Futures Eke Out Tiny Gains In Muted Session As China Troubles Mount

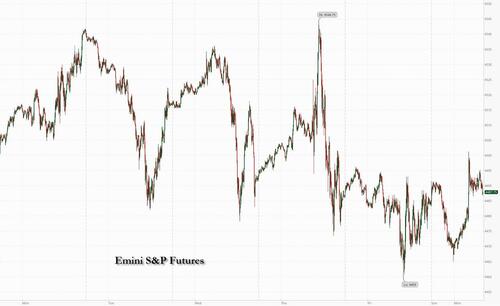

Futures have reversed earlier losses and are trading higher amid speculation (what else) for Chinese stimulus to address mounting financial and real estate risks, with European markets mixed and Asia slumping on the latest barrage of bad news out of China which however have not (yet) spilled over to the ROW. As of 7:45am ET, S&P emini futures were up 0.2% while Nasdaq futures traded 0.3% higher. 10Y TSY yields are flat at 4.15%, stabilized near their highest level since November. Commodities are lower with USD flat; energy and base metals coming for sale on weaker Chinese growth expectations while Ags mixed on Black Sea headlines. This week’s focus is on Consumer-sector earnings and Retail Sales data, but aside from that this week is an information vacuum into next week’s Jackson Hole so look for positioning/liquidity to guide markets.

In premarket trading, US Steel shares jumped as much as 32% after the steel producer rejected an unsolicited takeover offer from peer Cleveland-Cliffs and said it will instead start a review of its strategic options. Cliffs fell 6.4%. On the other side, Nikola plunged as much as 17% after the electric-vehicle maker says it’s recalling 209 Class 8 Tre battery-electric vehicles following the results of battery investigations. Here are some other notable premarket movers:

- Tesla drops as much as 2% after the electric vehicle maker rolled out a new round of price cuts in China, stoking worries that the move could restart a price war that had showed signs of abating.

- Airbnb gains 0.5% as Citi raises its price target on the stock, seeing the company and its product-led approach gaining share in the broader lodging market.

- Okta rises as much as 4.5% after Goldman Sachs raised the recommendation on the application software company’s stock to buy from sell, saying subscription revenue is likely to bottom.

With investors sitting on record first-half gains, they are contending with central bankers warning they are in no rush to cut interest rates. At the same time, China faces a stuttering economic recovery (and worsening property slump which could soon mutate into a new credit crisis once Country Garden’s grace period expires) while global stock market valuations are starting to look unjustifiably high.

“Higher yields, headwinds from valuations and China risks could spell more near-term selloff,” said Janet Mui, head of market analysis at RBC Brewin Dolphin.

The mood was dented overnight on news China property giant Country Garden was seeking to extend a maturing yuan bond for the first time. As reported last week, the Chinese developer is at risk of joining a slew of defaulters if it fails to make coupon payments on two dollar bonds within a 30-day grace period. The development came as China’s banking regulator announced it would set up a task force to examine risks at Zhongzhi Enterprise Group which missed payments on investment products sold to high-net worth clients and corporations.

“I suspect the risk of contagion beyond China is pretty low,” said Andrew Bell, chief executive officer at Witan Investment Trust. “But it is another reason for markets to be a little bit cautious over the summer.”

Meanwhile, as discussed over the weekend, systematic investors are near maximum long on equities, and short-covering has run its course, implying they’re more likely to turn sellers if volatility shoots up, Barclays Plc strategists said in a recent note. “Equity markets have had quite a strong rally over the last two or three months on hopes that we’re about to see the peak in interest rates,” Bell said. “The market was traveling a little bit on fumes, and now we have to live through the good news before before you can jump another step higher.”

Focus later this week will be on minutes of the Federal Reserve’s latest policy meeting as traders seek clues on the central bank’s next move. Investors who’d bet on a pivot to easier policy this year are having to adjust their bets as officials signal they will keep interest rates higher for longer.

