There Is A Giant Illusion For The Majority Of Market Commentators Choosing Not To See It

By Michael Every of Rabobank

Holy Illusions

Hands up how many of you had 528K down as your US payrolls guess? Nobody, because the Bloomberg survey low was 50K and the high 325K. While there are question marks over these data given Covid –nearly 3m people weren’t/couldn’t work due to it– and the “birth/death” model, the household survey saw jobs +179K; backwards payroll revisions were +28K; total employment was back to pre-pandemic levels, albeit with reallocation away from sectors such as leisure and hospitality (-1,214K) towards others, such as transport (+745K); the participation rate edged down to 62.1%, so the jobless rate fell to 3.5%, but even using pre-Covid participation rates unemployment would have been 5.4%, down from 5.5%; and average hourly earnings rose much faster than expected at 0.5% m-o-m, 5.2% y-o-y (and 6.0% annualized).

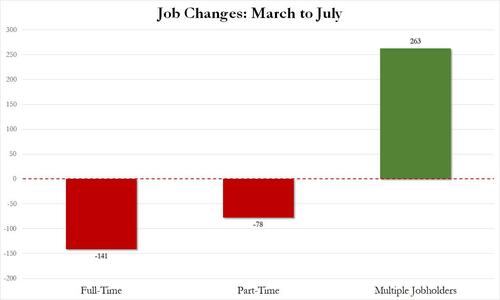

If it’s an illusion, and look at full-time vs. part-time and multiple jobs as a clue…

… it still convinced Larry Summers to warn that if US CPI falls back this week, the Fed must not pivot, and Krugman to add it’d be “no justification for a pivot toward easier money.” Indeed, it now seems the Fed may go another 75bps in September, and Bowman implies afterwards as well perhaps, and the Wall Street Journal underlines, “Witness the small army of Fed officials who have fanned out to warn markets that the Chairman didn’t mean what he supposedly wasn’t saying last week.” In short, the illusion of a Fed dovish pivot is dispelled, with 2-year Treasury yields up 16bp to 3.23% Friday, and 10s up 14bp to 2.83%. More to come: or record yield curve inversion.

Add a Fed pivot to “transitory” inflation on the list of illusions fading for the same underlying reason: the global system is crumbling. They join EU energy, economic, and foreign policy, as the German regulator calls for 20% cuts in household gas usage, and the West’s ‘Great Illusion’ that war just can’t happen (to it) in the modern world.

On which, Ukraine just got another $1bn in US arms as a new phase of the war looms around Kherson: a counter-attack appears imminent. However, don’t be under the illusion that the US can keep up that pace of arms supply – and its stocks can’t be replaced quickly once depleted. The same is true for Russia, and in terms of men, but their media says North Korea might strike a deal to send 100,000 soldiers to fight in Ukraine in exchange for food and energy(!) If so, the war escalates further, and the EU energy outlook darkens further. NATO member Turkey on Friday also struck a deal with Russia to deepen economic ties: that is a terribly muddied picture for the EU and US as they try to isolate Moscow. However, illusions abound on all sides: Russia just released a video aimed at attracting people to move there due to its ‘hospitality, vodka, and an economy that can withstand thousands of sanctions’.

Elsewhere, Reuters warns Chinese military exercises around Taiwan could disrupt key shipping lanes, and Taipei states they “simulate an attack” on its main island, drawing condemnation from the G7, but Russian support. China has now halted: communication with US military theatre leaders; defence meetings; maritime security dialogue; and co-operation over illegal migration, criminal justice, transnational crime, narcotics, and the climate – the US says this “punishes the world.” The White House is now leaning on Congress to delay the bipartisan Taiwan Policy Act of 2022, which designates it a major non-NATO ally, provides $4.5bn in military aid, upgrades its international status, and allows the imposition of sanctions, including SWIFT bans, on major Chinese financial institutions. As the Carnegie Endowment think-tank notes, “The US and China are seriously talking past each other…That disconnect will lead to a very unstable new baseline.”

Linking back to today’s title, Friday saw the release of ‘Holy Illusions’, a report from a key think-tank backing UK PM candidate Truss. It argues, “Just as in the 1970s, the country faces many interconnected, serious but superficially very different problems.” True.

Controversially, it diagnoses that “The most significant underlying economic problem… is the malign consequences of low to negative interest rates over a prolonged period.” Artificially low rates, it says, have “gradually prevented the normal mechanisms of a market economy from working properly… there has been a greater and greater search for yield on riskier and riskier assets, with everything that follows upon that, notably, market instability, huge asset price inflation, and inequality. The lack of rewards to enterprise and the ease with which fundamentally unproductive “zombie” companies can be maintained have made it difficult to generate those normal improvement mechanisms of a market economy which drive productivity and growth.” It’s hard to disagree with that Austrian and Marxist assessment.

The report then says other UK problems are manifold: “Implausible energy policies”; over-regulation, antipathy to risk; “Unsustainable” welfare; a shrinking labour force; a declining birth-rate (an issue in all major economies, except one); “Education systems that don’t educate”; and, it claims, high immigration. It warns that if current UK growth rates continue –and this was presumably before the BOE’s latest awful assessment– then by 2035 the likes of Poland will “overtake” the UK: will they then import British plumbers?

