Futures Rally Fizzles As Apple Slides, Payrolls Loom

An earlier rally in US equity futures fizzled and Treasuries steadied after days of sharp losses as Apple sunk to session lows, while traders awaited employment data for clues on the path for Federal Reserve interest rates. As of 7:45am ET S&P futures were fractionally in the red at 4,520 erasing a earlier gain of 0.3% and set to extend their biggest weekly decline since March; meanwhile Nasdaq futures were still in the green, up 0.2% thanks to Amazon.com surging 9% in premarket trading after revenue at the world’s largest e-commerce and cloud services company beat estimates. Europe’s Stoxx 600 index turned lower while Asian stocks rose, trimming their weekly decline, on pockets of good news in China and shreds of optimism that the spike in bond yields won’t last. The Bloomberg dollar index rose 0.1% while 10Y TSY yields added one basis point to trade at 4.19%.

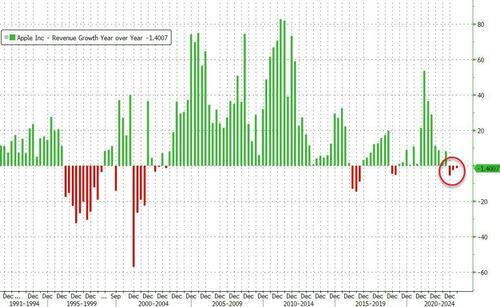

In premarket trading, Apple’s market value dropped 2%, sliding below the historic $3 trillion level after the world’s biggest company posted a third straight quarter of declining sales, sparking worries over tepid demand for its handsets and other gadgets

On the other end, Amazon.com shares jumped as much as 9.1% as analysts hiked their price targets for the stock en masse after the e-commerce and cloud computing company reported second-quarter results that beat expectations and gave a positive forecast. Here are the other notable premarket movers:

- Airbnb shares dip 0.2% after the company reported a lower-than-expected number of nights and experiences booked in the second quarter. Analysts saw the results as solid overall, though Citi said the miss could weigh on shares. .

- Amgen’s second-quarter earnings assuage investor concerns over the biotech’s performance after its weak first-quarter report, analysts say, noting inventory and volume both recovered and EPS slightly beat expectations.

- Assertio Holdings shares plummet 42% after the pharmaceutical company withdrew its full-year 2023 financial outlook to assess the impact of an FDA-approved generic indomethacin, an arthritis drug.

- Atlassian shares soar 23% after the team- collaboration software maker beat estimates on cloud revenue and operating margin. Outlook for margins to hit a bottom in fiscal 2024 was highlighted as a positive by analysts, even though the cloud growth guidance was viewed as conservative and the company struggled to sign up new customers amid slower corporate spending.

- Block Inc shares slide 4.1% in premarket trading Friday after its July gross profit growth forecast fell short for investors. The company also boosted its adjusted operating income guidance for the full year; the outlook beat the average analyst estimate.

- Coinbase rises 1.2%, after the cryptocurrency company reported revenue for the second quarter that beat the average analyst estimate, driven by higher retail transaction fee rates, analysts say.

- DraftKings shares soar 14% after the online sportsbook reported second- quarter revenue that beat consensus expectations and raised its forecast for the year. Analysts had a positive reaction to the print, with Goodbody saying it was an “excellent” update overall.

- Tupperware Brands shares soar 52% after the food-storage container company reached an agreement with its lenders to restructure its existing debt obligations, as it continues its turnaround efforts.

The market has been largely frozen ahead of today’s non-farm payrolls number (due at 830am) which is forecast to show the US added 200,000 jobs in July with crowd-soured whisper number higher at 222,000 (full preview here). While that would be the weakest print since the end of 2020, it’s still strong historically and a number exceeding that may fuel bets on more Fed hikes. A report Thursday underscored resilient US demand for workers and the mood in markets remains cautious. Here is a breakdown of payrolls forecasts by bank

- 290,000 – Citigroup

- 250,000 – Barclays

- 250,000 – Goldman

- 240,000 – HSBC

- 210,000 – Wells

- 200,000 – Credit Suisse

- 190,000 – Morgan Stanley

- 190,000 – SocGen

- 175,000 – Deutsche Bank

- 175,000 – JP Morgan Chase

- 150,000 – UBS

“With NFP still to come, I shouldn’t think investors are too willing to jump in with both feet just yet,” said James Athey, investment director at Abrdn.

