Authored by Kevin Muir via The Macro Tourist blog,

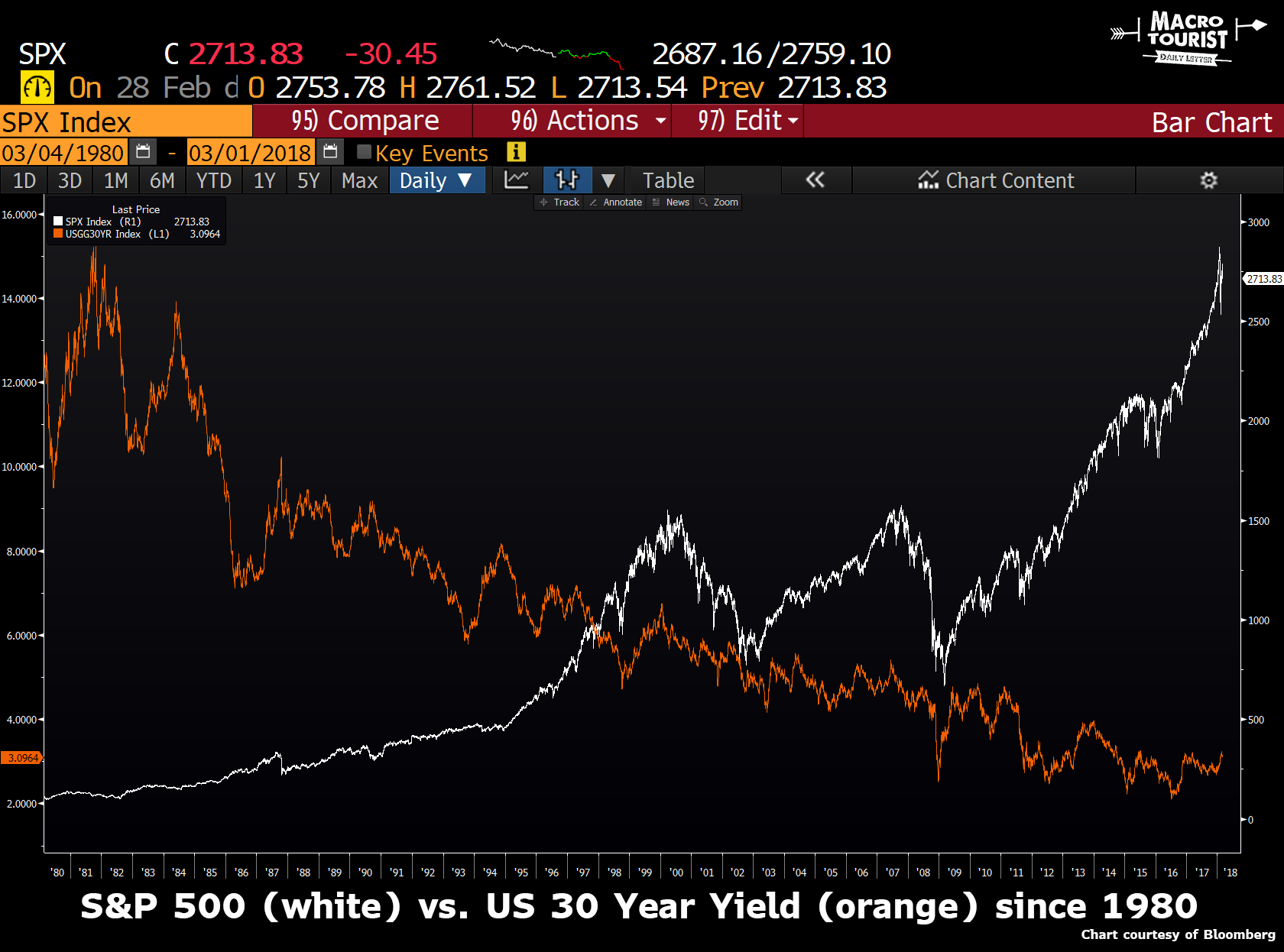

Stock markets up on a stick. Valuations stretched. Bond yields near sixty year lows. Real returns basically zilch.

