David Stockman On The Status Of The Everything Bubble Created By The Fed

Authored by David Stockman via InternationalMan.com,

The Wall Street Journal recently brought word that a professor Efraim Benmelech of the finance department at Northwestern University thinks the Fed is hurting housing and the consumer too much.

Opined he,

….those higher interest rates are making mortgages more expensive and leading to fewer home sales. That leads to less spending on appliances, paint and other home goods, because people commonly buy those items ahead of a sale and after moving.

“The actions of the Fed are leading to lower consumption,” he said.

You don’t say!

Then again, has it occurred to the good professor that the years and years of ultra low mortgage rates engineered by the Fed were totally unnatural, uneconomic and not sustainable?

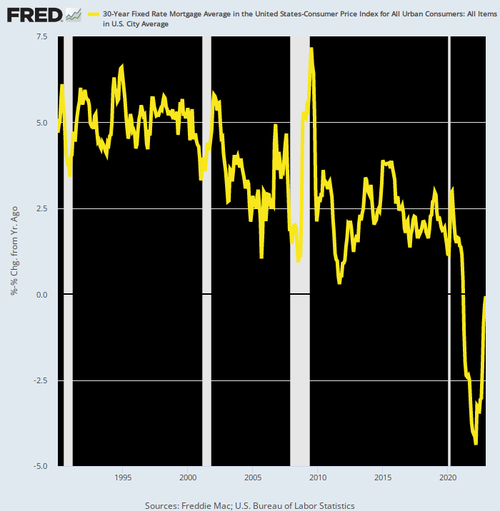

The evidence for that is in the chart below. It shows that for most of the last three decades, the Fed drove the after-inflation or “real” interest rate on 30-year mortgages steadily lower until it actually turned negative.

Inflation-Adjusted Interest Rate on 30-Year Fixed Rate Mortgages, 1990 to 2023

Stated differently, the unfolding recession is a long overdue and necessary purge of artificial economic activity stimulated and subsidized by the central bank’s own financial repression policies.

The Fed’s belated attempt to “normalize” interest rates, therefore, is not a mean-spirited policy to deliberately cause labor, manufacturing capacity and other economic resources to be idled. To the contrary, it’s a belated attempt to unshackle markets from the excesses, bubbles, malinvestments, inefficiencies and unsustainabilities that were the inherent results of decades of reckless money-printing.

One of the many bubbles created by the Fed’s relentless monetary expansion of recent years might be termed the “labor bubble”. By that we are referring to the madcap hiring undertaken by corporate HR departments in the aftermath of the Covid Lockdown disruption.

As it happened, they failed to meet staffing needs in the early days of the re-opening in 2021 owing to the fact that millions of workers had left the active labor force thanks to massive stimmies, early retirements and other welfare state inducements, along with mom and dad’s basements and checkbooks. So HR departments plunged into hiring “just in case” the re-opening boom of 2021 and early 2022 continued. In effect, they began to hoard labor.

Spotify CEO Daniel Ek admitted as much in a recent missive to employees announcing a 6% cut in the company’s workforce:

“In hindsight, I was too ambitious in investing ahead of our revenue growth. And for this reason, today, we are reducing our employee base by about 6% across the company. I take full accountability for the moves that got us here today,” the exec said.

Of course, the re-opening and stimmy boom didn’t last—notwithstanding the Fed’s massive money-pumping and monetization of the public debt issued to finance the $6 trillion of Covid bailouts.

Since the spring of 2021 when the stimmies peaked, the US economy has actually been slouching toward idle. In fact, once you strain out of the GDP numbers the one-time inventory rebuilding, which was necessitated by the drastic depletion of merchandise stocks triggered by the stimmy based consumer spend-a-thons, there is hardly any organic growth left.

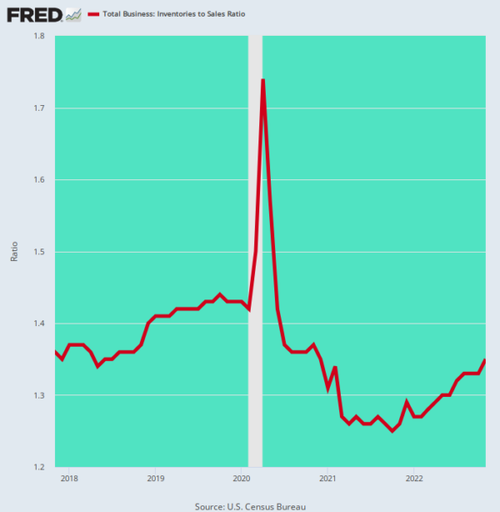

As shown in the chart below, the combination of Dr. Fauci’s Virus Patrol and the Washington spenders did a real number on the business economy. First, the normal business inventory-to-sales ratio exploded to the upside during the initial lockdowns and spending collapse, and then plunged to unprecedented lows as the stimmy-fueled boom in Amazon orders drained the system of its working inventories.

Whipsaw of Business Inventory-to-Sales Ratio, 2018 to 2022

Since reaching bottom in October 2021 inventories have been rebuilt to nearly normal levels, but that’s just the problem. The GDP gain reflected in the inventory rebuild is just a case of “one and done”. In fact, with the interest cost of carrying inventories now rising rapidly it is likely that the business sector restocking is over.

As we indicated, once you peel back the effect of inventory restocking, the stagnation of the US economy is starkly apparent. For instance, in the case of the industrial production index, which covers all of manufacturing, energy, mining and utility output, the level in March 2022 stood at 103.5.

As it happened, the index posted at a nearly identical 103.4 in December. Call it nine months of “growth” to nowhere!

Industrial Production Index, March to December 2022

Needless to say, none of this madness would have happened without the enabling hand of the Federal Reserve.

* * *

The truth is, we’re on the cusp of an economic crisis that could eclipse anything we’ve seen before. And most people won’t be prepared for what’s coming. That’s exactly why bestselling author Doug Casey and his team just released a free report with all the details on how to survive an economic collapse. Click here to download the PDF now.

Tyler Durden

Sun, 03/26/2023 – 13:30

via ZeroHedge News https://ift.tt/mFrsdiK Tyler Durden