Europe’s Stoxx 600 is up 0.2% with telecommunication, retail and financial stocks leading gains while energy and basic resources fall. The index had opened slightly lower, tracking declines in Asia. Here are some of the most notable European movers:

- Philips shares rise as much as 6.2%, the most since April, after John Elkann’s Exor buys 15% stake in the Dutch medical technology company in a deal valued at €2.6b

- Gerresheimer rises as much as 2.3%, extending its record high, as Jefferies adds to the clean sweep of positive analyst ratings on the German glass and plastic producer, based on strong medium-term growth expectations

- Bilfinger rises as much as 9.5% following the German industrial firm’s second-quarter results, with UBS highlighting an improvement in margins

- Valneva shares plunge as much as 13%, the most since September 2022, after the French vaccine maker said the US FDA has revised its decision date for the company’s chikungunya virus vaccine candidate

Asian stocks fell, headed for its lowest close in 10 weeks, amid a selloff in Chinese equities as worries about the nation’s economy and troubled property sector dented investor sentiment. The MSCI Asia Pacific Index dropped as much as 1.7%, with Alibaba and TSMC among the biggest drags. Most regional markets were down, with China’s CSI 300 Index falling more than 1% and close to erasing all of the gains it made since the Politburo meeting in late July while almost all of the 80 members of Hong Kong’s Hang Seng Index slipped Monday. Debt woes deepened at Country Garden Holdings, formerly China’s biggest developer, while jitters also mounted over a trust company’s delay in paying its maturing wealth products. Plunging credit growth in July further underscored growing deflationary pressure in China.

Japan’s Nikkei 225 initially swung between gains and losses in which early advances on the back of a weaker currency were wiped out as the index succumbed to the broad risk-off mood. ASX 200 was lower amid headwinds from Australia’s largest trading partner and with participants inundated by a slew of earnings releases.

“There’s indeed a massive wall of worry for China bulls,” and foreign investors continue to sell, said Derek Tay, head of investments at Kamet Capital Partners. “Lots of cracks are showing, no less in credit risks, triggered by the latest Country Garden profit warnings.”

The Asian stock benchmark posted a second-straight weekly decline last week amid growing unease over China’s economic outlook and the prospect of higher-for-longer interest rates in the US. Upside surprise in US producer prices triggered a rout in Treasuries, boosting the case for further rate hikes by the Federal Reserve. Investors will look at a series of economic data out of China on Tuesday along with continued corporate earnings, Japan’s GDP and minutes of the latest Reserve Bank of Australia meeting for further market direction

In FX, the BBG Dollar Spot Index was mixed, trading higher, then lower and now almost unchanged; the USD/JPY fell 0.1% after having risen over 2% last week: the yen steadied after breaching its year-high level of 145.07 versus the dollar as investors started to monitor for any signs the government may intervene as it did last year. GBP/USD was little changed ahead of a slate of UK data releases this week, including jobs data and July’s CPI reading. The euro rose 0.1% against the dollar ahead of second quarter euro-zone GDP due Tuesday. The offshore yuan fell 0.2% to 7.2747 per dollar. The ruble weakened beyond the psychologically important level of 100 to the dollar for the first time since March last year, as Russia’s war in Ukraine drags on and international sanctions throttle the economy. The Swedish krona is the worst performer among the G-10s, falling 0.5% versus the greenback.

In rates, Treasury yields are slightly higher curve, backing off from highs neared earlier in the session; yields on gilts and bunds are also hovering around unchanged following a subdued overnight session in which yields were broadly rangebound. Treasury yields richer by up to 1.5bp across long-end of the curve which outperforms slightly, flattening 5s30s spread by around half a basis point; 10-year yields sit around 4.15%, near top of Friday’s range, with bunds outperforming by 1.5bp in the sector. Argentine dollar bonds fell sharply on Monday after a populist who vowed to burn down the central bank won surprisingly strong support in a primary vote.

In commodities, Crude futures decline with WTI falling 0.3% to trade near $82.95.

Looking at today’s calendar, it is a quiet start to the week, with no US economic data or Fed speakers.

