Futures Set For New Record High Ahead Of CPI, Fed Double Header

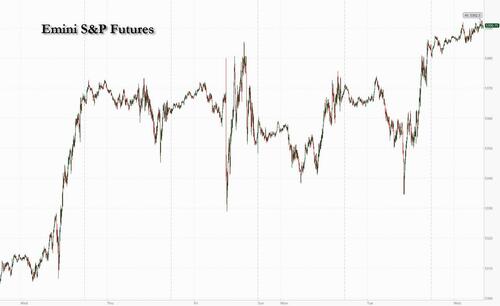

Futures are up modestly after another record close on Wall Street heading into today’s double whammy of CPI, and FOMC Dot Plot update, with Nasdaq leading and small-caps lagging. As of 8:00am, S&P futures are up 0.1% to 5,390 and set to extend the stretch of record highs as traders position for the potential disruption from US inflation data landing just hours ahead of Federal Reserve’s interest rate decision on Wednesday; Nasdaq futures rose 0.2%. Bond yields are flat to down 1bp after a stellar 10Y auction yesterday; the Bloomberg Dollar index rose again after four days of gains. Commodities are higher, led by Energy, despite with metals lagging. Today’s focus will be on the doubleheader of CPI and the Fed (our previews can be found here and here).

In premarket trading, Mag7 and semis names are mostly positive thanks to Oracle shares surging 8.7% to a new record high after the infrastructure software company announced a cloud infrastructure partnership with Google Cloud, as well as one with Microsoft and OpenAI. Oracle also reported fourth-quarter results that featured better-than-expected Cloud Infrastructure revenue, even as it missed on total revenue and earnings. PetMed shares drop 11% after the online pet pharmacy reported results.

Investors are preparing for a rare double-whammy of US CPI data and Fed announcements that have the potential to upend markets.

“Today is a big day in terms of economic data and Fed announcement,” said Ipek Ozkardeskaya, an analyst at Swissquote Bank. “It could determine the global market mood for the rest of the month, and a good part of summer.”

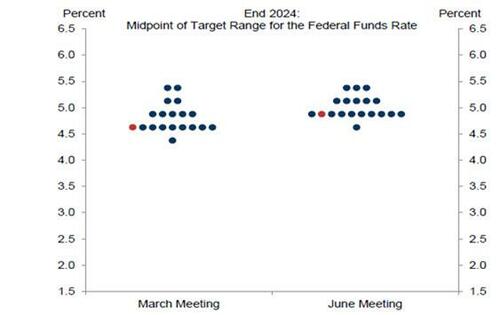

While policymakers are widely expected to hold borrowing costs at a two-decade high, there’s less certainty on officials’ quarterly rate projections, also known as the dot plot, where most expect the Fed to revise its dot plot from three rate cuts for the balance of 2024 to two, but a hawkish surprise of just one rate cut can not be excluded (see preview here). In any case, Fed voters already have the CPI print for May and it will feature prominently in their deliberations.

“If it’s two, I think the market reaction can be quite positive and would support new highs in the S&P 500,” Grace Peters, head of investment strategy for Europe, Middle East and Africa at JPMorgan Private Bank, said on Bloomberg TV.

Ahead of the Fed, the May consumer price index reading is due at 8:30 a.m. and is supposed to show another modest slowdown in inflation, with Goldman’s trading desk saying that it is optimistic for a low print. Here is JPM’s core CPI MoM market reaction matrix (more details here).

- Above 0.4%. The first tail-risk scenario, this outcome is likely achieved by an increase in both Core Goods and Core Services, with Core Goods flipping from deflationary to inflationary MoM. Within Core Services, we would likely see shelter inflation increase. The bond market reaction would likely be a 12-15bps increase as part of a bear flattening. Equities would react negatively to this repricing. Given the acceleration higher in inflation, rate cut bets for 2024 would evaporate and we will see the return of views of a rate hike. This would be exacerbated by any comments from Powell suggesting rates are not restrictive enough. Probability 5%, SPX falls 1.5% to 2.5%.

- Between 0.35% – 0.40%. This outcome is likely achieved by a smaller than expected disinflationary impulse from Core Goods with Shelter remaining flat. Bonds react negatively as Sept/Nov rate cut views decrease. With market fixings pricing in ~0.26% for Core MoM, the bond market reaction could be larger than expected with many Equity investors focused on the surveyed number of 0.3%. Probability 15%, SPX falls 1% to 1.25%.

