US futures flat ahead of a key earnings release from Nvidia, the $3 trillion stock at the forefront of the global artificial-intelligence frenzy and the culprit for most of the market’s upside in the past two years. Viewed a barometer for AI spending across much of the technology industry, Nvidia – viewed by many as this bubble’s CSCO – is expected to project revenue growth of more than 70% for the current quarter when it reports after market close on Wednesday (full preview here). Any disappointment is certain to roil markets, given the company’s heft in US indexes. As of 8:00am S&P futures are flat, trading largely unchanged for the past week; Nasdaq 100 futs are barely in the red as NVDA erases an earlier gain in the green pre-mkt with the balance of Mag7 performing similarly and Semis are also bid. Bond yields are lower, tracking another sharp drop in oil. The USD is extending on yesterday’s gains while commodities are lower, led by Energy though Base Metals are continuing their recent bull run. The macro data focus will be on Fedspeak, bond auctions, and mortgage applications which gained 0.5% after last week’s double digit plunge (-10.1%).

In premarket trading, NVDA is flat, having rallied about 160% this year, far outpacing the Nasdaq 100’s 16.4% gain. Bank of America is down again, after Warren Buffett continued to shrink his stake, selling an additional $982 million of stock in the second-largest US bank. Nordstrom rose 8.3% after the department-store chain issued a stronger-than-expected adjusted earnings-per-share outlook. Super Micro Computer shares were set to extend Tuesday’s losses after Hindenburg Research said it’s short the maker of server equipment. Here are some other notable premarket movers:

- AeroVironment rises 9% after the defense company won a US Army contract valued at as much as $990 million.

- Ambarella soars 21% after the semiconductor-device company forecast revenue for the 3Q that beat the consensus estimate. The company is “clearly turning the corner,” Morgan Stanley said.

- Box rises 8% after the software company raised its full-year forecast.

- Foot Locker drops 6% as a 2Q same-store sales beat isn’t enough to sustain the stock’s rally of 46% since the last earnings report on May 30.

- Kohl’s rises 3% after the retailer raised its full-year forecasts for EPS and operating margin.

- nCino slides 12% after the financial-technology company’s 3Qrevenue guidance fell short of expectations.

- Nordstrom gains 3% after the department-store chain improved its comparable-sales forecast for the year and issued a stronger-than-expected adjusted earnings-per-share outlook.

- Semtech rises 4% after the semiconductor device company’s second-quarter earnings beat estimates.

- SentinelOne ticks higher by 2% after the security software company boosted its full-year revenue guidance.

The Nvidia report and earnings guidance are seen as crucial at a time when markets are grappling with the possibility of a US recession and whether the Federal Reserve can cut interest rates fast enough to engineer a soft landing. Money markets currently price about 100 basis points worth of interest rate cuts this year, starting September.

“The Nvidia result has become very much like a macro event, in some ways as big as the payrolls and CPI releases in terms of market impact,” said Justin Onuekwusi, chief investment officer at wealth manager St James Place. “There’s a lot of money, a lot of leverage in these consensus names and it will take only a slight disappointment to cause significant volatility in markets.”

European stocks are solidly in the green, rising 0.6% and at the highest since mid July, led by chemical and insurance names. GSK shares rise as much as much as 2.8% after the drugmaker said it welcomes a decision by the Delaware Supreme Court to review a lower state court decision related to the ongoing Zantac litigation, which allows the introduction of plaintiffs’ expert evidence at trial. Here are the most notable European movers:

- Novonesis shares rose after the Danish maker of industrial enzymes increased its forecast for sales growth this year. Citi analysts called the 2Q results “solid,” though they also said further share upside might be limited.

- Ageas rises as much as 6.5%, the most since March 2022, after the Belgian life insurance firm’s first-half net operating profit beat estimates, driven by strong inflows. KBC highlights the “hoped for” share buyback, which will start next month.

- Maire shares gained as much as 8.5% in Milan, the biggest increase since March 5, after Jefferies initiated coverage of the Italian technology and engineering company with a buy recommendation.

- Kingfisher shares fall as much as 2.7% after Citi downgraded the retailer to neutral, ending a buy recommendation that has stood since February.

- Stadler Rail’s share price drops as much as 6.5% after the Swiss train manufacturer reported disappointing results with a miss on revenues, Ebit and free cash flow.

