Futures Storm Higher To Start The Week As “Most Hated Rally” Steamrolls Bears

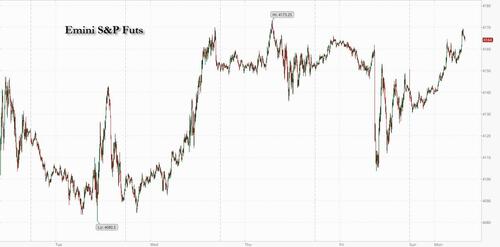

US equity futures rose to start the week as the “most hated meltup” continued just as we said it would over the weekend as stubborn bears are forced to cover and start chasing higher out of FOMO, while Treasury yields fell while investors assessed the path of monetary policy ahead of this week’s critical CPI data. Nasdaq 100 futures rose 0.7% while S&P 500 futures gained 0.5% by 7:30 a.m. in New York after the underlying benchmarks dropped on Friday following news that US job growth soared beyond expectations. Meanwhile, the yield on the 10-year Treasury dropped to 2.79% after soaring at the end of last week, while the dollar dipped and bitcoin jumped above $24K.

In premarket trading, stocks tied to renewable energy, such as Tesla, rose after the Senate passed a key bill that Democrats called the largest investment in fighting climate change ever made in the country. Meanwhile, cryptocurrency-exposed companies like Coinbase Global Inc. and Riot Blockchain Inc. climbed as Bitcoin breached $24,000. Bank stocks are also higher in premarket trading as the broader equity market rises. In corporate news, Avalara is being acquired by Vista Equity Partners for $93.50 a share in a deal that values the tax software maker at roughly $8.4 billion. Meanwhile, Robinhood is set to pay $9.9 million to resolve lawsuits over crashes on its trading platform in 2020.

“The sentiment will mostly depend on this week’s inflation data,” said Ipek Ozkardeskaya, senior analyst at Swissquote. “If US inflation starts easing, the Fed could rethink about smaller rate hikes, which could give another positive swing to the stocks.”

Friday’s “stellar” jobs data eased fears of a recession while increasing the chances that the Federal Reserve will be more aggressive in its fight to tame inflation. Over the weekend, San Fran Fed President Mary Daly said the central bank is “far from done yet” in bringing down prices and suggested a 50 basis-point rate increase isn’t the only option on the table for the next meeting.

The Friday payrolls data surprise “was large enough to re-ignite the inflation debate and renew focus on US CPI prints,” said Peter McCallum, a strategist at Mizuho. “Indeed, a very unexpected move lower in US CPI is needed for the market to stop thinking about the Fed having to do more. And with more tightening, the probability of a hard landing rises.”

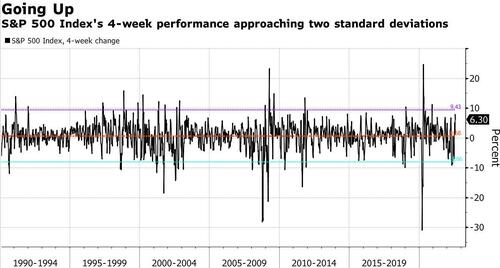

Meanwhile, as Bloomberg notes, the S&P 500 climbed more than 6% over the past four weeks, approaching the level of two standard deviations for data going back 30 years.

That’s unusual in the absence of a clearly event-driven market such as during the global financial crisis or the start of the Covid-19 pandemic. However, The advance in equities could face another test from a likely contraction in corporate margins next year as costs remain high, according to strategists at Morgan Stanley and Goldman Sachs.

“We think it’s premature to sound the all-clear simply because inflation has peaked,” Morgan Stanley strategists led by Michael Wilson said. “The next leg lower may have to wait until September” as the negative effects of falling inflation on company profits become more reflected in earnings.

Looking at the week’s key data, the closely watched CPI is seen rising 0.2% in July from a month earlier, which would be the smallest advance since the start of 2021. However, the so-called core measure, which strips out energy and food, probably climbed a concerning 0.5%, based on the median estimate in a Bloomberg survey of economists.

