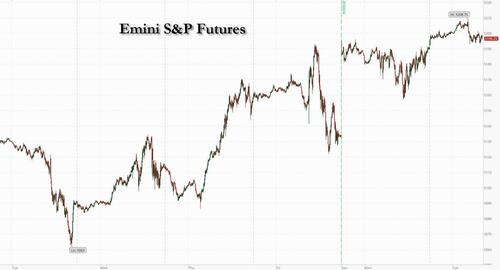

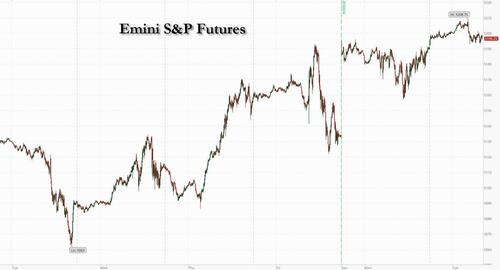

US equity futures rose with European and Asian market ahead of the closely watched February CPI data which could have an impact on the decision and messaging delivered by the Fed next week. As of 7:50am, S&P futures are up 0.2% while Nasdaq futures add 0.5% as TMT sees support from Semis (NVDA +1.9%) and the balance of Mag7 names are up 50bp – 95bps pre-market. Treasuries also edge higher, with US 10-year yields falling 1bps to 4.09%. Gilts outperform, boosted by soft UK wage data and solid auction demand. UK 10-year yields fall 7bps to 3.90%. European stocks rise 0.4%, led by gains in mining and bank shares. The yen is the weakest of the G-10 currencies, falling 0.4% versus the greenback after BOJ Governor Ueda noted pockets of weakness in consumption. The Bloomberg Dollar Spot Index is little changed. Oil prices climb, with WTI rising 0.6% to trade near $78.40. Spot gold falls 0.3%.

In premarket trading, Oracle shares rose 14% after the infrastructure-software company reported third-quarter results that beat expectations on key metrics. It also said that “demand for our Gen2 AI infrastructure substantially exceeds supply.”

US-listed Chinese stocks trade broadly higher in Tuesday’s premarket session as a rebound from a February low gathers steam. Here are some other notable premarket movers:

- Acadia Pharmaceuticals shares slump after the biopharmaceutical company said it does not intend to conduct any more trials for pimavanserin after a Phase 3 study in schizophrenia failed to meet its primary endpoint.

- Porsche AG flagged weaker returns this year with a record four new model launches weighing on sales and profit. Operating margin is set to come in between 15% to 17%, weaker than analyst expectations and below the company’s mid-term goals.

- Asana (ASAN US) shares fall 2.9% after the application software company reported its fourth-quarter results. While revenue was better than expected, analysts flagged some causes for concern.

- Carvana (CVNA US) rose 3.9% as Jefferies raised the recommendation on the stock to hold from underperform. The broker says the online used-car dealer’s “operational adjustments may have driven sustainable improvements to unit economics.