Earlier in the session, Asian stocks rose as technology shares gained ahead of Nvidia’s earnings due later Wednesday, which could shine a light on the momentum of the rally. The MSCI Asia Pacific Index advanced as much as 0.2%, with TSMC and Toyota Motor among the biggest contributors. Shares in Japan and Taiwan edged higher, while China and Hong Kong benchmarks fell following a slew of disappointing corporate earnings. Nvidia’s earnings will offer clues on whether the artificial-intelligence frenzy has more room to run. Expectations of interest rate cuts by the Federal Reserve have also benefited rate-sensitive tech names, with traders now turning their attention to next week’s non-farm payrolls figures.

In FX, the dollar rose about 0.2% rising versus all its G-10 rivals except the Aussie which is flat after CPI topped estimates; the greenback is still on track for its steepest monthly decline this year, undermined by rate-cut bets. Most other currencies lost ground, with the euro dropping 0.5%. The Norwegian krone was the weakest, falling 0.5% against the greenback.

In rates, Treasuries are marginally richer across the curve with 10-year futures above Tuesday’s high in muted price action. US 10-year around 3.81% is around 1bp lower on the day with bunds and gilts in the sector outperforming by 4bp and 2bp; Treasury curve spreads are little changed. European rates outperform Treasuries, supported by gains in German long-end rates. German bond gains are long-end-led, with 30-year yields lower by ~5bp and 5s30s, 2s10s spreads flatter by 1.5bp and 2bp on the day. US session includes $70 billion 5-year note auction, following good demand for Tuesday’s 2-year note sale.

In commodity markets, gold retreated $15 to around $2,509/oz, after a three-day advance that took it closer to its all-time high, while Brent crude futures shed 1%, adding to the previous day’s slide; WTI fell 0.9% to trade near $74.80.

Bitcoin fell below the $60,000 level as part of a broad crypto market retreat that included a sharp drop in second-largest token Ether.

The US economic data calendar empty for the session; Fed speakers scheduled include Bostic at 6pm

Market Snapshot

- S&P 500 futures little changed at 5,647.50

- STOXX Europe 600 up 0.3% to 520.45

- MXAP up 0.2% to 186.19

- MXAPJ little changed at 576.03

- Nikkei up 0.2% to 38,371.76

- Topix up 0.4% to 2,692.12

- Hang Seng Index down 1.0% to 17,692.45

- Shanghai Composite down 0.4% to 2,837.43

- Sensex up 0.4% to 82,000.78

- Australia S&P/ASX 200 little changed at 8,071.40

- Kospi little changed at 2,689.83

- German 10Y yield down 2.7 bps at 2.26%

- Euro down 0.3% to $1.1149

- Brent Futures down 0.9% to $78.81/bbl

- Gold spot down 0.7% to $2,507.21

- US Dollar Index up 0.28% to 100.84

Top Overnight News

- Australia’s Jul CPI comes in at +3.5%, down from +3.8% in June but a bit firmer than the consensus forecast of +3.4%. WSJ

- Bank of Japan Deputy Gov. Ryozo Himino has backed the case for further interest-rate hikes if the economy and prices grow as expected, echoing recent comments from the central bank’s chief. WSJ

- Protests in China are on the rise as the effects of a slowing economy rattle citizens and Beijing refrains from taking bolder steps to shore up growth. Cases of dissent increased 18% in the second quarter compared to the same period last year in figures documented by the China Dissent Monitor at Freedom House, a US advocacy group. The majority of events linked to economic issues. BBG

- China’s plans to issue billions of dollars of government bonds before the end of the year could lead to a correction in the price of the country’s treasuries, people close to the central bank have warned, bursting what some have called a bubble in the market. FT

- Middle East tensions continue to cool as Hezbollah and Iran signal they want to avoid a larger war from commencing. NYT