It unsurprisingly argues Brexit is not an issue, even if it means short-term costs (and clearly more immigration is not on the cards). It says the UK isn’t willing or able to do anything with the “full democracy” Brexit grants it, as “Our governing class seems to have forgotten how to govern, how to guide a state, and how to set a goal and direction of travel.”

Then –perhaps contradicting itself for some readers– it argues, “Given this set of daunting problems… there really ought to be strong political movements… to analyse and begin to deal with them. That is not the case. Instead we see the reverse – a refusal to get to grips with the problems or even to acknowledge them. It is easier to ignore the most pressing economic and societal issues of the day, pretend they don’t exist, or claim they will be solved automatically as normal conditions return. We are, it seems, studiously pretending to be asleep.” Again, no arguments here. To show it is not like the others, it dares to ask, “What is to be done?” – and it tells us government must:

“Convince the public that change is needed. The public must come to feel that we have taken a wrong path and to react against it.” They are already there! Just as we have mortgage strikes in China, we may see energy strikes in the UK; and some warn of a looming ‘winter of discontent. (And don’t think Putin doesn’t see this too, and won’t act accordingly.)

“Show the electorate an alternative,” which is “to increase the productive capacity of our economy (because without that other problems simply cannot be solved)”. They are with you! But here comes the rub. What does that mean on energy? Silence. Moreover, the government must “persuade the public… that collectivist, socialist solutions are incapable of achieving that.”

But how do you get the private sector to invest productively when other governments will? See ‘how the US gave away a breakthrough battery technology to China’, because the inventor “talked to almost all major investment banks; none of them [wanted to] invest in batteries,” as they “wanted a return on their investments faster than the batteries would turn a profit.” Will higher rates, lower taxes, and deregulation force banks to make loans to productive rather than “fictitious capital”? Austrians say yes: Marxists say not, and with the better track record; and they add that even productive loans will just be made abroad, where it is cheaper to invest.

That gaping theoretical/policy hole is more evident when we are then told the government must “persuade the public that this alternative route is actually possible; that [it] has a plan to get the country onto it; that continuing on the current path will simply make the inevitable correction measures more painful; and that failure to take such measures will mean a materially worse outcome. [It must] make this alternative politically feasible and hence potentially attractive.”

–But what alternative?!–

Its conclusion avoids the answer in saying that: “A successful nation state needs market economics to create prosperity, and requires solidarity and a clear sense of identity to sustain itself. A reform programme must be similarly broad-based. It should reject the artificial polarity between the “market” –“right wing” economics and economic globalisation– and “society” –“left wing” statism and solidarity– but recognise instead that running a successful country involves elements of both.”

It just doesn’t say how beyond rates, taxes, and fostering ‘national unity’: yet the latter alone was *wrongly* presumed by Smith and Ricardo to stop capitalists investing abroad at all, which we just edit out of our textbooks! If only we could edit it out of our financial flows so easily.

Ironically, the report also says, ”the political difficulty is that governments and politicians have not for many years set out the reality of how economies work and how prosperity is created. Levels of understanding are low.” Yes, they are: if it was as simple as ‘getting the state out of the way’, China would not be an economic superpower and Afghanistan might be.

Yet the underlying message that we been ‘getting GDP wrong’, and we can’t get it right by only focusing on GDP is arguably very valid, as is the criticism of relying on low rates policy. We *do* need a higher common purpose, and higher rates, and others are saying similar things: here is an example arguing, “Without that, any aspiring state is just a gated community for the working wealthy, much like the ones for old retirees in South Florida.” It’s just that we need *more* than that structurally to boot, and ‘Holy Illusions’ still seems to cling to its own in avoiding that conclusion.

It *could* be seen as backing a neo-Hamiltonian free market behind high tariff barriers, with industrial policy, which was how the US (and China) developed. Yet that mercantilist model is also an illusion for the UK and others not large enough for economies of scale and a modern army, especially as large rivals *are* state-backed and have one; and as high debt levels logically require MMT and higher interest rates, if just to pay for that military. The flurry of legislation coming out of the US is not a million miles away from some of those ideas and developments.

But if we need ‘Hamilton’ in blocs, the UK still just rejected being a member of one. Does that mean it will end up in a new Holy Anglosphere? Some say that’s no illusion, other that it is. Regardless, the above still implies global national-security/commodity/supply-chain/tech/values fragmentation ahead; and higher interest rates; and lower asset prices; and more productive, higher-wage investment – as we had already projected as a 2030 scenario. Unless that’s just my own holy illusion.

What isn’t is that if you don’t keep track of these seemingly-esoteric developments, you won’t be in a position to call where rates are going – which is why nobody in markets called three (or four?) back-to-back 75bps Fed hikes this year. That was “not how the political economy works”. But the political economy had changed. To paraphrase Keynes, “When the facts change, I change my forecast. What do you do?”

That is what you should be focused on: not the illusion of the relevance/positivity of Chinese July trade data released Sunday, which showed exports up 18% y-o-y and imports only 2.3%, for a staggering trade surplus of $101.3bn. Does anyone think this $1.2 trillion annualised figure is good news for anyone: not China (where it means no demand); not globally (where it means no local supply). There is a giant illusion for the majority of market commentators choosing not to see it.

Tyler Durden

Mon, 08/08/2022 – 09:04

via ZeroHedge News https://ift.tt/oSDk4QZ Tyler Durden