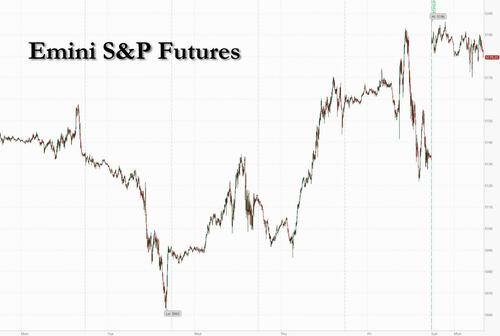

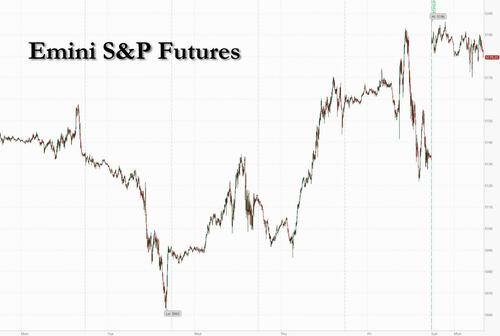

US equity futures are poised to open lower on Monday, extending Friday’s slide into this data-heavy week after pulling back from all-time highs at the end of last week, with technology shares leading declines in the wake of data giving mixed signals about the strength of the job market. Ahead of tomorrow’s CPI print, S&P futures were down 0.2% at 7:50am, but off the worst levels of the session.

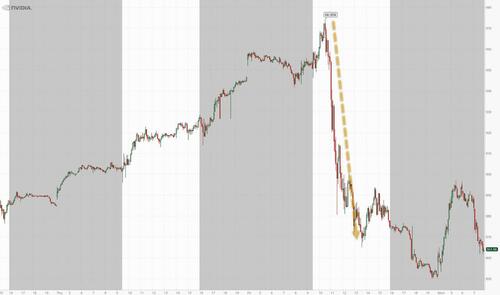

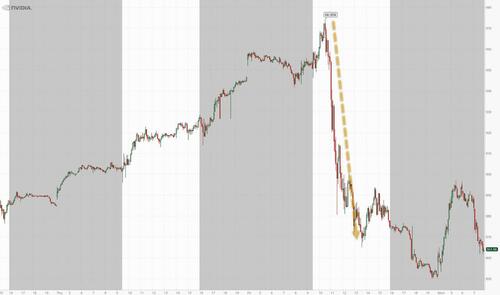

Nasdaq futures dropped 0.3% with Nvidia fluctuating wildly in the pre-market after its huge 10% intraday reversal on Friday, which followed a weaker than expected jobs report (and actually quite catastrophic NFP print if one actually reads the details).

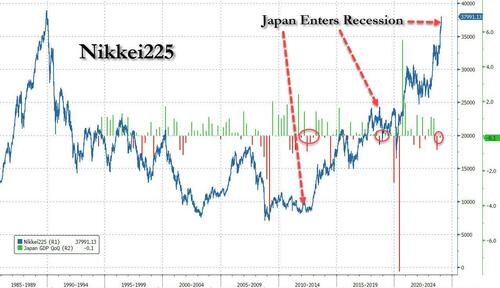

The overnight session also saw the Nikkei 225 tumble 2.2%, and the drop was far worse earlier before a sharp ramp in the last 30 minutes of trading, as growing speculation the Bank of Japan will end Yield Curve Control and/or raise interest rates lifted the yen and hurt exporters

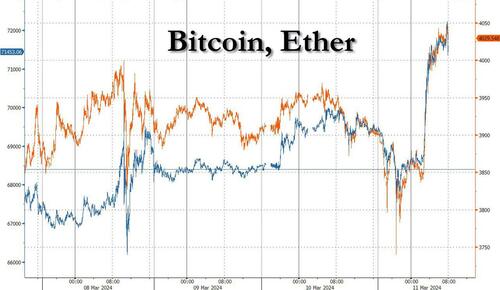

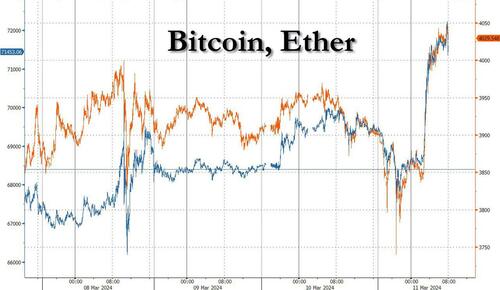

Bitcoin briefly topped $72,000 for the first time, advancing for a sixth straight day and taking this year’s rally to almost 70% on the back of massive inflows into US exchange-traded funds; a tacit endorsement by Donald Trump who will be the next president in November, also helped push the crypto currency higher