- Between 0.30% – 0.35%. This scenario has the widest range of outcomes since the low end of the range supports the disinflationary trend and the higher end of the range the stickier inflation argument. Feroli’s forecast for 0.33% would keep the YoY number flat from last month’s print. The biggest drivers are weak disinflation in shelter, increases in vehicle, medical, and communication prices. Given the move in bond yields on Friday (+14.6bps to 4.43%), there is likely a more muted response to a hotter print. Also referencing Friday, it was surprising to see stocks slough off the bond market move with the SPX falling only 11bps instead of 1%+ as we have seen over the last couple years in response to significant and sudden moves in bond yields. Probability 40%, SPX loses 0.75% to gains 0.75%.

- Between 0.25% – 0.30%. As mentioned, the market fixing implies a 0.26% core reading and the move in yields may not be as strong as one would expect on a beat where one would expect ~15bps move in the 10Y yield but this is a positive outcome for risk assets as this print would likely restart the Goldilocks narrative with 24Q1 data being viewed as an anomaly. Probability 25%, SPX gains 0.75% to 1.25%.

- Between 0.20% – 0.25%. The immediate reaction would be a surge in September rate cut expectations with some likely pointing to July for a surprise, insurance cut given the move by the ECB. While July sees highly unlikely, putting September back on the table would be view favorably by risk assets and we could see some yield curve steepening to aid the Cyclicals/Value trade. Probability 12.5%, SPX gains 1.25% to 1.75%.

- Below 0.20%. Another tail-risk scenario, likely fueled by a material decline in shelter inflation with goods disinflation supporting the print. Look for a collapse in yields, a material increase in July cut expectations, and a rally across all risk assets ex-commodities. In Equities, this would look like an “everything rally” with both NDX and RTY outperforming the SPX. This outcome, if confirmed in the July print, would trigger a reset in thinking about which stage of the economic cycle we currently reside as well as talks of the Fed having achieved a No Landing/Soft Landing scenario. Probability 2.5%, SPX gains 1.75% to 2.50%.

In Europe, the volatility of the past two days is subsiding investors were caught unprepared for French far-right gains in the weekend’s European Parliament elections; European stocks are on course to rise for the first time in four sessions, led by gains in banks, insurance and financial services. The CAC 40 is higher but underperforming its regional peers as political uncertainty continues to linger. Here are the biggest European movers:

- UCB shares gain as much as 5.6%, the most since February and to a record high, after JPMorgan raised its recommendation for the Brussels-listed biotech to neutral from underweight.

- Credit Agricole shares rise as much as 3.2% after Jefferies upgrades to buy, saying that the pullback in French banks since President Emmanuel Macron called a snap election presents an opportunity.

- Rentokil shares jump as much as 16% after US investor Nelson Peltz’s Trian Fund Management amassed a stake that made it one of the ten biggest shareholders in the pest controller.

- Richter shares gain as much as 1.5% after Hungarian pharmaceutical company agreed to buy some assets from Mithra Pharmaceuticals and its subsidiary late Tuesday.

- RWS Holdings shares rise as much as 6% after the translation services company’s interim results, with Berenberg saying growth returned in the second quarter and should now continue into 2H.

- Lonza shares dip as much as 3.2%, weighed down by speculation that a potentially beneficial US bill may be excluded from the National Defense Authorization Act due to a tight pre-election schedule.

- Legal & General shares fall as much as 4.7%, most since April 25, after the UK financial services firm forecast a slowdown in dividend-per-share growth.

- Colruyt shares plunge as much as 14% after the retailer issued cautious guidance because of increased competition and promo pressure.

- Umicore shares drop as much as 9.1%, to their lowest intraday since 2011, as the Belgian materials technology firm downgraded its guidance.

- Camurus shares fall as much as 6.1% after holder Sandberg Development offers 1.35m shares at SEK550 apiece, representing approximately an 8.6% discount to the last close.

- Stabilus shares fall as much as 17%, the steepest decline on record, after the German machinery maker sent out a profit warning last night, cutting its revenue and Ebit margin guidance.