Investors indeed are biding their time until after the jobs report is out: the jolt from Fitch Ratings stripping the US of its triple-A credit ranking was compounded by news Wednesday that the government will boost quarterly debt sales to $103 billion, more than expected. Yields soared to the highest since November as traders fretted over the increased supply, wiping out the Treasury market’s gains for 2023.

Meanwhile, the recent tumult in markets is making investors wary. Bank of America’s clients are moving out of equities as the risk of an economic contraction remains high, strategist Michael Hartnett said. “Private clients are shifting back to ‘risk-off’ mode,” he wrote in a note, adding that a hard landing was still a risk for the second half amid the higher bond yields and tighter financial conditions.

Europe’s Stoxx 600 index rose 0.3% as it looks to snap a three-day losing streak as travel and leisure shares outperformed. European natural gas headed for the biggest weekly gain since June. Here are the most notable European movers:

- Credit Agricole shares rise as much as 6.1% after the French lender reported a surge in profit for the second quarter and beat consensus expectations, analysts said

- Bpost gains as much as 7.8% after the postal company had second-quarter results which analysts say were overall positive, with a decent performance in Belgium offsetting a softer US market

- Commerzbank dropped as much as 3.8%, the worst performer on the Stoxx 600 Banks Index, as a lack of detail in the German lender’s 2H share buyback plan, overshadowed a 2Q beat on net interest income and an improved full-year outlook for lending

- Carl Zeiss Meditec falls as much as 6.9%, the most since May, after the German medical optics firm reported a “disappointing” set of 3Q figures, according to Oddo analysts, who flag lower mid-term guidance as another key negative

- WPP shares fall as much as 8%, the most in a year, after the advertising agency reduced its full-year organic growth forecast, citing lower revenue from US technology clients and a weaker-than-expected sales rebound in China

- IMCD shares dropped as much as 8.3%, the biggest drop since May last year, after the chemicals distributor reported revenue in the first half of the year that missed analyst estimates

- Genmab fell as much as 3.6% after the Danish biotech reported its latest earnings, which analysts said highlighted a pipeline that’s mostly unexciting until 2024

- Freenet shares fall as much as 2.3% to the lowest level since January, erasing an earlier 1.9% gain, after the telecom and media firm’s core mobile communications segment missed 2Q revenue estimates

- Lanxess shares slide as much as 4.9%, with Morgan Stanley highlighting weak free cash flow in the chemicals company’s 2Q result as a key negative, caused by a fall in adjusted Ebitda

- Sika shares drop as much as 3.9% after the Swiss construction-materials company reported 1H results that were below expectations, partially due to costs related to its recent

Asian stocks rose, trimming their weekly decline, on pockets of good news in China and shreds of optimism that the spike in bond yields won’t last. The MSCI Asia Pacific Index advanced as much as 0.5%, before fading most of the gains with benchmarks in Hong Kong, China and Vietnam among the biggest gainers. The MSCI regional gauge is still headed for a more than 2% drop this week, its worst since late June, as the dollar strengthened and bond yields spiked globally as traders assess the outlook for the US economy.

The macro backdrop has become more favorable for Asian equities, according to Goldman Sachs. Investors should “use the potential soft late-summer seasonality to position for the typically strong 4Q,” as US economic data support soft-landing prospects and China’s Politburo meeting positively surprised, strategist Timothy Moe wrote in a note.

- Chinese stocks got a boost Friday on expectations of more funding for the property sector and a jump in brokerage shares due to a cut in a reserve payment ratio. The People’s Bank of China said it will step up its monetary support for the economy and help banks control liability costs.

- Stocks dipped in Australia, Taiwan and Singapore, with benchmarks in the latter two poised to cap their worst week since October.

- Australia’s ASX 200 was rangebound as gains in the commodity-related sectors and financials were counterbalanced by weakness in defensives, while the RBA’s quarterly Statement of Monetary Policy provided little to shift the dial and reiterated that some further tightening may be required.