Elsewhere, bond yields were mixed with 10Y yield rising 1bp to 4.08%; the USD is flat following its worst performing week of the year. Commodities are mixed with strength in Energy but weakness in Ags/Metals; base metals are underperforming precious metals with iron ore plunging 7%. CPI is the macro focus this week but there are several bond auctions to watch esp. with the potential for BOJ to tweak YCC/ZIRP next week.

In premarket trading, cryptocurrency-linked companies rally as Bitcoin extends gains to an all-time high, surpassing the $71,000 mark. Among movers Coinbase Global (COIN) +7.2%, Riot Platforms (RIOT) +5.7%. Boeing dropped 1.4% after a weekend of negative headlines, which included the DOJ opening a criminal investigation into the incident on an Alaska Airlines-operated 737 Max 9 jet in January, and also another mid-air incident, this time involving a Boeing 787. Here are some other notable premarket movers.

- Choice Hotels gains 3.3% after the company ends attempts to combine with Wyndham Hotels & Resorts (WH). Wyndham falls 5.3%.

- EQT falls 3.7% after agreeing to buy back its former unit Equitrans Midstream Corp. (ETRN) in an all-stock transaction valued at about $5.2 billion, the latest in a flurry of deals in the oil and gas industry. Equitrans rises 8.7%.

- Lexicon Pharmaceuticals gains 11% after the placement of $250 million of equity securities.

- The company also posted quarterly results.

- Revance Therapeutics advances 6.5% after the biopharmaceutical company reported to the SEC on Friday that CEO Mark Foley purchased 30,000 shares valued at $209,400.

- Staar Surgical rises 4.6% after Stifel raised its rating on the implantable eye lens company to buy, citing a favorable entry point and potential upside to first-quarter sales.

Looking at this week’s main economic event, Tuesday’s CPI report, BBG calls it “a key piece of the puzzle” toward completing the backdrop for the Fed to start cutting rates in the middle of the year. While comments from policy makers last week appeared very dovish, and swaps traders see a June rate cut as a virtual lock, a stronger-than-anticipated jump in consumer prices could derail rallies in stocks and bonds fueled by confidence that the Fed is on the verge of pulling inflation back to its target. That was the case last month, when the CPI data triggered a market selloff. The impact may be stronger this time because it’s the last major piece of economic data before the Fed’s March 20 meeting.

“The bottom line is that loads of folk are preoccupied trying to predict or front-run a first Fed rate cut,” said Mark Dowding, the CIO at RBC BlueBay Asset Management. “I still see this as some months away.”

Further moderation in US prices would support the disinflation narrative that broadly remains intact, despite a pullback in the number of Fed rate cuts expected this year. Core prices in the consumer price index are expected to tick 0.3% higher in February from a month earlier, and 3.7% on a year-over-year basis — which would be the smallest annual rise since April 2021. Recent comments from policy makers have supported the case for easing. The S&P 500 rallied 1% Thursday when Powell said in his testimony before the Senate that the central bank is “not far” from being ready to cut interest rates. The same day, Powell’s European counterpart Christine Lagarde said the European Central Bank could start reducing rates as soon as June, sending the Stoxx Europe 600 Index up 1.3%.

“A lack of a second-half growth inflection could serve as a headwind for economically sensitive areas of the market, particularly if the Fed holds off on cutting rates longer than expected,” according to Morgan Stanley’s chief US equity strategist Michael Wilson, one of the most prominent bearish voices on Wall Street. His 2024 target for the S&P 500 is 4,500, implying a roughly 12% drop from Friday’s close.