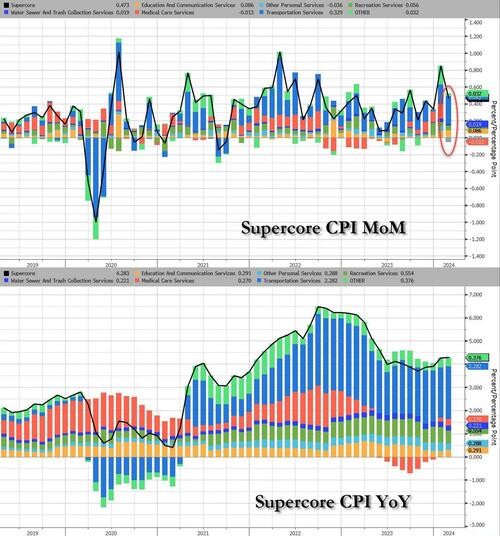

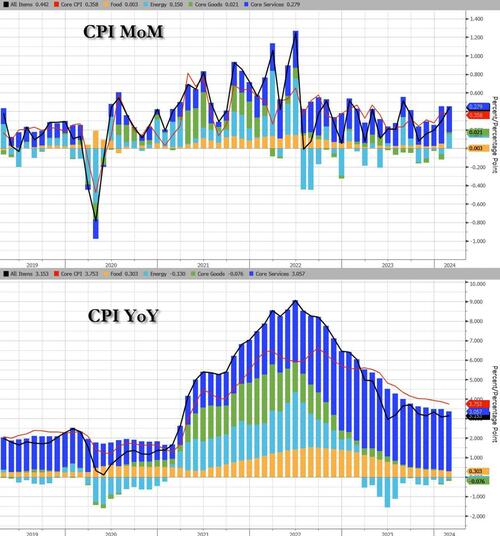

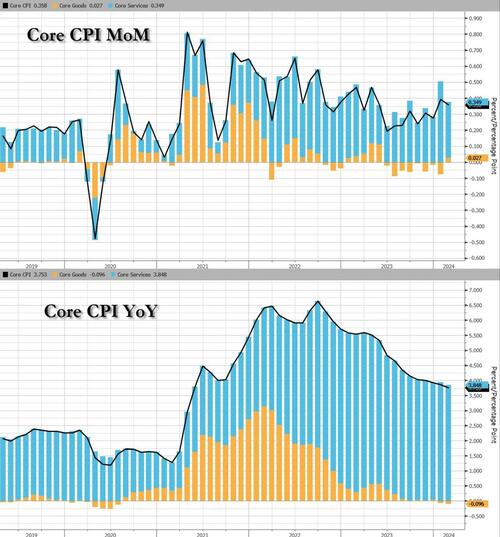

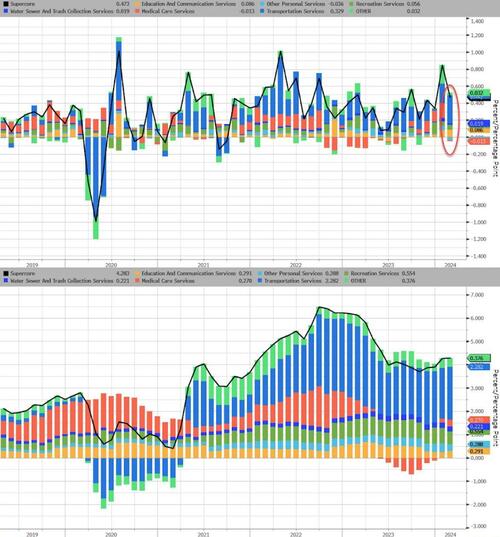

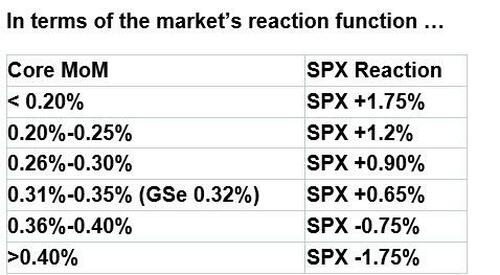

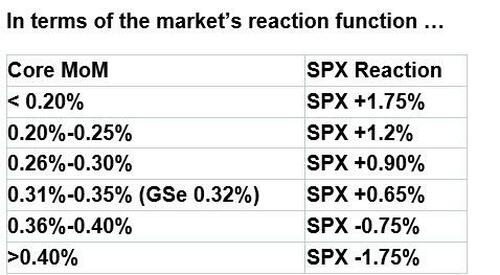

As discussed in our CPI preview (full note here), CPI is likely to accelerate, while the core gauge should slow slightly, according to Bloomberg Economics. A monthly rate of 0.3% or lower would be seen as a positive catalyst, according to Goldman.

“Today is another CPI day, we’ll have a lot of volatility around the data,” Claudia Panseri, UBS Global Wealth Management’s chief investment officer for France, said in an interview with Bloomberg TV. “What is important is the market has normalized expectations about interest rate cuts. We still expect inflation coming down, we still expect that the Fed cuts its rate in June.”

“Ultimately, we don’t expect the February CPI report to provide clear enough evidence of disinflation to boost the Fed’s confidence to cut rates,” Bloomberg economists Anna Wong and Stuart Paul wrote in a note. “However, they could have enough confidence as soon as May.”

The options market is more concerned about a big S&P 500 move after the inflation report than it is about the Fed’s interest rate decision next week, according to Citigroup Inc. Traders are hedging for moves of 0.9% in either direction, the biggest implied shift ahead of a consumer price index report since April 2023.

Elsewhere, the yen weakened for the first time in six days after Bank of Japan Governor Kazuo Ueda pointed to some weakness in consumption of nondurable goods, while also signaling the central bank remains on track to end its negative-interest-rate policy. The BOJ makes it next policy decision on March 19. Japan’s 10-year bond yield climbed to the highest level in three months following a Jiji report that said the BOJ will end negative interest rates at next week’s meeting if wage data comes out strong.

European stocks rise 0.4%, led by gains in mining and bank shares. Banks and basic resources are the best-performing sectors, while utilities lag. Here are some notable premarket movers:

- Wacker Chemie rises as much as 9.5%, the most since May, as the German chemicals company forecast first-quarter earnings above estimates, and issued full-year guidance that Baader analysts described as “better than feared.”

