US futures are trading modestly in positive territory and just shy of all time highs, after swinging between gains and losses as Europe trades higher and Asia closed weaker after US markets shrugged of a higher core CPI print and focused on the more constructive disinflation components (Super core 47bps vs 85bps). As of 7:50am, S&P futures traded +0.1% while Nasdaq futures were modestly red; earlier, Germany’s DAX hit 18K for first time, while EuroStoxx50 hit 5K for first time in 24 years.

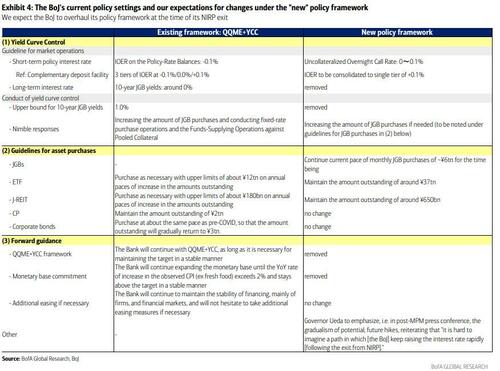

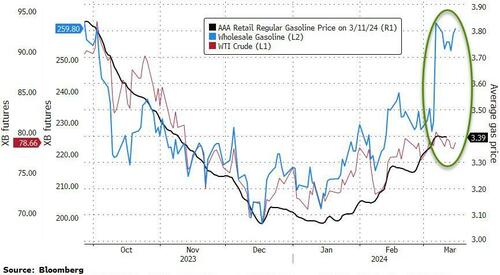

Overnight newsflow was relatively quiet outside of early results from Japan’s wage negotiations which showed majority of companies agreeing to unions demands: previously, BOJ’s Ueda said wage negotiations were critical in deciding when to phase out its big stimulus program while Japan PM Kishida noted in Parliament that Japan has not emerged out of deflation, pushing back some expectations of BOJ exiting negative rates next week. UK Jan Industrial Production printed softer, Jan GPD/Manf Production in-line, and EZ Industrial Production printed weaker as well. Donald Trump clinched the Republican presidential nomination, setting up a combative election race with President Joe Biden. Elsewhere, US TSY 10Y yields are trading 1bp higher at 4.17% while bond yields across Europe ticked lower; the Bloomberg dollar index is fractionally lower, WTI crude is +$1.05 at $78.65, and bitcoin just hit a new all time high above $73,000.

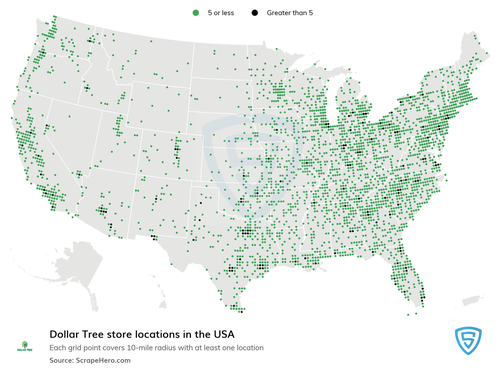

In premarket trading, Nvidia shares rose again after the chipmaker rallied 7.2% and added $153 billion in market value on Tuesday. Tesla slipped after Wells Fargo downgraded the stock to underweight from equal-weight. Dollar Tree slumped after reporting fourth-quarter sales and profit that missed Wall Street’s expectations. The retailer also announced plans to close about 600 Family Dollar stores in the first half of the fiscal year.

- Beauty Health soars 21% after the skin-care company reported fourth-quarter sales that topped consensus estimates. The company named Marla Beck as CEO after a stint as interim CEO that began in November.

- Clover Health rises 9% after the Medicare Advantage insurer reported revenue for the fourth quarter that beat the average analyst estimate.

- Dollar Tree slumps 6% after issuing an annual sales outlook that fell short of the average analyst estimate at the midpoint of the forecast range.

- Eli Lilly rises about 1% after teaming up with Amazon.com Inc. to expand its nascent business of selling weight-loss drugs directly to patients.

- Petco (WOOF) rises 3% after the company reported comparable sales for the fourth quarter that topped the consensus estimate. Petco also said Ron Coughlin has stepped down as CEO/Chairman.