- Safestore shares drop as much as 3.1% after the self-storage company’s interim results showed a drop in adjusted earnings, while warning full-year EPS will be at the lower-end of consensus.

Earlier, stocks in Asia fell for a second day, led by weakness in Japanese and offshore Chinese shares. The MSCI Asia Pacific Index declined as much as 0.4%, with Alibaba and Toyota among biggest drags. Benchmark in China was flat while that in Hong Kong closed at the lowest level since late April. Shares in Japan fell, while those in Korea were among the top gainers. In China, consumer prices rose less than expected in May and factory prices dropped for the 20th month in a row, fueling concerns over persistently weak demand. “Asian markets waded through murky waters today, with investors on edge ahead of a double-dose eventful day,” said Hebe Chen, an analyst at IG Markets. Also, specific headwinds are raising alarms for traders in China, Hong Kong, and Japan, she said.

In Hong Kong, the Hang Seng index slipped below the “crucial 18,000 level” due to the lackluster China’s CPI data and fresh speculation about looming US chip restrictions, Chen said, adding that Japanese stocks tumbled as hot PPI muddles the outlook for the Bank of Japan’s monetary policy decision due this Friday.

In FX, the Bloomberg Dollar Spot Index gained 0.1%, edging up for a fifth straight day as Treasury futures positioning data suggested the Fed will likely keep borrowing costs elevated. “A higher-than-expected US CPI will make the tone of the FOMC meeting more hawkish and result in USD strength,” said Richard Grace, a senior currency analyst at InTouch Capital Markets in Sydney. “Conversely, a lower-than-expected CPI will see the USD depreciate as Fed Chair Powell maintains the optimism for eventual rate cuts”

In rates, treasuries are also slightly higher ahead of US consumer prices and the Federal Reserve decision, with US 10-year yields falling 1bps to 4.40%. Traders are pricing an 80% possibility that the Fed may cut rates in November, while they price a total of 39 basis points of easing by the end of the year. French 10-year yields are flat at 3.22%. Gilts rise, with little reaction shown to a slight beat for UK GDP in April.

In commodities, oil prices are higher, with WTI rising 1.3% to trade near $78.90 a barrel. Spot gold falls ~$3 to around $2,314/oz.

Bitcoin in consolidation mode in-fitting with broader markets; currently sitting just above USD 67k.

Today’s economic calendar includes includes May CPI (8:30am), monthly budget statement and FOMC rate decision (2pm). Fed officials scheduled to speak after the FOMC meeting include Powell (2:30pm news conference), Williams (Thursday), Goolsbee and Cook (Friday)

Market Snapshot

- S&P 500 futures little changed at 5,387.00

- STOXX Europe 600 up 0.5% to 519.79

- MXAP little changed at 178.98

- MXAPJ up 0.3% to 559.05

- Nikkei down 0.7% to 38,876.71

- Topix down 0.7% to 2,756.44

- Hang Seng Index down 1.3% to 17,937.84

- Shanghai Composite up 0.3% to 3,037.47

- Sensex up 0.4% to 76,762.03

- Australia S&P/ASX 200 down 0.5% to 7,715.51

- Kospi up 0.8% to 2,728.17

- German 10Y yield little changed at 2.61%

- Euro up 0.1% to $1.0752

- Brent Futures up 0.8% to $82.61/bbl

- Gold spot down 0.2% to $2,312.95

- US Dollar Index little changed at 105.19

Top Overnight News

- China’s May inflation is essentially inline (but still soft), with the CPI +0.3% (vs. +0.3% in Apr and vs. the Street +0.4%) and the PPI -1.4% (vs. -2.5% in Apr and vs. the Street -1.5%). RTRS

- Brussels will impose tariffs of up to almost 50 per cent on Chinese electric vehicles, brushing aside German government warnings that the move risks starting a costly trade war with Beijing. The European Commission notified carmakers on Wednesday that it will provisionally apply additional duties of between 17 and 38 per cent on imported Chinese EVs from next month. FT

- The US Treasury is expected to roll out a big expansion of its secondary sanctions program on Russia this week, treating any foreign financial institution transacting with a sanctioned Russian entity as though it is working directly with the Kremlin’s military-industrial base. FT