- Porsche shares gain as much as 3.4%, erasing earlier losses as Stifel says the German luxury carmaker’s fourth quarter earnings and cash flow “look good.” While analysts flag the disappointing 2024 outlook and see further consensus downgrades, Bernstein sees more opportunities being highlighted in the second half of the year and 2025.

- Synthomer shares jump as much as 27% after the British chemicals company signaled a “cautiously encouraging” start to this year’s trading, and said it expects earnings progress in 2024 — whether or not the macroeconomic backdrop improves.

- TP ICAP rises as much as 14% after announcing a new buyback after reporting full-year results boosted by record growth in its energy and commodities arm.

- Medartis shares soar as much as 9.9% after the Swiss orthopedic company’s sales beat estimates and it reported positive operating cash flow.

- PolyPeptide shares rise as much as 6.9% after the Swiss biotech firm reported sales that beat estimates and said it had signed three new large contracts in 2023. ZKB said the figures are good overall, but noted that the company is still in a transitional phase.

- Leonardo shares jumped as much as 6.8% in Milan after the Italian tech company announced a 2024-2028 plan that sees an increase in profitability and dividend.

- GEA Group rises as much as 3.1% after RBC double-upgrades to outperform from underperform, saying the farm machinery company’s shares look cheap and offer significant re-rating potential.

- Sensirion shares fall as much as 13% after the sensor maker reported results which fell short of expectations due to muted demand and customers holding high levels of inventory. Analysts said that the Swiss firm’s 2023 earnings were weak, blaming an impact from currency movements and investments.

- UK Pet Stocks slide after the UK Competition and Markets Authority said it provisionally decided to launch a formal investigation into the veterinary market. Jefferies expects the outcome of the investigation to be largely limited to transparency measures. Meanwhile, Liberum views Pets at Home as “relatively well positioned” in light of the regulator’s concerns, though sees this as “not great news” for CVS Group.

- Persimmon shares slide as much as 4.4% to a three-month low, with analysts saying that the UK homebuilder’s 2024 outlook was cautious as the company flagged an uncertain trading environment amid high interest rates and an upcoming UK general election. While Persimmon has already given a trading update earlier in the year, analysts were hoping for stronger guidance on margins in particular.

- Domino’s shares decline as much as 12% after the company reported full-year like-for-like sales that Shore Capital said were softer than expected. Meanwhile, Jefferies noted commentary on the company expecting growth to be lower in the first quarter due to holding back on marketing spend.

Earlier in the session, Asia-Pac stocks traded mixed following the tentative mood stateside and as participants await US CPI data.

- Hang Seng and Shanghai Comp. diverged with the former boosted by continued tech strength and as property developers showed resilience including Vanke despite being cut to junk by Moody’s, while the mainland was pressured by lingering headwinds including US-China frictions and economic concerns.

- Nikkei 225 slipped at the open after firmer-than-expected PPI data and the ongoing hawkish BoJ-related speculation, but then clawed back the majority of the losses after BoJ Governor Ueda refrained from any major hawkish commentary.

- ASX 200 notched slight gains but with upside capped by a lack of macro drivers and mixed business surveys.

In FX, the Bloomberg Dollar Spot Index is little changed; the yen is the weakest of the G-10 currencies, falling 0.4% versus the greenback after BOJ Governor Ueda noted pockets of weakness in consumption. Japanese OIS market is pricing about a 76% chance of a March rate hike. The yen had been stronger earlier in the session after Jiji reported that negative rates are seen ending if the first result of wage increases by businesses that the Japanese Trade Union Confederation, (Rengo), will provide on Friday “significantly” exceeds last year’s 3.8%. “We see the BOJ exiting the negative-interest-rate policy in April on the belief that the BOJ might want to digest more data,” strategists at Malayan Banking Bhd led by Saktiandi Supaat wrote in a research note.

In rates, treasuries edged higher, with US 10-year yields falling 1bps to 4.09%. Gilts outperform, boosted by soft UK wage data and solid auction demand. UK 10-year yields fall 7bps to 3.90%. gilts rallied after a rise in the UK unemployment rate and easing wage growth added to the view that the Bank of England may start cutting interest rates in coming months. Japan’s 10-year bond yield climbed to the highest level in three months following a Jiji report that said the BOJ will end negative interest rates at next week’s meeting if wage data comes out strong.

In commodities, oil edged higher as traders awaited OPEC’s monthly report and industry figures on US stockpiles. Gold eased from a record high.