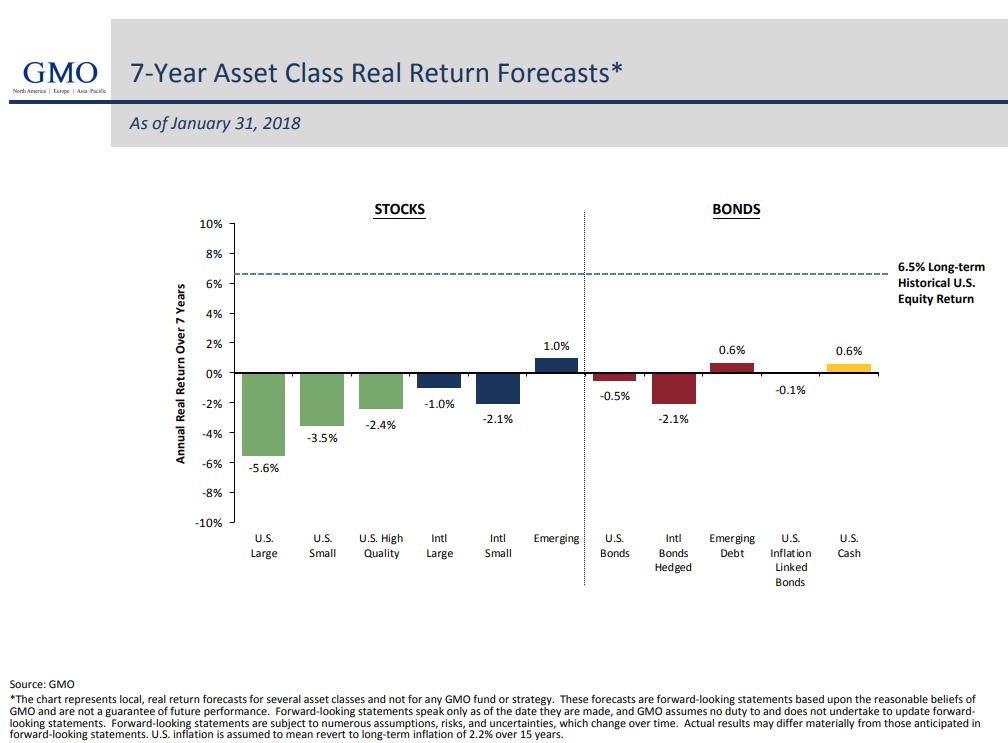

A decade of global financial repression has forced investors everywhere out the risk curve. Nothing is cheap. There is a reason that top quantitative research shops like GMO have forecasted future returns that look like this:

Cries of that awful acronym TINA ring through the halls of investment houses as clients take a big gulp and write blue tickets – despite the lofty prices. After all, everything is dear and their retirement still needs to funded.

The last remaining cheap asset?

Everywhere you look asset prices are on their highs, but there is one asset that is as cheap as it has ever been. No, it’s not sexy, and neither is it easy to buy, but if it were, it would probably be insanely overpriced, so let’s take those attributes as positive.

I am of course talking about grains.