- The world faces a “staggering” surplus of oil equating to millions of barrels a day by the end of the decade, as oil companies increase production, undermining the ability of Opec+ to manage crude prices, the International Energy Agency has warned. FT

- Israel/Hezbollah tensions spike after an Israeli strike killed the most senior Hezbollah commander since the start of the war in Gaza (Hezbollah fired a barrage of rockets toward Israel in response). Jerusalem Post

- Emmanuel Macron said he won’t resign if his party suffers a poor result in snap French parliamentary elections, saying that’s absurd. “I will kill this idea, which never actually existed.” The French president said he’ll appoint a PM as the constitution demands but that doesn’t mean handing control to the far right. BBG

- Today’s Fed meeting looks set to be one of the year’s most pivotal with Jerome Powell potentially offering his clearest hints yet to the rate path. Bloomberg Economics expects the new dot plot will probably indicate two 25-bp cuts this year, compared with three previously. BBG

- US crude inventories resumed their downward trajectory, led by a 1.9 million barrel decline at Cushing, API data is said to show. That would be the biggest drop in more than four months if confirmed by the EIA today. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued after the mixed handover from US peers as markets braced for the incoming US CPI data and the FOMC announcement. ASX 200 was pressured amid weakness in mining, tech, and the defensive sectors. Nikkei 225 retreated beneath the 39,000 level as participants digested firmer-than-expected PPI data which rose at the fastest annual pace in 9 months. Hang Seng and Shanghai Comp. were somewhat varied with underperformance in Hong Kong as China Evergrande New Energy Vehicle shares dropped around 20% amid the threat of losing key assets after local administrative bodies demanded repayment of CNY 1.9bln in subsidies by its units. Meanwhile, the mainland was cautious amid frictions with the US and after mixed Chinese inflation data including softer-than-expected CPI and a narrower deflation in factory gate prices.

Top Asian news

- US President Biden’s administration is to widen sanctions on Wednesday on the sale of semiconductor chips and other goods to Russia, according to Reuters sources. US will change export controls to include US-branded goods and not just those made in the US, while the measures are aimed at targeting third-party sellers in China and Hong Kong that are supplying Russia.

- China reportedly weighs a ban on bank distribution of hedge fund products, according to Bloomberg.

- Chinese Foreign Ministry says EU tariffs on Chinese EVs violate market economy principles and international trade rules; China will take all measures to firmly defend interests.

- EU intends to impose provisional tariffs on Chinese EV’s of 21% for cooperating companies, 38.1% for those which have not

European bourses, Stoxx 600 (+0.4%) are entirely in the green, attempting to trim some of this week’s significant losses, sparked by political uncertainty in Europe. European sectors hold a strong positive bias, with Banks taking the top spot as the sector finds its footing after this week’s weakness. Autos is the clear laggard, after news that the European Commission will notify carmakers that it will provisionally impose additional duties of up to 25% on imported Chinese EVs from next month. US Equity Futures (ES +0.1%, NQ +0.1%, RTY -0.1%) are trading on either side of the unchanged mark with price action tentative ahead of today’s key risk events, which includes US CPI and the FOMC Policy announcement.

Top European News

- ECB’s Kazaks sees hopes of further rate cuts this year. Need to be convinced that inflation will not return.

- ECB’s Villeroy says inflation will be below 2% in France starting next year, even at 1.7%.

- ECB Schnabel says the economy is recovering gradually, last mile of disinflation is proving bumpy; first indications of easing wage growth.

- UBS expects BoE to start cutting interest rates in August (prev. forecast June)

- French President Macron says they have not been able to form lasting coalitions. EU vote clear, could not be ignored.

FX

- USD is flat and in a narrow range as participants await the double dose of US risk events in the form of CPI and the FOMC; DXY resides within 105.21-32 parameters, well within yesterday’s 105.09-46 range.

- EUR price action has been uneventful thus far awaiting today’s key risk events; EUR/USD in a 1.0733-47 range thus far.

- GBP has also been trading sideways finding intraday resistance at 1.2750 (vs low 1.2729) with little immediate move seen in the wake of in-line GDP which ultimately resulted in little change in BoE pricing.

- JPY is very modestly softer irrespective of the overnight risk aversion and firmer-than-expected PPI data; USD/JPY currently trading within a 157.03-37 range.