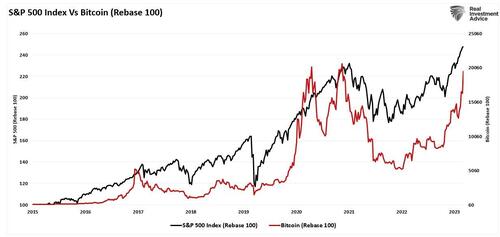

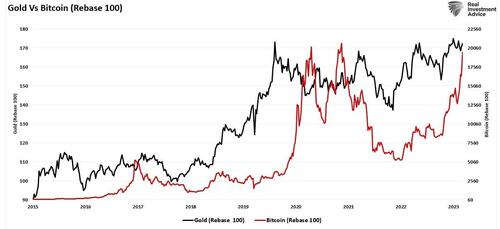

Bitcoin held just above $72,000 after surpassing that level for the first time on Monday, with Ethereum also lower but remains above USD 4k.

Looking to the day ahead now, the main highlight will be the US CPI release for February. Other US releases include the NFIB’s small business optimism index for February, and the monthly budget statement for February. In the UK, there’s also the monthly labour market data. Central bank speakers include the ECB’s Holzmann and the BoE’s Mann. Lastly, there’s also a 10yr US Treasury auction.

Market Snapshot

- S&P 500 futures up 0.2% to 5,135.25

- MXAP up 0.3% to 176.85

- MXAPJ up 1.0% to 541.76

- Nikkei little changed at 38,797.51

- Topix down 0.4% to 2,657.24

- Hang Seng Index up 3.1% to 17,093.50

- Shanghai Composite down 0.4% to 3,055.94

- Sensex up 0.5% to 73,869.33

- Australia S&P/ASX 200 up 0.1% to 7,712.53

- Kospi up 0.8% to 2,681.81

- STOXX Europe 600 up 0.3% to 503.05

- German 10Y yield little changed at 2.30%

- Euro little changed at $1.0924

- Brent Futures up 0.5% to $82.63/bbl

- Gold spot down 0.3% to $2,176.94

- US Dollar Index little changed at 102.91

Top Overnight News

- The BOJ is mulling a March hike but the outcome’s too close to call, people familiar said. A final decision will come after the initial tally from spring wage talks is released Friday. The yen pared declines made earlier on comments from Kazuo Ueda that highlighted weakness in consumption. BBG

- Samsung and SK Hynix, the world’s leading memory chipmakers, have stopped selling used chipmaking equipment for fear of falling foul of US export controls on China and western sanctions on Russia. FT

- China’s exports are surging as the country’s factories seek int’l buyers amid weak domestic demand, but the rush of products is set to raise fresh tensions between Beijing and the world’s major economies. NYT

- The United Steelworkers union will ask President Joe Biden to open a trade investigation into alleged Chinese unfair economic practices in the shipbuilding and maritime logistics sectors. FT

-

- ECB leaning toward keeping the Minimum Reserve Requirement (MMR) at the current 1% level, a positive for banks given concerns the figure could rise. BBG

- UK jobs report for Jan is soft, with employment -21K (vs. the Street +5K and vs. +72K in Dec) while wage growth cools. RTRS

- President Vladimir Putin has sacked the commander of Russia’s navy after it suffered a series of humiliating losses in the Black Sea, according to Ukrainian officials with knowledge of the shake-up. FT

- Jamie Dimon said a US recession isn’t off the table, but the Fed should wait for more clarity before it cuts interest rates. “The worst case would be stagflation,” he warned. BBG

- ORCL +13% in pre mkt trading after it reported 3 cents of EPS upside for FQ3 thanks to higher op. margins, and mgmt. made very bullish comments on the call about its cloud infrastructure business. “Demand for our Gen2 AI infrastructure substantially exceeds supply—despite the fact we are opening new and expanding existing cloud datacenters very, very rapidly. Our Gen2 Cloud Infrastructure business will remain in a hypergrowth phase—up 53% in Q3—for the foreseeable future”. RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the tentative mood stateside and as participants await US CPI data. ASX 200 notched slight gains but with upside capped by a lack of macro drivers and mixed business surveys. Nikkei 225 slipped at the open after firmer-than-expected PPI data and the ongoing hawkish BoJ-related speculation, but then clawed back the majority of the losses after BoJ Governor Ueda refrained from any major hawkish commentary. Hang Seng and Shanghai Comp. diverged with the former boosted by continued tech strength and as property developers showed resilience including Vanke despite being cut to junk by Moody’s, while the mainland was pressured by lingering headwinds including US-China frictions and economic concerns.