- Tesla (TSLA) falls 2% after Wells Fargo cuts the recommendation on the EV maker’s stock to underweight, saying there are fresh risks to EV volumes as price cuts are not having as much impact as before.

- ZIM Integrated Shipping (ZIM) falls 4% after the marine shipping company reported its fourth-quarter results and gave an outlook.

Traders held onto Fed rate cut bets for this year even after US inflation came in higher than expected on Tuesday. Futures are pricing in nearly 70% odds that the central bank will start easing in June and enact at least three quarter-point cuts over the course of 2024. Policymakers next gather March 19-20, where investors will key into the Federal Open Market Committee’s quarterly forecasts for rates, including whether fresh employment and inflation figures have prompted any changes.

“It’s going to be hard for the Fed not to be hawkish in the next meeting as the fight against inflation clearly isn’t won yet,” said Justin Onuekwusi, chief investment officer at wealth manager St. James’s Place. “That print does make you sit up and be alert of the risk inflation remain stubbornly high and that has massive feed-across right across portfolios. Markets may be underestimating impact of sticky inflation as they are still aggressively pricing a June rate cut.”

European stocks rise with the Stoxx 600 hovering near a record high and the Stoxx 50 breaching 5,000 for the first time in 24 years. Retail shares are leading gains after positive updates from Zalando and Inditex. Utilities and banks also outperform. Here are some of the biggest movers on Wednesday:

- Zalando shares jump as much as 18%, the most in five years, after results that analysts describe as positive, with a beat on adjusted ebit for 2023 and updated targets for growth through 2028. RBC analysts say they are confident in the German company’s ability to capture growth as consumer demand recovers.

- Inditex shares climbed as much as 5.2% to a fresh record high after the Zara parent reported what analysts called strong results thanks to continued robust demand for its clothing collections. The Spanish retailer plans to increase its annual dividend by 28% to €1.54 per share. H&M and the broader retail index also gain.

- BNP Paribas rises as much as 3.4% after the lender forecast higher-than-expected profit and stepped up cost savings measures.

- Balfour Beatty shares gain as much as 10%, its biggest intraday gain since August 2022, after the construction and infrastructure group reported full-year adjusted earnings per share that came ahead of consensus expectations. Additionally, the company announced a share buyback of £100 million for 2024. Liberum noted the strength in the company’s Gammon Construction joint venture, with Jardine Matheson.

- E.On shares jump as much as 7%, most in more than a year, after it reported a positive update according to Jefferies, with outlook ahead of consensus. Company also announced CFO Marc Spieker will assume role of COO and Nadia Jakobi is set to become CFO.

- Keywords Studios shares gain as much as 13%, the most since May 2020, after the company maintained FY goals issued in January, offering reassurance in a video game industry marked by layoffs at bellwethers including Sony and Electronic Arts. Keywords provides external technical support to video-game makers.

- Vallourec shares gain 9.8% after ArcelorMittal said it’s buying a stake in the tubular steel company from Apollo Global Management for about €955 million. Analysts highlight the deal triggers M&A speculation around Vallourec, and Oddo BHF expects ArcelorMittal to launch a takeover bid once the six-month lock-up period expires.

- Adidas shares fall as much as 4.1% as a lack of a full-year guidance upgrade from the sportswear maker disappointed some analysts, even as results were in line with January’s pre-released figures. The focus turns to the German firm’s growth outlook for the first quarter, and whether it will indeed see a pick-up in trading in the second half of the year.

- Solvay drops as much as 5.2% after guidance for lower Ebitda in 2024. Analysts note that the chemicals company’s commitment to a stable or growing divided may offset negatives from falling Ebitda. Investors will focus on the soda ash price assumptions, Morgan Stanley said.

- Geberit falls as much as 4.8% after the Swiss maker of building materials missed earnings estimates. The stock had rallied ahead of the earnings, gaining almost 8% from the start of February through Tuesday.

- Stadler Rail shares fall 3.3% after the Swiss train manufacturer’s sales and operating margins came in lower than estimates. The company’s 2024 outlook also weighs on sentiment, according to Vontobel.

The European Central Bank is also poised to start rate cuts soon, with Governing Council member Martins Kazaks saying on Wednesday reductions could come “within the next few meetings.” Bank of France Governor Francois Villeroy de Galhau said borrowing costs may be cut in the spring, with June more likely than April for a first move.