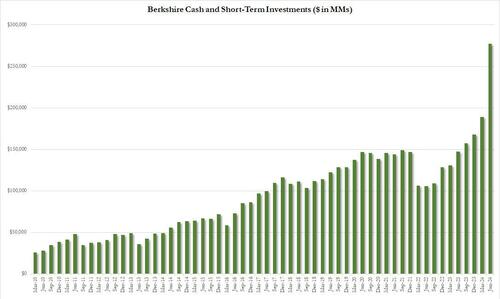

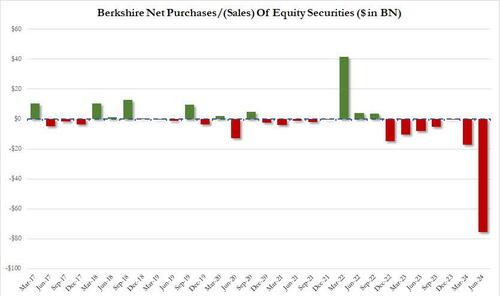

- Warren Buffett sold an additional $982 million of Bank of America Corp. stock as his conglomerate continues to shrink its investment in the second-largest US bank. His Berkshire Hathaway Inc. has trimmed the stake by a total of almost 13% in a series of sales since mid-July, generating $5.4 billion in proceeds. Berkshire disclosed the latest disposals in a regulatory filing late Tuesday, detailing sales on Aug 23, 26 and 27. BBG

- US Democratic Presidential Candidate Harris and her VP candidate Waltz will be interviewed on CNN this week Thursday: Reuters.

- Apple cuts about 100 services jobs as part of priority shift: Bloomberg.

- CAICT shipments of phones within China +30.5% Y/Y at 24.2mln handsets in July. Shipments of foreign branded phones, including Apple (AAPL) iPhones within China, +2.7% Y/Y in July: Reuters

- Israel launched a major counterterrorism operation involving hundreds of troops in multiple West Bank cities. WaPo

- Russia cares more about capturing Pokrovsk in Ukraine’s Donbas region than in repelling the Ukraine cross-border strike in the Kursk region. NYT

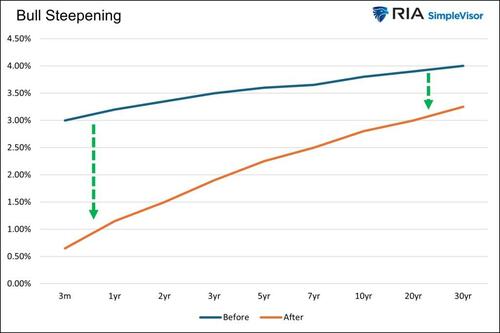

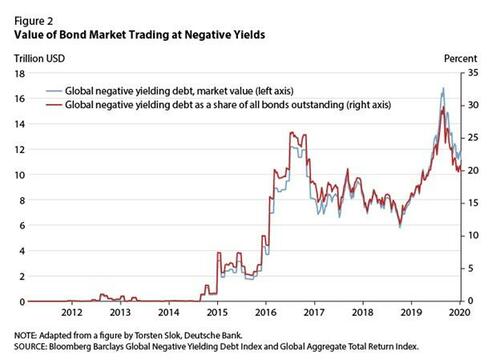

- Investors are pouring cash into US government bond exchange traded funds as bond fever spreads through the market ahead of the Federal Reserve’s expected interest rate cut in September. BlackRock’s TLT, the biggest ETF tracking long-dated Treasury bonds, pulled in nearly $4bn between the start of August and this Monday, according to data from Morningstar. The fund has had bigger inflows in only three months since it launched in 2002. FT

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded subdued but mostly within tight ranges following a mixed lead on Wall Street, whilst volume in APAC remained low amid thin summer trade. ASX 200 was pressured by Telecoms and Energy, whilst the hotter-than-expected Aussie CPI sent the index lower, albeit briefly. Nikkei 225 was hindered by the recent upside in the JPY, although price action was contained to tight ranges. Losses lead by Banks and Miners. No notable reaction was seen to BoJ Deputy Governor Himino who noted financial and capital markets remain unstable and the BoJ needs to monitor their developments with the utmost vigilance. Hang Seng and Shanghai Comp initially traded in tight ranges but the Hang Seng later extended on losses with Hong Kong seeing its earnings pick up in pace – Meituan and BYD traded lower ahead of earnings.

Top Asian news

- BoJ Deputy Governor Himino said financial and capital markets remain unstable, and BoJ needs to monitor their developments with the utmost vigilance. He added the BoJ will adjust the degree of monetary accommodation if it has growing confidence that its outlook for economic activity and prices will be realized, and the central bank needs to closely monitor developments in recent market volatilities including weaker stocks and stronger JPY.

- Alibaba (BABA/ 9988 HK) converted its secondary listing on the Hong Kong Exchange into a primary listing; says the Co. is now a dual primary listed firm on the NYSE and HKEX.