Top Asian News

- BoJ Governor Ueda said Japan’s economy is recovering moderately but with some weak data seen, while they see weakness in consumption of non-durable goods and need to see if a virtuous cycle is underway. Ueda also stated they have seen various data since January and more will come out this week which they will look at comprehensively in reaching an appropriate monetary policy decision, while they are focusing on whether a positive wage-inflation cycle is kicking off in judging whether a sustained and stable achievement of the price target is coming into sight. Furthermore, Ueda later commented that it is possible to control short-term rates at an appropriate level by paying interest on reserves parked with the BoJ and if inflation accelerates and warrants monetary tightening, it is possible to do so by raising rates without scaling back BoJ’s bond holdings.

- BoJ is reportedly mulling a March hike with the outcome too close to call, according to Bloomberg sources.

- BoJ will likely offer numerical guidance on how much government bonds it will buy upon ending NIRP and YCC to avoid causing market disruptions, according to Reuters sources. BoJ is likely to roughly maintain the current pace of bond buying after ditching YCC, and forgot shar cuts in the amount for the time being. BoJ is likely to forgo offering explicit guidance on how soon it will hike rates again amid uncertainties in the economic outlook. Any guidance on future policy path is likely to be in line with Ueda comments on maintaining accommodative monetary conditions even after ending negative interest rates. Note: The guidance on government bonds buying is in-fitting with recent sources.

- Former BoJ Official Kiuchi says the BoJ could potentially cancel YCC in March, via Bloomberg TV

- US State Department said the US must employ all the tools at its disposal to outcompete China wherever possible and it announced USD 2bln to create a new international infrastructure fund which will help compete with China by providing an alternative.

- US House is to vote on Wednesday on the bill which will give ByteDance six months to divest TikTok or face a ban, according to the majority leader’s spokesperson.

- US steel unions urge US President Biden to open a probe into Chinese shipbuilding, according to FT.

- South Korean chipmakers halt old equipment sales over fears of a US backlash, according to FT.

- Nissan (7201 JT) is reportedly mulling cutting China production by as much as 30%, according to Nikkei; Honda Motors (7267 JT) reportedly mulling cutting China production by some 20%.

- China Vanke in debt swap talks with banks to stave off default, via Bloomberg

European bourses, Stoxx600 (+0.3%) began the session on a firm footing, though edged lower throughout the European morning as sentiment waned. The FTSE100 (+0.8%) outperforms, lifted by the weaker Pound and its exposure to Mining/Energy names. European sectors hold a strong positive tilt; Banks continue to advance ahead of an ECB meeting regarding European banking policies, whilst Utilities is found at the foot of the pile. US equity futures (ES +0.1%, NQ +0.4%, RTY +0.2%) are mixed, with slight outperformance in the NQ, with the Tech sector benefitting from strong Oracle (+13.3% pre-market) earnings.

Top European News

- Morgan Stanley says chances of a UK rate cut in Q2 looks “severely under-priced”; the base case is for a cut in May

- European Parliament is reportedly to take the European Commission to court regarding the EUR 10.2bln payoff for Hungary, via Politico citing sources.

- Spanish Economy Minister is “optimistic” about agreement with other parties over approval of the 2024 budget. Sees latest economic data backing govt’s 2% GDP forecast.

- Irish Central Bank sees HICP in 2024 at +2.0 (prev. +2.3% in December), 2025 at +1.8% (prev. +2.1%) and 2026 at 1.4% (prev. +1.4%), while it sees GDP in 2024 at +2.8% (prev. +2.5%), 2025 at +3.5% (prev. +4.5%) and 2026 at +3.3%. Furthermore, it stated that risks to the economic growth outlook are tilted to the downside and risks to the inflation outlook are broadly balanced.

- Riksbank’s Jansson says the risk of high inflation becoming entrenched has diminished, demand-side activity suggests limited upside risk to inflation.

- Riksbank’s Thedeen says if inflation prospects remain favourable, we cannot rule out the possibility of a H1 cut. Inflation has fallen recently and is on firmer ground.

FX

- DXY is marginally firmer thanks to a softer JPY and GBP. DXY marginally eclipsed yesterday’s peak of 102.93 to print a high of 102.94.

- Uneventful trade for the EUR with EZ-wide updates lacking. EUR/USD sits in a tight 1.0922-39 range and is respecting yesterday’s 1.0914-48 parameters.

- GBP is on the backfoot vs. peers with Cable losing 1.28 status following jobs data which showed soft wages and an unexpected uptick in the unemployment rate. GBP/USD as low as 1.2777 with not much in the way of support until the 10DMA at 1.2732 and 7th March low at 1.2722.

- JPY the laggard across the majors as the Yen’s advances vs. the USD grind to a halt. “Non-hawkish” remarks from Ueda can be cited as the catalyst but it is fair to say the decline in USD/JPY had to wane at some point.