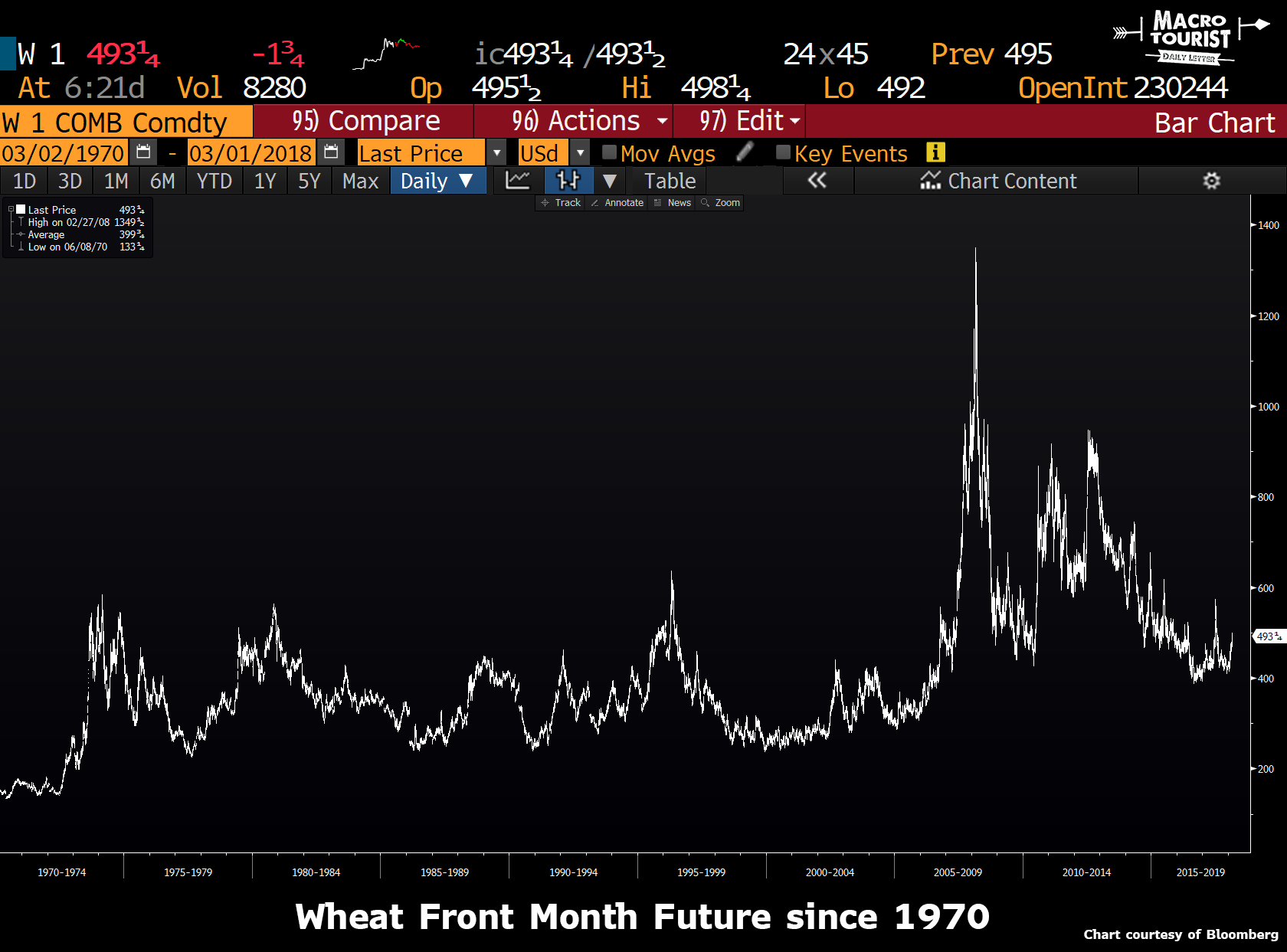

You might say to yourself – but wait, it’s not like grain prices are ticking at all-time lows, so what do you mean?

And you would be correct. Over the past half century, grains have been lower many times.

Wheat was less expensive in the 1990’s.

