Ugly, Tailing 7Y Auction, But It Could Have Been Worse

After one ugly 2Y auction and one catastrophic 5Y sale on Monday, today the week’s truncated auction schedule saw the last coupon issuance for the week when the Treasury sold $40BN in 7Y paper. And while the auction was not as bad as the infamous Feb 21 “failed” 7Y auction but it sure was ugly.

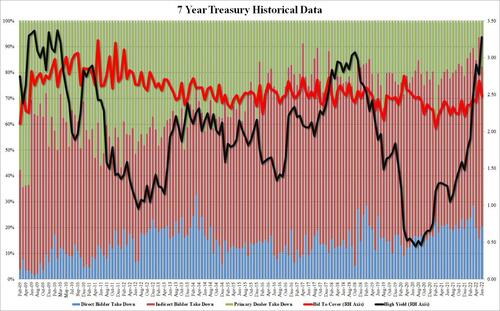

The high yield of 3.280% was just over 50bps higher compared to the 2.777% in the May auction. and was the highest since Feb 2010 when the auction printed at 3.37%. More importantly, the auction also tailed the When Issued 3.259% by 2.1bps, the biggest tail of 2022 (Dec 2021 was 2.3bps).

The bid to cover dropped from 2.690 to 2.481, the lowest since April, but was above the six-auction average of 2.41.

The internals were also ugly, if not dire, with Indirects sliding from 77.9% to 61.9%, the lowest since March and below the 64.9% recent average. And with Directs rising to 20.4%, the most since March, Dealers were left holding 17.7%, up from the record 6.4% in May.

Overall, an ugly auction, but not catastrophic and certainly stronger than yesterday’s 5Y. That said, a few weeks of QT, a few more rate hikes and we won’t be surprised if we have an actual failed belly-buster auction.

Tyler Durden

Tue, 06/28/2022 – 13:19

via ZeroHedge News https://ift.tt/vrBM5dj Tyler Durden