The Road To A More Global Yuan Runs Through Moscow

By George Lei, Bloomberg Markets Live reporter and analyst

Chinese President Xi Jinping concluded his Russian visit on Wednesday without much progress on peace in Ukraine. China, however, has pushed for deeper trade and investment links with its northern neighbor using its own currency. That suggests the path of least resistance for yuan internationalization now runs through Moscow instead of London or Singapore.

China and Russia are committed to “significantly” increasing trade volumes by 2030 and pledged to steadily boost the proportion of local currency settlement, according to a joint statement released Tuesday. That might sound like cheap political talk, though a closer look at developments since the war in Ukraine shows the Chinese currency is already making major inroads in all walks of Russian financial life.

The share of yuan in Russian export payments surged 32-fold in 2022 to 16% by year-end, according to the Bank of Russia. Its use in Russian imports also jumped to 23% from 4%. Yuan savings accounted for 11% of Russia’s total FX deposits as of January, compared with practically zero when the war broke out. The Chinese currency has also overtaken the dollar and euro as the most traded FX on the Moscow Exchange.

Never before has the yuan — which is not fully convertible — been so widely used for trade, private savings and FX transactions in a trillion-dollar economy that regularly ranks among the world’s biggest. “Market logic mostly prevails over geopolitics until one day it does not,” wrote Alexander Gabuev, a senior fellow at the Carnegie Endowment for International Peace.

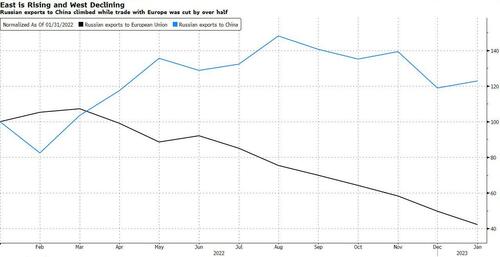

Western sanctions that sharply curtailed Russia’s dollar and euro access acted as a push factor, while booming trade with China served as a pull. Russia overtook Saudi Arabia to become China’s biggest oil supplier in February while Beijing’s total energy purchases ballooned to $88b over the past 12 months, surging more than 50% from the period ending February 2022. Chinese businesses have also expanded in its northern neighbor, filling the void left by departing Western brands.

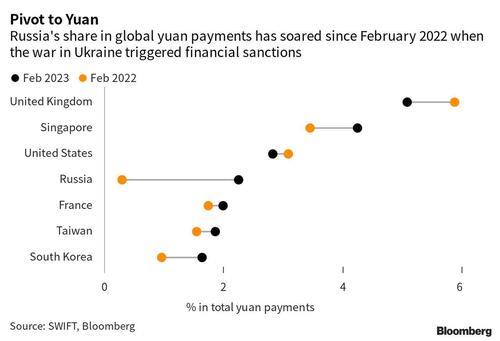

Russia is now the 5th biggest user of the Chinese currency, with 2.3% of global yuan payments, behind Hong Kong, the UK, Singapore and the US, according to SWIFT. A year ago, the country didn’t even make the cut for the top 15: Its share in worldwide yuan payments was less than 0.3%. At this speed, Russia is poised to become the biggest yuan user outside Hong Kong in the next couple years.

This week, the Russian central bank made it more costly for commercial lender to have liabilities in dollar and euro by raising the mandatory reserve requirements on “unfriendly” currencies. The longer the war and sanctions drag on, the more entrenched yuan gets in Moscow’s financial ecosystem. Should the current trajectory persist, Russia will probably become the first major economy where the Chinese currency has an equal standing with its American and European counterparts.

Tyler Durden

Thu, 03/23/2023 – 23:08

via ZeroHedge News https://ift.tt/ARUbchP Tyler Durden