European stocks fell for the first time in four sessions, with the Stoxx 600 down 0.6% as basic resources led declines after iron ore slumped on slackening demand from China. Tech stocks are also underperforming, as they did on Wall Street on Friday. Here are the biggest movers Monday:

- LEG Immobilien climbs as much as 4.4%, lifted by a better-than-expected dividend proposal from the German residential property firm and expectations of stabilization in real estate prices

- HelloFresh shares rise as much as 5.7%, rebounding slightly after Friday’s profit warning sent the meal-kit firm tumbling 42%, with some analysts defending the firm, while other cut their price targets

- Admiral gains as much as 4.4% as Berenberg sees “plenty of reasons to be very optimistic” about the UK car insurance company’s outlook and hikes estimates for the next two years

- Darktrace shares gain as much as 10% as the cybersecurity firm extends a post-earnings rally, with Numis upgrading its forecasts for adjusted Ebitda margin for FY24 through FY26

- Enel shares rise as much as 1.4% after Italy’s biggest utility said Saturday that it will sell a majority stake in its electricity distribution activities in the Milan region to competitor A2A

- European chip stocks see wide losses following Friday’s drop among US peers. BE Semiconductor leads declines, sliding for a second day amid concerns over the adoption of its hybrid bonding technology

- Telecom Italia falls as much as 9.9% as investors remained skeptical over the firm’s attempt to reassure the markets that a planned €22b sale of its network later this year will allow it to meet debt targets

- Currys shares fall as much as 12% to trade below the initial proposed offer from Elliott, after the US firm said it is not in an “informed position” to make an improved offer for the retailer

- Raiffeisen falls as much as 12% in Vienna on news the Austrian lender had a meeting last week with US government representatives over the matter of sanctions with Russia

- JDE Peet’s drops as much as 4.9% after the coffee company announced late Friday that its CEO Fabien Simon would be departing the firm. ING said the change “can’t come soon enough”

- Italian lenders drop after the Bank of Italy said it plans to introduce a capital buffer to cover systemic risks equal to 1.0% of domestic exposures weighted for credit and counterparty credit risks

Earlier in the session, Asian stocks fell for the first time in four days, dragged lower by a pullback in high-flying semi shares and a selloff in Japanese equities. The MSCI Asia Pacific Index declined as much as 1.2% and was headed for its biggest drop since Jan. 17. The region’s chip stocks, which rallied alongside US peers last week on optimism that generative artificial intelligence will boost demand, slumped on Monday after worries over lofty valuations triggered Nvidia Corp.’s worst slump since May. TSMC was the biggest drag on the Asian benchmark, followed by Japan’s Toyota.

The Nikkei 225 Index lost more than 2% and slumped below 39,000 as growing speculation the Bank of Japan will raise interest rates boosted the yen and hurt exporter shares. Stocks in Hong Kong and China bucked the broad regional downtrend after data on Saturday showed Chinese consumer prices rose for the first time since August, easing some concerns over deflation. Bilibili led a rally in tech stocks in Hong Kong after JPMorgan upgraded the stock on strong guidance.

In FX, the Bloomberg Dollar Spot Index slipped 0.1%, extending losses into a seventh day, its longest losing streak in almost four years. The yen tops the G-10 FX pile, rising 0.3% versus the greenback as speculation swirls around the Bank of Japan meeting next week – the BOJ did refrain from ETF buying today even after the Topix fell 2.3% by midday local time.

In rates, treasuries are narrowly mixed with front-end of the curve underperforming slightly; 2-year yields cheaper by around 2bp on the day. US 10-year yields around 4.08%, marginally cheaper on the day with bunds lagging by around 0.5bp and gilts outperforming by 1.5bp in the sector; front-end underperformance in the US flattens 2s10s spread by 1.2bp on the day and 5s30s by 1.5bp. Moves across core European rates also muted, with bunds marginally flatter. The US session includes a wave of supply, with heavy corporate issuance expected alongside an auction of 3-year Treasury notes. Tuesday brings CPI data, and 10- and 30-year debt auctions are slated for the first half of this week. US auctions kick-off at 1pm New York with $56b 3-year note sale, followed by $10b 10-year and $22b 30-year on Tuesday and Wednesday, respectively.

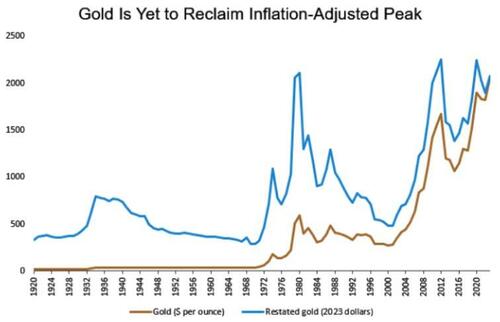

In commodities, oil held a loss ahead of reports from OPEC and the IEA this week that may provide clues on the demand outlook. WTI traded near $78. Spot gold is also little changed around $2,178/oz, trading at an all time high.