European stocks tracked US futures higher, with the Euro Stoxx 50 is up 0.5%. IBEX outperforms peers, adding 0.6%, FTSE MIB is flat but underperforms peers. Real estate, tech and financial services are the strongest-performing sectors.

Earlier in the session, Asian stocks edged lower as concerns about more aggressive interest-rate hikes by the Federal Reserve and fresh Covid lockdowns on the Chinese resort island of Hainan weighed on sentiment. The MSCI Asia Pacific Index dropped as much as 0.5% before paring, with losses in technology and consumer discretionary shares offsetting gains in materials firms. Hong Kong stocks led declines around the region, even as the government cut the hotel quarantine for inbound travelers to three days from seven. A better-than-expected July jobs report in the US fueled expectations of faster Fed monetary tightening, with investors monitoring this week’s inflation data for further clues. Meanwhile, the lockdowns in China’s Hainan province have stranded tens of thousands of tourists, dealing a blow to its duty-free retail industry.

Asian equities capped their third-straight weekly gain last Friday as the region shrugged off rising geopolitical risks in the Taiwan Strait. Investors also continue to assess the ongoing corporate-earnings season. “We believe markets have discounted a fair bit of the earnings cuts to come, partly driven by the tech inventory de-stocking cycle in the coming months,” said Soo Hai Lim, head of Asia ex-China equities, at Barings. “Improving fundamentals, more attractive valuations and relatively looser monetary conditions in Asia can help deliver relative equity outperformance for the region in the coming months.”

Japanese stocks reversed earlier losses with the Nikkei 225 Index closing at its highest since March 29, as investors assessed a slew of earnings reports from local firms. The Topix Index rose 0.2% to 1,951.41 as of market close Tokyo time, while the Nikkei advanced 0.3% to 28,249.24. Suzuki Motor Corp. was among the top performers on the Nikkei, jumping more than 10% after an earnings beat. Bandai Namco also advanced after its outlook was raised. Daiichi Sankyo Co. contributed the most to the Topix Index gain, increasing 5.2%. Out of 2,170 shares in the index, 1,033 rose and 1,030 fell, while 107 were unchanged. “Today’s Japan stocks are moving over micro factors such as the earnings results,” said Hiroshi Matsumoto, a senior client portfolio manager at Pictet Asset Management. “Some Japanese companies are reporting good results.”

India’s equity index climbed to its highest level in nearly four months, boosted by gains in HDFC Bank and Reliance Industries. The S&P BSE Sensex rose 0.8% to close at 58,853.07 in Mumbai, after falling by as much as 0.2% at the start of the session. The NSE Nifty 50 Index gained 0.7%. Of the 30 members on the Sensex, 20 rose and 10 fell. All but one of 19 sectoral indexes compiled by BSE Ltd. advanced, led by a gauge of capital goods companies. The market is shut on Tuesday for a local holiday. HDFC Bank advanced to its highest level since April 13 as the Economic Times newspaper reported that the private sector lender raised $300 million in deposits from expat Indians, quoting unnamed people familiar with the matter. Reliance Industries climbed most in a week as the oil-to-retail conglomerate said it will begin investing across the green-energy value chain. State Bank of India dropped after its quarterly report showed net income below analysts’ estimates.

Bloomberg dollar spot index flat after paring earlier decline. JPY and EUR are the weakest performers in G-10 FX, AUD and NZD outperform.

In rates, Treasuries held gains amassed during European session, led by bigger gains across core European bonds and unwinding a portion of Friday’s jobs-report selloff. US long-end yields richer by ~4bp, flattening 2s10s by ~2bp, 5s30s by less than 1bp; 10-year around 2.79% trails comparable bunds and gilts by 2bp-3bp. Treasuries 2s10s curve inversion deepens to as much as 42.3bps, the lowest since 2000. No US data or Fed speakers are slated for Monday; refunding auctions begin Tuesday, July CPI scheduled for Wednesday.short-end yields underperform bunds by about 4 bps. Peripheral spreads widen to Germany with 10y BTP/Bund adding ~7bps to 212.8bps after Italy’s outlook was cut to negative by Moody’s on political risk.

