With over $13 trillion in global notional debt trading with a negative yield, it will hardly come as a surprise that there is a line of investors stretching around the block for even the least fundamentally sound bonds which still offer a modest positive yield, such as those which for the past 2 years were only purchased by the ECB. We are of course talking bout Italian bonds, and not just any variety, but 50-year bonds issue offered by Europe’s financial problem child.

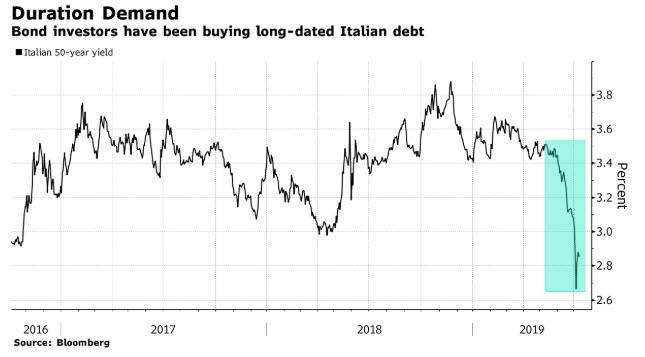

The frenzied demand for Italian bonds that won’t be repaid in most investors’ lifetimes (they mature in 2067) – or perhaps ever, if Italy defaults on its debt – was such that they attracted demand of over €17.5 billion for the €3 billion offering, making them roughly 6x oversubscribed, despite a yield of just 2.9%, almost a full percent lower than what this paper yielded in late 2018.

To Bloomberg this represents the “latest example of the intense hunt for yield spurred by dovish monetary bets. even as the stronger-than-expected U.S. jobs report on Friday clouds the case for aggressive monetary easing.”

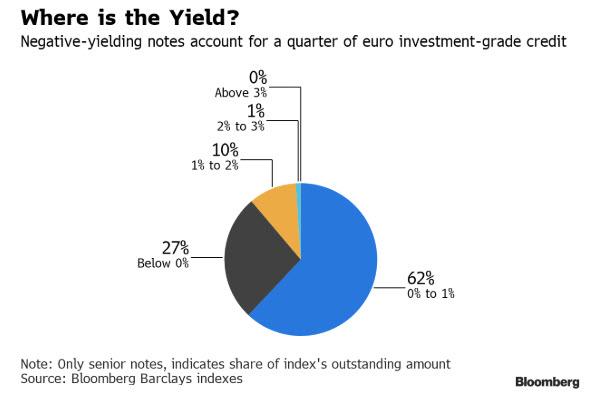

Meanwhile, as Italian bond yields tumble on expectations that the ECB will restart its QE in the coming months, Europe is slowly collapsing under Albert Edwards’ ice age, and the number of corporate junk bonds trading with a sub-zero handle in euros now stands at 14, compared to zero at the start of the year. Even emerging-market issuers are joining the not-so-exclusive negative yield club, while a whopping 27% of Europe’s investment grade bonds are now trading with a negative yield sign.

Not even Wall Street expected the kind of panicked buying that has emerged in recent weeks: “Coming into the year we were expecting a rally following the fourth quarter sell-off,” said Jens Vanbrabant, head of European loans and high yield at Wells Fargo Asset Management. “But that rally morphed into a yield-grab.”

“In a world where the outstanding pool of positively-yielding European government debt for fund managers to invest in is shrinking all the time, this is where the price goes,” SocGen’s Kit Juckes told Bloomber. “I think yields are more likely to fall further than rise from here.”

Taking advantage of the frenzied yield grab, Italy is also issuing 3- and 7-year notes as Italy’s premium over German bunds touched the lowest level in over a year last week. Both Spain and France also auctioned debt at record-low borrowing costs last Thursday. Investors are turning to peripheral euro-area bonds as the yields on German bunds last week dipped below the ECB’s -0.4% deposit rate for the first time ever.

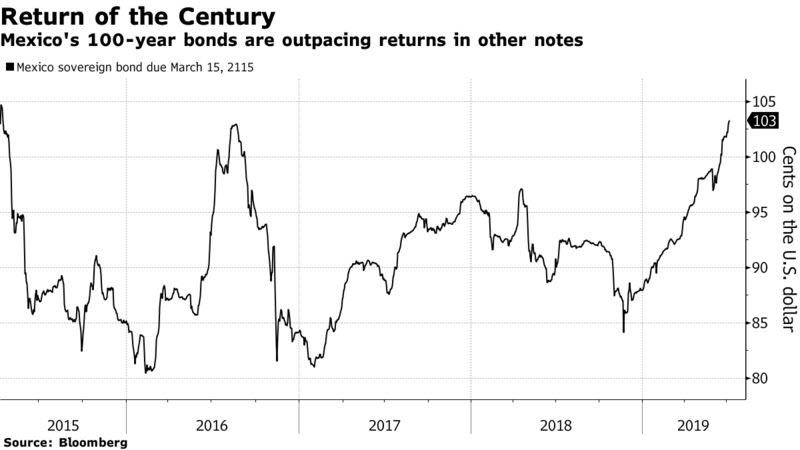

But wait, there’s more because with not a hint of hawkishness around the globe, money managers are now making a killing on debt that won’t mature for nearly 100 years. The result: bond investors making stunning returns of 19% on average by holding on to 100-year debt from the three most prominent issuers: Argentina, Mexico and state-controlled Petroleo Brasileiro SA. That’s almost double the gain for the benchmark emerging-market debt index.

“There’s been a scramble for any bond with some spread – the longer, the better,” said Guido Chamorro, a senior investment manager at Pictet in London, who’s overweight Mexico century bonds. His emerging-market debt fund has topped 75% of peers this year, according to data compiled by Bloomberg.

That said, following Friday’s sharp spike in yields – which has since subsided – questions emerged if the world was facing the mother of all VaR shocks as virtually everyone is now long record duration; still as Bloomberg adds, with intensely bullish bond bets built into cross-asset funds, “the bar for a tantrum is looking low, as traders eye make-or-break pronouncements from U.S. monetary officials.”

This all can change tomorrow if Powell throws markets another curve ball and shift the Fed’s posture back to hawkish:

“The question is whether this week Powell will try to calibrate expectations,” said BlackRock’s head of economic research Elga Bartsch. “We think a 100 basis points of insurance rate cuts between now and next summer is very ambitious and that means the U.S. government bond market is probably likely to be the most exposed.”

As for century bonds, which are among the riskiest debt securities in the world, they would “get slaughtered” if the Fed shocks markets by not lowering borrowing costs at the end of July, according to Hari Hariharan, chief executive officer of NWI Management. Is he really worried this will happen? No: he likes Petrobras’s 100-year debt on the possibility of bond buybacks.

Not worried about a hawkish surprise is also Tina Vandersteel, money manager at GMO in Boston, who prefers Mexico’s 100-year securities over Argentina’s for the same reason as Chamorro. Assuming a global monetary ice age isn’t fully priced in, yet, century bonds would be the bonds that benefit the most as interest rates across the entire world sink into negative territory.

Why is everyone so confident that there is nothing to be worried about? Zsolt Papp, money manager at JPMorgan Asset Management in London explained it best: “The Fed will likely remain accommodative. That’s good for EM and century bonds.”

This, as Goldman admitted yesterday, is the crux of the issue: the Fed is no longer in charge, and instead the market is dictating terms to the central banks, and the market’s message is clear – lower rates, more liquidity, making the rich richer while eradicating savers and the entire global middle class.

via ZeroHedge News https://ift.tt/2S2Opki Tyler Durden