Futures Slide, Oil Jumps As Middle East Tensions Soar

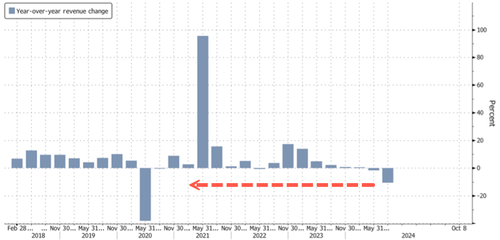

US equity futures are weaker with small caps underperforming while Treasuries erased some of the previous day’s gains as escalating tensions in the Middle East spooked traders and sent oil sharply higher for a second day after Iran fired about 200 ballistic missiles at Israel, drawing a vow of retaliation from Prime Minister Benjamin Netanyahu and further raising the risks to crude supplies from the region. As of 8:00am ET S&P futures were down 0.2% but off the worst levels of the session following yesterday’s flight to safety; as shown in the chart below the cash index has been largely flat for the past 2 weeks. Nike shares are set to fall after the firm withdrew its guidance and KKR is weighing a takeover bid for an Asian chipmaker. Nasdaq futures were also in the red with Mag 7 names all lower ex-META. Europe’s stocks benchmark erased earlier gains. The China bid continues with HK +6.2% as property (+14%) and tech (+8%) power the region higher. Japan PM Ishiba said this morning that Japan is not in environment now for additional rate hike & will coordinate with BOJ on economy while ECB member Kazaks said an October cut was likely but warned against aggressive easing expectations.FTSE +5bps/DAX -45bps/CAC -5bps/ Shanghai closed/Hang Seng +6.2%/Nikkei -2.18%. TSLA reports sales numbers today. Bond yields are higher 3bps to 3.76% compared with a low of 3.69% on Tuesday when demand for havens fueled appetite for government bonds. The dollar was flat while commodities were well bid across all three complexes with crude the unsurprising standout as Israel focuses on delivering a ‘significant retaliation’ sending Brent crude climbed toward $76 a barrel (it was below $70 at one point yesterday) as it prices in a renewed risk premium for the world’s most important commodity, given the Middle East accounts for about a third of global supplies. Looking at today’s calendar we get the ADP private payrolls, as well as 3 Fed speakers; geopolitics will remain in focus. Vance decisively won last night’s VP Debate, but it is unclear how this will move the polls.

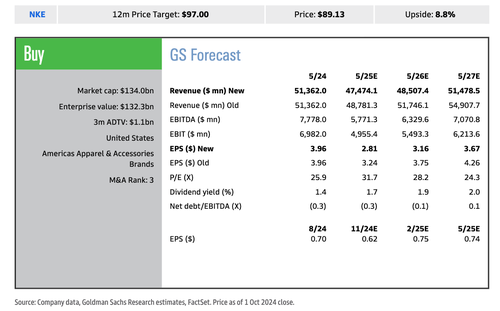

In premarket trading, JD Sports Fashion Plc fell after reporting results; Nike Inc. fell as much as 5.7% in premarket trading after the company scrapped its full-year sales guidance citing leadership transition later this month. Nike is facing one of its roughest patches in decades, moved to reset Wall Street’s expectations ahead of new Chief Executive Officer Elliott Hill’s arrival. Here are some of the biggest US movers today:

- Apple shares edge lower, falling 0.4% in premarket trading as JPMorgan analysts follow their peers at Barclays and Citi to trim their estimates for iPhone units.

- US-listed Chinese stocks are rallying in premarket trading on Wednesday, pointing to further gains after Beijing followed other major cities to relax home purchase rules.

- MSCI is Evercore ISI’s top pick among business services stocks as the broker initiates coverage of the sector, which analysts say includes quality businesses with high market shares.

Middle East escalations have taken center stage as Israel vowed significant retaliation after Iran fired up to +150 ballistic missiles at the country yesterday. This stood out from Axios: “Israeli officials staring down all-out regional war tell Axios Israel will launch a “significant retaliation” to Tuesday’s massive missile attack within days that could target oil production facilities inside Iran and other strategic site.”

“Clearly there is a lot of uncertainty,” Anna Rosenberg, head of geopolitics at Amundi Asset Management, told Bloomberg TV. “Nevertheless I think the market is still very much operating in the base-case expectation that it remains more or less contained and doesn’t spiral out in an all-out war. And I think right now, that is the right thing to do.”