In commodities, WTI trades within Friday’s range, falling 0.3% to around $88. Base metals are mixed; LME nickel falls 2.4% while LME lead gains 1.9%. Spot gold is little changed at $1,775/oz.

In crypto, noted upside for the space amid thin newsflow elsewhere, with Bitcoin surpassing USD 24k at best and thus marginally eclipsing last week’s USD 23.9k peak.

It’s a quiet start to the week in econ data with nothing scheduled on the economic slate and no Fed speakers either; refunding auctions begin Tuesday, July CPI scheduled for Wednesday.

Market Snapshot

- S&P 500 futures up 0.3% to 4,157.75

- STOXX Europe 600 up 0.6% to 438.13

- MXAP down 0.1% to 160.53

- MXAPJ down 0.4% to 524.35

- Nikkei up 0.3% to 28,249.24

- Topix up 0.2% to 1,951.41

- Hang Seng Index down 0.8% to 20,045.77

- Shanghai Composite up 0.3% to 3,236.93

- Sensex up 0.8% to 58,862.37

- Australia S&P/ASX 200 little changed at 7,020.62

- Kospi little changed at 2,493.10

- German 10Y yield little changed at 0.89%

- Euro little changed at $1.0187

- Gold spot down 0.1% to $1,773.21

- U.S. Dollar Index down 0.11% to 106.50

Top Overnight News from Bloomberg

- China Extends Military Exercises Near Taiwan With New Drill

- Ships Resume Taiwan Routes Even as China Continues to Drill

- Oil Endures Choppy Start to Week With Demand Concern to the Fore

- Senate Passes Democrats’ Landmark Tax, Climate, Drugs Bill

- Yen Shorts Crumble as 2022’s Hottest FX Trade Comes to an End

- ‘Most Vulnerable’ Emerging Markets Now Face Euro Recession Risk

- Jack Dorsey Tweets ‘End the CCP’ After China Covid Report

- Carlyle CEO Resigns in Sudden Reversal of Generational Shift

- SoftBank Reports Record $23.4 Billion Loss as Holdings Fall

- India Seeks To Oust China Firms From Sub-$150 Phone Market

- Five States Risk Undoing Legitimacy of 2024 Election

- CVS Health Is Mulling a Bid for Signify Health, WSJ Reports

- Winners and Losers in Democrats’ Signature Tax and Energy Bill

- NYC Mayor Greets New Bus of Migrants Sent by Texas Governor

- Daly Says Fed Is ‘Far From Done Yet’ on Bringing Inflation Down

- Buffett’s Berkshire Pounces on Market Slump to Scoop Up Equities

- Bitcoin Believers Are Back to Watching Stocks After Crypto Crash

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks traded mixed with price action choppy as participants reflected on the encouraging Chinese trade data and post-NFP hawkish pricing of Fed rate hike expectations, with sentiment also clouded by geopolitical risks related to China’s military drills near Taiwan and renewed shelling of Ukraine’s Zaporizhzhia nuclear plant. ASX 200 traded indecisively around the 7,000 level as weakness in the consumer-related sectors was offset by a strong mining industry, with OZ Minerals the biggest gainer after it rejected an indicative proposal from BHP. Nikkei 225 pared opening losses although the upside was capped amid the ongoing deluge of earnings including SoftBank which is scheduled to announce its results later today and with a cabinet reshuffle set for later this week. Hang Seng and Shanghai Comp were varied with the mainland indecisive as mostly stronger than expected Chinese trade data, including a record surplus in July, was counterbalanced by COVID woes after Sanya in the Hainan province was placed on lockdown which has trapped tens of thousands of tourists.