- PBoC injected CNY 277.3bln via 7-day Reverse Repo at a maintained rate of 1.70%

European bourses, Stoxx 600 (+0.3%) began the session on a modestly firmer footing. As the morning progressed, some slight divergence was seen in the markets; the DAX 40 (+0.3%) edged to session highs, whilst the FTSE 100 (-0.1%) tilted lower. European sectors hold a strong positive tilt; Insurance takes the top spot, propped by post-earning gains in Prudential (+2.7%). Basic Resources is found at the foot of the pile, hampered by broader weakness in underlying metals prices. US Equity Futures (ES U/C, NQ +0.2%, RTY U/C) are flat/modestly firmer, with slight outperformance in the NQ ahead of NVIDIA (+0.2%) earnings after-hours. The data docket for the remainder of the day is void of any key data releases, but Fed’s Bostic may help to spur some action.

Top European news

- Political Deadlock Revives French Stock Risks After Olympic Calm

- Morgan Stanley’s Ex-Germany Head Named as CEO of Flatexdegiro

Geopolitics: Middle East

- Israeli, US, Egyptian and Qatari negotiators were meeting in Doha on Wednesday for “technical/working level” Gaza ceasefire talks, via Reuters citing sources.

- The Israeli army launched a large-scale operation against militants in various parts of the northern West Bank, according to Al Jazeera citing Israel Channel 14.

- “Hundreds of Israeli soldiers take part in the operation in the northern West Bank with full air cover”, according to Sky News Arabia.

- Israeli operation in the West Bank is expected to last for days, according to Israel Channel 14. Sky News Arabia suggested “Israeli operation in Tulkarm and Jenin [in West Bank] is expected to last for a long time, up to weeks”, according to Sky News Arabia.

- “Israel’s Channel 14: The army mobilized thousands of soldiers from special units in preparation for the large-scale operation in the northern West Bank”, according to Al Jazeera.

- “Israeli army storms Aida camp in the southern West Bank”, according to Al Arabiya.

- An Israeli delegation from the Mossad, the IDF and the Shin Bet will travel to Doha on Wednesday to continue talks with US, Qatari and Egyptian officials to close the remaining gaps in the Gaza hostage and ceasefire deal, via Axios’ Ravid.

Geopolitics: Ukraine

- Several oil tanks reportedly on fire at Glubokinskaya oil depot after Ukraine’s drone attack in Russia’s Rostov region, according to Reuters citing Telegram reports.

US Event Calendar

- 07:00: Aug. MBA Mortgage Applications +0.5%, prior -10.1%

DB’s Jim Reid concludes the overnight wrap

Markets put in a subdued performance yesterday, with little in the way of major drivers pushing financial assets in either direction. To be fair, that should soon change from today, as we’ve got Nvidia’s earnings coming out after the US close tonight, which have become an important macro event in their own right over recent quarters, with reactions that rival the sort of moves taking place after surprise jobs reports or CPI releases. The days ahead will also bring some other pivotal data releases, including the PCE inflation print on Friday, followed by the US jobs report next week. But in the meantime, risk assets were pretty steady, with the S&P 500 (+0.16%) posting a modest increase that kept it within 1% of its all-time high from mid-July.

Of course, much of the focus right now is on the Fed and how much they’ll cut rates in September. But even there, the data we had yesterday was inconclusive, and meant that markets continued to struggle for direction. For example, we got some good news from the Conference Board’s consumer confidence indicator, as the confidence reading rose to a 6-month high of 103.3 (vs. 100.7 expected). So that helped to push back on the narrative that the economy was deteriorating into a sharper downturn. But on the other hand, the labour market indicators fell to their weakest levels so far in this cycle, which supported concerns about the recent slowdown in the labour market. Specifically, the difference between those saying jobs were plentiful, and those saying they were hard to get, fell to just 16.4%, which is the smallest that gap has been since March 2021.

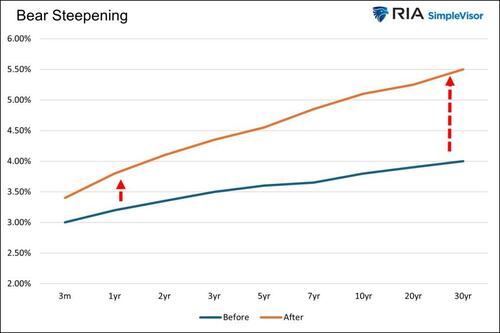

With that data in hand, investors maintained their view that there was a moderate chance of a 50bp rate cut at the upcoming meetings. For instance, futures are now pointing to a 33% probability of a 50bp move in September, up from 28% the previous day. But that’s still a long way from where pricing had been at the height of the market turmoil at the start of the month, when a 50bp move was even fully priced at one point intraday. Investors didn’t have any Fed speakers to go off either yesterday, although Atlanta Fed’s Bostic is scheduled to speak on the economic outlook tonight.