European stocks have pared an earlier gain to trade little changed, with the energy sector outperforming as investors assess the escalating crisis in the Middle East as well as the impact of more stimulus in China. Oil producers rise as crude prices extend gains, while real estate stocks and utilities are the biggest laggards. Here are some of the biggest movers on Wednesday:

- European oil, defense shares extend recent gains amid increased tensions in the Middle East after Iran fired about 200 ballistic missiles at Israel. Airline stocks in the region decline on similar grounds.

- Wacker Chemie shares rise as much as 8.4% after the US Commerce Department set preliminary duties on solar imports from Southeast Asia in a move that could benefit the German manufacturer of polysilicones.

- Grenke shares rise as much as 5.8%, the most in three months, after the German leasing finance provider reported strong growth in new business volumes.

- European luxury stocks rebound, even as analysts remain cautious with Deutsche Bank cutting price targets across the sector amid uncertainty over a recovery in Chinese demand for high-end goods.

- JD Sports shares drop as much as 6% after a profit beat in the first half was countered by a weak update from its major partner Nike, which reported a sharp drop in sales and withdrew its guidance overnight.

- Pirelli shares drop as much as 4.7% to the lowest level since February after shareholder Brembo sold its entire stake in the tire manufacturer.

Elsewhere, Chinese stocks listed in Hong Kong jumped the most in almost two years after Beijing followed other major cities in relaxing home purchase rules. HK surged 6.2% as property (+14%) and tech (+8%) power the region higher; property developers led the rally, with a gauge of the sector surging as much as 47%, while an index of brokerage shares jumped 35%, both record intraday moves. There’s growing optimism China’s recently announced stimulus blitz has brought an end to the three-year slide in Chinese shares that was driven by the stuttering economy and a multi-year property crisis.

In FX, the yen is the weakest of the G-10 currencies, falling 0.5% against the greenback after Bank of Japan Governor Ueda sent dovish signals regarding the policy outlook and after Japan’s Prime Minister Shigeru Ishiba said the environment doesn’t call for raising interest rates again. The Bloomberg Dollar Spot Index is little changed.

In rates, US yields are cheaper by 1.5bp to 4bp across the curve near session highs, 10-year by nearly 3bp on the day with bunds and gilts in the sector lagging by an additional 2.5bp and 4.5bp. Gilts lead a selloff in European government bonds, with UK 10-year yields rising 7 bps to 4.01%. US 10-year yields climb 3 bps to 3.76%.

In commodities, oil prices climbed for a second day after Israel vowed to retaliate against Iran after it fired ballistic missiles at Israel in a severe escalation of hostilities. WTI is up near 3% to around $71.85 a barrel. Spot gold drops ~$9, paring some of Tuesday’s safe-haven led rally.

Looking at today’s calendar, US economic data includes September ADP employment change at 8:15am. Fed speakers scheduled include Hammack (9am), Musalem (10:05am), Bowman (11am) and Barkin (12:15pm)

Market Snapshot

- S&P 500 futures little changed at 5,755.75

- STOXX Europe 600 up 0.4% to 522.86

- MXAP up 0.4% to 196.53

- MXAPJ up 1.4% to 629.24

- Nikkei down 2.2% to 37,808.76

- Topix down 1.4% to 2,651.96

- Hang Seng Index up 6.2% to 22,443.73

- Shanghai Composite up 8.1% to 3,336.50

- Sensex little changed at 84,266.29

- Australia S&P/ASX 200 down 0.1% to 8,198.19

- Kospi down 1.2% to 2,561.69

- German 10Y yield little changed at 2.09%

- Euro little changed at $1.1079

- Brent Futures up 1.9% to $74.94/bbl

- Gold spot down 0.4% to $2,652.69

- US Dollar Index little changed at 101.18

Top Overnight News

- BOJ’s Ueda sends somewhat dovish signals in highlighting the uncertain outlook for the US economy and unstable financial markets. BBG

- Chinese shares listed in Hong Kong jumped the most in almost two years on the Hang Seng’s first day open after a holiday. Stan Druckenmiller still said he’s staying away from China “as long as Xi Jinping is running” the country. BBG

- ECB’s Kazaks says the central bank will likely cut in Oct, but cautions markets against becoming too ambitious with easing expectations. BBG