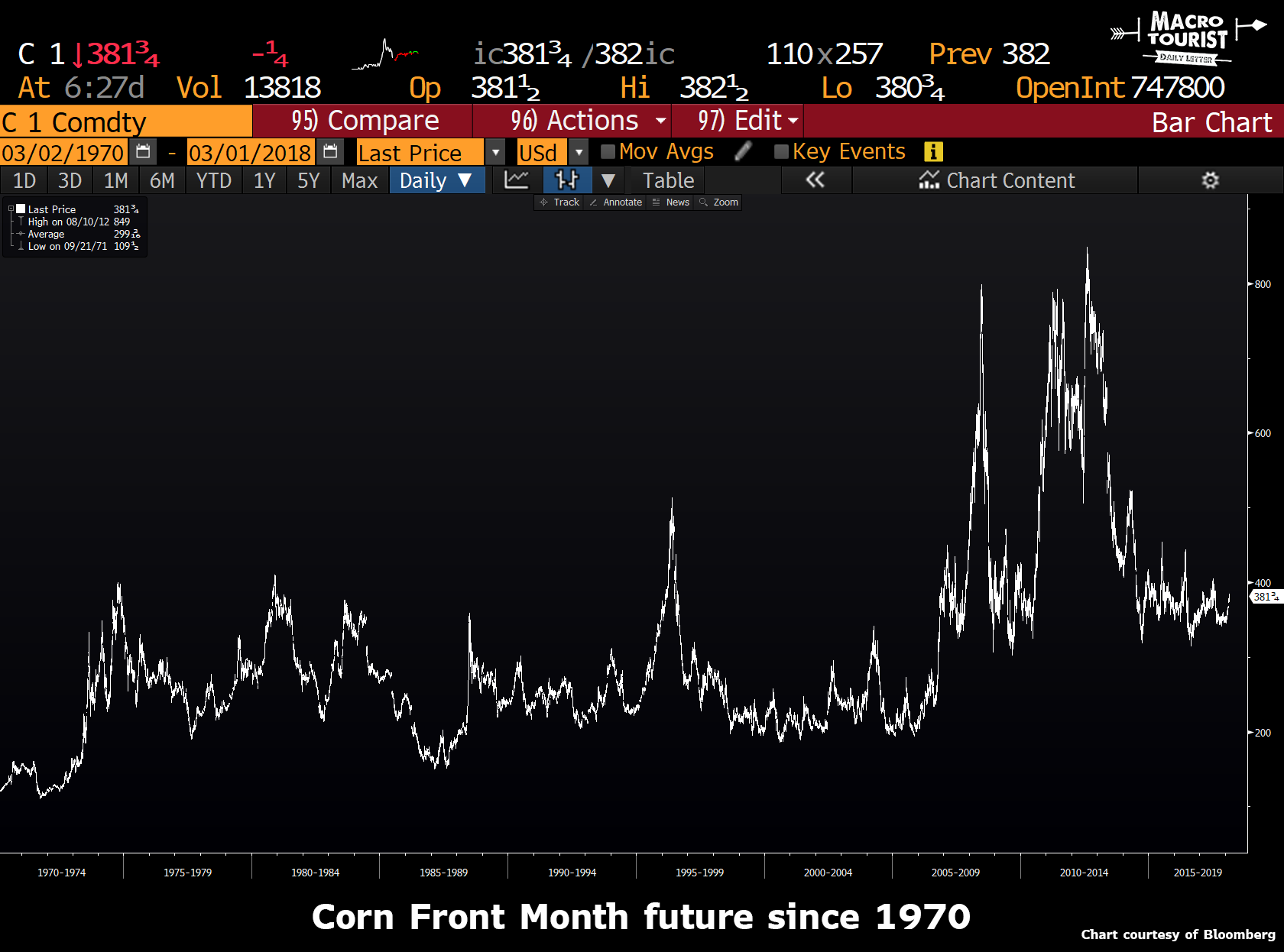

Corn is currently in the middle of the range.

And you might even argue that soybeans are relatively high compared to the last few decades.

But we need to recognize that these charts have a timeline measured in decades. Think about that for a second. What do you know that has basically gone sideways in price since 1970?