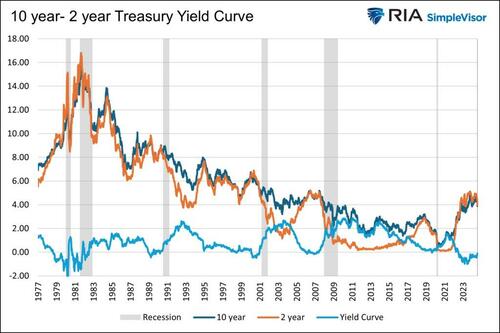

With the total amount of Fed cuts priced by December’s meeting ticking up +3.3bps to 104bps, front-end Treasuries rallied yesterday, and the 2yr yield came down -3.6bps to 3.90%. That rally was helped by a solid 2yr auction that saw $69bn of bonds issued 0.6bps below the pre-sale yield. However, there was a marginal selloff at the long end, and the 10yr yield rose +0.6bps on the day to 3.82%. That said, the 10yr real yield (-0.3bps) extended its recent decline, closing at its lowest level since January at 1.67%.

Over in Europe, there was a more pronounced bond selloff, which saw yields on 10yr bunds (+4.3bps), OATs (+5.9bps), BTPs (+7.4bps) and gilts (+5.8bps) all post a decent rise. With yields rising more in Europe than the US, the broad dollar index (-0.30%) fell to a new one-year low, whilst sterling closed at its strongest level against the dollar since March 2022 at $1.3261.

The European rates selloff in part followed a few comments from ECB officials, including Dutch central bank governor Knot, who said that “I will have to wait until I have the full data and information going into that meeting to decide my position on whether September is appropriate”. Overnight, our European economists published a new piece in which they discuss the factors that will determine how quickly the ECB will cut rates in the coming months (link here). This follows another note yesterday in which they assessed the hawkish and dovish perspectives on the current ECB outlook (link here).

For equities, all attention is now on Nvidia’s earnings release tonight, which has helped to drive significant market moves recent quarters. For instance, their results in February saw the S&P 500 surge by +2.11% the next day, marking its second-best daily performance of 2024 so far. Bear in mind that Nvidia’s share price is already up +159% on a YTD basis, making it the top performer in the entire S&P 500, and it has risen by more than +1000% since its low in October 2022.

Ahead of that release, the main US indices saw little change, with the S&P 500 (+0.16%) and the NASDAQ (+0.16%) both posting modest gains. Nvidia (+1.46%) rose ahead of its results, which pulled the Philadelphia Semiconductor Index higher (+1.10%), but the Mag 7 saw a modest decline overall (-0.30%) given losses from Tesla (-1.88%) and Amazon (-1.36%). Small-cap stocks also struggled, with the Russell 2000 down -0.67%. Over in Europe though, the STOXX 600 (+0.16%) and the DAX (+0.35%) both closed at a one-month high.

Overnight in Asia, there’s been a worse performance for equities, with several major indices losing ground. That includes the Hang Seng (-0.97%), which is currently on track for its worst performance in over three weeks, back when the market turmoil was at its most severe at the start of the month. Other indices have also lost ground, including the CSI 300 (-0.61%), the Shanghai Comp (-0.22%), the KOSPI (-0.29%) and the Nikkei (-0.03%). US equity futures have also remained subdued, with those on the S&P 500 unchanged this morning.

In the meantime, we also got Australia’s latest CPI data for July overnight. That showed CPI falling to +3.5% (vs. +3.4% expected), and the trimmed mean also eased back to +3.8%. Given the data was a bit stronger than expected, markets dialled back their expectations for rate cuts slightly, and Australian government bond yields have risen overnight, with the 10yr yield up +3.0bps to 3.94%.

There wasn’t much other data yesterday, although the Richmond Fed’s manufacturing index for August fell to -19 (vs. -14 expected), which is its lowest level since May 2020. Alongside that, the FHFA’s house price index for June fell by -0.1% (vs. +0.1% expected).

To the day ahead now, and earnings releases include Nvidia after the US close. From central banks, we’ll hear from the Fed’s Bostic, along with the BoE’s Mann. And data releases include the Euro Area M3 money supply for July, along with French consumer confidence for August.