- Antipodeans are both steady vs. the USD with NZD faring marginally worse in quiet newsflow. AUD/USD holding above 0.66 and contained within yesterday’s 0.6596-0.6627 range.

- PBoC set USD/CNY mid-point at 7.0963 vs exp. 7.1885 (prev. 7.0969).

Fixed Income

- Gilts are bid after the morning’s labour market data. Action that took Gilts to a 99.98 high just a tick shy of Monday’s best and by extension a handful below last week’s 100.03 contract high. Thereafter, Gilts extended to a fresh contract peak of 100.17 following the strong auction.

- Bunds are a touch firmer given the above but much more contained as the pre-CPI lull and heavy supply docket holds greater sway than UK data; holding around the 133.56 peak which is 50 ticks below Monday’s best.

- USTs are holding marginally in the green ahead of US CPI, at the upper-end of narrow 111-18 to 111-22 bounds. Resistance at 111-31 & 112-04+ from the last two sessions, low point from those days also provides support at 111-16+ and 111-08.

- UK sells GBP 3.75bln 4.625% 2034 Gilt: b/c 3.61x (prev. 3.09x), average yield 3.927% (prev. 4.132%) & tail 0.2bps (prev. 1bps)

- Japan to issue JPY 350bln of climate transition bonds later in the month, via Reuters citing sources; targeting four issuances of this type a year.

- Netherlands sells EUR 2.05bln vs exp. EUR 2-2.5bln 2.50% 2030 DSL: average yield 2.481% (prev. 2.334%)

Commodities

- Crude is firmer but off best levels as the Dollar strengthened with newsflow light thus far ahead of US CPI, but geopolitical concerns linger; Brent holds around USD 82.75/bbl.

- Precious metals are mixed with spot gold hampered by the initial Dollar strength, while spot silver is slightly more resilient; XAU briefly dipped under yesterday’s low (2,174.86/oz).

- Base metals are mixed and lack firm direction ahead of the US CPI later today; 3M LME copper trades within a USD 8,628.00-8,675.50/t range.

- UBS says we continue to retain negative outlook for Palladium, expecting it to remain the laggard in precious metal sector this year.

- Commerzbank raises its gold price forecast for end of this year and end of next year to USD 2.2k/toz (prev. 2.1k)

- Russia’s Lukoil refinery work in Nizhny Novgorod region was temporarily stopped due to an “incident”, while it was later reported that the oil processing unit in Nizhny Novgorod was on fire after a drone attack, according to Russian agencies.

- Main crude distillation unit (AVT -6) at Russia’s Norsi refinery is damaged, via Reuters citing industry sources; the damage at Russia’s Norsi refinery means that at least half of Norsi production is halted.

- Morgan Stanley lowers TTF gas price forecast to USD 8/MMBtu (prev. USD 8.5/MMBtu) for Q2’24 and Q3’24; forecast to USD 10.00/MMBtu (prev. 10.5/MMBtu) for Q4’24.

- Iraq Basrah April OSPs: Asia -0.60/bbl vs Oman/Dubai (prev. -0.80/bbl); Europe -5.85/bbl vs Brent (prev. -5.45/bbl), Americas -0.95/bbl vs ASCI (prev. -1.00/bbl), according to SOMO.

- Kuwait sets April KEC Crude OSP for Asia at Oman/Dubai plus USD 0.55/bbl, USD +0.30/bbl M/M, according to Reuters citing traders

Geopolitics: Middle East

- Islamic Resistance said it targeted Ben Gurion Airport with drones on Monday evening, according to Al Jazeera.

- Four Israeli strikes targeted eastern Lebanon’s Baalbek, according to two security sources cited by Reuters

- Yemen’s Houthis said they targeted ‘American ship Pinocchio’ in the Red Sea and their operations are to escalate during Ramadan. However, US Central Command said Houthi forces targeted the merchant vessel Pinocchio on Monday which is a Singaporean-owned, Liberian-flagged ship although the missiles did not impact the vessel and there were no injuries or damage reported.

- EU leaders to urge Israel to refrain from ground operations in Rafah, via Reuters citing draft summit text; calls for “immediate humanitarian pause leading to sustainable ceasefire” in Gaza

Geopolitics: Other

- Ukrainian military intelligence said they are preparing to launch serious offensive operations in Crimea, according to Al Arabiya.

- Russian air defence systems destroyed Ukraine-launched drones near Moscow, according to Moscow’s Mayor.

- US President Biden responded there was no need for that when asked if he would support US troops at the Polish border.

- China Maritime Safety Administration announced live firing drills in some areas in the East China Sea from March 12th-14th.

