Nvidia Plunges After Preannouncing Terrible Q2 Results, Slashes Guidance, Blames “Macroeconomic Headwinds”

Just as stocks were set to blast off right out of the gates as the “most hated rally” accelerates, moments ago investors got a cold shower after video chip giant Nvidia preannounced disappointing Q2 earnings more than 2 weeks early (originally scheduled for Aug 24), blaming the reverse bullwhip effect for taking $1.3 billion of charges “primarily for inventory” and slashing guidance due to “lower sell-in of Gaming products reflecting a reduction in channel partner sales likely due to macroeconomic headwinds” and “challenging market conditions that are expected to persist into the third quarter.” The only good news: the company isn’t trimming (or ending) its buybacks which will continue as scheduled.

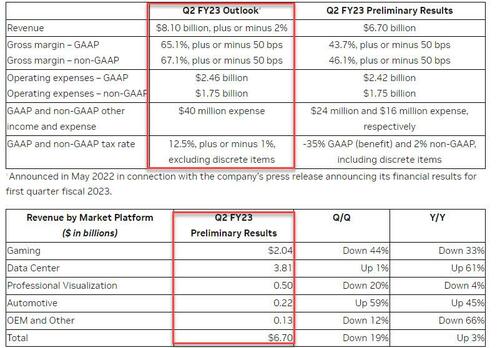

Here are the details:

- Prelim revenue $6.70 billion, far below the est $8.10, down 19% sequentially and up 3% from the prior year reflecting weaker than forecasted Gaming revenue

- Prelim adjusted gross margin 46.1%

- Prelim adjusted operating expenses $1.75 billion

Commentary and context:

- Second quarter results are expected to include approximately $1.32 billion of charges, primarily for inventory and related reserves.

- The only silver lining: buybacks will continue: “We plan to continue stock buybacks as we foresee strong cash generation and future growth.”

- The shortfall relative to the May revenue outlook of $8.10 billion was primarily attributable to lower sell-in of Gaming products reflecting a reduction in channel partner sales likely due to macroeconomic headwinds. In addition to reducing sell-in, the company implemented pricing programs with channel partners to reflect challenging market conditions that are expected to persist into the third quarter.

- Data Center revenue, though a record, was somewhat short of the company’s expectations, as it was impacted by supply chain disruptions.

- The significant charges incurred in the quarter reflect previous long-term purchase commitments we made during a time of severe component shortages and our current expectation of ongoing macroeconomic uncertainty,” said Colette Kress, EVP and CFO of NVIDIA.

- “Our gaming product sell-through projections declined significantly as the quarter progressed,” said Jensen Huang, founder and CEO of NVIDIA. “As we expect the macroeconomic conditions affecting sell-through to continue, we took actions with our Gaming partners to adjust channel prices and inventory.

- There will be no call today, and instead NVIDIA will host its conference call on the previously scheduled time at Wednesday, Aug. 24, at 2 p.m. PT (5 p.m. ET).

Full release below (link):

NVIDIA (NASDAQ: NVDA) today announced selected preliminary financial results for the second quarter ended July 31, 2022.

Second quarter revenue is expected to be approximately $6.70 billion, down 19% sequentially and up 3% from the prior year, primarily reflecting weaker than forecasted Gaming revenue. Gaming revenue was $2.04 billion, down 44% sequentially and down 33% from the prior year. Data Center revenue was $3.81 billion, up 1% sequentially and up 61% from the prior year.

The shortfall relative to the May revenue outlook of $8.10 billion was primarily attributable to lower sell-in of Gaming products reflecting a reduction in channel partner sales likely due to macroeconomic headwinds. In addition to reducing sell-in, the company implemented pricing programs with channel partners to reflect challenging market conditions that are expected to persist into the third quarter.

Data Center revenue, though a record, was somewhat short of the company’s expectations, as it was impacted by supply chain disruptions.

Second quarter results are expected to include approximately $1.32 billion of charges, primarily for inventory and related reserves, based on revised expectations of future demand.

“Our gaming product sell-through projections declined significantly as the quarter progressed,” said Jensen Huang, founder and CEO of NVIDIA. “As we expect the macroeconomic conditions affecting sell-through to continue, we took actions with our Gaming partners to adjust channel prices and inventory.

“NVIDIA has excellent products and position driving large and growing markets. As we navigate these challenges, we remain focused on the once-in-a-generation opportunity to reinvent computing for the era of AI,” he said.

“The significant charges incurred in the quarter reflect previous long-term purchase commitments we made during a time of severe component shortages and our current expectation of ongoing macroeconomic uncertainty,” said Colette Kress, EVP and CFO of NVIDIA.

“We believe our long-term gross margin profile is intact. We have slowed operating expense growth, balancing investments for long-term growth while managing near-term profitability. We plan to continue stock buybacks as we foresee strong cash generation and future growth,” she said.

In kneejerk reaction, NVDA plunged more than 8%, hammering the broader semiconductor space and also dragging broader market futures modestly lower.

Finally, since we know everyone is concern, yes – Nancy Pelosi dodged the proverbial bullet by dumping all of her NVDA calls two weeks ago (at a loss).

Tyler Durden

Mon, 08/08/2022 – 09:18

via ZeroHedge News https://ift.tt/YOfkUmQ Tyler Durden