In FX, the Bloomberg Spot Index slips to reverse modest earlier gains while the yen was the weakest of the G-10 currencies, falling 0.2% versus the greenback to 148.05; the krone led G-10 gains. “BOJ Governor Kazuo Ueda clearly indicated yesterday that wages were the last piece of information needed before the central bank could decide whether to end its negative interest rate policy next week, said David Forrester, a senior FX strategist at Credit Agricole CIB in Singapore. “So the partial tally of the spring wage negotiations this Friday will be a decisive factor for the BOJ and the JPY in the coming week.” The pound was flat.

In rates, treasuries edged lower, with US 10-year yields rising 1bps to 4.16%. Gilts fall after data showed the UK economy rebounded in January. UK 10-year yields rise 2bps to 3.96%. Gilts lag across core European rates as market digests an offering of 30-year inflation-linked debt and a wave of domestic data. US session includes 30-year bond reopening, following soft reception for Tuesday’s 10-year sale. Treasury auction cycle concludes with $22b 30-year bond reopening after $39b 10-year reopening tailed by 0.9bp, while Monday’s 3-year new issue stopped through by 1.3bp. WI 30-year yield at ~4.320% is roughly 4bp richer than February refunding, which stopped through by 2bp in a strong auction

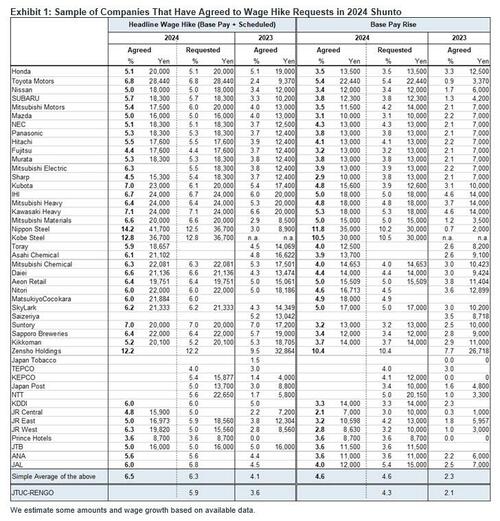

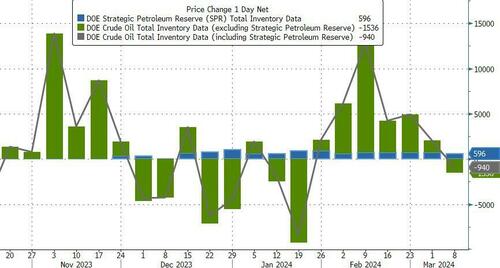

In commodities, oil advanced after four days of losses as an industry report pointed to shrinking US crude stockpiles, offsetting wavering OPEC cuts. WTI rose 1.5% to trade near $78.70. Spot gold adds 0.2%. and trades near all time highs.

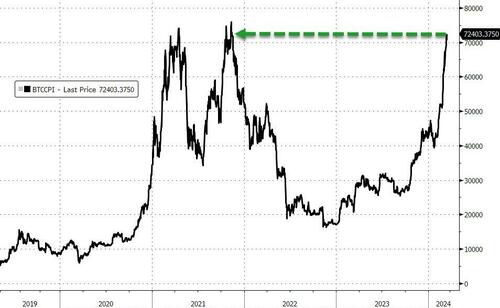

Bitcoin rises 3% to a record high above $73,000 with Ethereum (+2.7%) also catching wind.

To the day ahead now, and data releases include UK GDP and Euro Area industrial production for January. Central bank speakers include the ECB’s Cipollone and Stournaras. And in the US, there’s a 30yr Treasury auction taking place.

