Yesterday we reported that in the aftermath of the failure of China’s Baoshang Bank (BSB), and its subsequent seizure by the government – the first takeover of a commercial bank since the Hainan Development Bank 20 years ago – the PBOC appeared to panic and injected a whopping 250 billion yuan via an open-market operation, the largest since January.

And while the bank first failure of a Chinese bank resulted in some notable turmoil in China’s interbank market, where the issuance of Negotiable Certificates of Deposit was partially frozen as overnight funding rates spiked, dragging prices of both corporate and sovereign bonds briefly lower, we warned that “Baoshang is just the tip of the iceberg.”

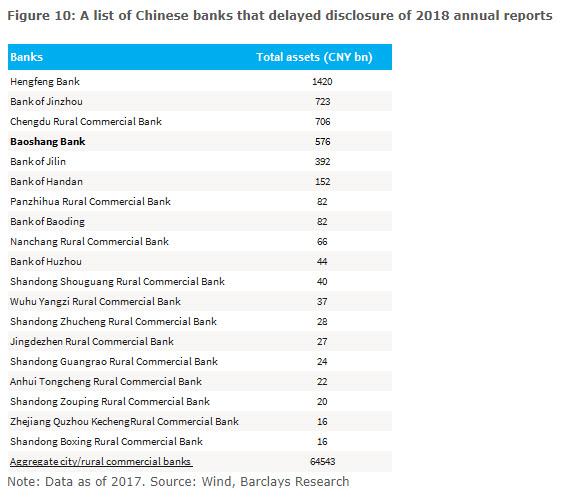

According to UBS analyst Jason Bedford, who in 2017 was the first to highlight Baoshang’s troubles, there are several other banks that have “identical leading risk indicators” to Baoshang. Hengfeng Bank, Jinzhou Bank Co. and Chengdu Rural Commercial Bank all failed to publish their latest financial statements, have a large portion of their balance sheets invested in “loan-like investment assets” and are subject to negative local media coverage.

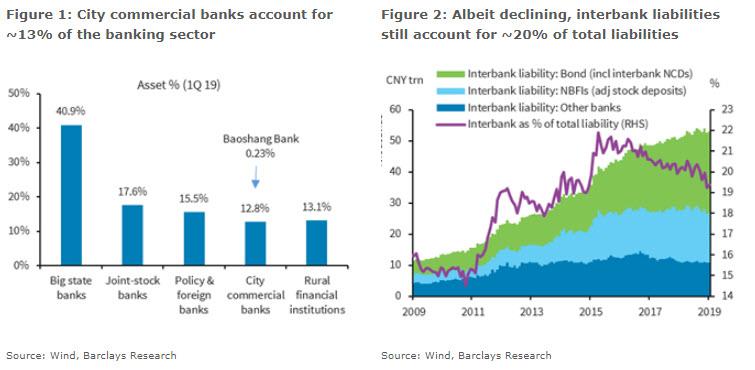

To be sure, storm clouds had been gathering above for quite some time. Here is a quick primer on how BSB was unique, and why it was especially at risk, courtesy of Barclays.

BSB is a city commercial bank (Figure 1), with a AA+ credit rating from Dagong Credit Rating Group. However, it has faced more problems and financial difficulties than banks with a similar credit rating. BSB has not published its annual report since 2016, which to us suggests significant asset quality stress. Its ratio of 90-day overdue loans to NPL stood at ~180% in 2016, versus an average of ~110% for similar sized banks. Meanwhile, its key stakeholder (~30%), Tomorrow Group, has been under an anti-graft investigation with its founder Xiao Jianhua missing since 2017.

It has been a notably aggressive player in China’s interbank market, with ~40% of its funding from wholesale sources, compared with a ~25% average for smaller regional banks, and ~20% for all banks in April 2019 (see Figure 2). As a result, BSB has been hit hard by the deleveraging drive and tightening of the interbank funding channels.

Most of the above was already well-known, at least in the aftermath of the BSB collapse. What investors are far more curious about is i) will the failure become systemic, and ii) who will fail next.

Addressing the first question, Barclays analyst Jian Chang writes that the bank doesn’t expect the BSB takeover to cause a systemic crisis (many would disagree). The reason: the bank’s total assets/outstanding loans/deposits only accounted for 0.23%/0.18%/0.14% of China’s whole banking system (as of Q3 2017, the latest available data on BSB), and the PBoC is committed to “keeping eye on the liquidity situation of medium-to-small banks, and make use of various tools such as OMOs to ensure reasonably ample liquidity in the system and maintain stability in the money market rates”.

