Biden (Yes, Biden) Promises Rate-Cut By Year-End As Fed Minutes Signal Caution & Slowing QT

Thanks to today’s magnificent unwind, the market and monetary-policy landscape has changed dramatically since the last FOMC meeting on March 20th. Gold is still the biggest winner while bonds are a bloodbath with stocks flat and the dollar and oil up…

Source: Bloomberg

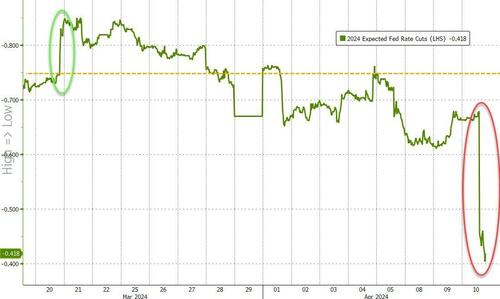

But that’s just the start as expectations for rate-cut expectations (and timing) have collapsed in the three weeks since The Fed met…

From three cuts fully priced-in, the market is now pricing in one, with a 50% chance of second….

Source: Bloomberg

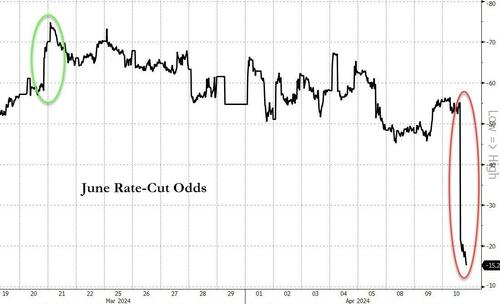

And June is off the table entirely for a cut (with May FF options even hinting at the chance of a rate-hike)…

Source: Bloomberg

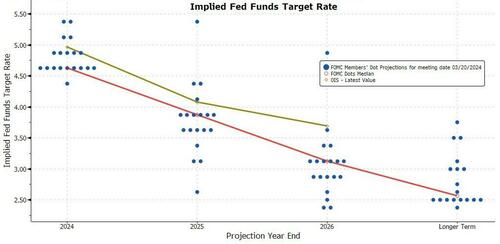

The market is now significantly more hawkish than The Fed’s dots from just three weeks ago suggested…

Source: Bloomberg

So, given how stale these Minutes are – what exactly is it that The Fed wants us to know from them?

The highlights:

-

*FOMC Minutes: Recent Inflation Numbers ‘Disappointing’ to Fed Officials

-

*FOMC Minutes: Fed Officials Wanted More Confidence on Inflation Before Cutting Rates

-

*FOMC Minutes: Officials Agreed to Keep Rates High if Inflation Progress Stalls

-

*FOMC Minutes: Fed Prepares Slower Pace of Treasury Runoff ‘Fairly Soon’

-

FOMC Fed Minutes: Almost All Participants At Fed’s March 19-20 Meeting Judged It Would Be Appropriate To Pivot To Less

On inflation goals:

Participants generally judged that risks to the achievement of the Committee’s employment and inflation goals were moving into better balance (NOT ANYMORE)

Consumer price inflation continued to decline, but recent progress was uneven. (NOT ANYMORE)

On delaying cuts:

…all 19 Fed officials generally agreed that high inflation readings in January and February “had not increased their confidence” that inflation was falling steadily to their 2% target.

On tapering QT:

Although most officials saw the process as proceeding smoothly, they “broadly assessed” it would be appropriate to take a cautious approach to further runoff given market turmoil in 2019, the last time the Fed tried to shrink its portfolio.

“The vast majority of participants thus judged it would be prudent to begin slowing the pace of runoff fairly soon,” the minutes showed.

Finally, this was very interesting!!!

President Biden chimed in on Fed policy…

“Well, I do stand by my prediction that, before the year is out, there’ll be a rate cut,” Biden said Wednesday at a White House press conference alongside Japanese Prime Minister Fumio Kishida, adding that today’s CPI report could delay a rate cut by at least a month…

So much for ‘Fed independence’ that Powell was spouting on about in his speech last week.

The Fed has been assigned two goals for monetary policy – maximum employment and stable prices.

Our success in delivering on these goals matters a great deal to all Americans. To support our pursuit of those goals, Congress granted the Fed a substantial degree of independence in our conduct of monetary policy. Fed policymakers serve long terms that are not synchronized with election cycles.

Our decisions are not subject to reversal by other parts of the government, other than through legislation.

This independence both enables and requires us to make our monetary policy decisions without consideration of short-term political matters.

Such independence for a federal agency is and should be rare. In the case of the Fed, independence is essential to our ability to serve the public.

Just a reminder…

Interesting pic.twitter.com/dSq89Qd2JM

— TeneX Trades (@TeneXTrades) April 10, 2024

And finally…

“One of Chair Powell’s responsibilities is to protect the public standing of the Fed,” said Vincent Reinhart, chief economist at Dreyfus and Mellon.

“The closer the FOMC acts to the election, the more likely it is that the public will question the Fed’s intent.”

Read the full FOMC Minutes below:

Tyler Durden

Wed, 04/10/2024 – 14:04

via ZeroHedge News https://ift.tt/ZAFIXPx Tyler Durden