A 5% Pay-Cut Is Coming For 37 Million Student Loan Borrowers

Authored by Mike Shedlock via MishTalk.com,

About 37 million borrowers will have to start paying back their student loans after a 3 year hiatus. Let’s discuss what that means…

Millions of student-loan borrowers will soon restart paying back their loans. This is equivalent to a Four or Five Percent Pay Cut according to Wells Fargo.

The typical monthly loan payment will be between $210 and $314, Wells Fargo estimated using data collected in 2019.

The return of loan payments will take more of a bite out of many borrowers’ budgets than a single year of dramatic rises in inflation did. From December 2021 to December 2022, the income of a typical U.S. household decreased on average by 1% when adjusting for inflation, according to estimates from the economists Thomas Blanchet, Emmanuel Saez and Gabriel Zucman.

Supreme Court Strikes Down Student Debt Cancellation, Cites Nancy Pelosi

The US Supreme Court wisely struck down President Biden’s executive power garb that usurps powers granted by the Constitution to the legislative branch of government. The 77-Page Supreme Court Decision was 6-3.

A paragraph on page 23 (PDF page 28) caught my eye.

… (quoting Gonzales v. Oregon, 546 U. S. 243, 267–268 (2006)). As then-Speaker of the House Nancy Pelosi explained: “People think that the President of the United States has the power for debt forgiveness. He does not. He can postpone. He can delay. But he does not have that power. That has to be an act of Congress.” Press Conference, Office of the Speaker of the House (July 28, 2021).

If you thought Nancy Pelosi never made any sense, you stand corrected.

On June 30, I commented Supreme Court Strikes Down Student Debt Cancellation, Cites Nancy Pelosi

Hoot of the Day

Despite being warned in advance, by Nancy Pelosi, President Biden called the decision “unthinkable”.

Precisely because he could not think, Biden kept upping the ante with more and more delays culminating in debt forgiveness.

Biden doesn’t think. Instead he lets Elizabeth Warren do his thinking for him. Warren’s handwriting is all over the unthinking president’s handling of student debt. And her signature is all over Biden’s Marxist nominees to the Fed.

Elizabeth Warren May as Well Be President, She Makes All Biden’s Calls

On December 28, 2021 I made the case Elizabeth Warren May as Well Be President, She Makes All Biden’s Calls

Joe Biden’s nominee for the Comptroller of the Currency Saule Omarova on oil, coal and gas industries: “We want them to go bankrupt if we want to tackle climate change.”

No one should be surprised by this even though Biden is not bright enough to find these Marxist nut cases on his own.

See the above link for details on who is making Biden’s calls.

And check out this Tweet by Saule Omarova praising Russia.

Until I came to the US, I couldn’t imagine that things like gender pay gap still existed in today’s world. Say what you will about old USSR, there was no gender pay gap there. Market doesn’t always “know best.” https://t.co/vvnx9DZICN

— Saule Omarova (@STOmarova) March 31, 2019

“Say what you will about old USSR, there was no gender pay gap there.“

Mercy!

Student Debt Repayment is Highly Disinflationary

Yesterday, I commented, “Nothing is more inflationary than paying people to do nothing.”

The opposite is true here. Nothing is more disinflationary than making people pay for something that used to be “free”.

Student debt cancellation wasn’t really free, of course, it was just spread out to make it a big deal for some and a very tiny deal to the rest.

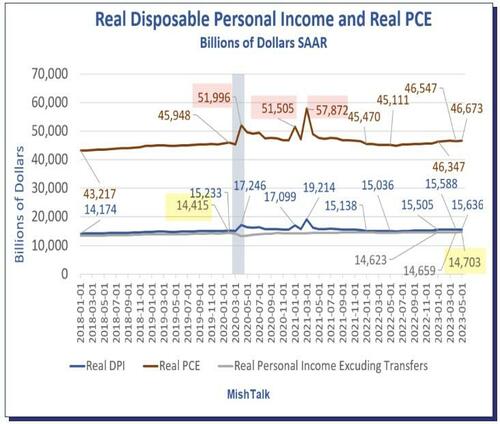

Real Disposable Personal Income and Real PCE

Real Personal Income Chart Notes

-

Real means inflation adjusted by the PCE price index.

-

PCE stands for Personal Consumption Expenditures.

-

Transfer payments are free money handouts such as Social Security, Medicare, Medicaid, and the three huge rounds of fiscal stimulus.

Excluding transfer payments, real income has gone nowhere. But the huge handouts led to equally huge jumps in income and spending.

The Fed has been struggling with inflation ever since. Demographics adds to the problem.

Student Debt Repayment Magnitude

The impact of the cancellation will have nowhere near the impact of three rounds of inflation causing fiscal stimulus.

Free money went nearly everywhere. Student debt forgiveness was targeted at a much smaller audience.

Do Rising Wages Tend to Increase Inflation?

The above discussion ties in with my post yesterday, Do Rising Wages Tend to Increase Inflation?

Think of three rounds of fiscal stimulus as paying people to do nothing. After a three year hiatus to students, repayment mandates will feel like making people pay for something that was once free.

Student debt repayment will impact spending but it’s nothing compared to fiscal stimulus handouts.

* * *

Tyler Durden

Tue, 07/18/2023 – 07:20

via ZeroHedge News https://ift.tt/dU2I7qv Tyler Durden