West Coast Rail Networks Clogged As Supply Chain Normalization Delayed

The key question is when supply chain congestion eases in the US. The question to that answer is not yet, as a new Bloomberg report shows the US’ largest containerized seaport in Los Angeles and Long Beach in Southern California (responsible for 42% of all containerized trade with Asia) has been hit with worsening rail delays.

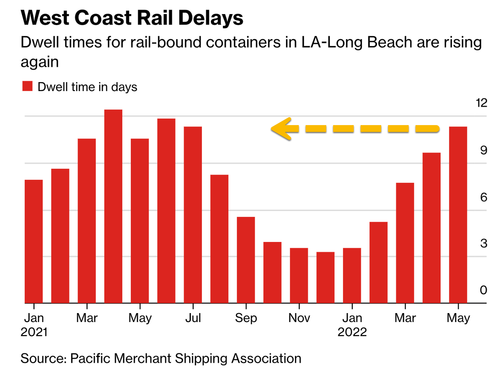

Dwell times for rail-bound containers have been steadily increasing since February and are back to levels not seen since the major port bottlenecks of summer 2021.

The Port of Los Angeles has recently enlisted help from the White House to clear a backlog of rail-bound containers that’s tripled since February, taking up space on its docks and causing congestion. As of Monday, there were more than 28,000 rail-container units on the ground, about two-thirds of which had been waiting to be picked up for nine days or more. -Bloomberg

Increasing rail congestion comes as thousands of dockworker contracts across the West Coast are about to expire following unsuccessful negotiations between labor unions and major railroads.

If dockworkers or railroad workers strike, normalizing supply chains would be delayed. There’s also the risk of China’s reopening, and the backlog of goods headed in containers for US West Coast ports could further snarl supply chains.

Bloomberg also outlines that trucking woes and lack of warehouse space exacerbate bottlenecks for rail networks.

Trucking

More than half of the truck gates at the Port of Los Angeles are still going unused on average due in part to the inconsistent staffing and operation hours at the terminals and distribution centers outside of the port, on top of the lack of space at warehouses.

Moving about 70% of the US’s freight tonnage, truckers don’t feel encouraged to go in during off-peak hours because parts of the supply chain often don’t operate around the clock, said Matt Schrap, chief executive officer of the Harbor Trucking Association. Before the bottlenecks emerged, truckers could pick up containers in the early morning and then store them at truck yards until space opened up at warehouses. But these sites are now “full of empty containers and chassis, and land has become an extreme premium.”

“More trucks aren’t going to necessarily solve the thing — it’s a productivity issue,” Schrap said in an interview.

Warehousing

The vacancy rate at Southern California facilities is now around 0.3%, with the lack of availability particularly acute in the Inland Empire counties of Riverside and San Bernardino, Port of Los Angeles Executive Director Gene Seroka said at a virtual meeting of harbor commissioners last week. During normal times, the vacancy rate stood as high as 5%, he added.

“We can’t build these facilities fast enough, and even though we boast 2 billion square feet from the shores of the Pacific now out to the desert region of Southern California, we’ve got to turn that cargo out faster and have enough space under roof to manage all of these consumer and manufacturing products,” he said at a separate briefing earlier this month.

The West Coast bottleneck appears to be building inland, in rail, trucking, and warehousing networks — adding to increasing delays as the supply chain congestion shows little signs of abating.

Tyler Durden

Tue, 06/28/2022 – 19:05

via ZeroHedge News https://ift.tt/RO7iTdM Tyler Durden