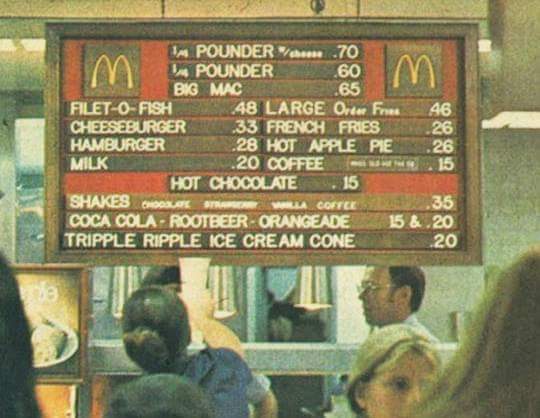

I don’t know about the prices at your McDonalds, but a Big Mac is a lot more expensive than 65 cents in my neck of the woods.

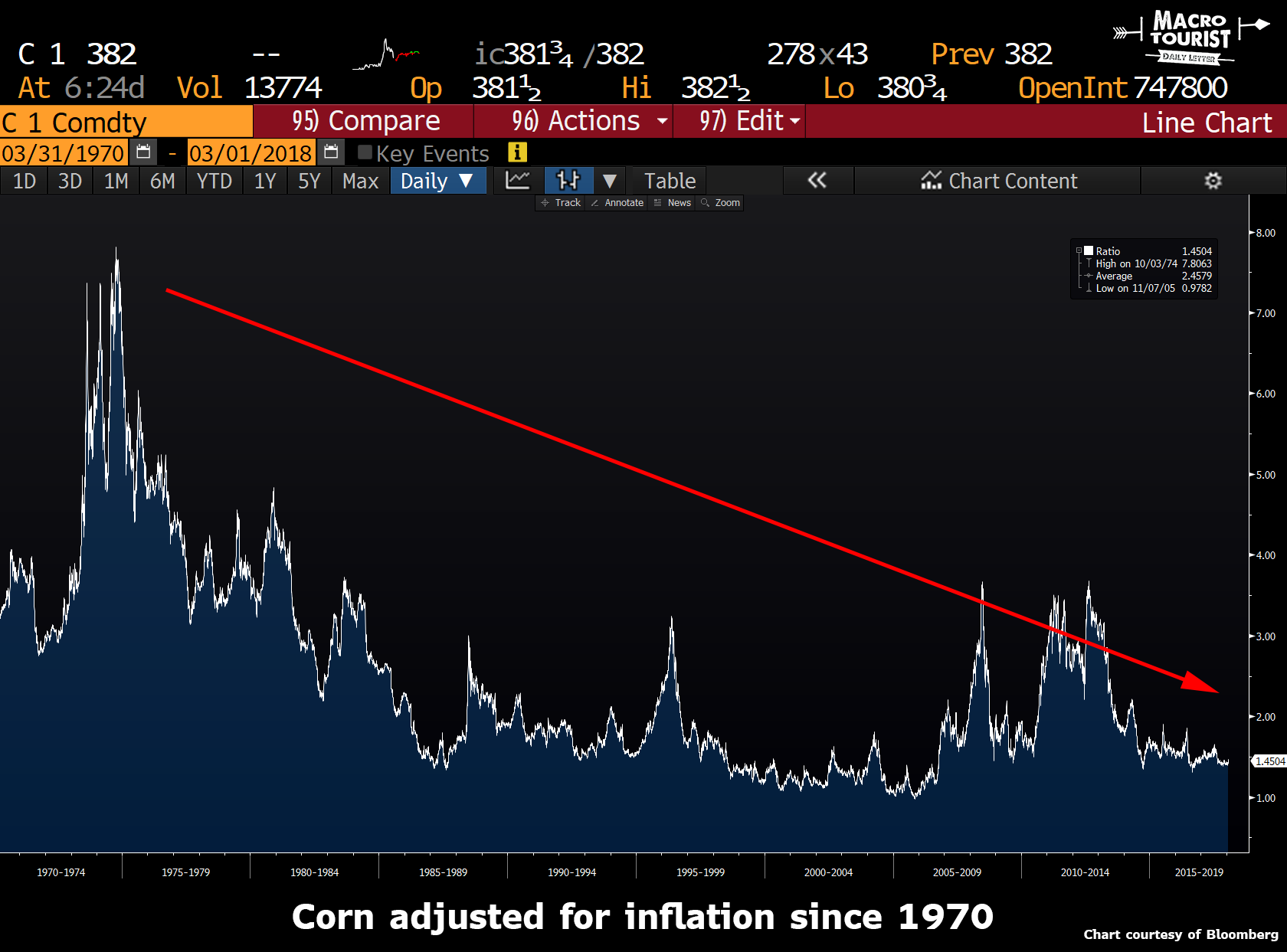

Quickly looking at the charts of wheat, corn and soybean without adjusting inflation is disingenuous. In real terms, the price of these commodities has collapsed over the past half a century.

Let’s have another gander at these same three charts, except this time let’s adjust it by CPI inflation.

Now that changes the picture dramatically. Adjusted for inflation, grains are sitting on their lows.