Market Snapshot

- S&P 500 futures little changed at 5,176.25

- STOXX Europe 600 little changed at 506.38

- MXAP down 0.3% to 176.21

- MXAPJ down 0.3% to 540.31

- Nikkei down 0.3% to 38,695.97

- Topix down 0.3% to 2,648.51

- Hang Seng Index little changed at 17,082.11

- Shanghai Composite down 0.4% to 3,043.84

- Sensex down 1.0% to 72,924.23

- Australia S&P/ASX 200 up 0.2% to 7,729.44

- Kospi up 0.4% to 2,693.57

- German 10Y yield little changed at 2.30%

- Euro little changed at $1.0929

- Brent Futures little changed at $81.99/bbl

- Gold spot up 0.0% to $2,158.75

- US Dollar Index little changed at 102.93

Top Overnight News

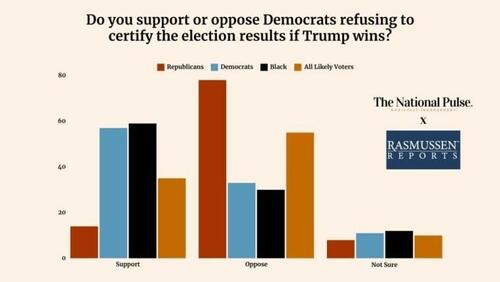

- US President Biden secured enough votes to clinch the Democratic presidential nomination and Donald Trump secured enough delegates to win the Republican nomination, according to Reuters.

- Eli Lilly (LLY) is partnering with Amazon Pharmacy (AMZN) to deliver prescriptions sold through direct-to-consumer website.

- Some of Japan’s biggest companies, including Toyota, Nissan, and Nippon Steel, hand out large wage hikes to their workers (the biggest increases in decades), paving the way for a BOJ rate hike next week. FT

- China is scrapping a string of infrastructure projects in indebted regions as it struggles to reconcile a need to save money with this year’s target for economic growth. FT

- Chinese state media has touted President Xi Jinping as a market-friendly reformer on par with the paramount leader Deng Xiaoping, in an apparent attempt to dispel skepticism over the country’s growth outlook. BBG

- The European Central Bank will lower borrowing costs in the spring, with June more likely than April for a first move, Bank of France Governor Francois Villeroy de Galhau said. BBG

- Putin says Russia is willing to resolve the Ukraine war “by peaceful means”, but insists Moscow would require security guarantees to do so. BBG

- Donald Trump and Joe Biden have both secured enough delegates to clinch their respective party nominations, cementing a November rematch. The 2024 election is expected to be one of the most expensive on record. BBG

- US crude stockpiles fell by 5.5 million barrels last week, the API is said to have reported, registering the first decline in seven weeks if confirmed by the EIA. Gasoline and distillate supplies also dropped. BBG

- Global dividends hit a record $1.66 trillion last year, according to Janus Henderson. Payouts were up 5%, with almost half the growth coming from the banking sector. It’s the third annual record for dividends and the fund manager expects another all-time high this year. BBG

- Hedge funds are unwinding short Treasury futures bets at a rapid clip, a sign that basis-trade positions are diminishing. This is probably due to asset managers pivoting into investment-grade credit. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as early momentum from the tech-led gains on Wall St was offset by Chinese developer default concerns and as participants digested Japanese wage hike announcements. ASX 200 was led higher by consumer stocks after China’s MOFCOM released an interim proposal to remove tariffs on Australian wine although the advances in the index were limited by losses in the mining sector as iron ore prices continued to tumble. Nikkei 225 swung between gains and losses with initial strength reversed amid firm wage hike announcements. Hang Seng and Shanghai Comp. were varied and price action was contained within relatively narrow ranges with the Hong Kong benchmark kept afloat by strength in auto names and tech, while the mainland was pressured amid developer default fears and with the US House set to vote later on the TikTok crackdown bill.

Top Asian News

- Country Garden Holdings (2007 HK) onshore bondholders said they have not received a coupon payment due on Tuesday, while the developer said funds for a CNY 96mln coupon payment due on Tuesday were not fully in place and it plans to do its best to raise money for payment within a 30-day grace period, according to Reuters.

- TikTok US executives told headquarters recently that a ban wasn’t an imminent risk, according to WSJ citing sources. However, it was separately reported that the US House plans to vote on the TikTok crackdown bill today at around 10:00EDT (14:00GMT).

