China Plunge Protectors Emerge In Last Hour Of Trading To Push Stocks To Session Highs After 10-Day Holiday

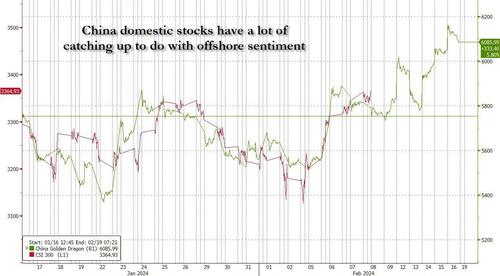

With onshore traded Chinese stocks closed last week for the Lunar New Year holiday, expectations were high that Monday’s reopen would push domestic markets sharply higher if only to catch up with offshore proxies in Hong Kong and in the US, where the Nasdaq China Golden Dragon ETF has ramped sharply higher in recent days.

And while Chinese stocks did initially push higher – buoyed by solid travel and tourism data that suggested consumption revved up even as the broader economy struggles with deflation and a property crisis – the early thrust quickly fizzled out as it has much of the past year, as investors quickly shifted to selling the lack of news and demanding more than just words from Beijing. Sentiment wasn’t helped by property sales once again missing the mark as did the lack of rate reductions on the MLF, despite “Chinese Premier Li Qiang called for “pragmatic and forceful” action to boost the nation’s confidence in the economy.”

As Goldman’s Rich Privorotksy wrote this morning, “even with a robust recovery in travel and spend data (LV raising prices in China) underlying issues in property remain thorny and policy support seems restrained. Copper giving back some of Friday’s gains as is iron ore, coking coal and the rest of the ferrous complex.”

So in a bid to maintain the recent bullish sentiment, with stocks wobbly and threatening to close read after a 10 day hiatus, the plunge protection team appeared on the scene to do just that: protect against a plunge and in the process send Chinese stocks to session highs.

As Bloomberg reports, a number of exchange-traded funds in China tracking the nation’s midcap stocks saw surging turnover. Traded value of both the China AMC CSI 500 ETF and Harvest CSI 500 ETF surged to record highs, while those of Tianhong CSI 500 ETF, BOC International CSI 500 ETF, CIB CSI 500 ETF were also elevated from average levels.

As Bloomberg’s John Liu notes, some of these ETFs have been monitored by traders as likely purchase targets by the state.

“What’s interesting is that one week before the CNY, they started to buy more of CSI 500 and CSI 1000, which is new. And so for us, that seems to me that they are broadening that scope and hopefully trying to reinforce that message that they do care about market stability,” says Jason Lui, BNP Paribas Head of APAC Equity & Derivative Strategy, in an interview with Bloomberg Television.

The intervention helped the CSI 500 Index pare its losses after falling as much as 1.5% while the benchmark CSI 300 Index closed at session highs, rising 1.2% after briefly dipping into the red earlier.

Still, even with the solild close, Chinese stocks lagged the big advances seen last week in Hong Kong, as buoyant tourism data from the holidays suggest strong consumption, doubts run deep over China’s longer-term battle with a weak economy and property crisis. Also of note is that the PBOC held the interest rate on its one-year policy loans at 2.5% on Sunday, as investors continued to patiently await more stimulus.

As Bloomberg’s Ven Ram writes, “on the face of it, Chinese equities seem compellingly cheap: the CSI 300 Index offers a prospective earnings yield of more than 8%, a dividend yield approaching 3%, not to mention a double-digit return on equity. The stock market, as a whole, is trading at just 1.3x its book value, meaning the proxy for the world’s biggest factory is changing hands at nearly what it cost the owners to build the businesses to where they are today.“

Yet, cheap can get cheaper as global investors have discovered, with Chinese shares having tumbled for three years in row in 2023. Domestic policymakers have unveiled a host of measures in recent months to prop up stocks, but there is no point trying to restore sentiment when the problems are deeply structural. What is happening with Chinese equities is symptomatic of what is happening with its real economy. Set the latter right, and investors will follow in spades. But trying to address sentiment toward stocks without setting the economy right will pay poor dividends.

In contrast, with its economy in recession, its central bank one giant cartoon and its population a demographic disaster, global investors can’t seem to get enough of stocks in neighboring Japan. There, stocks are extremely expensive, and that would perhaps be an understatement. The earnings’ yield on the Nikkei 225 Index is anemic, the return on equity is not quite compelling and all in the context of an economy that, with some luck, may grow just about 1% this year.

As Ram concludes, “given their relative valuations, it would seem that investors may be tempted sooner rather than later to rotate out of Japan into China. Just now, though, there seem to be few takers.”

Tyler Durden

Mon, 02/19/2024 – 09:55

via ZeroHedge News https://ift.tt/gs94Bu2 Tyler Durden