Market Snapshot

- S&P 500 futures up 0.2% to 4,489.25

- MXAP down 1.2% to 161.74

- MXAPJ down 1.2% to 509.90

- Nikkei down 1.3% to 32,059.91

- Topix down 1.0% to 2,280.89

- Hang Seng Index down 1.6% to 18,773.55

- Shanghai Composite down 0.3% to 3,178.43

- Sensex little changed at 65,326.94

- Australia S&P/ASX 200 down 0.9% to 7,276.95

- Kospi down 0.8% to 2,570.87

- STOXX Europe 600 little changed at 459.33

- German 10Y yield little changed at 2.62%

- Euro little changed at $1.0954

- Brent Futures down 0.4% to $86.50/bbl

- Gold spot up 0.1% to $1,915.10

- U.S. Dollar Index little changed at 102.83

Top Overnight News from Bloomberg

- China’s economic recovery is being weighed down by a worsening property slump, with the latest data likely to show little sign of a rebound in growth.

- The yen touched its weakest in nine months as Japan’s interest-rate gap with the US pushes the currency toward levels that last year saw intervention by authorities in Tokyo.

- One of China’s largest private wealth managers is triggering fresh anxiety about the health of the country’s shadow banking industry after missing payments on multiple high-yield investment products.

- Gas is back as a risk to the global economy with potential strikes in major producer Australia threatening to shatter the fragile balance of global supplies — and send consumer bills rising once more.

- Unmoved by recent signs that inflation pressure is abating, economists continue to predict that the European Central Bank will deliver one final increase in interest rates next month.

- The ruble broke through the psychologically important level of 100 to the dollar for the first time since March last year, even after Russia’s central bank sought to arrest the slump by halting its foreign- currency purchases on the domestic market for the rest of 2023.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were pressured as ongoing Chinese economic woes and developer default concerns sapped risk appetite ahead of upcoming notable events including several key data releases worldwide and FOMC minutes. ASX 200 was lower amid headwinds from Australia’s largest trading partner and with participants inundated by a slew of earnings releases. Nikkei 225 initially swung between gains and losses in which early advances on the back of a weaker currency were wiped out as the index succumbed to the broad risk-off mood. Hang Seng and Shanghai Comp declined with the Hong Kong benchmark the worst hit amid heavy losses in tech and the property industry owing to default concerns after Country Garden Holdings suspended trading of 11 onshore bonds and Sino-Ocean Group announced the suspension of trading of 6% guaranteed notes due 2024. China’s recent lending data also added to the ongoing slowdown fears after New Yuan Loans slumped by nearly 90% to the lowest since 2009, while participants are also bracing for tomorrow’s Chinese activity data and this week’s upcoming earnings releases from large tech names including Tencent and JD.com.

Top Asian News

- China’s State Council issued guidelines to further optimise the foreign investment environment and will improve the protection of foreign investment rights and interests, while it will crack down on infringement of IP for foreign-invested enterprises. China will also implement relevant preferential tax policies for foreign-invested firms and will explore a convenient and secure management mechanism for cross-border data flows, according to Reuters.

- Country Garden Holdings (2007 HK) said it will suspend trading of its 11 onshore bonds from Monday with the resumption to be determined at a later date and Sino-Ocean Group (3377 HK) announced the suspension of trading of 6% guaranteed notes due 2024, while Longfor Group (960 HK) was said to have made a CNY 1.7bln early bond payment related to an onshore bond.

- Country Garden (2007 HK) is looking to extend maturing CNY bond over three years, according to Bloomberg.

- Chinese hedge funds are reportedly in crises after losses and with US investors retreating, according to Bloomberg.

- China has reportedly set up a taskforce for its largest asset fund manager Zhongzhi after missed trust payments, according to Bloomberg0

- RBI was reportedly likely selling dollars via state-run banks, according to traders cited by Reuters, while it was also reported that Indonesia’s Central Bank intervened in the spot FX market and domestic NDF markets to prevent high volatility in the IDR exchange rate, according to an official.

- Foxconn (2317 TT) – Q2 2023 (TWD): Revenue 1.31tln (exp. 1.34tln), Net 300bln (exp. 25.9bln), Operating profit 30.9bln (exp. 33.2bln); sees Q3 cloud and network revenue decline Y/Y; Sees Q3 Computing revenue decline Y/Y. Cuts FY23 Revenue to ‘slightly decline’ y/y (prev. “flat”). Sees components and other profits to slightly decline in 2023 Y/Y. Sees slight Y/Y decline in consumer electronics products, according to Bloomberg and Reuters.