In crypto, Bitcoin briefly topped $72,000 for the first time, advancing for a sixth straight day and taking this year’s rally to almost 70% on the back of massive inflows into US exchange-traded funds; a tacit endorsement by Donald Trump who will be the next president in November, also helped push the crypto currency higher; Ethereum soared past 4k and is also approaching its all time high. LSE said it will accept applications for the admission of Bitcoin (BTC) and Ethereum (ETH) crypto ETNs in Q2 2024. Indian cryptocurrency investment platform Mudrex is now offering US spot-Bitcoin (BTC) exchange-traded funds (ETFs) to Indian investors, according to CoinDesk.

On the economic data calendar today we have the February New York Fed 1-year inflation expectations; main events this week includes CPI, retail sales, PPI, Empire manufacturing, industrial production and University of Michigan sentiment. No scheduled Fed speakers due before March 20 policy decision

Market Snapshot

- S&P 500 futures down 0.1% to 5,122.25

- STOXX Europe 600 down 0.3% to 501.77

- MXAP down 0.8% to 176.35

- MXAPJ little changed at 536.84

- Nikkei down 2.2% to 38,820.49

- Topix down 2.2% to 2,666.83

- Hang Seng Index up 1.4% to 16,587.57

- Shanghai Composite up 0.7% to 3,068.46

- Sensex down 0.5% to 73,765.19

- Australia S&P/ASX 200 down 1.8% to 7,704.22

- Kospi down 0.8% to 2,659.84

- German 10Y yield little changed at 2.26%

- Euro little changed at $1.0942

- Brent Futures up 0.1% to $82.18/bbl

- Gold spot up 0.0% to $2,179.85

- US Dollar Index little changed at 102.70

Top Overnight News

- European stocks fell along with US equity futures at the start of a data-heavy week that will test the market’s conviction that Federal Reserve Chair Jerome Powell and his colleagues are moving closer to dialing back their inflation fight: BBG

- Japan’s economy avoided falling into a recession at the end of last year, helped by robust spending by businesses, an outcome that improves the optics for the central bank as it mulls the timing of its first interest rate hike since 2007: BBG

- China’s CPI overshoots expectations in Feb (+0.7%, up from -0.8% in Jan and ahead of the Street’s +0.3% forecast) while PPI deflation worsened (-2.7%, down from -2.5% in Jan and below the Street’s -2.5% forecast). SCMP

- Since touching a five-year low in February, China’s benchmark CSI 300 index has climbed 14%. But traders and analysts say those searing gains have been driven chiefly by China’s so-called “national team” of state-run institutions buying in tandem with the CSRC’s punitive actions. There is little renewed appetite among either local or foreign investors, many of whom want to see much more monetary and fiscal stimulus from Beijing. And strategists point to a rally in Chinese government bonds that they say reflects persistent concerns over slowing growth. FT

- Iron ore slumped 7% — dropping below the $110 a ton mark — after disappointing demand in China left the market lumbered with swelling inventories. The plunge in the steelmaking ingredient was the most since mid-2022 on an intraday basis, and it was headed for the lowest close since August last year. BBG

- Apple and Tesla cracked China, but now the two largest US consumer companies in the country are experiencing cracks in their own strategies as domestic rivals gain ground and patriotic buying often trumps their allure. Falling market share and sales figures reported this month indicate the two groups face rising competition and the whiplash of US-China geopolitical tensions. Both have turned to discounting to try to maintain their appeal. FT

- BOE comes under growing pressure to ease policy as the UK jobs market reveals cracks (the latest Recruitment and Employment Confederation/KPMG report showed starting salary growth falling to the lowest level in nearly 3 years). London Times

- Ukraine could begin flying Western F16 fighter jets as soon as July, although there won’t be many of them initially. NYT

- President Biden signed a $460 billion spending package on Saturday to avert a shutdown of critical federal departments even as lawmakers continue to wrestle over a financing blueprint for many other agencies more than halfway into the current fiscal year. NYT

- IRS says it can deliver an expanded Child Tax Credit (CTC) automatically to families without any extra work (meaning Congress isn’t facing a deadline of April to pass the needed legislation as the IRS can remit the cash automatically regardless of whether a family has filed taxes). WaPo

- OpenAI said that Mr. Altman, who returned to OpenAI just five days after he was pushed out in November, did not do anything that justified his removal and would regain the one role at the company that still eluded him: a seat on the company’s board of directors. NYT