- The Nikkei 225 swung between gains and losses as an early retreat beneath the 32,000 level was met with dip buying which then petered out.

- Indian stocks ended their three-day long losing streak on Friday boosted by gains in technology and pharmaceutical companies. The S&P BSE Sensex rose 0.7% to 65,721.25 in Mumbai, while the NSE Nifty 50 Index advanced by the same magnitude. For the week, both indexes closed with 0.7% losses but fell less than the 2.4% decline in the MSCI Asia Pacific Index.

In FX, the Bloomberg Dollar Spot Index is up 0.1% amid position unwinds ahead of the US nonfarm payroll data. However, the measure is still set for a third weekly advance. The Aussie added as much as 0.6%, extending an exporter-driven gain after the central bank implied that rates may have to remain at elevated levels for longer. The Swiss franc is the worst performer among the G-10’s, falling 0.4% versus the greenback.

“Solid ADP likely raised market expectations for NFP already, which means that the USD is vulnerable to a sell-on- rally reaction tonight,” said Fiona Lim, senior currency analyst at Malayan Banking Berhad in Singapore. “We had seen a bout of strong US data for much of the past week that lifted the USD,” she added

In rates, 30-year bonds edged higher with yields down 2bps while two-year borrowing costs rise 4bps. 10Y Yields were flat at 4.18%. The treasury curve was flatter into early US session, paring a four-day steepening move for 2s10s and 5s30s spreads. 5s30s returns to negative after flipping positive for the first time since June 13 on Thursday. Front-end-led weakness follows similar bear-flattening in bunds and gilts during London morning. Bunds are lower, having extended declines after German factory orders saw their largest rise in three-years.

In commodities, crude futures advance with WTI rising 0.5% to trade near $82. Spot gold is little changed around $1,934.

Bitcoin is under marked pressure in relatively narrow ranges which remain above the USD 29k mark given overall price action is somewhat tentative pre-NFP.

Looking ahead to today, we have the US July jobs report, the UK July construction PMI, new car registrations, Italian June industrial production, German construction PMI for July as well as factory orders, French Q2 wages and June industrial production, the Eurozone June retail sales and the Canadian jobs report for July. We will hear from the BoE’s Pill, and earnings releases from Dominion Energy and LyondellBasell.

Market Snapshot

- S&P 500 futures up 0.4% to 4,538.25

- MXAP little changed at 166.06

- MXAPJ little changed at 526.16

- Nikkei up 0.1% to 32,192.75

- Topix up 0.3% to 2,274.63

- Hang Seng Index up 0.6% to 19,539.46

- Shanghai Composite up 0.2% to 3,288.08

- Sensex up 0.4% to 65,513.20

- Australia S&P/ASX 200 up 0.2% to 7,325.34

- Kospi little changed at 2,602.80

- STOXX Europe 600 up 0.1% to 458.55

- German 10Y yield little changed at 2.63%

- Euro little changed at $1.0943

- Brent Futures up 0.3% to $85.43/bbl

- Gold spot down 0.0% to $1,933.24

- U.S. Dollar Index little changed at 102.56

Top Overnight News

- China continues to speak forcefully about providing stimulus to the economy and bolstering growth – the PBOC on Thurs pledged to channel more financial resources into the private economy. RTRS

- China will relax a range of social control policies as the gov’t scrambles to pull various stimulus levels to bolster the economy. SCMP

- Japan’s state pension fund — the world’s largest — posted a record 9.5% gain of ¥18.98 trillion ($133 billion) in the three months through June. Domestic stocks were the top performers, gaining 14.4% as stable inflation and bigger stakes from investors including Warren Buffett reinvigorated local markets. Overseas bonds gained 8.1%. BBG

- Maersk cuts its outlook for global container volume growth in 2023 (given the weak start of the year and the continued destocking, Maersk now sees the global container volume growth in the range of -4% to -1% compared to -2.5% to +0.5% previously). BBG

- Ukraine attacked the oil export infrastructure that helps fund Moscow’s invasion for the first time on Friday, using a drone strike to damage a Russian naval vessel outside the port of Novorossiysk. FT