- As Israel weighs how to respond to Tehran’s latest missile barrage, it could take a page from its previous playbook when, after days of deliberation, its military targeted a single Iranian military site. WSJ

- Israel has destroyed about 50% of the missiles and rockets that Hezbollah accumulated over the last ~30 years, dealing a significant blow to the terror group. NYT

- The Saudi oil minister has said that prices could drop to as low as $50 per barrel if so-called cheaters within OPEC+ don’t stick to agreed-upon production limits, according to delegates in the cartel. WSJ

- Russian forces are steadily capturing territory inside Ukraine “with speed and aggression not seen since the full invasion in 2022”. WSJ

- Barclays aims to bolster returns in its investment bank by focusing on advisory and equity capital markets while deemphasizing debt underwriting. FT

- VP nominees Tim Walz and JD Vance focused on policy and defending their running mates at the top of the ticket in a mild-toned debate. Vance, who succeeding in softening his typically aggressive delivery, won according to a CBS poll. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed with some cautiousness seen amid heightened tensions in the Middle East after Iran conducted a missile attack on Israel. ASX 200 was rangebound as gains in the commodity-related industries offset the losses in the tech and consumer sectors. Nikkei 225 slumped at the open and retreated beneath the 38,000 level after the prior day’s currency strength. Hang Seng resumed its China stimulus-spurred rally on return from the holiday with notable strength in tech and property.

Top Asian News

- Japan’s new Economy Minister Akazawa said a complete exit from deflation is the top priority and he wants the BoJ to share their view that an exit from deflation is the top priority, while he commented that the BoJ should be careful about raising rates as it takes time to fully exit deflation. Akazawa also stated that it is not necessarily correct that PM Ishiba is positive about further rate hikes and that Ishiba’s comment on the need for monetary policy normalisation has various conditions attached.

- BoJ Governor Ueda says “Japan’s economy is recovering moderately albeit with some weak signs”; “trend inflation, likely below 2%, is likely to accelerate”; says markets remain unstable. “Uncertainty surrounding Japan’s economy prices remain high”, “We must be vigilant to impact of markets, FX moves, an their effect on Japan’s economy”, “We must scrutinise market moves with a high sense of urgency for the time being”.

- Japan’s Finance Minister Kato says Japan is seeing signs of recovery; “We will strengthen this trend, aiming for higher growth via higher wages and investment”. “Hope that BoJ will take the appropriate policy to achieve 2% inflation target, while taking into account financial situations”. “Expect thorough communication with market when asked about BoJ monetary policy”.

European bourses, Stoxx 600 (+0.1%) opened on a tentative footing, however, sentiment gradually improved as the morning progressed, with indices now generally in positive territory to varying degrees. In recent trade, bourses have edged slightly off best levels. European sectors are mixed; Energy tops the pile, propped up by the geopolitical-induced strength in oil prices; a factor which has weighed on Travel & Leisure names. Consumer Products is also towards the top of the pile, assisted by gains in Luxury amid continued optimism surrounding China on its return from Holiday. US Equity Futures (ES -0.2%, NQ -0.2%, RTY -0.6%) are modestly lower across the board, continuing the weakness seen in the prior session with slight underperformance in the RTY.

Top European News

- Citi expects the ECB to cut by 25bps in October and December and through the beginning of 2025, to reach a deposit rate of 1.50% by September 2025.

- UBS expects the ECB to cut at the October, December, January, March, April & June meetings for a total of 150bps.

- ECB’s de Guindos says “Broadly speaking, the problems we are discussing today derive from the incompleteness of the Economic and Monetary Union” adds “risks to growth remain tilted to the downside”.

- ECB’s Lane slide deck “Expectations and Monetary Policy”

- German engineering orders +7% Y/Y in August (Domestic -7%; Orders +13%); Jun-Aug -3% Y/Y (Domestic -6%, Foreign Orders -1%), according to VDMA.

FX

- The rally in the USD has paused for breath with DXY unable to advance above yesterday’s 101.39 peak. Wednesday’s price action was driven by geopolitics and if the situation in the Middle-East escalates, this could have some bearing on today’s price action; looking at US-specifically, ADP National Employment will be in full focus ahead of the NFP on Friday.

- EUR/USD has moved back onto a 1.10 handle in the wake of Tuesday’s USD rally. For EUR-specifically, ECB’s Kazaks put his weight behind a likely rate cut this month. The Single-Currency is currently flat and trades within a 1.1055-82 range.