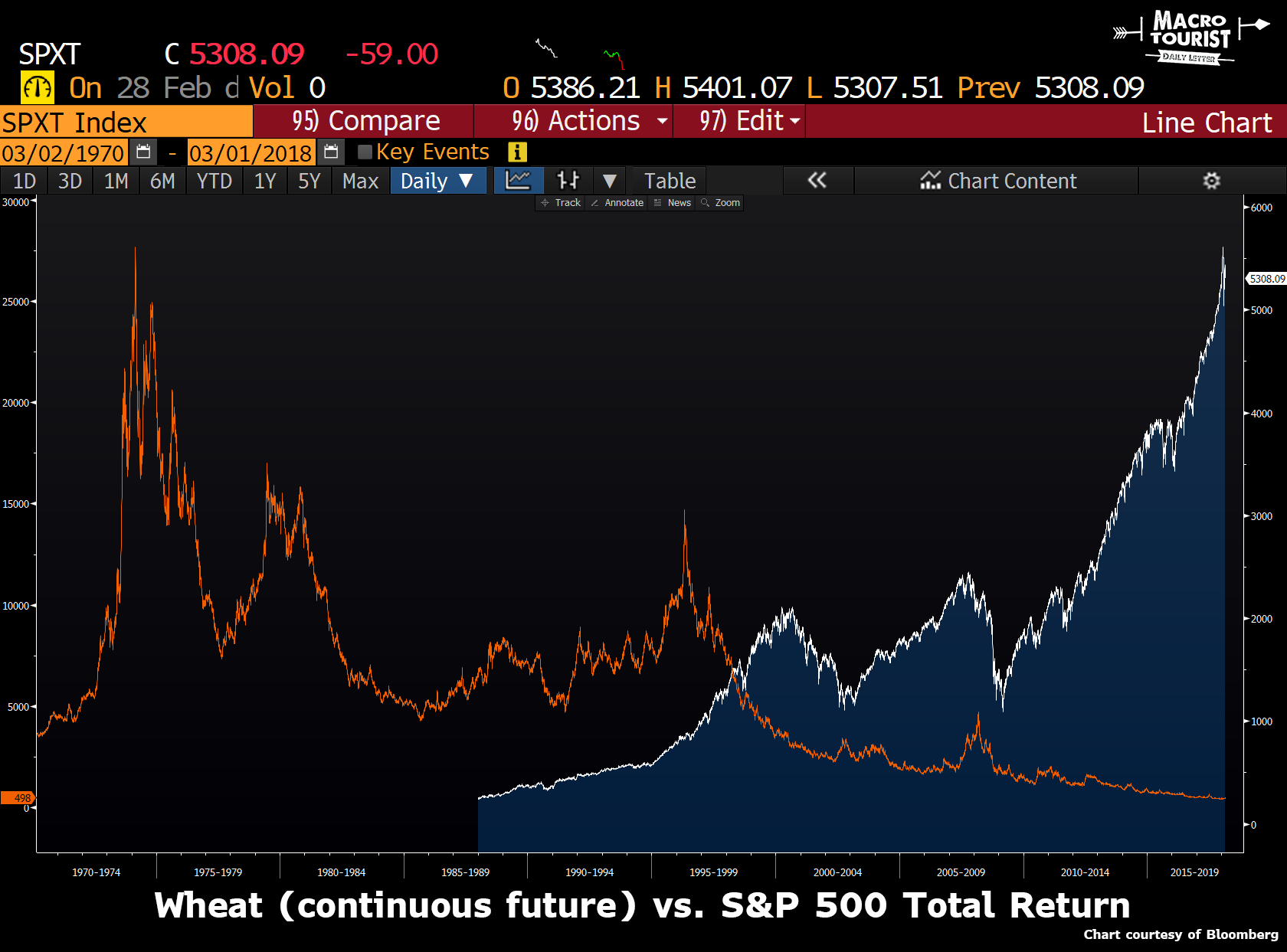

And it gets worse. If you think about the opportunity cost of holding grains as an asset versus equities, the returns between the two asset classes are as disturbing as the unsettling amount of nude scenes in Jason Segel’s movies.

Evaluating these returns is not as simple as looking at the cash price of the different grains. Due to the slope of the futures curve, the carrying cost of holding the various grains is enormous. When you add up all the negative carry, even without adjusting for inflation, the returns have been abysmal. And then, contrast that to the fact that equities often pay a dividend, the reinvested total return for stocks is even better than what most investors realize.

Here’s a chart of the continuous wheat futures (adjusted for carry) versus the S&P 500 total return (index unfortunately doesn’t go back all the way to 1970):

Adjusted for inflation, and contrasted to other asset classes, it’s obvious that there probably has been no worse investment than being long grain futures over the past 50 years.

Breaking out like a teenager

I have been banging this theme home for quite some time now – Never Ending Grain Pain, Nickels in the Urinals, It’s not too late, Cheap as Dirt or The Last Remaining Cheap Asset. There is no doubt that I have been wrong. Yeah sure, sometimes my timing was decent for a trade, but let’s face it – the call has been a dud. Grains are still on their ass. The reasons for their decline are numerous and I don’t want to bother rehashing the causes again.

