Dow’s Longest Win-Streak In 6 Years Shrugs Off Recession-Signaling Yield-Curve Collapse

Ever so quietly under the covers of a quiet summer week, US Macro data surprised to the downside, with the biggest weekly drop since Feb 2019…

Source: Bloomberg

But that didn’t disturb the equity market melt-up (except for Nasdaq but more on that later). This was The Dow’s best week in 4 months (best 2-weeks since Oct ’22), Nasdaq’s 3rd weekly loss in last 5 weeks.

The Dow is up 10 days in a row (managing to hold on with a 0.01% gain on the day!!) – its longest winning streak since Feb 2017…

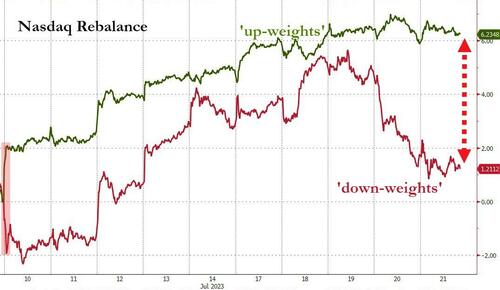

With the Nasdaq rebalance taking place, we look back at the performance of our ups-versus-downs basket pairs trade with the up-weights outperforming the down-weights (dominated by the Magnificent 7 stocks) by around 5ppts…

Source: Bloomberg

It was quite a week for ‘most shorted’ stocks with the opening 30 mins every day either a pukefest or buying-panic…

Source: Bloomberg

Some of the lipstick came off the un-profitable tech stocks pig this week…

Source: Bloomberg

Bank earnings dominated the early week with MS outperforming and Citi not so much…

Source: Bloomberg

Tough week for some of the big-tech firms…

Treasuries were mixed this week with the short-end underperforming (2Y +8bps, 30Y -2bps)…

Source: Bloomberg

The yield curve flattened (deeper inversion) this week, having reversed from the pre-FOMC levels…

Source: Bloomberg

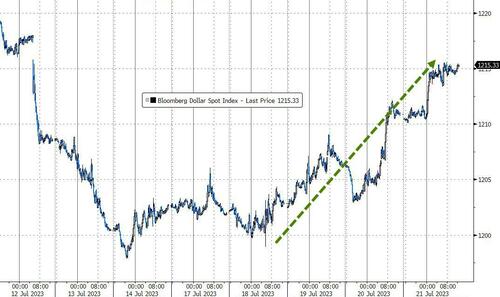

The dollar bounced back to its best weekly gain since Feb ’23…

Source: Bloomberg

Crypto was basically flat on the week with Ripple the only standout…

Source: Bloomberg

In commodity-land, crude managed gains, but copper was ugly; gold was slightly higher and silver down…

Source: Bloomberg

NatGas ripped higher to its first positive week in over a month…

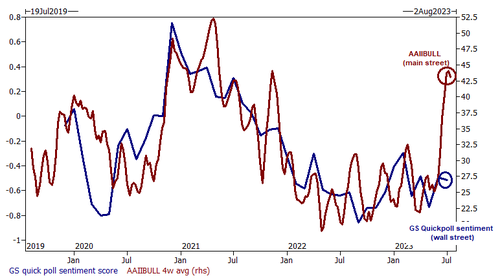

Finally, as Goldman points out, there is an increasing bifurcation between optimism on main street (AAIIBULL) and optimism on wall street (GS sentiment score)…

While the two were on relatively the “same page” over the last four years, retail is much more positive than professional traders.

And the decoupling between the decade-old regime of global liquidity and US equities continues to widen…

Source: Bloomberg

Probably nothing, right?

Tyler Durden

Fri, 07/21/2023 – 16:00

via ZeroHedge News https://ift.tt/S9rbWFO Tyler Durden