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with a downbeat mood with most major indices pressured after Friday’s tech-led declines in the US, while participants also digested last week’s hawkish BoJ source reports and Japanese GDP. ASX 200 slumped in which the mining and resources industries led the declines across all sectors. Nikkei 225 fell beneath the 39,000 level following recent source reports that suggested a potential exit from NIRP this month and after Japan’s revised Q4 GDP data missed expectations but showed the economy averted a technical recession. Hang Seng and Shanghai Comp. bucked the trend with the former boosted by tech strength and with Hong Kong’s top market regulator seeking an expansion of the Stock Connect and lower the asset threshold for mainland China investors to CNY 100k. Conversely, the mainland was much less decisive after mixed Chinese inflation data which showed a return to acceleration in consumer prices.

Top Asian News

- China’s Housing Minister said they should let some property developers go bankrupt or restructure according to legal and market-based rules, while the official stated that commercial banks have approved over CNY 200bln of loans for housing projects as of February under the coordinated mechanism. The minister said home sales will improve in an orderly and forceful way and China is to improve the supply of government-supported affordable housing, while they will work with the top financial regulator to guide cities to set up the property funding coordination mechanism. Furthermore, it was also stated that the priorities this year are work on construction kick-offs, housing quality and construction security.

- China’s Human Resources Minister said overall employment pressure has not eased and structural problems remain in the jobs market, while the minister added that they are confident they can keep stable employment and that demand for jobs is high in AI and big data sectors, according to Reuters.

- Chinese regulators held meetings with financial firms to discuss China Vanke (2202 HK) debt, while regulators asked large Vanke lenders to enhance financing support and asked private debt holders to discuss maturity extension, according to Reuters sources.

- US President Biden’s administration is weighing sanctions on several tech companies including memory chipmaker ChangXin Memory Technologies, according to Bloomberg.

- Hong Kong’s top market regulator called for an expansion of the Stock Connect and is seeking to lower the asset threshold for mainland China investors to CNY 100k, according to Bloomberg.

- Japan’s Keidanren Chair says they are feeling greater momentum for wage hikes at this year’s spring labour talks vs the prior year. High possibility the BoJ will normalise monetary policy in the near future, do not know if this will occur in March. Likelihood of achieving inflation around 2% is increasing. Prolonged monetary easing as a “shot in the arm” for the economy is not healthy.

- Japanese PM Kishida is to hold a three-way meeting between the government, labour and corporate management on March 13th to strengthen momentum for higher wages.

- BoJ makes no ETF purchases on Monday, “despite morning decline in TOPIX”, Bloomberg says.

- China is said to be studying lower down payment ratio for cars, according to Chinese Premier Li cited by Bloomberg

European bourses, Stoxx600 (-0.4%), are entirely in the red, with the Eurostoxx50 (-0.7%) hampered by significant losses in chip-maker ASML (-3.3%). European sectors hold a strong negative tilt; Real Estate is propped up by Leg Immobilien (+5.5%), post-earnings; Tech is weighed on by negative sentiment permeating within the semi-conductor industry. US equity futures (ES -0.1%, NQ -0.1%, RTY +0.1%) are mixed and are trading on either side of the unchanged mark; earlier, the NQ posted heftier losses, hampered by Nvidia (+1.6% pre-market), which was initially lower by as much as 2% in the pre-market, though has since reversed course. Newsflow around NVDA includes a lawsuit regarding NeMo AI and a WSJ profile article.

Top European News

- ECB’s Kazimir saw the ECB should wait until June with the first rate cut; rushing a move is not smart or beneficial. Upside risks to inflation are “alive and kicking”. Need more hard evidence and only in June will confidence threshold be reached. Discussions on easing should already start, ECB will use weeks ahead of that. Prefers “smooth and steady” cycle of policy easing.

- UK PM Sunak is reportedly mulling curbs to welfare spending to fund the government’s ambition of further tax reductions, according to The Sunday Times.

- Exit polls suggest Portugal’s centre-right coalition is on course to narrowly defeat the incumbent socialists but fall well short of a majority in Sunday’s closely fought snap general election, according to The Guardian. It was later reported that Portugal’s socialist leader Pedro Nuno Santos conceded defeat and the leader of the centre-right democratic alliance Luis Montenegro claimed victory.