- Russian Defence Ministry says Russia, China and Iran are to begin joint navy drills in the Gulf of Oman.

- European Commission Chief von der Leyen says considering new sanctions on Iran if reports of supplying Russia with missiles is true

US Event Calendar

- 08:30: Feb. CPI MoM, est. 0.4%, prior 0.3%

- Feb. CPI YoY, est. 3.1%, prior 3.1%

- Feb. CPI Ex Food and Energy MoM, est. 0.3%, prior 0.4%

- Feb. CPI Ex Food and Energy YoY, est. 3.7%, prior 3.9%

- Feb. Real Avg Hourly Earning YoY, prior 1.4%, revised 1.3%

- Feb. Real Avg Weekly Earnings YoY, prior -0.1%, revised 0.1%

- 14:00: Feb. Monthly Budget Statement, est. -$298.5b, prior -$262.4b

DB’s Jim Reid concludes the overnight wrap

Today the roadshow has moved onto Melbourne after a hectic day in Sydney yesterday. Walking between meetings in the hot sun has got me a bit worried I’m going to come back to the office with a tan next week with my team a bit confused as to how hard I was actually working. Actually my wife might be a bit confused too!

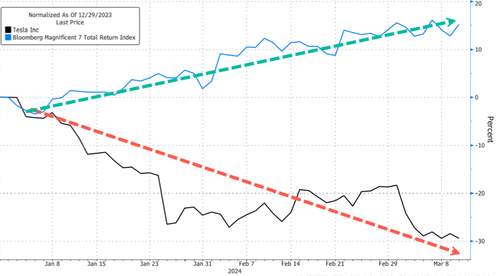

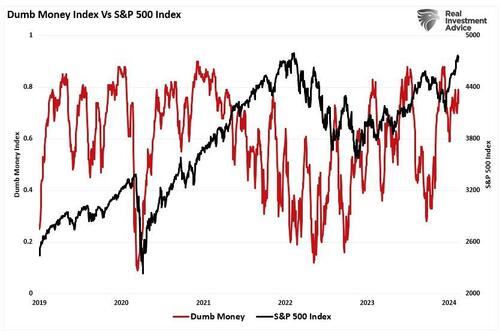

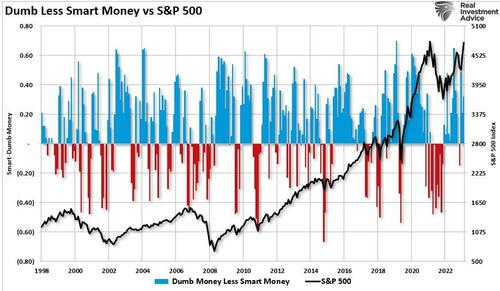

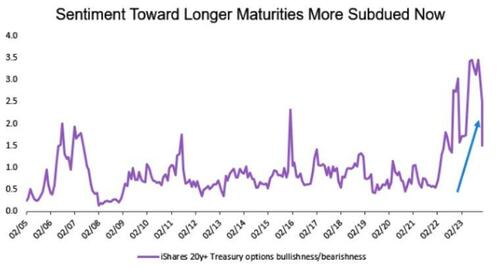

Markets have drifted into the shade a little to start the week as we await today’s all-important CPI print. The S&P 500 (-0.11%) fell back for the second session running with the Magnificent 7 (-1.12%) underperforming and the VIX (+0.50pts) up to its highest level (15.22) in nearly three weeks. The bigger story was renewed fears about inflation pushing 2yr Treasuries (+6.1bps) back up to 4.54%.

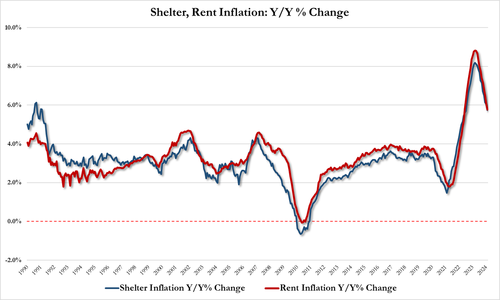

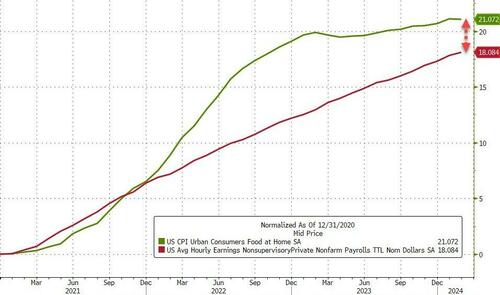

Those inflation concerns were heightened by the New York Fed’s latest Survey of Consumer Expectations, which showed medium- and long-term expectations rising again in February. In particular, the 5yr inflation expectation was up to a 6-month high of +2.9%, which was a reversal from the downward trend over the preceding months. Separately, there were also signs of a weaker labour market, as the mean probability of losing one’s job in the next year was up to 14.5%, which was the highest since April 2021. Moreover, the mean probability of finding a job in 3 months if one lost their job was down to 52.5%, again the lowest since April 2021.