- After starting the week above the 1.34 mark, Cable now sits on a 1.32 handle with heavy losses yesterday triggered by the haven bid into the USD. For now, GBP/USD is holding above Tuesday’s 1.3237 low and the 21DMA at 1.3233.

- JPY is struggling vs. the USD following yesterday’s indecisive session which drew a safe haven bid into both the USD and JPY. USD/JPY is currently tucked within Tuesday’s 142.97-144.53 range.

- Antipodeans are both slightly firmer vs. the USD in an attempt to claw back yesterday’s losses. AUD/USD has returned to a 0.68 handle after topping out on Monday at a fresh YTD peak at 0.6942.

Fixed Income

- USTs are essentially flat/incrementally lower and holding at a 114-18+ base, having faded from Tuesday’s geopolitically-driven 115-00 peak. Today’s docket is packed with ADP National Employment alongside Fed speak from Barkin, Bowman, Hammack & Musalem.

- Bunds are in the red, with yields firmer across the board in Europe after the marked dovish action seen on Tuesday in the European morning and then extended in the afternoon/evening on geopols. As it stands, Bunds at a low of 135.37, fading from the 136.00 mark and above yesterday’s 136.20 peak. OATs underperform marginally, with the OAT-Bund 10yr yield spread just shy of the 80bps mark. President Macron is due to speak from 14:15BST onwards.

- Gilts are directionally in-fitting with peers which are pulling back from a combination of dovish ECB pricing and geopolitical premia. At a 98.36 trough following the Gilt auction, owning to the softer b/c and wider yield tail vs the prior outing.

- UK sells GBP 4bln 4.125% 2029 Gilt: b/c 2.93x (prev. 3.29x), average yield 3.880% (prev. 3.811%) & tail 1.2bps (prev. 0.9bps).

- Germany sells EUR 3.704bln vs exp. EUR 4.5bln 2.60% 2034 Bund: b/c 2.0x (prev. 2.1x), average yield 2.08% (prev. 2.11%), retention 17.69% (prev. 18.04%)

Commodities

- Crude is firmer intraday, and holding onto the gains seen yesterday and overnight amid the geopolitical risk premium woven into prices after Iran attacked Israel. Brent Dec resides in a USD 74.24-75.55/bbl parameter.

- Mixed trade across precious metals with upside seen in spot silver and spot palladium whilst spot gold remains subdued since early European trade following recent geopolitically-induced gains. XAU currently resides in a USD 2,644.58-2,662.88/oz range.

- Base metals are mostly firmer in European trade despite the cautious risk tone, but with some potential continued tailwinds from the Chinese stimulus efforts. 3M LME copper reclaimed USD 10k/t to the upside.

- Saudi Energy Minister reportedly warns of USD 50/bbl oil as OPEC+ members flout production curbs, according to WSJ sources; interpreted as a threat Saudi is willing to launch a price war to keep market share if other countries do not abide. Saudi reportedly singled out Iraq which overproduced by 400k BPD in August.

- US Private inventory data (bbls): Crude -1.5mln (exp. -1.3mln), Distillate -2.7mln (exp. -1.5mln), Gasoline +0.9mln (exp. -0.1mln) Cushing +0.7mln.

Geopolitics

- Israeli PM Netanyahu “is expected to hold a limited security consultation in the afternoon with several senior ministers and defense chiefs to continue discussing the response to the Iranian attack”, according to Axios’ Ravid citing sources.

- Israeli military says regular infantry and armoured units are joining the ground operation in Lebanon.

- Yemeni Houthis says they targeted military posts deep inside Israel with “Quds 5” rockets, according to a statement; will not hesitate in broadening operations against Israel. Continuous US and UK support to Israel will put their interests under fire.

- Lebanon’s Hezbollah says it targeted areas north of Haifa City in Israel, with a large missile salvo.

- “Atomic Energy Organization of Iran: Nuclear facilities have been secured against any attacks”, according to Cairo News.

- “After Israel security cabinet meet: Israel is expected to respond ‘harsh’ against Iran, with the possibility of targeting strategic sites in Iran”; according Kann’s Stein.