European bourses, Stoxx600 (+0.2%), are modestly firmer, though with overall trade rangebound in what has been an uneventful session. The IBEX 35 (+1.3%) outperforms, led higher by post-earning strength in Inditex (+4.2%). European sectors are mixed; Retail outperforms, propped up by gains in Zalando (+13.5%) and Inditex. Autos is found at the foot of the pile, hampered by a poor Volkswagen (-0.8%) update. US equity futures (ES U/C, NQ -0.2%, RTY +0.1%) are trading around the unchanged mark, with slight underperformance in the NQ, paring back some of the strength seen in the prior session.

Top European News

- ECB’s Villeroy noted broad agreement in the ECB to start cutting rates in spring as the battle against inflation is being won, while he noted the risk of waiting too long before loosening monetary policy and unduly hurting the economy is now “at least equal” to acting too soon and letting inflation rebound, according to an interview with Le Figaro; In another batch of comments: Says the ECB is winning the battle against inflation; will remain vigilant on inflation but victory is within sight; Spring rate cut remains probably; more likely to cut rates in June than April.

- ECB’s Kazaks says ECB rate cut decision will come in the next few meetings; uncertainty remains high, and tensions in the labour market is still high.

- Citi expects BoE to start cutting rates in June (vs prev forecast of August).

Japan

- Japan Chief Cabinet Secretary Hayashi said it is important for wage hikes to spread to mid-sized and small companies, while he added they are seeing strong momentum for wage hikes. It was also reported that Toyota, Nissan, Panasonic, Hitachi & Nippon Steel were among the companies that have responded to unions’ wage hike demands in full.

- Japanese PM Kishida says will call for pay hikes exceeding last year at small and mid-sized firms during the meeting with labour union and management; Japan not yet emerging out of deflation.

- BoJ Governor Ueda says BoJ will consider tweaking negative rates, YCC, and other monetary easing tools if the sustained achievement of price target comes into sight. We must scrutinize whether positive wage-inflation cycle merges in deciding whether conditions for phasing out stimulus are falling into place. This year’s wage talks is critical in deciding timing on exit from stimulus. Unions have demanded higher pay, seeing many corporate management making offers that will stream in today and beyond. Will scrutinize the wage talk outcomes, as well as other data and information from hearings when making policy decisions.

- Japanese PM Adviser Yata says wage hikes this year likely to exceed last year’s; Must continue pay rises next year and thereafter to defeat deflation; must broaden pay hikes to workers nationwide and in every prefecture. When asked if solid wage offers could trigger end to NIRP in march, Yata says government will not meddle with the BoJ’s independent policy-making.

- BoJ is reportedly to mull ending all ETF purchases if price goal is in sight; likely to keep buying bonds to keep market stable and to intervene in the event of sharp yield upside, according to Bloomberg sources.

- Japan’s Business Lobby Keidanren Head Tokura says wage increases indicated in the preliminary survey of big firms’ wage talks are likely to exceed last years levels.

- Early signs of a strong outcome in this year’s annual wage talks have heightened changes the BoJ will end its negative interest rate policy next week, according to Reuters sources; “There seems to be enough factors that justify a March policy shift”.

FX

- Marginal upside for the USD which has seen DXY kiss the 103 mark in quiet trade. If the level is cleared, yesterday’s 103.17 will come into view.

- Uneventful price action for EUR with ECB comments unable to shift the dial. As such, the pair is sticking to a 1.09 handle and within yesterday’s 1.0902-43 range.

- GBP is steady vs. the USD and stuck on a 1.27 handle as in-line GDP metrics failed to inspire price action. For now, yesterday’s 1.2746-1.2823 range holds.

- JPY is marginally softer vs. the USD but with losses tempered by reports that the BoJ could end ETF purchases. Today’s 147.24-89 range sits within yesterday’s 146.62-148.18 parameters. More broadly, focus is on in

- AUD is holding up vs. the USD despite falling iron ore prices, with AUD/USD maintaining 0.66 status and within yesterday’s 0.6596-0.6627 range. Likewise, NZD/USD is unable to break out of yesterday’s 0.6133-6184 range. RBNZ’s Conway later today could help to decide direction.

- PBoC set USD/CNY mid-point at 7.0930 vs exp. 7.1775 (prev. 7.0963).

Fixed Income

- Gilts are the relative laggards, at lows of 99.68, with the paper unreactive to the UK’s GDP data (which was broadly in-line). The downside can be attributed to Gilts paring some of Tuesday’s outperformance following the labour data and a strong DMO sale.

