Disinflationary Path Stalls As Non-Durable Goods Prices Spike But Supercore PCE Slides

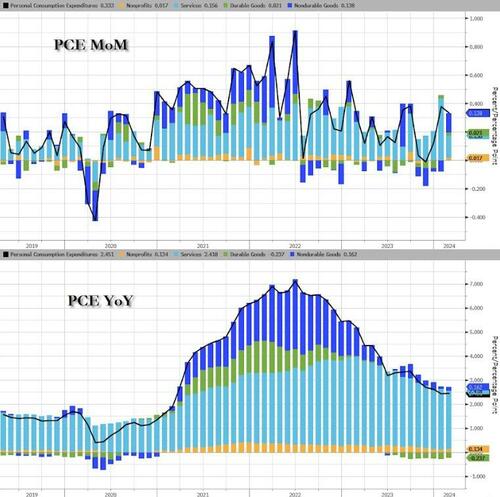

One of The Fed’s favorite inflation indicators – Core PCE Deflator – was flat at +2.8% YoY in February (as expected) – the lowest since March 2021.

However, the headline PCE Deflator stalled its disinflationary path, rising to +2.5% YoY (from +2.4%)…

Source: Bloomberg

Durable Goods deflation slowed and non-durable goods inflation picked up in February…

Source: Bloomberg

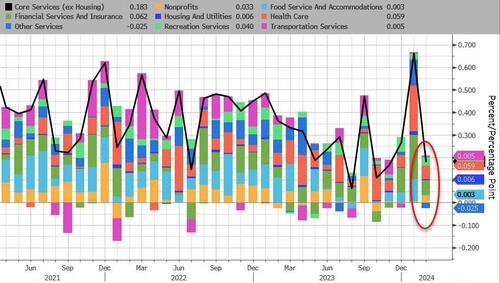

The so-called SuperCore – Services inflation ex-Shelter – remains stalled around +3.33% YoY (up 0.18% MoM)…

Source: Bloomberg

But SuperCore MoM tumbled significantly (as Healthcare cost inflation fell and Other Services prices deflated)…

Source: Bloomberg

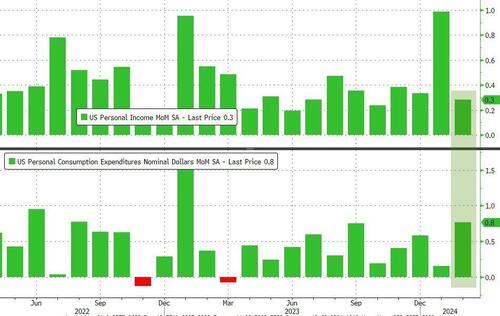

Income and Spending both rose in February with spending far outpacing income (+0.8% MoM vs +0.3% MoM respectively)…

Source: Bloomberg

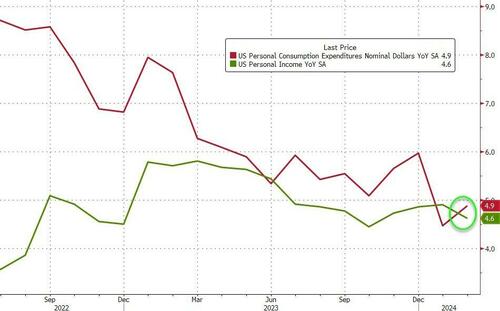

On a YoY basis, spending is once again outpacing income growth…

Source: Bloomberg

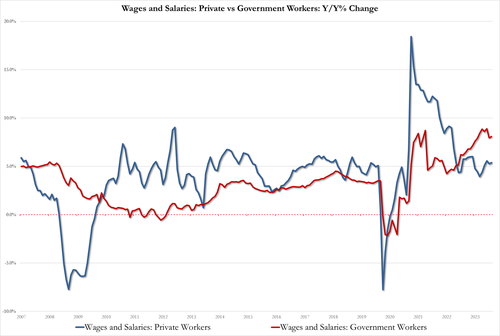

Government workers’ record wage growth in January was revised lower (because we caught them)…

-

Govt wages grew 8.1% in Feb, up from a downward revised 7.9% in Jan and below the record high of 8.9% in December

-

Private wages grew 5.4% in Feb, up from 5.3% in Jan and back to their pre-covid growth rates

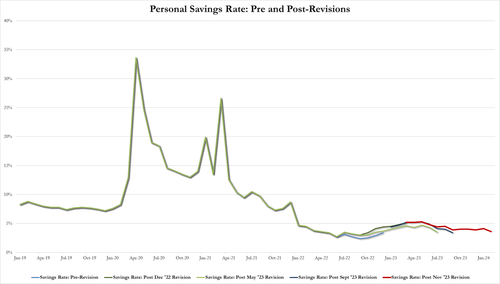

As one would expect with that level of spending, the savings rate collapsed to its lowest since Dec 2022…

Source: Bloomberg

Here’s why – government handouts rose significantly once again (+$39BN MoM)…

Source: Bloomberg

Finally, while the markets are exuberant at the survey-based disinflation, we do note that it’s not all sunshine and unicorns. The vast majority of the reduction in inflation has been ‘cyclical’…

Source: Bloomberg

Acyclical Core PCE inflation remains extremely high, although it has fallen from its highs.

Is The (apolitical) Fed really going to cut rates 4 times this year with a background of strong growth (GDP) and still high Acyclical inflation?

Tyler Durden

Fri, 03/29/2024 – 08:47

via ZeroHedge News https://ift.tt/Obs5QFU Tyler Durden