- “Lebanese media: Israeli army advances towards a Lebanese army checkpoint in Al-Adaisseh, southern Lebanon”, according to Sky News Arabia

- Iranian state television reported that Tehran confirmed it fired 200 missiles in its attack on Israel, according to Sky News Arabia.

- Iran’s armed forces said if Israel responds to the Iranian attack it will be met with vast destruction of its infrastructure and if Israel’s backers directly intervene against Tehran, their interests and bases in the region will face Iran’s strong attack.

- Iran’s Foreign Minister commented on X that Iran exercised self-defence under Article 51 of the UN Charter and Iran’s action is concluded unless the Israeli regime decides to invite further retaliation, while he said Israel’s enablers now have a heightened responsibility to rein in the warmongers in Tel Aviv. Iran’s Foreign Minister also commented that there is a possibility that the confrontation with Israel will continue in the coming days and forces are on standby, as well as noted that Iran told the US not to get involved following the missile attack on Israel and warned that any new action by Israel or its supporters will face a more severe response.

- Israel’s Home Front Command lifted restrictions on Israelis after the end of Iranian missile attacks and said it will defend the citizens of Israel and respond to Iranian missiles at the right time and place, according to Sky News Arabia. Israel’s Home Front Command also said it eased restrictions on large gatherings in much of Israel including Tel Aviv and Jerusalem areas.

- Israeli PM Netanyahu said Iran made a big mistake tonight and they will pay for it, while he added that the Iranian missile attack on Israel failed.

- Israel’s UN envoy said Israel will act and Iran will soon feel the consequences of their actions with the response to be painful.

- Israeli officials cited by Axios said Israel will launch a strong response within days to the major Iranian attack which could target oil production facilities inside Iran, according to Reuters and Al Jazeera.

- Israeli military said it conducted strikes on Hezbollah targets in Beirut and it issued warnings to residents of the Chiyah neighbourhood and Hadath al-Gharb in the southern suburbs of Beirut, while a correspondent reported eight Israeli raids on southern suburbs of Beirut in about two hours.

- Hezbollah said it struck Israeli artillery in Beit Hille with rockets, according to Al Jazeera. Hezbollah separately announced that it confronted an Israeli force infiltrating the Lebanese town of Adaisseh and forced it to retreat, while the Israeli army also reported heavy fighting with Hezbollah operatives in southern Lebanon.

US Event Calendar

- 07:00: Sept. MBA Mortgage Applications, prior 11.0%

- 08:15: Sept. ADP Employment Change, est. 125,000, prior 99,000

Central Banks

- 09:00: Fed’s Hammack Gives Welcome Remarks

- 10:05: Fed’s Musalem Gives Welcoming Remarks

- 11:00: Fed’s Bowman Speaks on Community Banking

- 12:15: Fed’s Barkin Speaks on Economy

DB’s Jim Reid concludes the overnight wrap

Markets got Q4 off to a turbulent start yesterday, with a sharp risk-off move after the White House said they had indications that Iran would imminently launch a ballistic missile attack against Israel, something that materialised only a few hours later. From a market perspective, the reaction was swift, and Brent Crude oil prices surged by around $3/bbl immediately after the news came out, as investors rapidly sought to understand if this could become a wider regional conflict across the Middle East. Risk assets reversed some of their sell-off later on but it was still a tough start to the quarter

The retracement of risk assets from their peak move lower came as parallels to Iran’s attack on Israel back in April, which did not lead to a broader escalation, emerged. Both instances saw similar reports come through in advance that an Iranian attack was about to happen, and this time Israel again said that it shot down most of the missiles and reported few casualties. That said, there were some indications that escalation risks might be higher this time around. The Pentagon said that this attack used around twice as many ballistic missiles as the one in April, while Iranian commentary was more ambiguous on whether the attack would be one-off. Israel’s PM Netanyahu said that Iran “made a big mistake tonight, and will pay for it”, while Iran’s Revolutionary Guard threatened a “crushing” response if Israel retaliated.

The events drove a geopolitical risk-off tone, with clear ramifications across multiple asset classes. Oil prices were most directly affected by the news, with Brent crude seeing its largest intra-day move since April 2023, trading below $70/bbl early on before peaking above $75/bbl as news of Iran’s strikes came in. It retreated slightly later on but is trading around $74.60/bbl as I type this morning. By comparison, back in April we saw oil prices hit their intraday highs for the year, at just above $92/bbl, just prior to Iran’s attack. But then oil prices began to fall back in the days that followed as the White House sought to avoid an escalation, and as tensions eased.