European bourses trade on the front-foot after shrugging off opening losses which were in part a by-product of Chinese-related concerns overnight. Sectors in Europe have a slight positive tilt with marginal outperformance in Telecoms, Banks and Retail names, whilst Energy and Basic Resource names lag on account of Chinese-inspired weakness in underlying commodity prices. Stateside, futures are trading slightly firmer ahead of a catalyst-thin docket, with the ES briefly topping 4,500.

Top European News

- UK government urged universities and unions to return to the negotiating table after industrial action suspended marking for months and left students without degree results, according to FT.

- S&P affirmed Denmark at AAA; Outlook Stable and affirmed Switzerland at AAA; Outlook Stable on Friday.

FX

- DXY eased from best levels – a partial pick-up in overall sentiment also sapped some of the Greenback’s strength rather than any real change in fundamentals.

- G10s are flat across the board with no real standout performers at the time of writing.

- PBoC set USD/CNY mid-point at 7.1686 vs exp. 7.2461 (prev. 7.1587)

Fixed Income

- Debt futures regain composure after overcoming several bouts of selling pressure, albeit not uniformly and without an obvious catalyst.

- Bunds bounce from 131.22 to 131.59 to trade 12 ticks above par.

- Gilts emulate the feat between 93.35-93.75 parameters before waning.

- T-note tagged along within a 109-30+/110-08+ range having closed at 110-06 on Friday.

Commodities

- WTI and Brent futures have rebounded from session lows after the European cash open, with price action overnight largely dictated by broader market sentiment.

- Dutch TTF futures have trimmed earlier gains but remain positive by around 2% intraday.

- Spot gold moves in tandem with the Dollar while base metals have largely rebounded from APAC lows.

- Australia’s Fairwork Commission has issued an order that unions can conduct industrial action ballot of employees of Chevron’s (CVX) Wheatstone platform, according to Reuters.

Geopolitics

- Russian Defence Ministry said the Russian military opened warning fire on a dry cargo ship near Ukraine flying a Palau flag and the cargo ship then went on its way to Ukraine after inspection by the Russian military, according to Reuters.

- Russian Defence Ministry said Russia thwarted Ukraine’s attempt to carry out a terrorist attack on objects in Russia and that Russia destroyed a Ukrainian drone over the Belgorod region. It was also reported that the regional Governor said apartments and vehicles were damaged which may have been due to a drone attack, according to Reuters.

- Russia’s Defence Ministry said Ukraine tried to strike Crimea Bridge with S-200 rockets although there were no casualties, while it was also reported that traffic on the Crimean Bridge was temporarily stopped, according to Reuters.

- UK defence intelligence said the Wagner Group is likely moving towards a downsizing and reconfiguration process largely to save on staff salary expenses and there is a realistic possibility that the Kremlin no longer funds the Wagner Group, according to Reuters.

- Taiwan’s Vice President Lai said during his visit to the US that Taiwan will not back down to threats. Lai separately commented through social media that he is happy to arrive at the Big Apple which is an icon of liberty, democracy and opportunities, while he is looking forward to seeing friends and attending transit programs in New York. Furthermore, the chair of the US body that handles relations with Taiwan is to meet with Taiwan’s Vice President in San Francisco, while China’s Foreign Ministry said China firmly opposes Taiwan independence separatists’ visiting the US under any name and for any reason, as well as criticised Lai of stubbornly adhering to the separatist position of Taiwan independence and of being a troublemaker, according to Reuters.

- North Korean leader Kim inspected missile and arms factories, while he called for a drastic boost in missile production capacity, according to KCNA. according to KCNA and Yonhap.

- Chinese Defence Minister to visit Russia and Belarus from Aug 14-16, according to Chinese state media.

- Japan and the United States will jointly develop a new type of missile to intercept hypersonic projectiles being developed by countries such as North Korea, China and Russia, according to Kyodo sources.