- Antipodeans are both modestly firmer facilitated by an attempted recovery in base metals, but with gains capped as the risk tone remains cautious ahead of the aforementioned risk events.

- PBoC set USD/CNY mid-point at 7.1133 vs exp. 7.2558 (prev. 7.1135).

Fixed Income

- USTs are flat ahead of US CPI for one final read into the FOMC meeting where market pricing currently has a 99% chance of an unchanged rate. Currently holding near a fresh WTD high at 109-20, sparked by Tuesday’s strong US auction.

- Bunds are firmer with initial impetus stemming from Tuesday’s strong US auction and perhaps some marginal follow through from UK GDP numbers. Bunds are within a 130.21-130.50 bound, and have edged down towards the mid-point of the range after a poorly received Bund auction.

- Gilts are firmer, in tandem with broader strength in EGBs/USTs; amidst this, the morning’s UK GDP metrics were broadly in-line but the internals around Construction/Manufacturing were soft and sparked a very modest dovish move to BoE pricing.

- Germany sells EUR 3.3bln vs exp. EUR 4bln 2.20% 2034 Bund: b/c 2.0x (prev. 2.8x), average yield 2.6% (prev. 2.53%) & retention 16.75% (prev. 17.9%).

- UK sells GBP 900mln 0.625% I/L Gilt 2045: b/c 3.88x real yield 1.304%

Commodities

- Crude is firmer and at session highs, continuing to build on yesterday’s bullish private inventory data which saw a larger than expected draw in crude and gasoline. Additionally, geopolitical updates out of Israel/Hezbollah point towards recent escalations within the region. Brent Aug currently around USD 82.85/bbl.

- Precious metals are flat/mixed as traders look ahead to the US CPI and FOMC; XAU sits in a USD 2,310.60-2,317.70/oz range.

- Base metals are attempting a recovery from the recent slide in prices induced by Fed expectations following Friday’s NFP data. Chinese inflation did little to sway prices as trades await upcoming US macro events.

- IEA Oil Market Report: lowers 2024 demand growth forecast by 100k BPD to 960k BPD; 2025 oil demand growth seen at 1mln BPD amid a muted economy and clean energy tech deployment; major oil surplus seen this decade as demand peaks.

- UBS says on Gold “we have raised our 2024 avg. forecast and year-end target by 8% to USD 2365 and USD 2600 respectively”

- US Private Inventory Report (bbls): Crude -2.4mln (exp. -1.05mln), Cushing -1.9mln, Distillate +1mln (exp. +1.6mln), Gasoline -2.5mln (exp. +0.9mln).

- Azerbaijan oil production was 62.1k/T day in May.

Geopolitics: Middle East

- Rocket sirens are reportedly sounding over several towns in Northern Israel, according to Horowitz on X; Israeli media says “Heavy bombardment from Lebanon towards northern Israel, and sirens activated in Tiberias, Safed, and Galilee” via Sky News Arabia.

- IDF Radio reports “More than 100 rockets fired from the south Lebanon on Safed, Tiberias and their surroundings in a few minutes”.

- Hamas official said their response to the Gaza ceasefire deal is responsible, serious, and positive, while the official added the response opens a wide way to reach an agreement.

- Israeli official said Hamas has rejected the proposal for a hostage release presented by US President Biden, while the official added that Israel received the Hamas response via mediators and that Hamas changed the proposal’s main parameters.

- Israeli airstrike on south Lebanon killed four people including a senior Hezbollah field commander, according to three security sources cited by Reuters. It was later noted that the Hezbollah commander killed in an Israeli airstrike on Tuesday was the most senior member killed in the last 8 months.

- US Pentagon said Secretary of Defense Austin discussed with his Israeli counterpart by phone efforts to calm tensions along the Israeli-Lebanese border, according to Sky News Arabia.

- Rocket sirens are reportedly sounding over several towns in Northern Israel, according to Horowitz on X; Israeli media says “Heavy bombardment from Lebanon towards northern Israel, and sirens activated in Tiberias, Safed, and Galilee” via Sky News Arabia; IDF Radio reports “More than 100 rockets fired from the south Lebanon on Safed, Tiberias and their surroundings in a few minutes”.