- Polish Central Bank projections: Scenario of extended anti-inflation measures, sees 2024 CPI at 3.0%, 2025 at 3.4% and 2026 at 2.9%; If not extended then sees 2024 CPI at 5.7%, 2025 at 3.5% and 2026 at 2.7%.

- UBS expects the BoE to start cutting rates in August vs May expected earlier.

FX

- DXY is flat but the USD is showing varied performance vs. peers. 102.63 low print for the session is above Friday’s NFP-induced trough at 102.35. Conviction on USD-related moves likely to be low today given CPI on Tuesday.

- Steady trade for EUR/USD in quiet newsflow within tight parameters of 1.0933-47 and respecting Friday’s 1.0918-81 range.

- JPY’s recent strong run vs. the USD has continued with the currency receiving a boost from GDP figures which showed Japan did not enter a technical recession at the end of last year. USD/JPY has been as low as 146.54 but is yet to crack Friday’s trough at 146.48.

- Antipodeans are both softer vs. the USD but AUD more so after being hampered by Iron ore futures falling over 7% in Singapore. AUD/USD is just about maintaining 0.66 status.

- NOK is weaker in the wake of softer-than-expected Norwegian inflation metrics but well within recent ranges vs. the EUR.

Fixed Income

- Overall trade for Bunds have been contained; benchmarks derived a modest bid alongside a dip in broader risk sentiment, with the ‘haven’ move taking Bunds to a 134.04 peak before paring. A move which stopped shy of Friday’s 134.15 best. Hawkish sentiment from ECB’s Kazimir sparked modest pressure in the Bunds, though ultimately proved fleeting as his remarks echoed recent sources which favour a June cut.

- UST price action is following EGBs but with the magnitude of moves even more limited; currently trading towards the mid-point of narrow 111-23 to 111-31 bounds. Fed blackout underway and no Tier 1 data due today as we await US CPI on Tuesday and 3yr supply this evening.

- Gilts once again the relative outperformers, but directionally in-fitting with peers. High of 99.99 is just a handful of ticks shy of last week’s 100.03 peak, which also marks the contract high. As above, the docket ahead remains light.

Commodities

- Crude is modestly firmer, having spent the majority of the European morning flat despite ongoing geopolitical tensions and after reports that Saudi is to reduce Arab heavy crude supply next month, due to oil field maintenance; Brent holds just shy of USD 82.50/bbl.

- Precious metals are holding mild upward biases amid a steady/caged Dollar, with newsflow light this morning and the calendar sparse; XAU sits in a USD 2,175-2,189.12/oz range.

- Base metals are flat/mixed amid a steady Dollar and little in terms of fresh fundamental newsflow to drive price action. That being said, Iron ore slumped in APAC hours despite a clear driver, but with some suggesting sub-par stimulus for the Chinese Real Estate market.

- Saudi Arabia plans to reduce Arab heavy crude supply to term customers in Asia next month due to oil field maintenance, according to Reuters sources.

- Saudi Aramco CEO said FY saw lower crude oil prices and lower volumes sold but noted that 2023 saw global oil demand reach record levels despite geopolitical tensions and they expect the global oil market to remain healthy this year, while he considers supply and demand to be in reasonable balance. Saudi Aramco CEO said they are ready and able to react to market opportunities and can increase maximum capacity if needed. Furthermore, they are interested in LNG in the US and are looking at further opportunities to invest in China, as well as see significant growth in oil demand in China and Asia, according to Reuters.

- Qatar set April marine crude OSP at Oman/Dubai + USD 0.25/bbl and land crude OSP at Oman/Dubai + USD 0.05/bbl, according to a pricing document cited by Reuters.

Geopolitics: Middle East

- US President Biden said it is always possible that there could be a Gaza ceasefire before Ramadan and he was not giving up, while he said he believes Israeli PM Netanyahu is “hurting Israel more than helping Israel” with his approach to the war against Hamas in Gaza and must pay more attention to the innocent lives being lost. Furthermore, Biden warned that an assault on Rafah is a “red line” but added that he is not going to cut off weapons to Israel and didn’t specify what the “red line” meant, in an MSNBC interview.

- Israeli PM Netanyahu said he intends to push ahead with an invasion of Rafah and insisted his priority is to prevent another terror attack like the October 7th Hamas raid, according to POLITICO.

- Israel conducted a raid targeting agricultural land near the Egyptian-Palestinian border in the Al Salam neighbourhood in Rafah, according to a correspondent cited by Al Jazeera.

