A ‘sad’ day…

We barely knew you @ericswalwell, may your campaign live on forever in our hearts. pic.twitter.com/25U8XtGjow

— Carpe Donktum🔹 (@CarpeDonktum) July 9, 2019

China went nowhere…

Weak day in Europe…

US Stocks briefly popped (S&P into the green) on China trade talk headlines (around 1400ET) but that did not last but – as usual – a buying panic arrived at around 1530ET lifting everything on no news, desperate to get the Dow green, but failed…

For a sense of that late-day idiocy in context…

What a fucking joke!

This is the Dow’s 3rd down day in a row – its worst streak of losses since March…

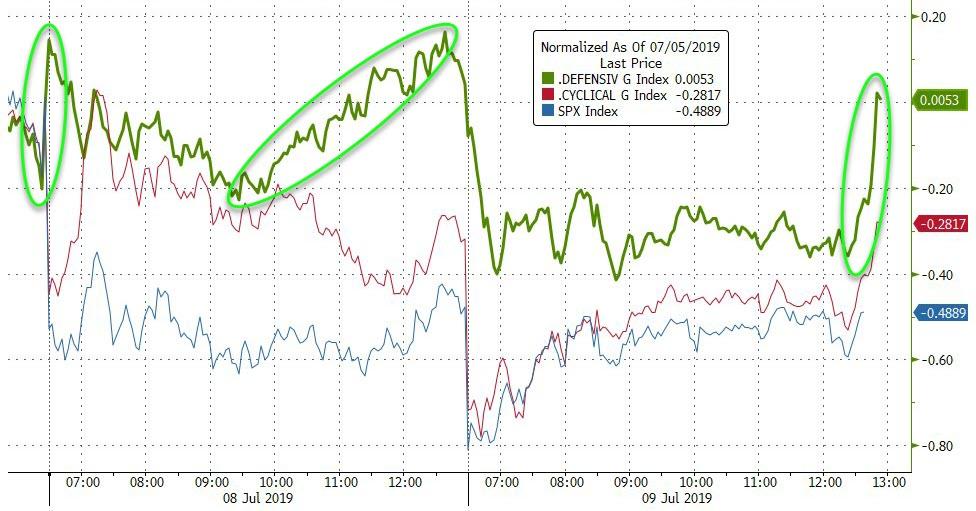

Defensives once again dominated the price action…

Boeing swings intraday prompted the Dow’s volatility as Qatar headlines spiked (on Trump hope) and then dumped (on reality) shares…

The analog remains…

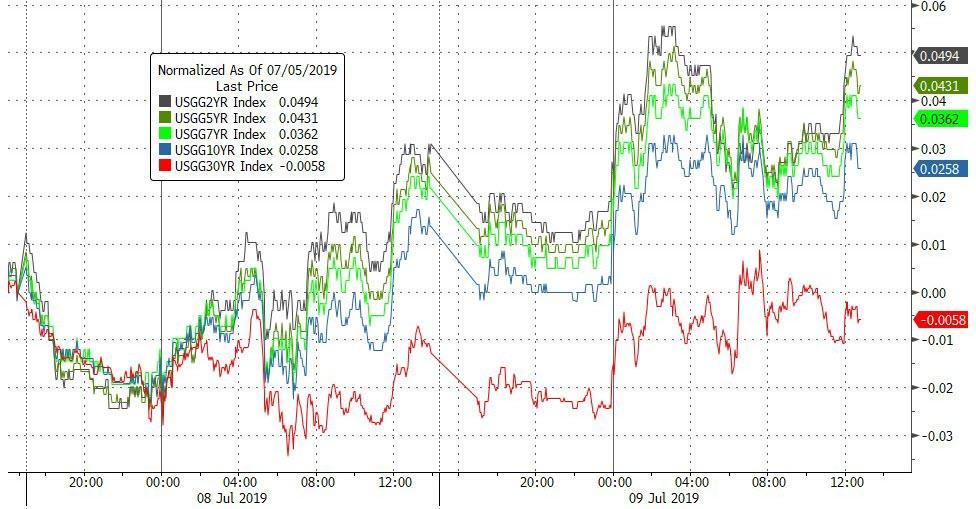

Treasury yields were higher across the curve with the short-end continuing to underperform (but 30Y remains lower on the week)…

10Y Yields could not break above Friday’s spike highs…

The Dollar extended its recent gains, erasing all losses since the FOMC statement…

The peso plunged today as the mexican finmin unexpectedly quit…

Cable tumbled back below 1.25, its lowest since April 2017…

Bitcoin pushed back above $12500…

Cryptos did get hit late on however…

Silver outperformed gold for the second day in a row, copper was crushed…

Spot gold tested back up to $1400 once again…but was unable to hold it…

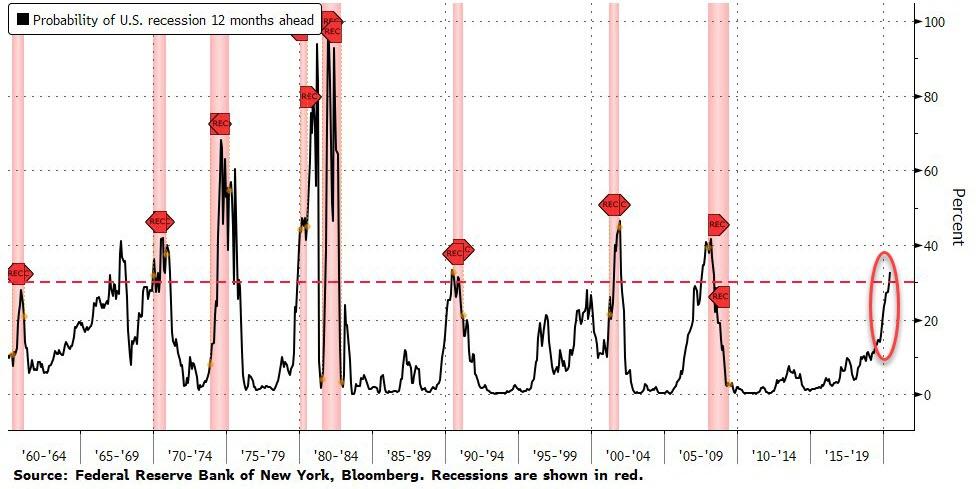

Finally, anyone who “can’t see the recession” coming to the U.S. isn’t looking at a key indicator, according to David Rosenberg, Gluskin Sheff & Associates Inc.’s chief economist and strategist. As Bloomberg reports, Rosenberg featured a gauge compiled by the Federal Reserve Bank of New York in a Twitter post Monday.

The monthly indicator is based on the gap between yields on three-month Treasury bills and 10-year notes, and shows recession probabilities over 12 months. The latest reading was 32.9%, a 12-year high. Adding insult to injury was the OECD leading indicator is now the lowest since the global economy was trying its utmost to climb out of the Great Recession in late summer 2009.

via ZeroHedge News https://ift.tt/2S4w723 Tyler Durden