US event calendar

- Nothing major scheduled

DB’s Jim Reid concludes the overnight wrap

Happy Monday to all our readers still actively following markets as we reach mid-August (whether from the office or your holiday). Henry and I will be holding the fort the next couple of weeks while Jim is in the Alps for a well-deserved (though I’m not sure entirely restful) break. In my recent move to Jim’s team, we did clarify that having twins will not be a pre-condition for others despite the multi-tasking and people management skills this brings. That said, Jim may have jinxed my weekend with his mention on Friday of the challenges of twin life. Any tips on managing big feelings of just-turned-3-years-old girls are very welcome!

Markets have avoided major tantrums of their own but have been in a far from cheerful mood in August so far. In the past week we have seen the highest weekly close for 10yr Treasury yields in 9 months (amid elevated rates vol), the weakest start to the month for equities since March, the weakest week for US semiconductor stocks since last October and oil prices reaching a 9-month high (more on these below). We’ll see if a full August lull takes over this week, but trading in Asia this morning offers some notes of caution.

In terms of events this week, we will get several soundbites on the strength of the US economic cycle, especially on the consumer front, with retail sales (Tuesday) industrial production (Wednesday) and a number of key retailers reporting results. In addition, the Fed will release the minutes of the July FOMC meeting (Wednesday). In Europe, the key data will be in the UK, with the July labour market (Tuesday), inflation (Wednesday) and retail sales (Friday). It will also be a busy week in Asia with the July activity data and the 1-year MLF rate decision in China (Tuesday) and with preliminary Q2 GDP (Tuesday) and national CPI (Friday) in Japan.

In more detail, our US economists expect monthly retail sales to rise +0.3% in July (vs +0.4% consensus and +0.2% prev.) with a slightly slower rise in retail control (+0.2% vs +0.5% consensus). We will also get July industrial production (DBe: +0.1% vs +0.3% consensus), housing starts, the NAHB housing market survey and business surveys from the New York and Philly Feds. The health of the consumer will be crucial to whether the US can avoid a recession. US households will face more headwinds in H2 – slowing employment growth, pass through of policy tightening as well as the resumption of student loan repayments and deferred taxes coming due – though these are more likely to become visible in the autumn. As a reminder, our US economists continue to see a baseline of a mild recession from late 2023, but consumer resilience has made it a closer call.

Consumer activity will also be in focus at the tail end of the earnings season with reports this week from Home Depot (Tuesday), Target (Wednesday) and Walmart (Thursday). Other notable corporate earnings include Cisco and Applied Materials in the US and Tencent and JD.com in China.

From a central bank perspective, the minutes of the July FOMC meeting may give us more hints about the Fed’s reaction function ahead of the September meeting. With the data-dependent tone from Fed speakers, any discussion on the expected path of inflation will be particularly interesting. On the topic of the expected Fed path, our rates strategists published an interesting chart on Friday, showing that while the latest Fed pricing is slightly below the June FOMC dot plot for 2023 and 2024, the two paths are very close from a real rates perspective. See here for more.

Over in Europe, the UK inflation print for July will be the highlight. A strong downside surprise last month drove the second strongest daily rally in 2yr gilts (-18bp) since March. Our UK economist Sanjay Raja sees headline inflation at 6.8% in line with consensus, with core at 6.9% (consensus 6.8%). This would mark the lowest headline inflation since February 2022, but still the highest among the G7. On the labour market, Sanjay sees average weekly earnings picking up to +7.3% yoy (+7.4% consensus).

In Asia, China will dominate the headlines on Tuesday with the July activity data including retail sales and industrial production (we also get the 1yr MLF rate fixing the same day). After weaker trade and bank credit numbers last week, investors will watch for further evidence on the trajectory of China’s economy. The same day we will get the Q2 GDP print in Japan (DBe: +0.9% qoq vs +0.7% qoq consensus). Meanwhile, Japan’s CPI print on Thursday is expected to show CPI ex fresh food and energy moving back to its May peak (+4.3% DBe and consensus vs +4.2% prev.).