- USTs are essentially unchanged in a quieter session for the US (on paper) after Tuesday’s marked CPI moves and a soft 10yr auction, despite the marked concession built in by the post-CPI reaction. Currently holds near session lows at 111-04.

- Bunds are slightly firmer after Tuesday’s marked US CPI-induced pressure. Specifics are relatively light thus far, but focus will be on the ECB Operational Framework Review (tentatively due today). Currently, Bunds hold around 133.24, with the peak for today at 133.27.

- Italy sells EUR 7.25bln vs exp. EUR 6-7.25bln 2.95% 2027, 3.50% 2031, 3.25% 2038 BTP Auction and EUR 1.25bln vs exp. EUR 1-1.25bln 4.0% 2031 BTP Green.

- Germany sells EUR 3.738bln vs exp. EUR 4.5bln 2.20% 2034 Bund: b/c 2.29x (prev. 2.10x), average yield 2.31% (prev. 2.38%) & retention 16.9% (prev. 17.5%)

Commodities

- Crude is firmer, taking impetus from Tuesday’s bullish private inventory data, with specifics light in the session thus far; Brent holds near session highs at +1.1%.

- Flat trade in gold and a mild upward bias in silver with the Dollar steady, calendar light, and with the ongoing geopolitical landscape potentially providing a modest underlying bid; XAU trades in a tight USD 2,155.86-2,161.66/oz range.

- Base metals are mixed with copper prices outperforming following reports that top Chinese copper smelters have reportedly reached an agreement to take action to curb falling fees.

- Azerbaijan oil production stood at 476k BPD in Feb (prev. 474k BPD in Jan), according to the Energy Ministry.

- Top Chinese copper smelters have reportedly reached an agreement to take action to curb falling fees, according to Reuters sources; smelters to cut output at loss-making plants.

- BP (BP/ LN) and ADNOC suspend USD 2bln talks to take Israel-based Newmed private, via Bloomberg.

Geopolitics: Middle East

- CIA Director Burns said there is “still a possibility” of a Gaza ceasefire deal but added that many complicated issues are still to be worked through.

- US may urge partners and allies to fund a privately run operation to send aid by sea to Gaza that could begin before a much larger US military effort, according to sources cited by Reuters.

- US Central Command announced that Houthis fired a close-range ballistic missile from Yemen toward USS Laboon in the Red Sea on March 12th but it did not impact the vessel, while CENTCOM forces and a coalition vessel successfully engaged and destroyed two unmanned aerial systems launched from Yemen.

Geopolitics: Other

- Ukrainian Army Chief Syrskyi and Ukraine’s Defence Minister Umerov held a phone call with US Defense Secretary Austin on weapons delivery to Ukraine, according to Reuters.

- A fire at oil refinery in Ryazan region extinguished, according to the governor cited by Reuters.

US event calendar

- 07:00: March MBA Mortgage Applications 7.1%, prior 9.7%

Government Agenda

- 4 p.m: US President Joe Biden delivers remarks in Milwaukee, Wisconsin on how his investments are rebuilding communities and creating jobs

- 11.15 a.m: US Secretary of State Antony Blinken meets with EU foreign affairs chief Josep Borrell

DB’s Jim Reid concludes the overnight wrap

Next stop on the global tour is Singapore as I’m about to board the plane from Melbourne here this evening. My vaguely fascinating fact about Singapore is that my grandfather was a civil engineer there in the 1920s and 1930s and helped build much of its rapid development at the time. He was Scottish and met my Dutch grandmother there and got married without speaking each other’s language and being able to understand each other. My wife says she’s done the same thing! His brother owned a very successful industrial company on the island and lost all his wealth and his company after the 1929 stock market crash. My entire family were eventually left penniless after the 1930s crash and then WWII. 90 years later and my kids have had the same impact on me!

I’m looking forward to landing in the pretty standard 35 degree heat that Singapore always seems to have on landing. Talking of the heat, even with another hot US inflation print, risk assets put in another strong performance yesterday, with both the S&P 500 (+1.12%) and Europe’s STOXX 600 (+1.00%) driven by strong tech gains (sound familiar?). The highs in the main indices came despite the latest US CPI report for February, which saw inflation come in strongly for a second month running, and led to growing fears that the last phase of getting inflation back to target would be the hardest. But despite the persistence of inflation, investors were remarkably unphased for the most part, and they continue to see a June rate cut as the most likely outcome.