Top Asian News

- Chinese authorities locked down the southern coastal city of Sanya during the weekend after a highly infectious Omicron strain was detected in the Hainan province, according to FT.

- China’s aviation regulator shortened the suspension time for inbound flights on routes found to have COVID-19 cases in which flights on a route with an identified COVID case will be suspended for a week if 4% of passengers test positive and will be suspended for two weeks if 8% of passengers test positive, according to Reuters.

- Hong Kong Chief Executive John Lee announced that the hotel quarantine will be reduced to 3 days from 7, with arrivals to be subject to a 3 + 4 format in which the 4 days will be home monitoring.

- Japanese PM Kishida said he will reshuffle the cabinet in the week ahead to address issues including COVID-19, inflation and Taiwan affairs, according to Reuters.

European bourses are firmer across the board after shrugging off mixed APAC trade, Euro Stoxx 50 +0.8%. Similar directional performance in US futures, though magnitudes are more contained amid limited newsflow with little scheduled ahead, ES +0.3%. Sectors are firmer with no overall theme emerging though Tech, Real Estate and Utilities are among the best performers.

Top European News

- UK Tory party leadership frontrunner Truss is under pressure to promise more to poor households facing a cost of living crisis this autumn after she expressed her preference to reduce taxes over ‘handouts’, according to FT.

- UK government plan to cut as many as 91k civil servant jobs over 3 years will require deep cuts to public services and cost at least GBP 1bln in redundancy payments, according to a Whitehall review cited by FT.

- UK government is to conduct a review of the foreign takeover of the National Grid’s gas transmission business amid increased concerns regarding energy security, according to FT.

- Italy’s centrist Azione party is to abandon the centre-left alliance with the Democratic Party just days after agreeing to an alliance to join forces in an effort to prevent a right-wing landslide, according to Bloomberg.

- Moody’s has cut its outlook on Italy to Negative from Stable, affirms BAA3 rating; risks to credit profile have been accumulating more recently due to the economic impact of Russia/Ukraine and domestic politics. Under baseline scenario, Italian debt to continue declining in 2022.

FX

- The USD index has pulled back further from Friday’s post-NFP 106.93 before seeing a bounce at its 10 DMA (106.25).

- Non-Dollar G10s are gaining momentum against peers, and vs the Buck; AUD holds the top spot.

- EUR/USD and GBP/USD trimmed earlier upside to trade back under 1.0200 and 1.2100.

- The Yen is the current G10 laggard amid broader risk and as the FOMC-BOJ pricing once again widens.

Fixed Income

- Core debt modestly firmer, experiencing some respite from Friday’s post-NFP pressure amid pronounced Fed repricing and yield upside.

- Albeit, in the context of recent session the circa. 70 tick upside in Bunds is limited.

- BTPs pressured as Moody’s cuts their outlook for Italy while further political developments seemingly strengthen the chances of the right.

Commodities

- WTI and Brent front-month futures saw upside momentum fade alongside a Dollar-rebound off lows.

- Spot gold is trading sideways around USD 1,775/oz amid a lack of drivers.

- Overnight, Chinese base metal futures opened firmer with added impetus from the Chinese trade data, whilst LME contracts trade somewhat mixed.

- Tesla (TSLA) has reportedly signed a contract worth circa. USD 5bln to purchase battery materials from nickel processing companies in Indonesia, via Reuters citing CNBC Indonesia.

- Russian oil product exports from Black Sea port of Tuapse planned at 1.443mln in Aug (vs 1.388mln in July), according to traders cited by Reuters.

- China is poised to begin another round of tax inspections on independent refiners, according to Reuters sources. Inspections are to last months, commencing later this month.

US Event Calendar

- Nothing major scheduled

DB’s Jim Reid concludes the overnight wrap

August has been fascinating so far with US recession talk pushed back with a string of better than expected data last week. The US economy simply cannot be deemed to be in a recession in a month when +528k jobs have just been added as payrolls showed on Friday.