- Five civilians were killed and nine were injured in an Israeli strike on a border village in southern Lebanon, according to Reuters.

- US Central Command said US Army vessel General Frank S. Besson departed for the eastern Mediterranean to provide humanitarian aid to Gaza by sea and is carrying the first equipment to establish a temporary pier vital for humanitarian supplies, according to Reuters.

- US Central Command said US Navy vessels and aircraft along with multiple coalition navy ships and aircraft shot down 15 one-way attack UAVs, while it was later reported that the US military downed a total of at least 28 uncrewed aerial vehicles in the Red Sea on Saturday, according to Reuters.

- UK Defence Minister said HMS Richmond shot down two drones on Friday night to repel a Houthi attack, while it was also reported that the French military destroyed four combat drones heading towards the European naval mission in the Gulf of Aden.

- “Israeli reports: Hamas deputy head Marwan Issa killed in shelling of Nuseirat camp”, according to Sky News Arabia.

Geopolitics: Other

- German Foreign Minister Baerbock is open to a missile swap with the UK to arm Ukraine, according to dpa.

- US and Japan are considering defence cooperation which could help Ukraine with the two sides looking at an arms arrangement ahead of a summit next month, according to Yomiuri.

- Iran, Russia and China are to hold joint naval drills on March 12th, via MEHR.

US Event Calendar

- 11:00: Feb. NY Fed 1-Yr Inflation Expectat, prior 3.00%

DB’s Jim Reid concludes the overnight wrap

A very good late afternoon from a hot Sydney where it’s been nice to be back after a decade, even if the trip has caused havoc with my body clock. I’d also forgotten how crushingly mind-numbing a 24-hour flight is. However, this weekend the alternative was a sleepover at home for five so I still may have been dealt the better hand.

Last night, I published a new chartbook that I thoroughly enjoyed researching with my team, entitled “Geopolitics: 2000 years of long-term charts”. The pack shows how the global geopolitical situation got to where it is today in the form of long-term charts and maps. It also tries to understand the likely paths going forward. Geopolitics is heavily linked to the changing nature of economic, military and demographic power across the world. These tectonic plates can grind against each other for years or decades, before shifting dramatically and causing a major upheaval in the global balance of power. Perhaps the biggest lesson from the pack and from history is that in the world of geopolitics and international relations, there are few permanent fixtures, only constant change. See the pack here.

In 2000 years I’m not sure if $250bn has ever been wiped off a stock in 3 hours before. That’s what happened to Nvidia on Friday as the stock went from being around +5% up to -6.5% down intraday before closing -5.55%. Then in after-hours trading on Friday, it was down almost another -3%. Remarkably it was still up +6.38% on the week, +21.3% in March so far, and has still posted a tenth week of consecutive gains. That said, the sell-off late in the week meant the S&P 500 (-0.65% Friday) was down -0.26% for the week, and just missed out on advancing for 17 of 19 weeks for the first time since 1964. The macro world is still in hock to the Mag-7 so keep an eye out for what happens next, but this week the macro world will have its own things to focus on with US CPI tomorrow.

On that, with 10yr US yields around -10bps lower, and the S&P 500 around +2% higher than where they were just before last month’s higher-than-expected CPI, it’s fair to say that markets have shrugged off this upside print alongside the high PPI and core PCE prints that followed. Before we preview the US CPI (tomorrow) and PPI (Thursday), the other main US highlights are the NY Fed 1-yr inflation expectations survey (today), retail sales (Thursday) and UoM consumer sentiment (Friday). There are also 3-, 10- and 30-yr UST auctions today through Wednesday.

In Europe, the monthly UK GDP for January on Wednesday and labour market indicators tomorrow come a week before the next BoE meeting. In Asia, we have China’s 1-yr MLF rate where our economists think we will see a 15bps cut. In Japan, the 1st survey results from the important shunto wage negotiations will be released on Friday, which will be key ahead of the BoJ meeting a week tomorrow where speculation mounts that negative rates will end. These are the main highlights but see the full week ahead at the end for all the week’s key global events.

Now expanding on the main event. With gas prices up around 4.1% from January, our economists expect headline CPI (+0.41% forecast, consensus +0.4%, vs. +0.31% previously) to grow faster than core (+0.30%, consensus +0.3%, vs. +0.39% previously). This would bring YoY core CPI two-tenths lower to 3.7%, with headline flat at 3.1%. Of some concern would be the three-month annualised rate ‘only’ ticking down a tenth to 3.9% while the six-month annualised rate would rise a tenth to 3.7%. See our economists preview and post-print webinar registration details here.