In terms of the details of the report, headline CPI came in at a 6-month high of +0.44%, which meant the year-on-year measure actually ticked up a bit to +3.2% (vs. +3.1% expected). Alongside that, core CPI was at +0.36%, which also meant annual core CPI was also above expectations at +3.8% (vs. +3.7% expected). Some of the blame was placed on shelter inflation, which was up by a monthly +0.43%. But even if you looked at core CPI excluding shelter, it was still up by +0.30%, so it’s difficult to say that shelter was the whole story behind the ongoing persistence. See our US economists’ reaction to the print here.

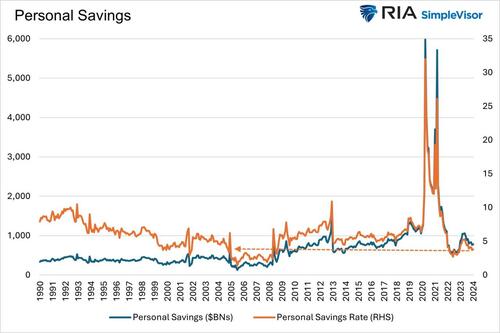

For the Fed, there must be some concern even if markets show little of this. For instance, if you look at core CPI on a 3-month annualised basis, it rose to +4.2%, so it’s getting harder to explain this away as just one month of bad data. Bear in mind that this is pretty high by historic standards as well, and apart from the post-Covid inflation, 3m core CPI hasn’t been that high since 1991. Alongside that, there was evidence that the inflation was coming from the stickier categories in the consumer basket. In fact the Atlanta Fed’s sticky CPI series is now up by +5.1% on a 3m annualised basis, the fastest it’s been since April 2023. So the concern for markets will be that inflation is showing some signs of rebounding, or at the very least stabilising at above-target levels.

When it comes to the Fed, the report led investors to dial back the rate cuts priced this year by -6.1bps, and futures now see 85bps of cuts by the December meeting. There was also a bit more doubt creeping into the chance of a cut by June, with 78% now priced in, down from 86% the previous day. But even with this slightly hawkish repricing, June is still considered the most likely timing for the first cut, which helped to support risk assets even though the print was above expectations. For the Fed, the most important question now will be how this affects the PCE measure of inflation, which is what they officially target. We won’t find that out until March 29th (Good Friday), but we should get a bit more info from the PPI report tomorrow, which has several components that feed into PCE.

The report led to a selloff for US Treasuries, with the 2yr yield (+5.0bps) up to 4.59%, whilst the 10yr yield (+5.4bps) rose to 4.15%. The 10yr yield had peaked at 4.17% intra-day shortly after the latest 10yr Treasury auction which saw slightly soft demand, with bonds issued +0.9bps above the pre-sale yield.

The fixed income selloff was echoed in Europe too, even if the overall performance was better there, with yields on 10yr bunds (+2.7bps) and OATs (+1.6bps) rising by a smaller amount. At the same time, markets remain confident of an ECB cut by June (priced at 91% vs 95% the day before). This is consistent with the latest ECB commentary, with Austria’s Holzmann (strong hawk) saying that a June cut was more likely than April, while France’s Villeroy suggested that “there’s a very broad agreement” to cut rates by the June meeting.

Yesterday’s main outperformer in the rates space were 10yr gilts (-2.5bps), which came after the UK labour market data was a bit weaker than expected over the three months to January. Notably, wage growth slowed to an 18-month low of +5.6% (vs. +5.7 expected), and the unemployment rate ticked up to 3.9% (vs. 3.8% expected).

Although sovereign bonds struggled yesterday for the most part, there was a much better performance for equities. In the US, the S&P 500 (+1.12%) closed at a new record, with tech stocks and the Magnificent 7 (+2.88%) leading the advance. Nvidia was +7.16% higher. Likewise in Europe, the STOXX 600 (+1.00%) hit an all-time high, and there were new records for the DAX (+1.23%) and the CAC 40 (+0.84%) as well. That said, gains more moderate outside of tech, with the equal-weighted S&P 500 up by +0.26%, while the small-cap Russell 2000 (-0.02%) narrowly lost ground for a 3rd consecutive day.