This still feels to me like a classic (albeit compressed), old fashioned boom bust cycle. The Fed has been aggressively behind the curve with monetary policy amazingly loose versus history. The Fed have tightened a bit but monetary policy operates with a lag and monetary policy was and is still very loose. Remember we’ve only been hiking since March and real Fed Funds are still c.-7%. I still think recession by around the middle of 2023 is a slam dunk and that risk assets will go well below their June 2022 lows when we’re in it but I’m still not convinced the official recession happens over the next few months. As a related aside, the 2s10s yield curve first inverted at the end of March. A recession always eventually follows this in the US but the shortest gap between that and a recession is c.9 months over the last 70 years of data covering 10 recessions. The fact that the yield curve is getting more inverted just cements the likely recessionary signal from the yield curve but it always takes time. Ultimately I think a recession will be a lagged response to the necessary tighter policy put in place since March and the hikes still to come.

If payrolls was a bit of a shock, next up will be US CPI on Wednesday which we will review below. Staying with US inflation we will also see PPI on Thursday and the inflation expectations in the University of Michigan consumer survey on Friday. Staying with prices China (CPI, PPI) and Japan (PPI) get in on the act on Wednesday too. A monthly dump of UK data including GDP will be out Friday and will attract attention after the BoE’s forecast of a 5 quarter upcoming recession last week. Elsewhere US earnings are 85% complete so the newsflow will slow down on this front. The full day by day week ahead is at the end but we’ll focus most attention on US CPI here today.

Our economists expect the headline YoY rate to finally dip after energy prices have fallen of late. They are looking for 8.8% (from 9.1%) with consensus a tenth lower. Core however is expected to increase two tenths to 6.1% YoY. If we see such an outcome it’ll be interesting if the market cheers what could be the start of a decline from the peak in the headline rate or remains concerned that core continues to edge up. Core should be more important to the Fed but the market has been known to take the dovish interpretation to events of late, payrolls notwithstanding.

On US PPI on Thursday, most of our economist’s attention will be on the healthcare component as this feeds directly into core PCE, the Fed preferred measure. So far the wedge between core CPI and PCE has been biased in CPI’s favour (i.e. higher) as CPI has a big bias to rents vs healthcare for PCE. Last month healthcare surged after 4 soft months. Our economists have detailed why they think it will continue to be strong in this note (Link here).

Across the Atlantic, this week’s UK GDP print is expected to be -0.2% QoQ, the first quarterly contraction since Q1 of 2021. The June figure is expected to contract by -1.2% MoM. Elsewhere earnings season is winding down after 423 S&P 500 and 403 Stoxx 600 companies have now reported. Our equity strategists have reviewed global earnings so far here, noting that while beats are roughly at the historical average in the US, they’re exceeding it elsewhere. Yet, bar energy stocks, consensus estimates for Q3 have been declining across regions. Looking at the line up for this week, notable reporters include Disney (Wednesday), Porsche (today), Deutsche Telekom, RWE, Orsted and Siemens (Thursday).

Asian equity markets are mostly on the softer side as we start the week. As I type, the Hang Seng (-0.73%) is lagging despite Hong Kong’s move to cut mandatory hotel quarantine from seven days to three. Additionally, the Kospi (-0.10%) is also trading lower in early trade whilst Chinese stocks are mixed with the Shanghai Composite (+0.19%) higher and the CSI (-0.33%) lower. Elsewhere, the Nikkei (+0.25%) is holding on to its gains this morning.

Moving ahead, US stock futures point to a slightly negative opening with contracts on the S&P 500 (-0.16%) and NASDAQ 100 (-0.11%) dipping in overnight trading.

Early morning data showed that Japan recorded its first current account deficit (-132.4 billion yen) in five months in June (v/s -706.2 billion yen expected) and reversing a +128.4 billion yen surplus in the preceding month as surging imports eclipsed exports.

