Six months after the worst year for hedge funds since 2011, the 2 and 20 community is enjoying a renaissance of sorts, with the hedge funds universe reporting the best first half performance since 2009, as equity managers piggybacked on surging stocks. According to Hedge Fund Research, funds rose 5.7% from January through June, with equity funds were the best-performing broad strategy, gaining almost 9% in the period, if still underperforming the S&P significantly.

Using a trite cliche, Rob Christian, head of investment research at K2 Advisors, told Bloomberg TV that “it’s a stock-picking market, definitely” even though what he really meant is that it’s a dovish central bank-picking market as the main reason for the stock surge in 2019 had everything to do with the surprise dovish reversal by the Fed, which is now expected to cut rates in three weeks, something that has “been most favorable for equity long-short managers, and particularly managers with a growth tilt.”

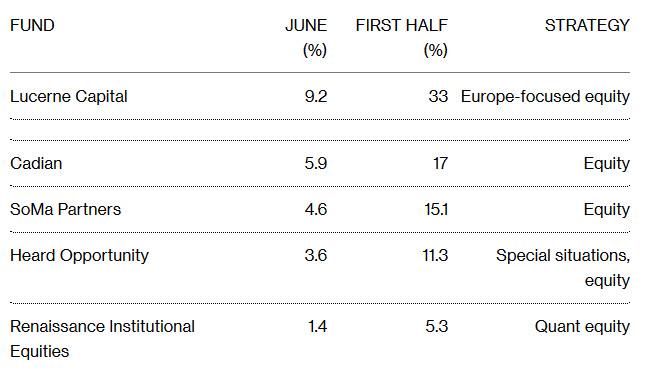

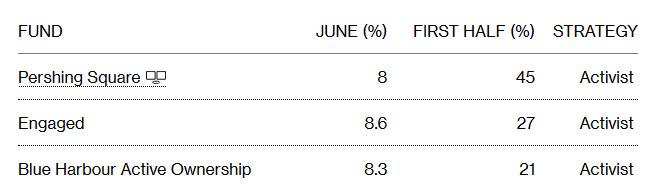

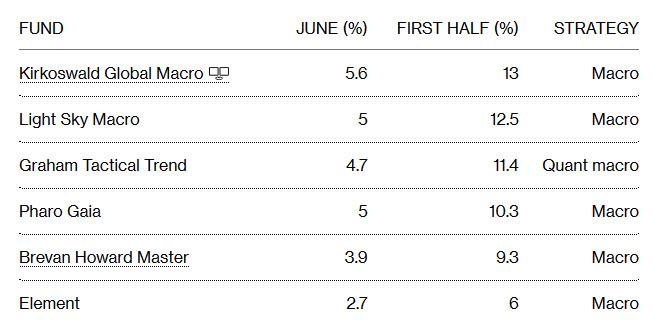

Courtesy of Bloomberg, this is how some of the more notable hedge funds did in the first half.

Of course, as noted above, the hedge fund gain pales in comparison to the S&P 500 Index, which returned almost 19% in this year’s first six months. Furthermore, one did not have to pay 2% of assets and 20% of the upside to some billionaire if one simply had bought SPY ETFs on January 1, thanks to central banks who for the past decade have been the market’s chief risk officers, springing to action when there is a risk of even a modest 10% correction.

Activist hedge funds did better, rising 11.4% in the first half according to HFR. And while the broader strategy of event-driven managers rose a more modest 6.6% this year, some notable outliers, wuch as Bill Ackman who had lost money for four straight years, exploded higher gaining 45%.

Among the big winners were also David Einhorn, whose fund had its worst year in 2018 but was up 18% in the first half. Macro funds also shown, with Brevan Howard posting its best first half since 2009, following last year’s rebound.

“Global macro has come back to life very quietly,” K2’s Christian said. Ex-Brevan Howard partner Ben Melkman saw his hedge fund, Light Sky Macro, beat his former employer this year, making 12.5% after two years of losses. Still, macro managers in general rose about 3% in the first half, remaining the worst-performing strategy, according to HFR.