- Chase Coleman’s Tiger Global has built a big stake in private equity group Apollo Global as the hedge fund looks outside of the technology investments that have been its mainstay in recent years in a hunt for better returns. FT

- GIR’s BOTTOM LINE on NFP: Estimate nonfarm payrolls rose 250k in July, above consensus of +200k and roughly in line with the +244k average pace of the last three months. Estimate private payrolls rose 225k. Estimate the unemployment rate edged down by 0.1pp to 3.5% reflecting a rise in household employment and unchanged labor force participation at 62.6%. 0.3% increase in average hourly earnings that lowers the year-on-year rate to 4.2%, reflecting waning upward wage pressures and positive calendar effect. GIR

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as most bourses in the region lacked firm direction after a lackluster handover from the US, while participants reflected on tech giant earnings and the latest PBoC support pledges. ASX 200 was rangebound as gains in the commodity-related sectors and financials were counterbalanced by weakness in defensives, while the RBA’s quarterly Statement of Monetary Policy provided little to shift the dial and reiterated that some further tightening may be required. Nikkei 225 swung between gains and losses as an early retreat beneath the 32,000 level was met with dip buying which then petered out. Hang Seng and Shanghai Comp were positive with gains led by the property sector after the latest policy support pledges by the PBoC which announced it is to rollout guidelines to support private firms and will expand debt financing tools, as well as implement differentiated housing credit policies.

Top Asian News

- PBoC official said RRR cuts, open market operations, MLF and all structural policy tools need to be flexibly used to maintain reasonably ample liquidity in the banking system and they will guide banks to effectively adjust mortgage interest rates and support banks to reasonably control the cost of liabilities. Furthermore, the official said monetary policy room is ample and they will step up counter-cyclical adjustment, as well as reasonably handle the interest rate level to prevent capital arbitrage, according to Reuters.

- China NDRC official said China’s economy is to keep stable, improving momentum in H2 and they will strengthen policy reserves to release huge market potential, while they will study a batch of policy reserves with greater intensity, according to Reuters.

- China’s Global Times tweeted that Shanghai’s securities regulator will conduct on-site inspections of securities companies such as Morgan Stanley Securities and Changjiang Financing Services as it targets employee management and anti-money laundering.

- US President Biden is being urged to limit further US investment in Chinese stocks and bonds ahead of an expected new order next week, according to FT citing US House China Committee Chair Mike Gallagher. It was also reported that the House China Committee Chair held out the possibility of a subpoena in the Blackrock (BLK) and MSCI (MSCI) probe if they do not provide “fulsome” answers about investments in blacklisted Chinese companies.

- China’s MOFCOM lifted anti-dumping and anti-subsidy tariffs on Australian barley from August 5th.

- RBA Statement on Monetary Policy said some further tightening may be required and the board considered hiking rates at the August meeting but decided the stronger case was to hold steady. RBA also stated that risks around inflation are broadly balanced but much depends on inflation expectations and inflation is moving in the right direction which is consistent with reaching the target by late 2025, while it added that tightening could provide some further insurance against upside inflation risks.

European bourses are modestly firmer, Euro Stoxx 50 +0.4%, in largely contained trade ahead of the US NFP report. Sectors are mixed with outperformance in Travel & Leisure amid strength in airliners and some gambling names, elsewhere Banking and Energy names are supported by yields and benchmarks respectively. Stateside, futures are a touch firmer and largely in-fitting with European peers, ES +0.3%; aside from NDP, participants are digesting the numerous after-hours results on Thursday including Amazon +8.8% and Apple -1.8%.

Top European News

- BoE Governor Bailey said rates will have to remain restrictive and it is “too early” to see victory on inflation, while he noted the last mile of the inflation fight is to take some time, according to a Bloomberg TV interview.

- UK PM Sunak is considering skipping the annual gathering of world leaders at the UN, according to the Telegraph.

- UK Chancellor Hunt asked the FCA to carry out an urgent review on concerns around “debanking” and the government will determine whether further action is necessary based on the findings. FCA is to ask the biggest banks and building societies for data on account terminations and the reasons for them, while it will provide an initial assessment of account terminations by mid-September.