Geopolitics: Other

- EU is proposing to sanction Russian oil-shipping giant Sovcomflot, according to Bloomberg.

- EU is pushing ahead with Chinese electric vehicle tariffs that are set to bring in more than EUR 2bln a year, despite opposition from Germany, according to FT. European Commission will notify carmakers that it will provisionally impose additional duties of up to 25% on imported Chinese EVs from next month. Note, it was reported that yesterday Chinese Auto Industry Association CPCA said the EU could impose a 20% tariff on Chinese EVs, which is an understandable trade practice.

- Japan mulls sanctioning groups including Chinese firms for aiding Russia’s invasion of Ukraine, according to NHK.

US Event Calendar

- 07:00: June MBA Mortgage Applications +15.6%, prior -5.2%

- 08:30: May CPI MoM, est. 0.1%, prior 0.3%

- May CPI YoY, est. 3.4%, prior 3.4%

- May CPI Ex Food and Energy MoM, est. 0.3%, prior 0.3%

- May CPI Ex Food and Energy YoY, est. 3.5%, prior 3.6%

- May Real Avg Hourly Earning YoY, prior 0.5%

- May Real Avg Weekly Earnings YoY, prior 0.5%, revised 0.6%

- 14:00: June FOMC Rate Decision

- 14:00: May Monthly Budget Statement, est. -$276.5b, prior -$240.3b

DB’s Jim Reid concludes the overnight wrap

Forgive me for feeling a touch melancholy this morning as I type this at 5am as a 50 year old. I’ll be celebrating by giving the opening speech this morning at DB’s 28th annual European LevFin conference featuring over 1000 investors and issuers. See you there if you’re attending. The highlights from my 40s were 3 kids I didn’t know if I’d ever have, 4 costly renovation projects, 6 knee surgeries, several inner ear surgeries, one back surgery and several trapped nerves. On the plus side of my mid-life crisis, my golf handicap has gone from 6 to 1.9 in my 40s which partly explains some of the ailments above. Let’s hope by the time I’m 60 I’ll have a few AI generated artificial limbs to help me hit the golf ball further.

It’s been another challenging 24 hours for European markets, with risk assets hacking out of the rough thanks to the ongoing political uncertainty in Europe. Meanwhile in a different universe, the S&P 500 (+0.27%) sailed down the middle of the fairway and hit a fresh all time with Apple (+7.26%) having its best day since November 2022 and returning above $3tn market cap and to an all time high itself after a difficult first 3-4 months of the year.

In terms of the European market moves, it was another difficult day for French assets. For instance, the 10yr Franco-German spread widened by another +5.0bps to 60bps, and the CAC 40 (-1.33%) fell to its lowest level in almost four months. Banks were among the worst affected again, with fresh losses for Société Générale (-5.02%), Crédit Agricole (-3.90%) and BNP Paribas (-3.89%). The three banks are now down -12.11%, -7.34% and -8.47% respectively since Monday’s open. At the height of the selloff yesterday, there were even unconfirmed press reports (later denied) that President Macron could resign after the election, before yields came off from their highs later on in the session.

President Macron is set to speak at a press conference today, but in the meantime, there have been growing questions about the political landscape his centrist alliance will be facing at the elections. On the left, an alliance was formed on Monday night between the Greens, Socialists, Communists and La France Insoumise. But on the right of the political spectrum there’s still uncertainty, as Éric Ciotti, who leads Les Républicains party, called for an alliance with Marine Le Pen’s Rassemblement National. Other figures in the party sternly rejected those suggestions, but the historic divisions between the traditional right-wing parties and the RN are becoming increasingly blurred as the latter has come to dominate the right-wing of the political spectrum in France . Later in the day, we heard that talks on forming an alliance between RN and the smaller far-right Reconquest party had broken down. In terms of the latest polls, an Ifop survey out yesterday had Marine Le Pen’s party on 35%, an alliance of four left-wing parties on 25%, and Macron’s alliance on 18%.

This political uncertainty weighed on markets across the continent. That included a third day of losses for the STOXX 600 (-0.93%), with the Stoxx banks index (-2.66%) seeing its largest decline since August. Equities slumped in several countries, with particularly sharp declines in southern Europe, including Italy’s FTSE MIB (-1.93%) and Spain’s IBEX (-1.60%). Sovereign bonds mostly rallied given the risk-off tone, and yields on 10yr bunds came down -4.8bps. But there was still a clear widening in spreads, with 10yr French yields (+0.2bps) just closing at their highest level of 2024 so far. Italian yields (-0.1bps) were also broadly flat despite the core rates rally.

