a further -3.23% as we go to press this morning. The debate about Russian natural gas invoicing appeared to reach a denouement yesterday; European importers will be able to pay for Russian supply in euros and dollars as contracts specify, with the conversion to rubles happening internally within Russia. Nevertheless, European natural gas gained +5.83%.

On the war, more reports joined the chorus signalling that Russian troops were indeed retreating from certain theatres, including various cities, airports, and the Chernobyl nuclear facility. While positive, the consensus is the locus of the war is moving to the east, rather than ending. Negotiations between Ukraine and Russia are set to resume today.

Foreshadowed in the lede, European sovereign yields staged a large rally to end the quarter. 10yr bunds, OATs, and BTPs all rallied more than -9bps, led by falling inflation compensation on the drawdown in oil prices; 10yr breakevens across Germany, France, and Italy, narrowed -7.0bps, -8.1bps, and -6.5bps, respectively. The rallies weren’t confined to the long-end, as -6.8bps of expected ECB rate hikes through 2022 were priced out as well.

It was smoother sailing for Treasury yields after a stormy quarter, but 2s10s nevertheless managed to dip below zero to close the quarter after briefly testing the waters earlier this week. 2yr yields climbed +2.8bps while 10yr yields dropped anchor, falling -1.1bps, leaving 2s10s at -0.06bps. As was the case earlier this week, the curve re-steepened after the initial inversion plunge, trading at +1.2bps this morning.

Stocks retreated on both sides of the Atlantic, with the STOXX 600 and S&P 500 falling -0.94% and -1.57%, cementing the first negative quarterly return for both indices since the original Covid onslaught in Q1 2020. STOXX 600 utilities (+0.37%) were the only sector in the green across both indices, with cyclical stocks the largest underperformers. The retreat was likely exacerbated by quarter end, which served to push the VIX (+1.23ppts) back above 20 for the first time this week.

Major Asian bourses are trading on the downbeat with tech stocks among the worst performers. Losses in the region are led by the Hang Seng (-0.72%), extending its previous session losses, with Chinese tech stocks listed in Hong Kong plunging. The Nikkei (-0.42%) is lagging after the BOJ’s quarterly Tankan business sentiment survey revealed that sentiment at Japan’s large manufacturers soured in the first three months of 2022. Chinese Caixin services PMI dropped to 48.1 in March, the steepest rate of contraction since February 2020. The deterioration was mainly triggered by the domestic Covid-19 resurgence. Despite the underwhelming data, Chinese stocks are outperforming the region, with the Shanghai Composite up +0.69%.

Outside of Asia, stock futures in the US are pointing to a positive start, with contracts on the S&P 500 (+0.25%), Nasdaq (+0.26%) and Dow Jones (+0.25%) all trading higher.

In data, US PCE increased 0.4%, month-over-month, in line with expectations, while the year-over-year measure moved to fresh four-decade high of 5.4%. The Chicago PMI printed at 67.9 vs. expectations of 57.0, while weekly initial jobless claims ticked up to a still low 202k vs. expectations of 196k. German unemployment fell by -18k in March (vs. -20k expected), which is the smallest monthly decline since last April. In turn, the unemployment rate remained at 5.0%, in line with expectations.

To the day ahead, Q2 kicks off with the March US employment situation report in the New York morning. Strong January and February data coincided with upside surprises and revisions to payrolls data, lending credence to the Fed’s position that the labor market is ready to withstand much tighter monetary policy, if not beckons it. Our US economists expect nonfarm payrolls to increase by +400k, bringing the unemployment rate to a post-pandemic low of 3.7%.

The Euro Area flash CPI will be the other main data, due at 10 am London, and is expected to show inflation rise to a fresh record since the single currency’s formation. After the massive upside surprises from Germany and Spain’s releases on Wednesday, yesterday brought another above-consensus print from France, where inflation rose to +5.1% on the EU-harmonised measure (vs. +4.9% expected). Meanwhile, Italy was the only one of the 4 biggest Euro Area countries not to see an upside surprise, but the +7.0% print (vs. +7.2% expected) nevertheless marked a gain over February’s +6.2% release.

The US will also have the March ISM manufacturing reading, while global manufacturing PMIs are due. Otherwise, central bank speakers include the ECB’s Centeno, De Cos, Makhlouf, Schnabel and Knot, as well as the Fed’s Evans.