- ECB says median and mean underlying inflation measures suggest that underlying inflation likely peaked in the first half of 2023. Although most measures are showing signs of easing, underlying inflation remains high overall. *Persistent and common components of inflation appear to have started to decline for service.

- A.P. Moeller-Maersk (MAERSK DC) Q2 (USD): EBIT 1.6bln (exp. 0.89bln), EBITDA 2.9bln (exp. 2.4bln). Forecast global container volume growth in a -4% to -1% range (prev. -2.5% to +0.5%), based on the continued destocking. “Overall, the environment for container trade and logistics services remains challenging. Currently, there is no sign of a substantial rebound in volumes in the second half of the year.”.

FX

- The broader Dollar and index trades on either side of 102.50 but closer towards the upper end of a tight intraday parameter thus far, underpinned by the upside in yields as US bonds remain under pressure.

- The antipodeans narrowly outperform in the G10 space, trading flat/firmer, after consecutive sessions of hefty underperformance amid a combination of the RBA pause, risk aversion, and softer data from the region. AUD could also be feeling some relief from reports that China’s MOFCOM lifts anti-dumping and anti-subsidy tariffs on Australian barley.

- Traditional havens give up some recent risk-induced gains in the run-up to the US jobs report, with little in terms of fresh newsflow to drive price action in recent trade.

- EUR and GBP are relatively flat against the USD and each other amid a light European calendar and quiet newsflow in the region. EUR/USD was unreactive to mixed EZ retail sales and the surprise and substantial growth in German Industrial Orders.

- PBoC set USD/CNY mid-point at 7.1418 vs exp. 7.1808 (prev. 7.1495)

Fixed Income

- Overall, comparably contained trade but bearish drivers continue to dictate action given an absence of fresh catalysts pre-NFP.

- As it stands, EGBs and USTs are pressured and at incremental lows for the week as the majority of price action remains driven by supply-side dynamics from the US.

Commodities

- WTI and Brent front-month futures exhibit a slightly firmer bias as markets gear up for the OPEC+ JMMC and thereafter the US jobs report.

- Spot gold is trading sideways in the run-up to the US jobs report with the yellow metal contained within yesterday’s range (USD 1,929.19-1,937.79/oz).

- Base metals remain mostly subdued amid the indecisive mood but hold onto a bulk of recent gains as all eyes turn to NFP. 3M LME copper holds above USD 8,500/t but declined from a USD 8,686/t overnight high.

- OPEC+ JMMC meeting to start at 12:30 BST/07:30EDT, according to EnergyIntel’s Bakr (previously guided for 13:00BSt/08:00EDT)

- White House’s Kirby said the US is to continue working with producers and consumers to ensure the energy market promotes growth after the Saudi decision on oil production.

- Kremlin spokesman says we can not believe statements by the US of their readiness to facilitate Russian exports if Moscow returns to grain deal, according to Ria.

- Nippon Steel (5401 JT) executive expects it will take a long time for China’s steel demand to recover.

Geopolitics

- Russian social media users reported explosions and gunfire near the Russian Black Sea port of Novorossiysk, while the Russian Defence Ministry later stated that Ukrainian forces attacked the Novorossiysk navy base with two sea drones and that the drones were destroyed, according to TASS.

- Caspian Pipeline Consortium says movement of ships resumes in Novorossiysk after drone attack.

- US Secretary of State Blinken said in the event of a return to the grain deal, the US will continue to make sure everyone can export food products safely including Russia. Blinken also stated they have not yet received a response from China’s Foreign Minister Wang Yi on the invite to the US but expect to have an opportunity and fully expect Chinese counterparts to come to the US.

- Russian and Turkish Deputy Foreign Ministers discussed the grain deal, according to Bloomberg.

- White House’s Kirby said the US remains concerned that North Korea will send munitions to Russia.

- US may put troops on commercial ships to stop Iran seizures, according to AP.