In early Asian trading today, the Japanese yen breached the key 145 level, falling to its lowest of the year against the dollar. This raises questions about possible BoJ intervention or scope for BoJ to accept higher JGB yields to support the yen. As we go to print, the yen has reversed its course and is trading at 144.90 per dollar, flat on the day.

Asian equity markets are extending their downward trend this morning. That mirrors Friday’s weakness on Wall Street and concerns over China’s property downturn. As I check my screens, Chinese equities are trading sharply lower with the CSI (-1.33%), the Shanghai Composite (-0.92%), and the Hang Seng (-2.22%). That follows a sell-off in real estate stocks with the shares of Chinese real estate company Country Garden Holdings down as much as -12% after the company suspended the trading of 11 onshore bonds. The lower sentiment has rippled through other bourses in Asia and the Kospi is down (-0.91%) while the Nikkei has edged lower (-0.42%) after a holiday.

In overnight trading, US stock futures are seeing fresh losses with those on the S&P 500 (-0.18%) and NASDAQ 100 (-0.23%) trading lower as risk appetite remains downbeat. Meanwhile, yields on the 10yr USTs (+1.96bps) have edged higher trading at 4.17%. Oil prices are also lower this morning following the concerns in China with Brent (-0.94%) at $85.99 and WTI (0.97%) at $82.38.

Looking back at last week, Friday’s data included US July PPI (+0.3% mom vs +0.2% exp), which sent a (somewhat expected) stronger signal for core PCE than we saw in core CPI the previous day. Meanwhile, the August University of Michigan survey was modestly encouraging, with current conditions at their highest since late 2021 and 1-year inflation expectations down to their joint lowest since early 2021. Over in Europe, UK Q2 GDP came in at +0.2% qoq (0.0% exp.), with the monthly June GDP print at +0.5%. This was above the range of estimates in the Bloomberg survey. This stronger print helped drive the sharpest sell off in 10yr gilts since early July (+16.3bps on Friday to 4.53%).

Volatility remained the dominant theme for bonds last week. 10yr Treasury yields rose +11.8bp to 4.155%, their highest weekly close since last October (+4.7bp Friday). 2yr yields saw a similar move (+12.9bps, +5.2bps Friday) while the 30yr rose +6.1bps (+1.0bps Friday). As we mentioned last week, this stands in contrast to the stable near-term Fed pricing, with the terminal rate staying in a 7bp range since late June. Over in Europe, 10yr bunds were +6.3bps on the week, with a +9.6bp sell off on Friday.

Equities confirmed a soft start to August, with the S&P 500 down -0.31% on the week (-0.11% on Friday), to its lowest level in over a month and down -2.72% month to date. Tech stocks led the weakening with the NASDAQ down -1.90% (-0.68% Friday). Meanwhile, the FANG+ index of tech mega caps (-3.64%) and the Philadelphia semiconductors index (-4.99%) saw their worst weeks since March and since last October respectively. This was led by Nvidia (-8.56%), though the chipmaker is still +180% ytd. The DOW Jones outperformed last week (+0.62%) but this was driven more by specifics of energy and healthcare than being a strong overall signal on the US economy, with the small cap Russell 2000 index down -1.65%. Over in Europe, Stoxx 600 was flat on the week (-0.02%) after a sizeable -1.09% reversal on Friday. France’s CAC (+0.34%) and Spain’s IBEX (+0.70%) gained on the week, while the DAX (-0.75%) and Italy’s FSTE MIEB (-1.09%) underperformed (the latter due to last Tuesday’s Italian bank tax news).

In the commodities space, the oil price rally lost some momentum but still eked out a seventh weekly gain in a row, adding upside to near-term headline inflation. Brent rose +0.47% on the week (+0.66% Friday). WTI was +0.45% on the week to $83.19/bl (+0.45% Friday), having reached a 9-month high of $84.40/bl on Wednesday. In Europe, TTF natural gas prices closed +20.35% higher on the week at EUR 35.8/MWh, after spiking to EUR 39.5, their highest since April, on Wednesday. Copper (-3.84%) saw its worst week in three months amid concerns over China’s property slump.

Tyler Durden

Mon, 08/14/2023 – 08:10

via ZeroHedge News https://ift.tt/SAW5vRN Tyler Durden