China Liquidated The Most US Securities In Four Years To Prop Up Plunging Yuan

Yesterday, when looking at the latest TIC data, we made a modest proposal: the reason why yields are blowing out has nothing to do with the contrived concept of “term premium”, nothing to do with some ridiculous myth that Bidenomics has decoupled the US from the rest of the world, which now finds itself in some Golden Age of economic growth (where mortgages are now 8% and all credit cards are maxed out), and everything to do with aggressive selling by a handful of key entities, the number one being China which has sold its Treasury holdings in 20 of the past 22 months…

… and the second one being foreign central banks, which after five months of purchases, dumped the most treasuries since the start of the year…

… just as 10Y yields blew out.

But it turns out there was much more, because while we were focusing on just the change in Chinese treasuries, we should have been looking at the bigger picture. And what it reveals, as Bloomberg wrote this morning, is that Chinese investors offloaded the most US bonds and stocks in four years in August, further fueling speculation Beijing is liquidating FX reserves to defend a weakening yuan, or for the same reasons Russia liquidated its own Treasury holdings in 2018: it knew, correctly, that the dollar would be weaponized against it… and if China has any intention to anex Taiwan in the future, why wouldn’t it be shifting away from US Treasury holdings? After all, it saw how quickly Russia would be cut off from SWIFT and the broader dollar regime.

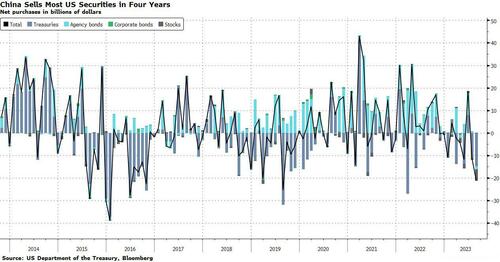

In any case, as the chart below shows, while the bulk of the $21.2 billion of the August sales were in Treasuries and US equities, the Asian nation also cut holdings of agency debt (debunking a widespread if erroneous theory that China is not selling TSYs).

To be sure, an FX liquidation to prop up the currency would make perfect sense: in August, the onshore yuan tumbled to its lowest against the dollar since November, prompting Beijing to tell state-owned banks to step up intervention in the currency market (recall this post from August: “China Launches War On Yuan Bears With 1000+ pip Fixing Gap Vs Estimates“)

“This could be to liquidate some bond holdings to obtain US dollar cash in case it is needed later to defend the yuan via intervention operations,” said Gareth Berry, a currency and rates strategist at Macquarie Group Ltd. in Singapore. “The same reason may go for why they sold stocks.”

In addition to the $14.9BN in US TSY solds in August, the most since May 2022, Chinese investors also sold a record $5.1 billion of US stocks in August, the data showed; incidentally that’s the month that the S&P swooned after hitting a 2023 high just after the Fed’s “final rate hike” FOMC meeting in late July.

While Chinese funds have been selling down holdings in Treasuries this year, they were buying a roughly comparable amount of US agency bonds. As such, the net sale of both types of bonds in August will raise eyebrows for investors tracking demand for US debt.

And, as we noted yesterday, it’s not just China: Japanese investors have also been paring their holdings of US securities, with sales of corporate bonds hitting a record.

“I suspect that Japan investors bought US corporate bonds over the past two years to obtain a yield pick-up over Treasuries,” said Macquarie’s Berry. “Now that Treasury yields have risen so much, they can feel more comfortable rotating back the other way.”

Tyler Durden

Thu, 10/19/2023 – 23:00

via ZeroHedge News https://ift.tt/pUF3joE Tyler Durden