Paging Steve Mnuchin…

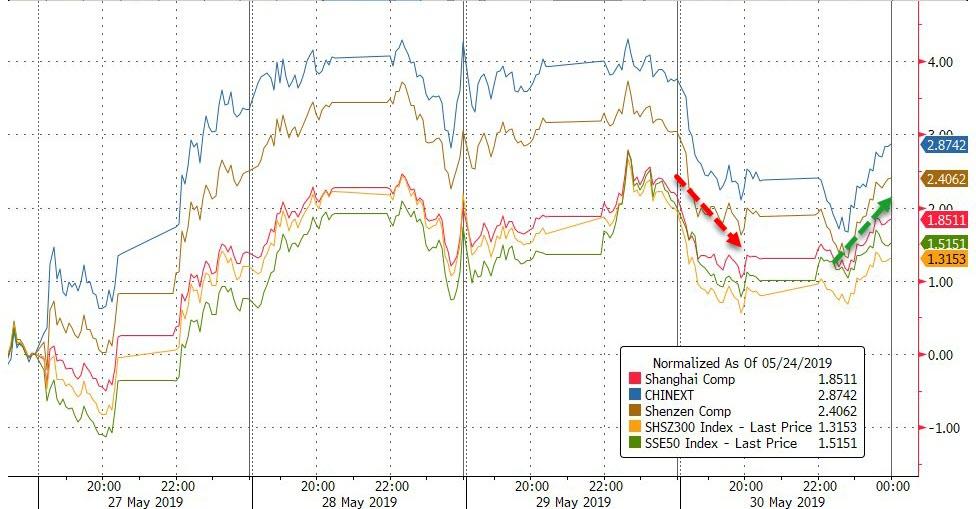

Chinese stocks were lower overnight as an afternoon bid failed to get back to even, but remain higher on the week thanks to PBOC’s panicky liquidity injection…

Italy (lower) and Spain (higher) diverged notably intraday as the latter got almost back to unch on the week…

Bund yields continue to inch nearer record (negative) lows…

US Small Caps were the biggest losers today with S&P, Nasdaq, and Dow desperately trying to hold green…However, on the week (and month), they’re all red…