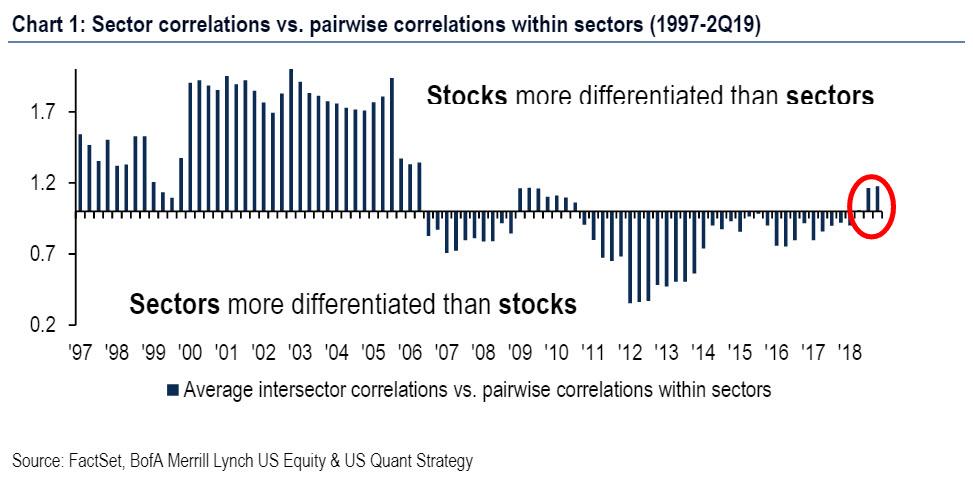

Looking at a more granular breakdown, Bank of America notes that a few months ago there was a big shift that has persisted: stocks are now more differentiated than sectors, suggesting less macro, and more micro. Among Growth funds (the best performing style group) 234bps of alpha came from their top 10 vs. bottom 10 stock bets. But sector allocation was less important, and sector bets detracted 13bps of alpha. Even headline risk has been less sector specific – e.g., analysts highlight that trade/tariffs can have very different effects on stocks based on sourcing, exports, etc.

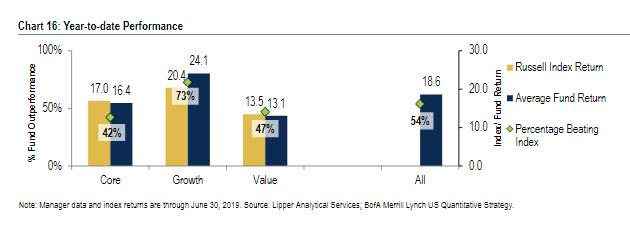

Not everyone had a great 6 months, however: across all categories, mid-cap managers saw the weakest hit rate overall, whereas small caps were the only size group with 50%+ hit rate (54%).

Like in large caps, Core and Value funds struggled within mid and small: Core posted a 17% hit rate in mid and 42% in small, and Value funds posted a 25% hit rate for mid cap and 47% for small cap funds.

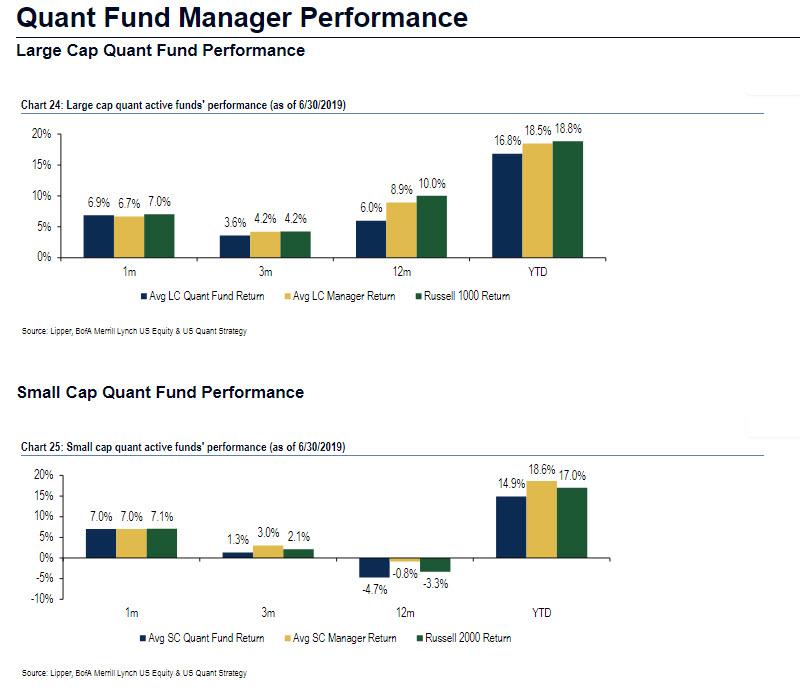

As usual there was an outlier, and in 2019 it was the quant funds that have had a miserable performance so far; according to Bank of America, quants ended the 1H with just 17% beating the market, with the average quant fund trailing the Russell 1000 by 2%, an underperformance that was attributable in part to whipsawed factor returns.

Quant funds’ higher exposure to Value factors also detracted from alpha: as has been the case for much of the centrally-planned recovery. value was the worst performing factor group YTD despite a June comeback.

via ZeroHedge News https://ift.tt/30vY71P Tyler Durden