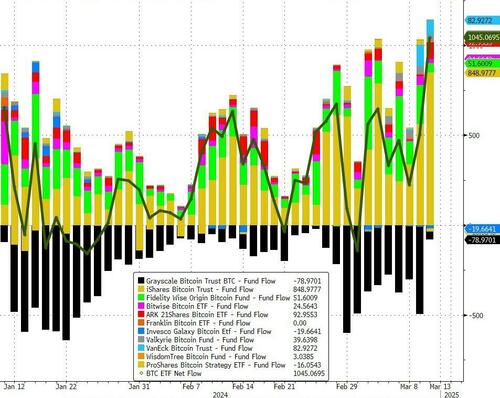

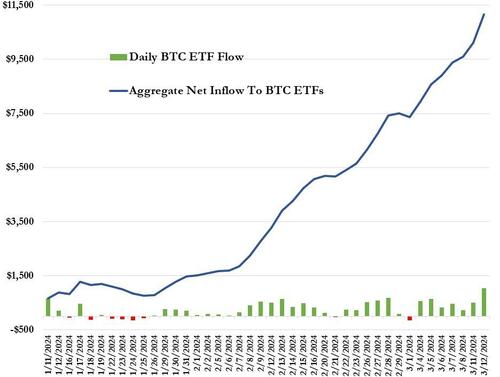

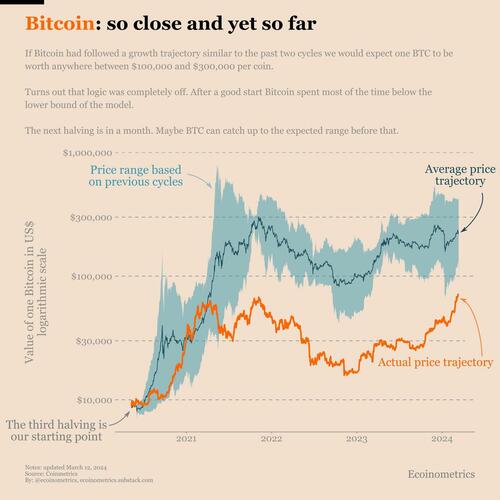

This backdrop was mostly positive for other risk assets. US HY credit spread fell -6bps, closing just 3bps above their 2-year low reached in late February. Meanwhile, Bitcoin posted a new intra-day high just shy of $73,000, surpassing the market cap of silver. Marion Laboure and Cassidy Ainsworth-Grace’s new report this morning discusses the upcoming halving event’s impact on Bitcoin prices, along with the Dencun upgrade scheduled for Ethereum today (link here).

Asian equity markets are mixed this morning with the Hang Seng (+0.26%) and the KOSPI (+0.11%) edging higher while the Nikkei (-0.36%) continues to drift back from last week’s all time highs. Elsewhere, stocks in mainland China are also seeing losses with the CSI (-0.59%) and the Shanghai Composite (-0.26%) dragged lower by property developers as Country Garden Holdings Co. missed a 96-million-yuan ($13 million) coupon payment on a yuan bond for the first time. Outside of Asia, US stock futures are struggling to gain momentum with those on the S&P 500 (-0.03%) and NASDAQ 100 (-0.06%) flat. In early morning data, the unemployment rate in South Korea unexpectedly dropped to +2.6% in February from January’s 3.0% level (v/s +3.0% consensus expectation).

Although the CPI release was the main data focus yesterday, there was also the NFIB’s small business optimism index from the US. That f ell to a 9-month low in February of 89.4 (vs. 90.5 expected). And there were also further signs of softening in the labour market, as the share planning to increase employment was down to a net +12, the lowest since May 2020 at the height of the Covid-19 pandemic. Likewise, the share of firms with positions they weren’t able to fill hit a three-year low of 37%.

To the day ahead now, and data releases include UK GDP and Euro Area industrial production for January. Central bank speakers include the ECB’s Cipollone and Stournaras. And in the US, there’s a 30yr Treasury auction taking place.