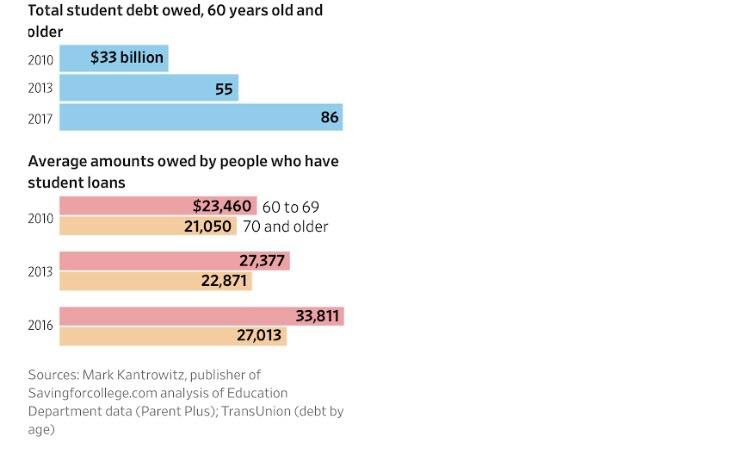

A generation of Americans over 60 years old owe $86 billion in student loan debt, according to a new write-up by the Wall Street Journal. This stunning sum is comprised not only of older people who took out loans for their children, but also some who took out loans for themselves during the last recession, under the guise that it would bolster their employment prospects.

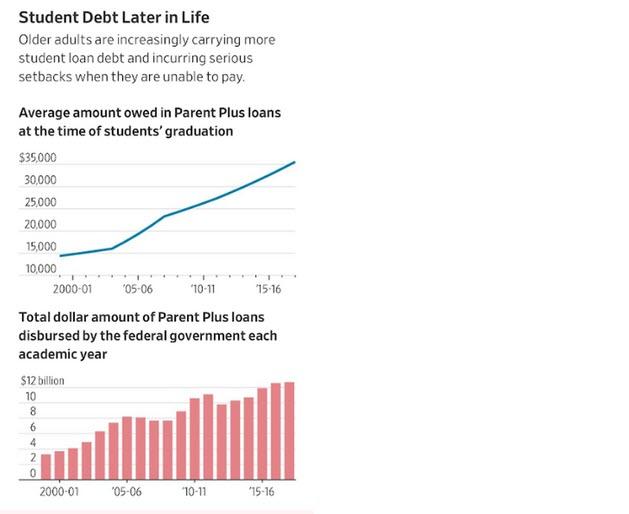

About 93% of all new private student loan money to undergrads during the current academic year included parent or adult signatures, which is up from 74% in 2008. Federal loans account for more than 90% of student debt, but the private market for these loans is also growing.

According to the report, borrowers in their 60s owed an average of $33,800 in 2017, which is up 44% from 2010. Total student loan debt was up 161% for people aged 60 and older in the seven years preceding 2017. This was the biggest increase for any age group over that span of time.

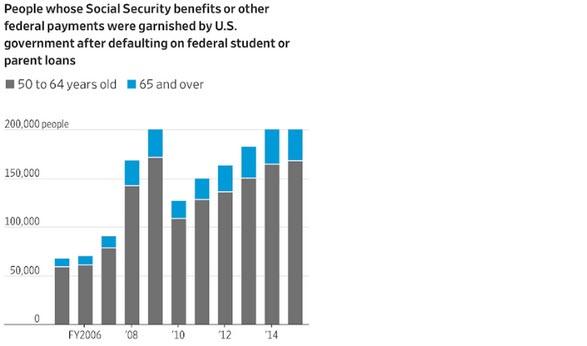

The result has been the monetary suffocation of a generation. Some people are even having their Social Security checks garnished. The federal government, who also happens to be the largest student loan lender, garnished the Social Security benefits or tax refunds of more than 40,000 people aged 65 or older in 2015 because of defaulting on student loan debt. That figure is up an astounding 362% from the decade prior.

The article profiles people like Anmte Grgas-Cice, who is 66 years old and owes about $29,000 in student loans. His only income is $1600 a month that he gets from Social Security, which he saw garnished for some of last year because he wasn’t paying his student loans.

He says that his decision to go back to school continues to “haunt his life”. In 2003 and 2004, he signed up for loans to go to the Art Institute in New York to study culinary art and restaurant design. His plans in the industry fell through and he is currently unemployed.

He limits himself to about $7 a day for food and relies on financial help from family to survive. “I put all my money to better myself,” he stated.

Student loan debt makes up one of the biggest chunks of the overall increasing debt burden of this generation. People 60 and older in the United States owe around $615 billion combined in credit cards, auto loans, personal loans and student loans as of 2017. That figure is up 84% since 2010.

The debt, made available by low interest rates and monetary policy that puts the stock market before common sense, is not fixing the problems created by the 2008 recession, but rather it’s making them worse for people of this generation. Between 2010 and 2017, people in their 60s accelerated their borrowing in nearly every category.

This has resulted in seniors having to work longer and harder just to service the debt they have taken on. And even though this generation is also accounting for a larger share of US bankruptcy filings, student loan debt is rarely dischargeable in bankruptcy.

via ZeroHedge News http://bit.ly/2TAJZ4n Tyler Durden