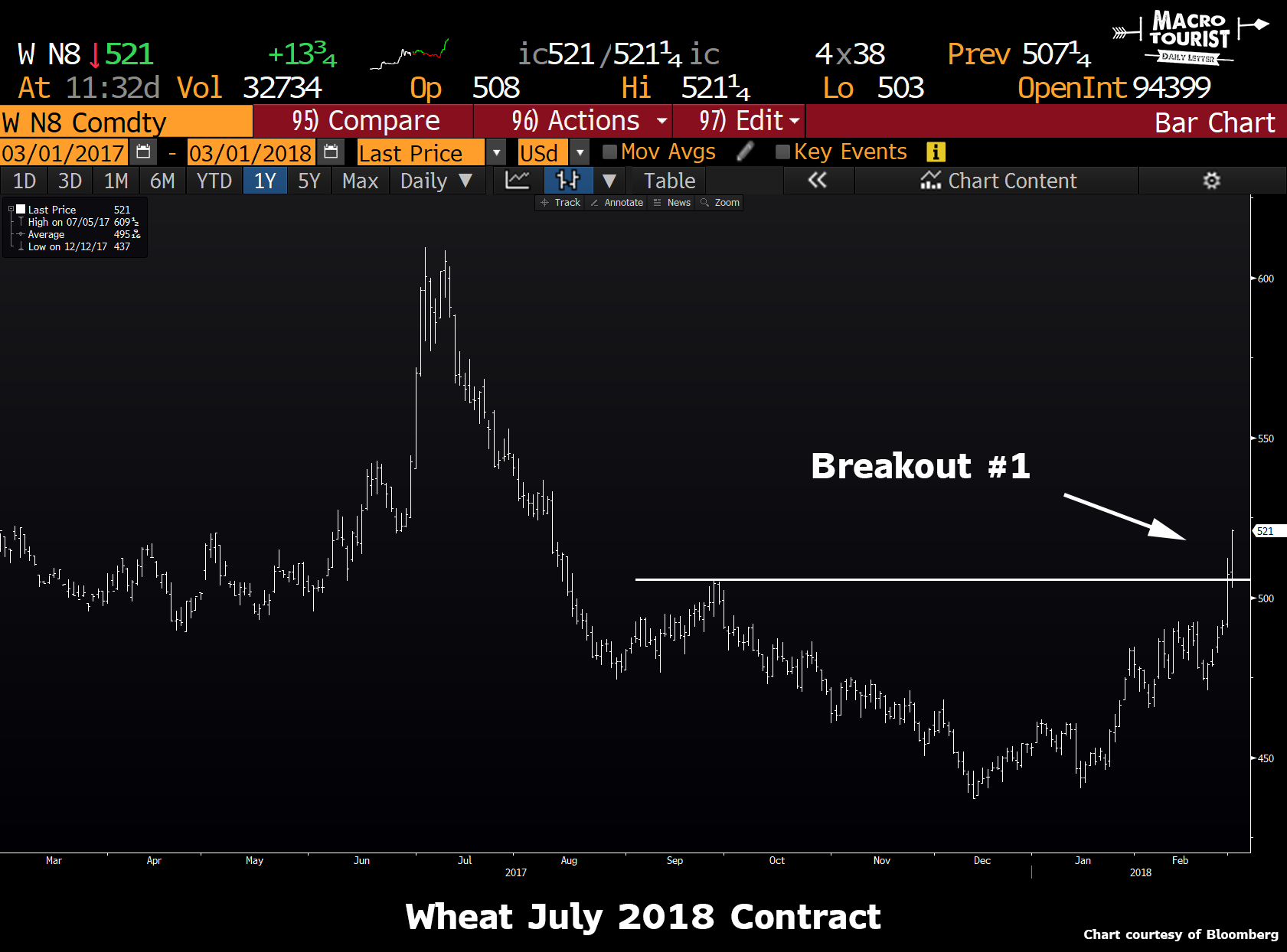

I am writing today’s post because, for the first time in quite a while, they are trading like they might want to rise.

Yup. Fighting with the market is often foolish, and waiting until the market starts to agree with your theory is usually the best course of action. Well, don’t look now, but the grains are breaking out all over the place.

Not alone

Over the past couple of months I have watched a few different shrewd traders plough into the grain market. Often these were guys who did not normally trade ags. My favourite Tesla skeptic, Mark Spiegel seems to have nailed the grain market bottom with his wandering in at the lows a couple of months ago. I am paraphrasing his reasoning here, but I think at heart Mark is a value investor, and for him, grains are unloved, cheap and offer a compelling risk reward. It ticks all the value investor’s boxes.

But some investors who are anticipating a food crisis in the future are paradoxically making the problems worse with their buying. One of the smartest guys on twitter, The Long View @ HayekAndKeynes (a must follow btw), has done a terrific job of highlighting the fact that Bill Gates is accumulating farm land and unfortunately making the problems worse for farmers:

Have a read of the highlighted article – Bill Gates gobbing up Georgia farmland too.

I don’t want to get into a discussion about the relative merits of Gates and other rich individuals buying farmland as investments, but I will note that some really smart investors are diversifying into what might be the last cheap asset.

It might seem like you have missed it because we have rallied 5% or 10% off the lows, but don’t forget – these grains are still astoundingly cheap on an inflation-adjusted basis or when you compare them to other asset classes. The bears will tell you there is a reason they are so inexpensive, but more important than any of these arguments is the fact that prices are behaving like they want to go higher. At the end of the day, price is the only indicator that doesn’t lie.

via Zero Hedge http://ift.tt/2oJrEE1 Tyler Durden