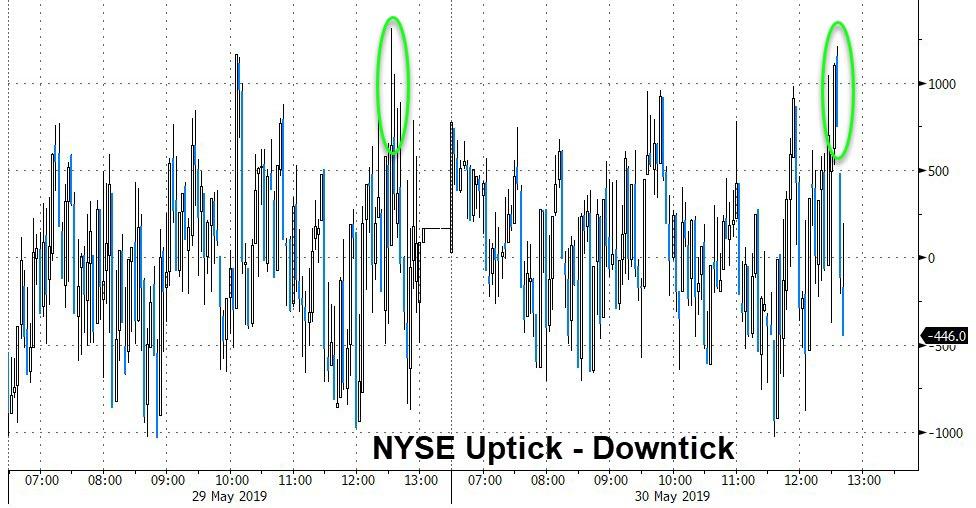

For the second day in a row a sudden buying panic program lifted at 1534ET…

Desperate to keep S&P above its 200DMA (but unable to get back above 2800)…

The trillion dollar tech stocks aren’t anymore…

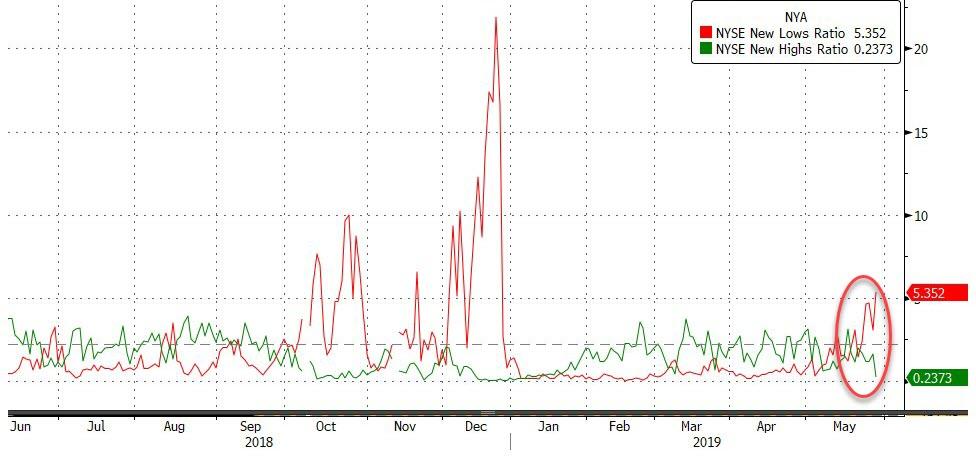

Breadth is starting to turn ugly in US stocks…

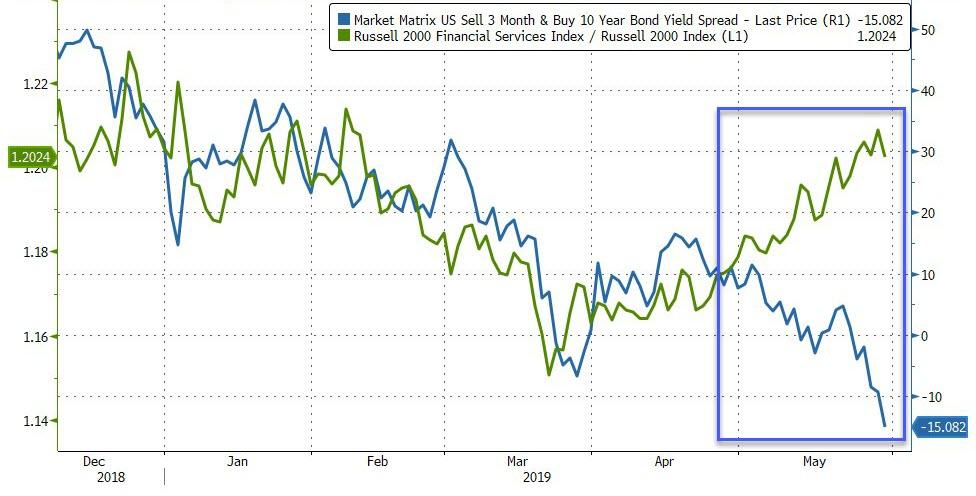

Financials continue to outperform the market, despite plunging yield curve…

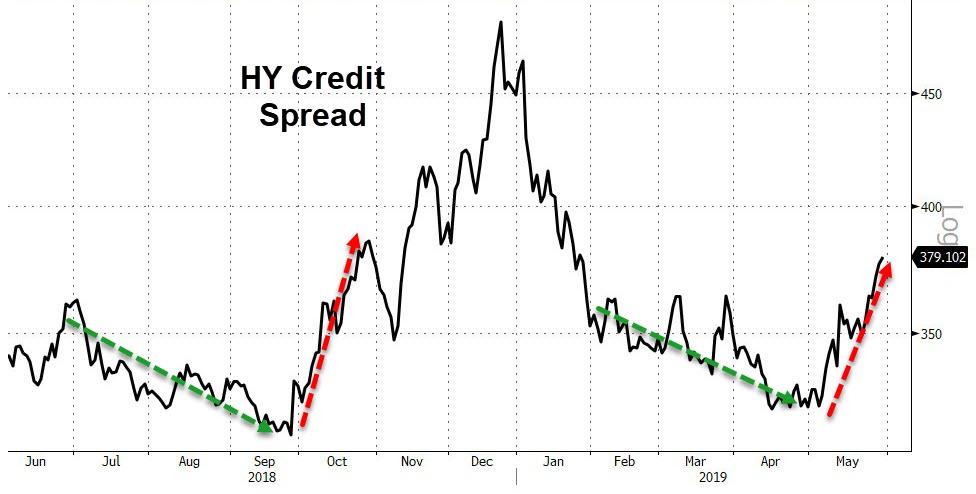

Credit spreads continue to push wider (echoing 2018)…

Signaling more pain to come for stocks…

Many claimed that after a strong month for bonds (and weak for stocks) that month-end pension rebalancing would spark forced buying in stocks… that didn’t happen…

Treasury yields tumbled once again (down 9-10bps on the week), despite a small hope-filled rise overnight…