DB’s Jim Reid concludes the overnight wrap

Another weekend ahead of being home alone and trying to play as many rounds of golf as my body permits. The family are going camping today. My wife and I have an unwritten understanding that camping is very bad for my back and therefore I’m not going. However, I think we both know that I have little interest in camping and it’s easier for a successful marriage to not have that conversation and just blame my back. My thoughts are that I haven’t worked hard for 28 years to sleep in a muddy field when I have a nice mattress at home. So it’s just Brontë and I and three rounds of golf.

The bond vigilantes have certainly camped out on the lawn of the US fixed income market this week as the sell-off entered its third consecutive day on Thursday (10yr UST +9.6bps) in the shadow of US Treasury credit quality jitters and confirmation of increased Treasury supply in the coming quarter. I’ve not heard anyone mention the comparison but there is a minor similarity to what happened with the UK last September and October. Back then an ambitious pro-growth UK budget by the new Prime Minister and Chancellor prompted sudden fears of heavy extra gilt supply, yields then surged and the LDI crises magnified it and we ended up with; UK asset managers having huge liquidity issues, BoE intervention, mass political top level resignations and a complete U-turn of a budget. Of course there are important differences, not least the Dollar has rallied slightly this week whereas Sterling slumped last year when the mini-crisis happened.

For the US the confusing thing is how much of the budget deficit increase of late is due to delayed tax receipts (due to winter storms) and how much is due to genuine stealth fiscal easing. It still feels like the former to me but that’s not to say that the weak US fiscal situation isn’t unparalleled in non-recessionary or non-crises times. Also there’s no denying that tax receipts are lower and interest costs higher at the moment so the increased issuance in the next few months is real. As such treasuries are making room for the extra supply. We’ll wait and see if it triggers any issues anywhere.

On a similar vein, back in March there were some who suggested that the straw that broke the camel’s back in the SVB downfall was possibly the Powell hawkish testimony to Congress earlier that week. So can any of us say with any certainty that the last of the market shocks from higher rates are behind us? Feel free to email me if you are 100% sure they are.

The renewed rates sell-off got an extra push with US data releases on the day that pointed to further resilience of the US labour market and upward price pressure in the US economy. In this context, it’s put a laser focus on the market’s favourite random number generator, namely payrolls later today. Our economists expect +175k (vs +200k expected by consensus), with the unemployment rate to remain steady at 3.6%. You can read their full preview here.

As we go into this important day, after the bell last night, we had mixed results from tech giants Apple and Amazon, which in aggregate have driven NASDAQ futures +0.50% higher as I type. Amazon shares gained +8.7% in after-market trading as it delivered stronger Q2 net sales ($134.38bn vs $131.63bn est.) and issued stronger sales and income guidance for Q3. By contrast, Apple shares lost some ground after hours. While its Q2 results broadly met expectations, they represented a third straight quarter of falling sales with iPhone sales a touch below estimates. So Apple’s $3trn market capitalisation achieved in late June may be at risk today. The two companies represent nearly 20% of the NASDAQ’s value so a big event to get through. S&P 500 (+0.34%) futures are also higher.

Back to the main story of the week now. The eventful start to August in the US Treasury market spilled into Thursday as the US Treasury officially kickstarted their increase in issuance, boosting the size of their T-bill auctions. The size of the 3-month bill sale rose from $65 billion to $67 billion, and the 6-month to $60 billion from $58 billion. This added to the issuance story that has been driving the selloff in US rates in the past few sessions. US 10yr Treasuries gained +9.6bps to 4.18%, again hitting its highest level since the 15-year peak of 4.24% reached last November. The long end again led the sell off, with +11.6bps rise in 30yr yields. 30yr mortage rates hit their highest level since 2000.

By contrast, the 2yr yield was virtually unchanged on the day, leading to a bear steepening of the 2s10s curve by +9.7bps. Although the curve remains deeply inverted (-70.8bps), this is the least inverted since May. Our rates strategists’ preferred term premium measure has also moved to its highest level since 2015. See their note here for more. Higher term premium has been one of our favoured trades for a while but has been surprisingly slow to work.