This included 10yr US yields being down -6.3bps to 4.405%. US yields had been trading modestly lower on the day in the risk-off environment emanating from Europe but then saw a sizeable rally after a strong 10yr Treasury auction. This saw the highest bid-to-cover ratio in over two years and the lowest primary dealer take up since August, with $39bn of bonds issued 2bps below the pre-sale yield.

The next test / opportunity for Treasuries will come with today’s epic double bill with the US CPI release for May, as well as the Fed’s latest decision. In terms of the Fed, they’re widely expected to leaves rates unchanged today, so the focus is likely to be on the latest dot plot, as well as the new economic projections. Last time, the dot plot still pencilled in three cuts this year, but only just, and it would have only taken one dot to shift for the median to be at two cuts. Since then, the inflation figures have remained higher than the Fed would ideally like, and our US economists expect the median dot to only show two cuts now, and they also see the core PCE forecast for this year being upgraded by two-tenths to +2.8%. Looking forward, they also see the 2025 dot being revised up by 25bps, so that would signal a shallower pace of cuts. See here for their full preview.

Of course, the signals from the meeting could be influenced by the CPI release earlier in the day, as a surprise in either direction could lead to shifts in their inflation projections. In terms of what to expect, our US economists expect headline CPI to come in at +0.12%, and core CPI to come in at +0.27%. If those are realised, then that would mean the year-on-year headline CPI comes in at +3.4%, while core falls to +3.5%. Click here for their full CPI preview and how to sign up for the subsequent webinar.

Ahead of this US markets were largely unphased by the developments in Europe, with the S&P 500 (+0.27%) posting another record high. One sector affected by contagion from Europe were banks as the S&P 500 banks index fell -2.15%. Tech stocks outperformed, with the NASDAQ up +0.88% and the Magnificent 7 up +1.00%. The latter came mostly as Apple (+7.26%) posted its best day since November 2022 to climb to a new all-time high. Less than two months ago Apple was down -16.7% from its last all time high back in December so a decent bounce back. Monday initially saw a dip after the OpenAI partnership was a “sell the fact” moment but the reaction turned much more positive yesterday.

Asian equity markets are mostly declining this morning with China’s soft consumer prices data weighing on proceedings. As I check my screens, the Hang Seng (-1.43%) is the worst performer among Asian indices on news that the US is considering further trade sanctions on China’s access to AI chip technology. Meanwhile, the Nikkei (-0.63%), CSI (-0.18%) and Shanghai Composite (-0.04%) are also trading marginally lower. The KOSPI (+0.38%) is managing to buck the trend though. US equity futures are flat along with US treasuries.

Coming back to China, CPI disappointed as it rose +0.3% y/y in May, weaker than market expectations for a rise of +0.4%. PPI contracted -1.4% y/y in May (v/s -1.5% expected), marking its smallest contraction since February 2023 and up from last month’s -2.5% decline. It has been negative for 20 months now though. Elsewhere, Japan’s PPI rose +2.4% y/y in May (v/s +2.0% expected) as against prior month’s upwardly revised increase of +1.1%.

Looking at yesterday’s other data, the UK unemployment rate rose to 4.4% (vs. 4.3% expected) over the three months to April, which is its highest level in two-and-a-half years. Separately in the UK, there’s just over three weeks until the election on July 4, and a YouGov poll showed the right-wing Reform UK party on 17%, just one point behind the governing Conservatives on 18%. Labour are still clearly ahead on 38%, but that’s the closest gap between the Conservatives and Reform in a poll so far.

To the day ahead now, and the main highlights will be the US CPI release, along with the Federal Reserve’s decision and Chair Powell’s press conference. Otherwise in Europe, we’ll get the UK GDP release for April, and central bank speakers will include ECB Vice President de Guindos, and the ECB’s Vujcic, Nagel and Villeroy.

Tyler Durden

Wed, 06/12/2024 – 08:13

via ZeroHedge News https://ift.tt/Cz1PMOm Tyler Durden