That sets us up for another CPI day, which is getting more attention than usual after last month surprised on the upside. In terms of what to expect this time round, our US economists think headline CPI will come in at a monthly +0.41%, which would keep the year-on-year measure at +3.1%. Then for core, they’re expecting it to be at +0.30%, taking the year-on-year measure down two-tenths to +3.7%. If that’s realised, it would also be the 4th consecutive month that core CPI has come in at +0.3% or +0.4%, which is still a bit too fast for the Fed to be comfortable. Indeed, last month’s surprise saw investors push out the likely timing of rate cuts, and futures are increasingly looking towards June as the most likely date for a first cut. However, risk assets did not really suffer from last month’s surprise, and since that release came out the S&P 500 is around 2% higher, the Magnificent 7 c.+1.2%, Bitcoin c.+45%, and US HY spreads c.-4bps tighter.

With all that to look forward to, US Treasuries lost ground across the curve, with the 2yr yield (+6.2bps) up to 4.54%, whilst the 10yr yield (+2.3bps) rose to 4.10%. That was echoed in Europe as well, where yields on 10yr bunds (+3.6bps), OATs (+4.2bps) and BTPs (+4.6bps) all moved higher. That came as investors slightly dialled back the amount of rate cuts priced in, with the Fed now expected to deliver 91bps of rate cuts by the December meeting, down -4.3bps on the day.

For equities it was also a weaker session, with the S&P 500 (-0.11%) clawing back some of its initial losses but still down marginally on the day. That was mostly due to losses among the Magnificent 7 (-1.12%), and Nvidia (-2.00%) continued to lose ground after its -5.55% decline on Frida y. It also marked the first time since the very start of the year that the Magnificent 7 has fallen by more than -1% for two consecutive days. Notable underperformers also included Meta (-4.42%) and Boeing (-3.02%), with the latter extending its YTD decline to -26% amid news that the Department of Justice opened a criminal investigation into January’s mid-flight blowout incident. That said, the equal-weighted version of the S&P 500 did rise +0.14%, with materials (+1.13%) and energy (+1.00%) stocks outperforming. Meanwhile in Europe, there was a mixed performance, as the STOXX 600 fell -0.35%, but there were still gains for the FTSE 100 (+0.12%) and the IBEX 35 (+0.19%), alongside losses for the CAC 40 (-0.10%) and the DAX (-0.38%).

In Asia, equity markets have put in a mixed this performance this morning. In Japan, the Nikkei (-0.41%) is on track to fall for a second day, and in China the Shanghai Composite (-0.24%) has also lost ground. But other indices have posted a better performance, with the Hang Seng (+2.23%) surging, whilst the KOSPI (+0.50%) and the CSI 300 (+0.40%) have also advanced. US equity futures are pointing higher as well, with those on the S&P 500 up +0.37%.

Otherwise this morning, the Japanese Yen has weakened -0.37% against the US Dollar after Bank of Japan Governor Ueda referred to “weakness in some household spending data”, even though he said “my view is that the gradual recovery continues.” That led to a bit more doubt about the prospect of a shift away from negative interest rates at next week’s meeting, and the 2yr JGB yield is down -0.1bps this morning at 0.19%. Overnight index swaps have also lowered the prospect of a shift by the April meeting from 87% to 84%. That said, the PPI inflation data for February came in a bit stronger than the consensus expected, with year-on-year PPI up to +0.6% (vs. +0.5% expected).

Whilst lots of assets struggled yesterday, Bitcoin (+3.87%) was an exception as it reached another all-time high, surpassing the $72,000 mark for the first time in trading. Remember that we’re still not quite at the all-time high in real terms though, as in November 2021, Bitcoin peaked at $68992, which is above $76,000 in today’s prices if you adjust for CPI inflation. As a reminder, Marion Laboure and Cassidy Ainsworth-Grace put out a report last week (link here) on why Bitcoin is trading at a record and why they expect prices to continue to go even higher this year.

To the day ahead now, and the main highlight will be the US CPI release for February. Other US releases include the NFIB’s small business optimism index for February, and the monthly budget statement for February. In the UK, there’s also the monthly labour market data. Central bank speakers include the ECB’s Holzmann and the BoE’s Mann. Lastly, there’s also a 10yr US Treasury auction.