The risk-off backdrop weighed on equities, with the S&P 500 (-0.93%) seeing a sizeable fall from its all-time high the previous day, although it did partially recover after trading -1.4% lower. The more cyclical sectors led the declines, with the information technology sector down -2.66%. The Magnificent 7 fell -1.32%, whilst the small-cap Russell 2000 also underperformed (-1.48%). In Europe, the STOXX 600 had been up +0.51% intraday just before the headlines came out, but reversed course to close -0.38% lower. In other assets, a move towards ‘safe havens’ saw gold rise +1.09% higher to $2,663/oz.

Over on the rates side, a rally for bonds was accelerated by the Middle East headlines, though by the close Treasury yields were only slightly lower than before the news broke. On the day, 2yr yields were -3.6bps lower to 3.61% while 10yr yields were down -5.0bps to 3.73%, their sharpest daily decline in three weeks. This morning in Asia 10yr yields have edged back up to 3.74%.

Bonds had already rallied earlier in the day after the latest US data, which added to the signs that the labour market was weakening. It’s true that job openings were stronger than expected in August at 8.040m (vs. 7.693m expected), but the other details in the report generally pointed in a more negative direction. For instance, the quits rate of those voluntarily leaving their job was down to 1.9%, the lowest since June 2020, and below its pre-Covid levels. So that was a fresh sign that people’s confidence in the labour market is still weakening, and the hires rate also fell back a tenth to 3.3%, in line with its joint-lowest since the Covid-19 pandemic. That was backed up by the ISM manufacturing too, which remained at 47.2 in September (vs. 47.5 expected), whilst the employment component weakened to 43.9.

Over in Europe, the sovereign bond rally was even larger, which came as Euro Area inflation fell beneath the ECB’s 2% target for the first time since June 2021. Specifically, headline CPI was down to +1.8% in September on the flash reading, which cemented investors’ conviction that the ECB was likely to accelerate its rate cuts and move again at the October meeting. Core CPI was a little stronger at +2.7%, but that was in line with expectations, and the news helped yields fall across the continent. Indeed by the close, yields on 10yr bunds (-8.8bps) were down to 2.03%, which is their lowest closing level since January. And the 2yr German yield (-4.7bps) was down to 2.01%, which is its lowest since December 2022. The combination of lower European rates and geopolitical risk-off saw the euro post its worst day against the dollar in over three months (-0.84%).

It was France that saw the biggest sovereign bond rally, however, which came as PM Michel Barnier delivered his first speech to lawmakers. From a market standpoint, the main headline was that France would be delaying its target to get the budget deficit beneath 3% of GDP from 2027 to 2029, and that they’d aim to cut the deficit to 5% of GDP next year. In turn, yields on 10yr OATs were down -10.0bps yesterday to 2.81%, and the Franco-German 10yr spread tightened a bit to 78bps, its tightest level in a week.

Asian equity markets are mostly lower this morning with the heightened geopolitical tensions. The Nikkei is leading the declines at -1.85%, followed by the KOSPI at -0.66% and the S&P/ASX 200 at -0.09%. In contrast, the Hang Seng is up by +6.02%, reflecting continued China optimism after its public holiday on Tuesday. Markets in mainland China are closed for the Golden Week holiday and will remain shut until the 8th. S&P (-0.2%) and Nasdaq (-0.15%) futures are edging lower. A quick skim at the headlines around the US VP debate don’t seem to suggest anything that’s moved the needle in this very tight election. I can’t pretend I was awake to watch it though.

Early morning data showed that South Korea’s inflation cooled more than anticipated in September, rising +1.6% y/y (v/s +1.9% expected), marking the weakest annual increase since February 2021 amid growing expectations of an imminent policy easing. It follows an increase of +2.0% in the prior month.

To the day ahead now, and data releases include the Euro Area unemployment rate for August, and in the US there’s the ADP’s report of private payrolls for September. Central bank speakers include ECB Vice President de Guindos, and the ECB’s Kazaks, Lane, Simkus, Elderson and Schnabel, along with the Fed’s Hammack, Musalem, Bowman and Barkin.

Tyler Durden

Wed, 10/02/2024 – 08:14

via ZeroHedge News https://ift.tt/kKeEATL Tyler Durden