Cable Rallies After ‘Hawkish’ Pivot By Bank Of England

The Bank of England held rates unchanged – as expected – today and while it signaled a ‘pivot’ to possible rate-cuts in the future, the market interpreted Governor Bailey’s comments (echoing comments from The Fed’s Powell) as pushing back the start of said cuts.

“We have had good news on inflation over the past few months. It has fallen a long way,” Bailey said in a statement that accompanied the decision on Thursday in London.

“But we need to see more evidence that inflation is set to fall all the way to the 2% target and stay there before we can lower interest rates.”

The decision marked the widest division on the direction of policy since 2008, with a three-way split of the vote:

-

6 MPC members voting for keeping rates on hold,

-

2 members (Haskel and Mann) voting for a hike, and,

-

1 member (Dhingra) voting for a (25bp) rate cut.

UBS notes that in terms of the forward guidance, the Committee re-iterated that “monetary policy will need to remain restrictive for sufficiently long” while taking out the explicit reference to further tightening if required (“[T]he Committee will keep under review for how long Bank Rate should be maintained at its current level”).

On the basis of this commentary from the BoE, August looks more likely than June given the pressures from wages.

“Despite a vote for an immediate rate cut, it still looks hawkish compared to what was priced in,” said Kamal Sharma, a strategist at Bank of America.

“Looking at the inflation forecast — 2.3% by 2026, they want to signal that we are not there yet on inflation and rate pricing excessive.”

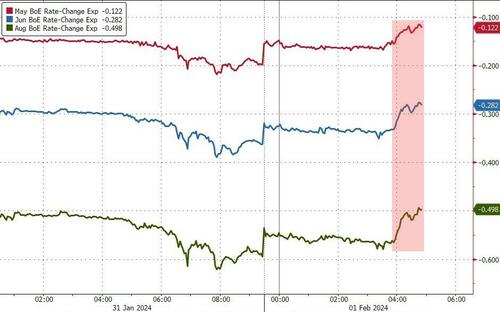

Rate-cut expectations have fallen (less rate-cuts priced in), but June remains fully-priced for 1 cut and 2 cuts by August…

Crucially, Gov Bailey’s opening statement was a dirdct message to the markets (similar to Powell’s):

“If we were to keep bank rate at 5.25% for the next three years, we think it is likely that inflation would eventually fall significantly below target.

But if we were to follow the market rate conditioning path, we think inflation would be above target for much of the next three years.

We need to get the balance right.

We have to keep monetary policy sufficiently restrictive for sufficiently long. Nothing more, nothing less.”

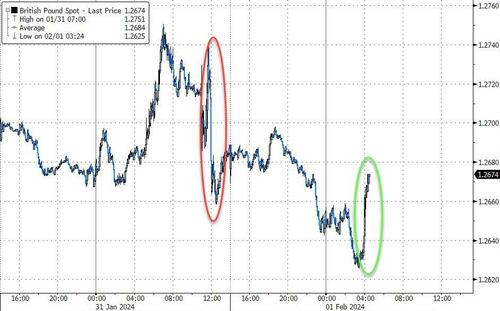

Cable is strengthening modestly on the moire hawkish report…

Finally, we note that the BoE raised its growth forecast for 2024, but even so now sees gross domestic product increasing by just 0.25%. In 2025, it expects an acceleration in growth to a still-modest 0.75%.

Additionally, in its new forecasts, the BOE said it now expects the inflation rate to fall to its target in the second quarter, and be well below that two years from now if it were to leave its key rate unchanged.

That is another signal that policymakers expect to ease monetary policy this year.

Tyler Durden

Thu, 02/01/2024 – 07:50

via ZeroHedge News https://ift.tt/VnpIizy Tyler Durden