Adding to the mix, US weekly jobless claims remained at the lower levels of recent weeks at 227k (vs 225k expected). We also had the US July ISM services index at 52.7 (vs 53.1 expected). However, it was the prices paid index that caught the attention after a solid increase to 56.8 (vs 54.1 expected), highlighting risks to the disinflation view. This marginally trimmed the size of expected rate cuts into 2024, as pricing for Fed fund futures in December 2024 gained +1.3bps.

In Europe we heard from ECB’s Panetta. A known dove, Panetta stressed the “persistence approach” whereby policy rates are to be kept at a restrictive level for an extended period over further tightening. This echoed ECB President Lagarde’s comments at Sintra earlier this year, at which she argued that persistent inflation requires a persistent restrictive monetary policy stance. Panetta also reiterated the ECB’s data dependence mode, highlighting that further adjustment may be necessary “should the inflation outlook materially deteriorate”. The speech followed downward revisions to the Eurozone PMI results for July. The composite index was revised from 48.9 to 48.6, with increased questions over domestic growth as services new business fell into contraction for the first time since December. Despite this backdrop, 10yr German bunds sold off by +7.1bps, more in line with the US trends than domestic themes.

The risk-off mood tempered in equity markets, as the S&P 500 fell by a more modest -0.25% on Thursday, but still seeing its third consecutive day of losses. The energy sector (+0.95%) outperformed off the back of an extension of the voluntary 1m b/d supply cut by Saudi Arabia through September, with additional extensions possible. WTI crude rallied +2.59% to $81.55/bbl and Brent gained +2.33% to $85.14/bbl. The risk-off sentiment likewise wound back for the technology sector with the NASDAQ seeing only a marginal decline of -0.10% before the Apple and Amazon results. European STOXX 600 earlier slipped -0.63%. European technology struggled, with semiconductors down -2.51% following disappointing earnings forecasts by German semiconductor darling Infineon (-9.33%). The German DAX thus underperformed, down -0.79%.

Over the channel in the UK, the BoE followed the Fed’s and ECB’s lead by hiking their policy rate by 25bps to 5.25% as expected by consensus. The MPC retained its data-dependent approach but demonstrated confidence that tight monetary policy is now weighing on economic activity, with the MPC stating that “the current monetary policy stance is restrictive” for the first time. The Committee also judged “that risks around the modal inflation forecast are skewed to the upside, albeit by less than in May.” Much like the ECB, the BoE played the higher for longer card, emphasising that policy needed to be restrictive for “sufficiently long” to ensure inflation returns to their 2% target rate. You can find our UK economist’s review of the meeting here.

Expectations for near-term BoE rate hikes were subsequently pared back, with the expected rate for the November meeting falling -10.3bps. That said, terminal pricing for early 2024 eased more marginally (-3bp yesterday). 2yr gilts continued their rally off the back of the meeting (-1.6bps), with a big steepening as 10yr yields (+6.7bps) rose in line with the global trend.

Asian equity markets are mostly higher as they approach the end of a volatile week. In terms of specific moves, Chinese stocks are seeing gains with the Hang Seng (+1.01%) leading the way followed by the CSI (+0.52%) and the Shanghai Composite (+0.48%) amid signs of support for private sectors from the People’s Bank of China (PBOC). Otherwise, the Nikkei (-0.09%) and the KOSPI (+0.04%) are showing a lack of direction with both trading in and out of negative territory this morning.

In central bank news, the Reserve Bank of Australia (RBA) trimmed the growth outlook of the country to 1% for this year from its earlier estimate of 1.25% as the ‘cost -of- living pressures’ coupled with a ‘rise in interest rates’ continue to weigh on demand. Still the central bank highlighted that inflation is moving in the right direction and sees consumer prices returning within the 2-3% target range at the end of 2025.

Looking ahead to today, we have the US July jobs report, the UK July construction PMI, new car registrations, Italian June industrial production, German construction PMI for July as well as factory orders, French Q2 wages and June industrial production, the Eurozone June retail sales and the Canadian jobs report for July. We will hear from the BoE’s Pill, and earnings releases from Dominion Energy and LyondellBasell.

Tyler Durden

Fri, 08/04/2023 – 08:16

via ZeroHedge News https://ift.tt/Vm5z8sn Tyler Durden