Almost four years ago, in September 2015 when bitcoin was trading at $200, we wrote “China Scrambles To Enforce Capital Controls (Which Is Great News For Bitcoin)” in which we explained that with China aggressively cracking down on its capital control “firewall”, bitcoin was set to soar. Specifically, we said that “if a few hundred million Chinese decide that the time has come to use bitcoin as the capital controls bypassing currency of choice, and decide to invest even a tiny fraction of the $22 trillion in Chinese deposits in bitcoin (whose total market cap at last check was just over $3 billion), sit back and watch as we witness the second coming of the bitcoin bubble, one which could make the previous all time highs in the digital currency, seems like a low print as bitcoin soars past $500, past $1,000 and rises as high as $10,000 or more.”

A little over two years later bitcoin had risen 100x, hitting $20,000 as a result of, you got it, a lot of Chinese scrambling to use bitcoin as a capital controls evading mechanism (and not, as some financial “experts” claimed at the time, a Russian ponzi scheme) one which prompted Beijing to unleash draconian measures to curb bitcoin use, and eventually succeeded to break the magnetic draw that the cryptocurrency held for millions of Chinese money-launderers (and momentum chasers).

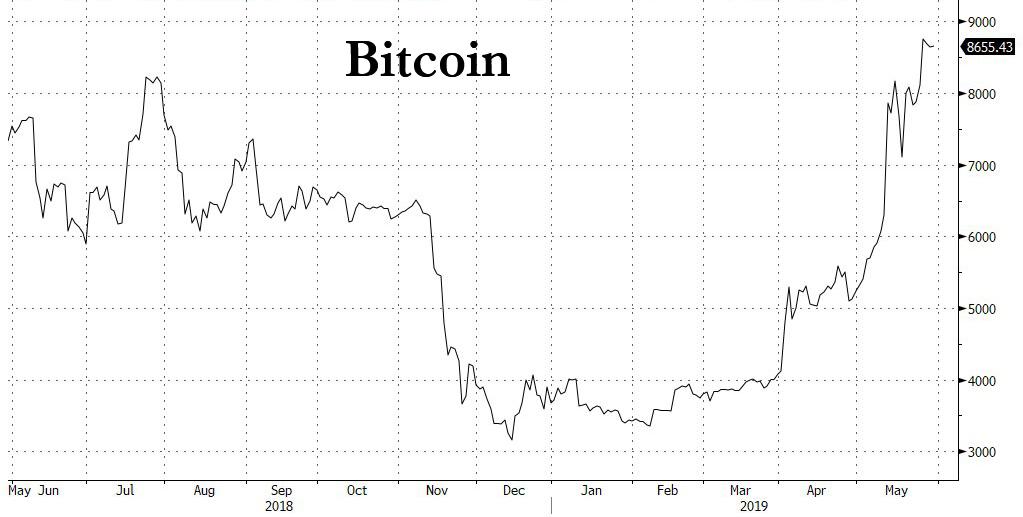

Fast forward to today when in just the past month bitcoin has soared nearly 140%, and is back to $9,000 after tradiong as low as $3,000 in December. The reason, no surprise, is yet another massive ramp up in Chinese capital control which have recently surpassed all of Beijing’s prior attempts at managing the flow of outbound capital.

But don’t take our word for it – none other than a former Chinese central bank adviser has admitted that Beijing’s capital account controls may be too “extreme” after personally being blocked from sending US dollar funds abroad because he was too old.

As the SCMP reports, Yu Yongding, a former central banker at the PBOC and currently a senior research fellow at the Chinese Academy of Social Sciences, a state-owned think tank, told a financial forum in Beijing on Wednesday that he recently tried to exchange yuan to the value of US$20,000 at a bank and transfer the money out of China to pay for a trip to visit relatives living abroad.

And then: surprise – the bank refused to provide the service even though Yu, like all citizens under Chinese law, is allowed to make foreign transfers of up to US$50,000 each year. According to Yu, the bank refused to provide the service because he is over 65.

“I always support capital account controls, and I always encourage such measures. But sometimes we tend to be too extreme in doing things,” Yu was quoted as saying by Chinese news portal Sina.com. “Legal foreign exchange deals are being hindered.”

While the former PBOC adviser confirmed the incident in a phone call with the South China Morning Post, he declined to elaborate further, declining to name the bank, and only stating that the implementation of China’s foreign exchange controls were “too rigid.”

“There were heavy outflow pressures in 2015 and 2016, but I don’t see clear signs of outflows at the moment,” Yu said.

Well, there wouldn’t be if capital controls are “extreme” although perhaps Yu was looking at the wrong place – if, as in 2016/2017 when Bitcoin exploded, the former central banker was instead looking at the price of cryptocurrencies he may observe some “clear signs” of outflows, those taking place via cryptocurrency.

Incidentally, Yu was one of most respected voices on China’s monetary and foreign exchange polices and he was also the only academic member on the central bank’s monetary policy committee when the People’s Bank of China opted to remove the fixed exchange rate between the yuan and the US dollar in 2005.

Meanwhile, China’s capital controls gatekeeper and FX regulator, the State Administration of Foreign Exchange (SAFE) maintains that there has been no change to the annual quota of US$50,000, although the foreign exchange regulator did not immediately respond to SCMP’s faxed questions regarding Yu’s case and bank policies that limit withdrawals.

As the SCMP notes, Yu’s case adds fresh evidence that China is tightening controls of personal purchases of US dollars despite the US$50,000 allowance. The Post reported earlier this month that some Chinese banks have increased scrutiny of foreign-currency withdrawals and quietly reduced the amount of US dollars customers are allowed to withdraw, fanning concerns that Beijing is cutting the supply to individuals and companies.

Why? Simple: because as part of China’s defense of the Yuan from sliding below 7.00 vs the dollar, a key psychological level that would lead to an avalanche of yuan selling and sharply draining China’s currency reserve – SAFE has maintained that the country has ample foreign exchange reserves, which stood at about US$3 trillion as of the end of April – Beijing is doing everything in its power to pre-empt this waterfall by making selling of the Yuan virtually impossible, in effect fully isolating China from the the global FX system. As a result those who are desperate to transfer their funds offshore are forced to find creative alternatives.

Such as buying bitcoin instead, something will only accelerate the longer China cracks down on enforcing capital controls, which in turn will be a function of how long the trade war lasts. In other words, the best hedge to a lengthy, escalating trade war may be cryptocurrency. And for those asking how high bitcoin could rise this time around, consider this – the market cap of the 5 largest cryptos (bitcoin, ethereum, ripple, bitcoin cash and EOS) is just $215 billion. China’s total deposits? $26.7 trillion, or roughly 124 times greater. Do the math.

via ZeroHedge News http://bit.ly/2W1Dacg Tyler Durden