For Thursday’s PPI, the main interest will be the sub components that feed into core PCE forecasts. As our economists point out, one of the more important will be the PPI for portfolio management and investment advice, which tends to follow equity prices with a one-month lag. We’ve seen a further equity rally since last month so it could be firm again. This remarkably added about 8bps to the January core PCE print despite only being about 1.6% of the basket. Our economists will also be scrutinising the PPI for selected health care industries, as this category currently has the highest weight in core PCE.

Overnight in Asia, Japanese equities are leading the slump, with the TOPIX (-3.03%) and the Nikkei (-2.87%) both experiencing sharp declines. In fact for the TOPIX, that currently leaves it on track for its worst daily performance since February 2021. The moves follow an upgrade to Japan’s GDP in Q4, with the latest release pointing to an annualised +0.4% expansion, rather than the -0.4% contraction that was first reported. In turn, that’s added to expectations that the Bank of Japan is set to adjust its negative interest rate policy as soon as the March meeting next week, with markets pricing in a 74% prospect of a shift. That’s also meant the J apanese Yen has strengthened further this morning, up +0.08% against the US Dollar, whilst the 2yr government bond yield (+0.7bps) is at its highest level since 2011 this morning.

That downbeat tone has been echoed elsewhere, with futures for the S&P 500 down -0.20% this morning. In Australia, equity markets have also slumped, with the S&P/ASX 200 down -1.82%. However, Chinese equities have been the exception to that pattern, with the CSI 300 (+0.59%) and the Shanghai Comp (+0.08%) both advancing, whilst the Hang Seng is up by a larger +1.29%. That comes after China’s February inflation data was released over the weekend, which showed CPI up by +0.7% year-on-year (vs. +0.3% expected). It also marks the fastest pace of inflation since March last year. However, PPI remained in deflationary territory, with a -2.7% decline in February (vs. -2.5% expected).

Looking back on last week, we had another payrolls Friday, which beat expectations after rising by 275k (vs 200k expected). Meanwhile, the unemployment rate rose to 3.9% (vs 3.7%), its highest level since December 2021, while average hourly earnings slowed to +0.1% (vs +0.2% expected). These headline moves were supportive of a soft landing narrative, but there were also some weaker details, notably a -124k downward revision to January’s payrolls. So a mixed release, suggestive of a cooler if still resilient US labour market.

Off the back of this, markets increased the amount of rate cuts expected this year. The amount of Fed cuts expected by the December meeting increased by +2.8bps on Friday (and +3.6bps on the week) to 95bps, though this did retreat after pricing in as much as 103bps shortly after the payrolls release. The first 25bps cut is nearly fully priced by June at 92% (vs 96% the day before and last week).

The data flow combined with slightly dovish central bank commentary sent sovereign bond yields lower last week. Yields on 2yr Treasuries fell -5.6bps (and -2.6bps on Friday), while 10yr yields fell -10.6bps to 4.08%, their lowest level in over a month (-0.9bps on Friday). Over in Europe, yields moved lower following the ECB decision last Thursday, with 10yr bund yields falling -14.6bps (and -3.9bps on Friday).

For equities, the S&P 500 had a soft end to the week, falling -0.65% on Friday. This left the index down -0.26% on the week, so as we mentioned at the top, narrowly missing out on recording 17 out of 19 weekly gains for the first time since 1964. Friday’s reversal was led by tech stocks, with NASDAQ down -1.16% (and -1.17% on the week) and the Magnificent 7 down -1.68% (-1.23% on the week). The tech stock volatility was exemplified by Nvidia, which closed -5.55% lower on Friday (and >10% down from its intra-day peak), but was still up +6.38% on the week to post a tenth week of consecutive gains. The equity optimism was more stable elsewhere, with the equal-weighted version of the S&P 500 up +0.91% on the week (-0.17% Friday), while in Europe the STOXX 600 gained +1.14% (+0.02% on Friday), hitting another record.

Finally in commodities, gold hit an all-time high in nominal terms of $2179/oz after rising +4.61% (and +0.96% on Friday). Bitcoin hit another all-time high last week, briefly trading above $70,000 for the first time early on Friday before ending the European session at $68,463 (up +10.57% on the week).