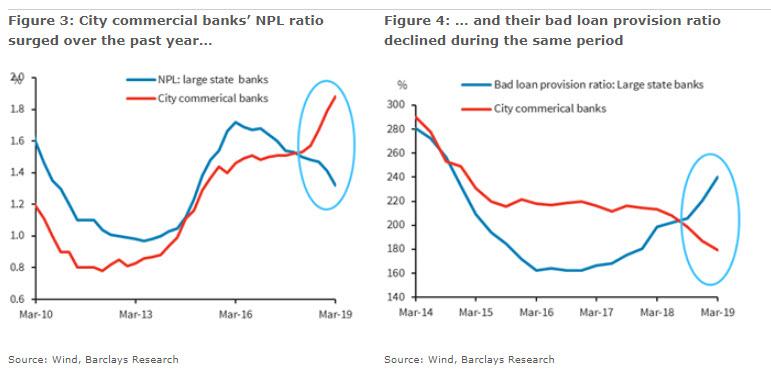

That said, Barclays admits that the takeover of BSB “highlights the difficulties and challenges facing some medium-to-small sized banks arising from China’s deleveraging campaign of the past several years and a slowing economy.” Specifically, during the first phase of “deleveraging the financial system” (August 2016 – October 2017), interbank lending, a major funding source facilitating the aggressive expansion of medium/small banks before, was significantly tightened. Then as the financial deleveraging extended to the real economy (Nov 17 – May 18), the resulting rise in corporate delinquency and defaults added to banks’ credit risks. Then, during the period of policy easing since the second half of 2018, banks’ asset quality has not been helped by the regulator’s push for more SME lending, “as the NPL ratio of urban commercial banks as a whole rose notably by ~30bp to 1.9% in Q1 19, from 1.6% Q2 18, while their bad-loan provision ratio declined by 30pp to ~180% over the same period (Figures 3-4).”

As such, Barclays expects more “exits” (read “failures”) of smaller banks or NBFIs (Non-bank financial institutions) either through takeovers or M&A with bigger parties, most likely with some regional significance (eg. urban or rural commercial banks. However, in keeping an optimistic outlook, Barclays does not view a few more bank failures as a systemic risk, “as the total >130 urban and >1300 rural commercial banks only account for ~10% of the banking sector.”

Meanwhile, the analyst notes the regulators’ efforts to help banks replenish their capital through various channels (eg. the recently introduced perpetual bonds which are a form of quasi QE) as “indicated by the government’s attempts to prevent systemic risks from materializing before they become too great to contain.“

Furthermore, the official remarks (listed below) suggest that, even if some FIs are allowed to “experiment” with bankruptcy, this would only go forward in a controlled and manageable manner (ie. mainly through mergers and restructuring) to ensure the government’s bottom line of no systemic risks being created.

Below is a list of selected comments by a Chinese official, in this case Xiao Yuanqi, the Chief Risk Officer of the CBIRC, in February 2019, which help understand the regulators’ thinking on smaller FIs, NPL risk exposure, and planned resolutions:

- He said that regulators will continue encouraging smaller and private players to join the market to expand access to credit for SMEs, meanwhile they will also work out measures to contain risks associated with smaller financial institutions (FIs).

- While some institutions will be allowed to experiment with bankruptcy, regulators will mainly use mergers and restructuring to defuse risks and force unqualified players out of the market.

- The authorities will also encourage lenders to step up efforts to offload their non-performing loans (NPLs). The banking sector has disposed of CNY3.48trn of bad loans over the past two years, according to CBIRC data, but commercial banks still have CNY2trn of NPLs on their balance sheets.

- Improving the supply of financing will involve shifting “inefficient” credit from industries suffering from overcapacity to areas with greater needs, such as SMEs in innovative and strategic sectors. Poorly performing companies with little prospect of improvement will be guided to exit the market through reorganization or bankruptcy.

Finally, for those curious which banks are most likely to follow in Baoshang’s footsteps, and fail next, Barclays has compiled a list of regional banks that have delayed publishing 2018 reports, the biggest red flag suggesting an upcoming solvency “event.”

via ZeroHedge News http://bit.ly/2W4RDUM Tyler Durden