Over the weekend, data revealed that China’s export growth unexpectedly picked up (+18.0% y/y) in July, the fastest pace this year, against a +17.9% increase in June and beating market expectations of a +14.1% gain, thereby offering an encouraging boost to the economy as its struggles to recover from a Covid-induced slump.

In overnight news, the US Senate approved a $739 billion climate and healthcare spending package ahead of crucial midterm elections in November. When signed into law, the bill, formally known as the Inflation Reduction Act, would allocate $369bn for climate action – the largest investment in US history. At the same time, it would increase corporate taxes and lower healthcare costs as part of the package.

Reviewing last week now and it was a pretty volatile start to August on the back of Pelosi’s visit to Taiwan, the better than expected ISM prints, hawkish Fed speak, and finally the monster payrolls report on Friday which finally got the message through that the narrative of a dovish Fed pivot the week before was exceptionally premature.

Quickly recapping Friday’s data, nonfarm payrolls came in at +528k – more than double the final estimate of +260k with a further boost from the upwardly revised June reading of +398k (vs +372k previously). It was also the highest reading since February’s +714k. The July payrolls gains also ensured that the US has now recovered the 22m of job losses in the aftermath of covid outbreak. Other indicators reinforced the risks to inflation – unemployment was down to 3.5% (3.6% previously) and average hourly earnings surprised to the upside at 0.5% or 5.2% YoY (vs consensus of 0.3% and 4.9%, respectively). Slight softness came from a -0.1ppt drop in the participation rate (62.1% vs 62.2% estimates) but this was mostly in the young and not the prime-age cohort which makes it less worrying. Upward beats in employment indices also came from ISM indices earlier in the week, with headline gauges for both beating economists’ estimates as well.

The payrolls beat led to the US 2yr and 10yr jumping by +18.3bps and +13.9bps on Friday bringing the total weekly yield gains to +34.1bps and +17.8bps, respectively. These gyrations also inverted the 2s10s further, with the slope touching a low of around -43bps intraday, before finishing the day at -40.3bps, a -4.0bps move, -16bps on the week and to the most inverted since 2000.

Fed futures now price in +69bps at the September meeting, so a roughly 76% probability of another +75bps hike in September (up from Thursday’s +59bps, 36%). There’s still along way to go before the next FOMC though with another set of payrolls and two CPI prints before the next meeting.

For the S&P 500 it was a week with a few ups and downs (including -1% immediately after payrolls) but ultimately the market rose +0.36% (Friday -0.16%). Higher yields on Friday also drove divergences between benchmarks, with the Nasdaq (-0.50%) struggling a bit but still +2.50% on the week amid decent earnings results. For small caps, though, better economic data than feared overpowered the effect of rates, sending the Russell 2000 up by +0.81% on Friday and +1.94% on the week.

Oil moved higher after payrolls (WTI +0.53% and Brent +0.85%), but were still down a significant -9.74% and -13.72% on the week.

In Europe, sovereign bonds were also hammered after the payrolls report although the steady march higher started early in the morning and continued until the end of the session. Unlike in the US, however, the curves mainly steepened, with 10yr bund yields +15.2bps (+21bps on the week) edging ahead of the 2yr ones +13.5bps (+19bps on week).

Friday also saw yields sell-off further in the UK, with the 2yr yield (+11.1bps) slightly less extreme than the 10yr (+16.0bps). But in part thanks to the BoE, the UK’s front end gained +25.5bps on the week relative to +28bps on the 10yr. The periphery was quiet last week with 10yr Italian spreads declining -6.5bps on Friday and -13.6bps on the week. The market has been more relaxed after the far-right populists (riding high in the polls) suggested they won’t abandon EU budget rules if they win the elections.

Finally, European stocks dipped as the STOXX 600 closed -0.76% on Friday, and -0.59% for the week. Financials (+0.16%) and energy (+0.54%) were the sole outperformers sector-wise on Friday after the robust payrolls.

Tyler Durden

Mon, 08/08/2022 – 08:03

via ZeroHedge News https://ift.tt/cnB4MHQ Tyler Durden