10Y Yields broke down to yesterday’s lows after Pence’s China comments…

The yield curve slumped back to cycle lows, erasing yesterday’s late-day bounce…

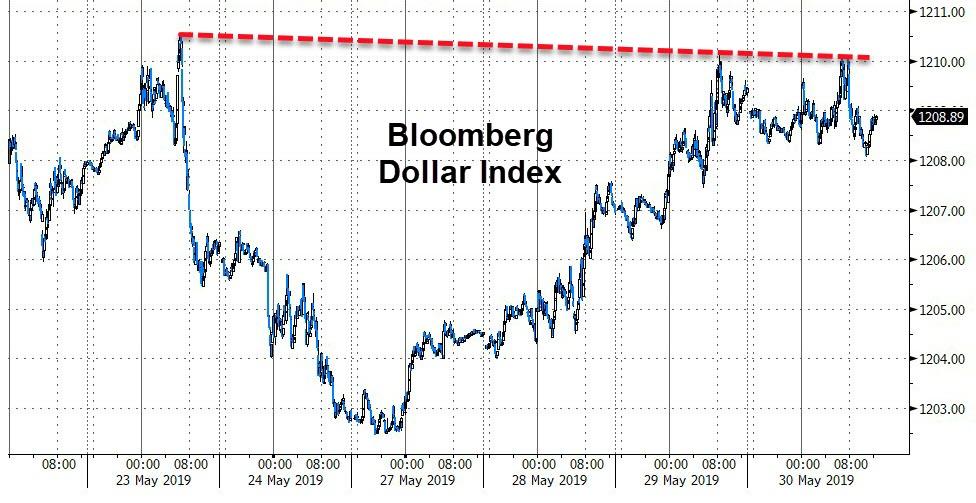

The Dollar was flat on the day, after testing yesterday’s highs (lower highs)…

Yuan managed gains on the day but remains down from PBOC warnings to shorts…

NOTE – the yuan fix has been oddly stable for the last two weeks, despite offshore yuan’s vol.

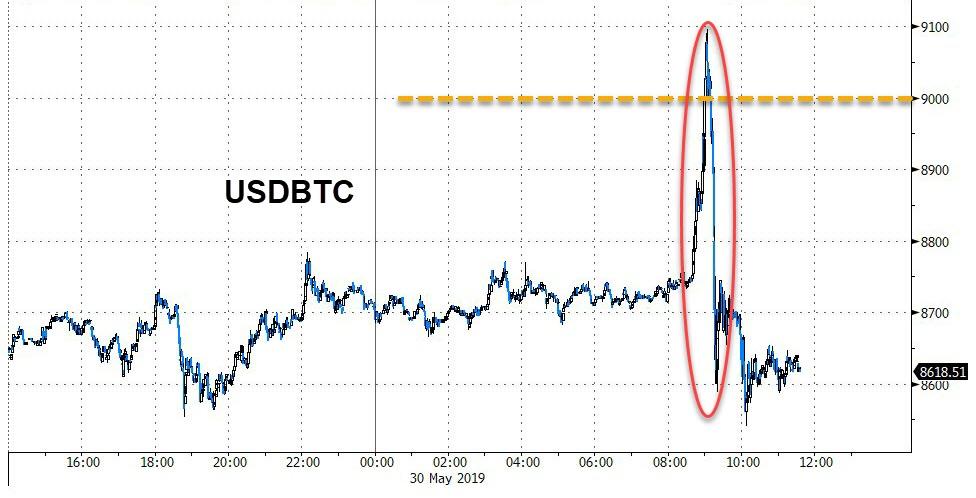

Bitcoin tagged $9,000 intraday but seemed to trigger sell orders at that level…

Which spread across the entire crypto space…

Despite the dollar going nowhere fast, commodities were volatile with safe-haven flows heading into PMs (gold outperforming) and crude clubbed after a smaller than expected inventory draw…

WTI is the lowest since mid-Feb (testing and losing its 100DMA)…

And gold was bid on heavy volume up to its 50DMA…

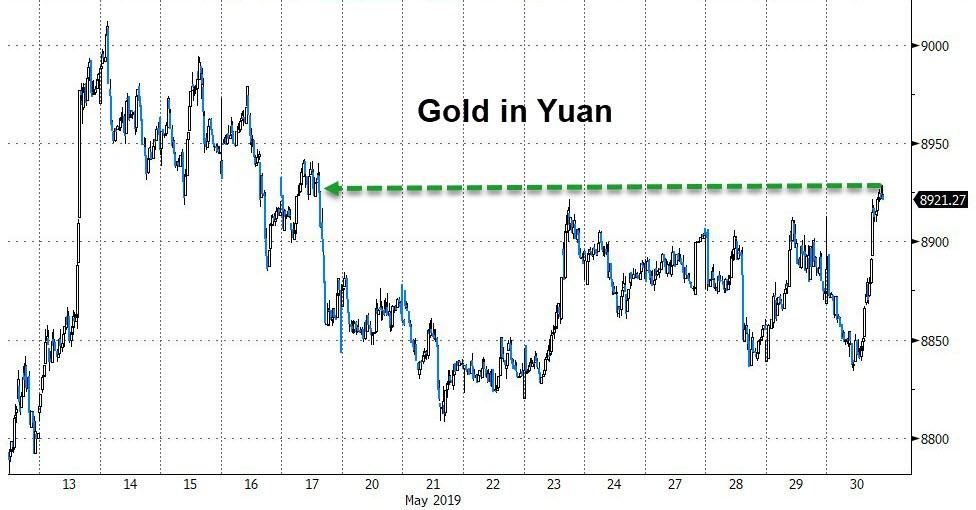

Combined with Yuan’s recent weakness, gold is strongest against the Chinese currency in over 2 weeks…

Finally, we note that, having diverged massively for a few months, the correlation between the S&P 500 and US Treasury yields has accelerated in recent weeks, back to its highest level since Aug 2016…

And its global…

The question is – will the relationship revert like in 2016 (rates higher) or 2007 (equities lower)?

via ZeroHedge News http://bit.ly/2W22yPb Tyler Durden