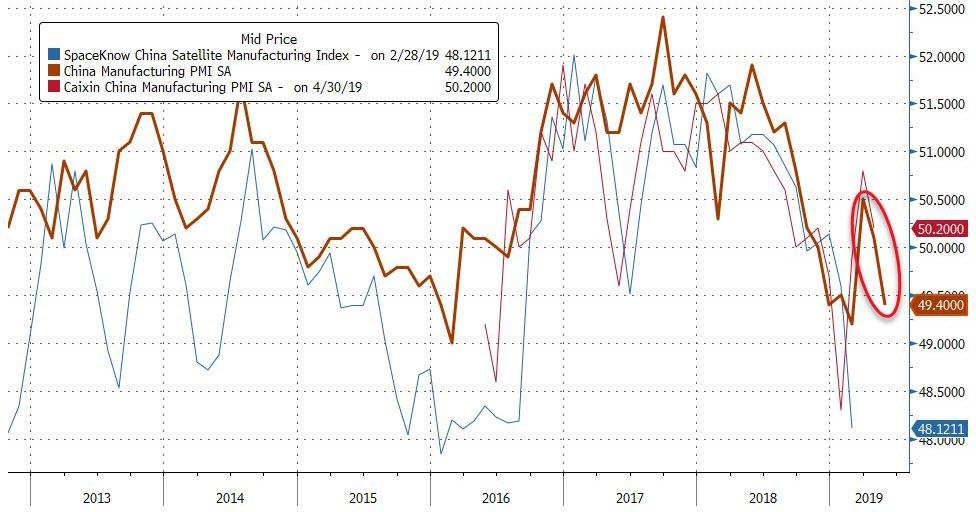

China’s Official May Composite PMI printed modestly lower than April’s at 53.3, with Services at 54.3 (in line with last month and goal-seeked expectations), while Manufacturing (expected to decline into contraction at 49.9) was considerably worse than expected, printing 49.4.

This was below the lowest analyst estimate of 49.5, and close to the lowest level in about a decade.

Under the hood of the manufacturing data, Output growth slowed, New Orders tumbled into contraction (with export orders plunging), inventories rose, employment slipped, and input & output prices contracted. The most affected were Small Enterprises.

The Services data also showed weaker new orders and employment with selling prices slumping into contraction

The drop clearly reflects pressure on the production side of the economy from the escalating trade war (following some pre-tariff stocking-up).

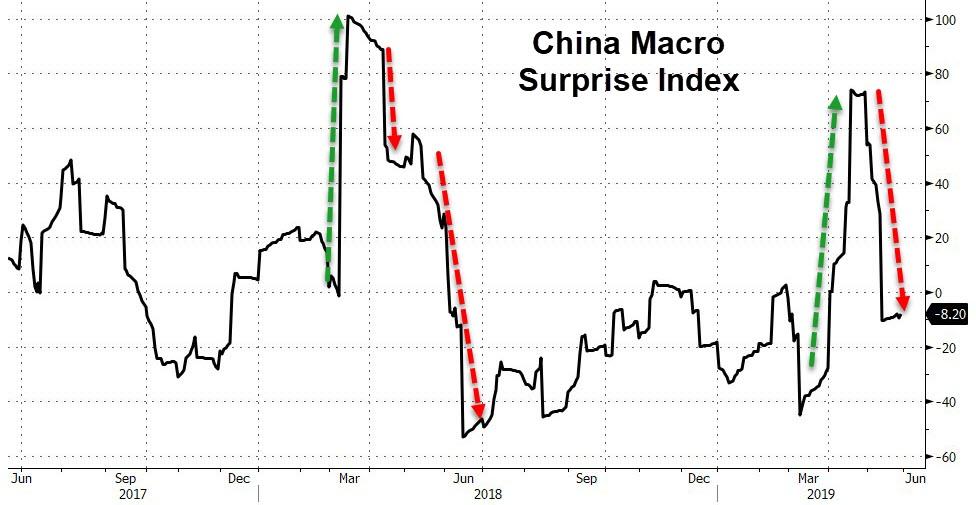

None of this should be a big surprise as much of Asia’s flash PMIs were weak and after spiking on record credit injections in the early part of the year, China’s macro data has collapsed against renewed optimistic expectations…

Looks like we are “gonna need a bigger boat” of cash to keep this red ponzi afloat, which is a problem as the signal from China’s April credit data was also negative. The unexpectedly large fallback in credit raised fresh doubts about whether the economy has found a bottom.

via ZeroHedge News http://bit.ly/2VYliz6 Tyler Durden