A ‘dovish-er’ than expected set of prepared remarks from Fed Chair Powell has sparked a bid in bonds, stocks, and gold as the dollar takes a dive ahead of his testimony late this morning.

Dow futures love the bad economic news… are up 150 points on Powell’s promises…

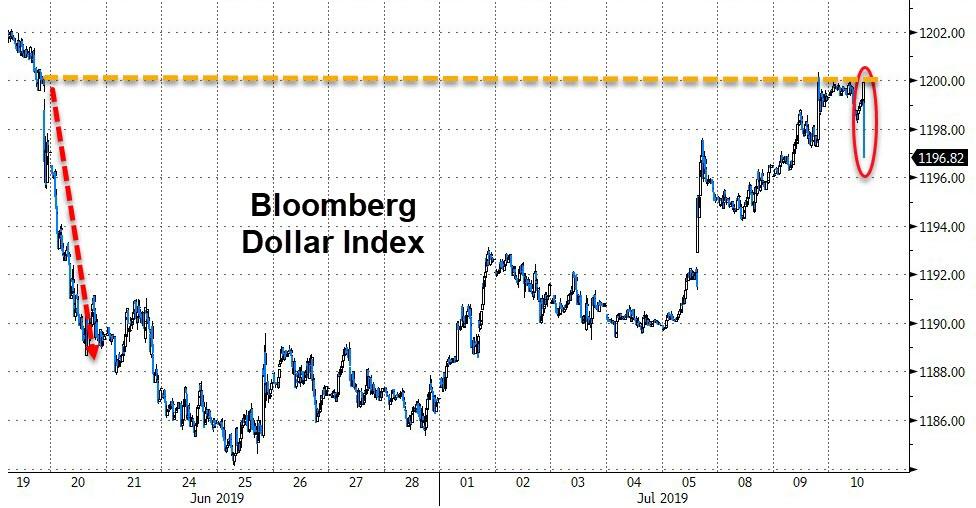

The dollar is rapidly pulling back from the pre-FOMC levels it has recovered to…

And as the dollar dives, investors are buying gold…

And bonds (also yields diving from the pre-FOMC levels)…

Powell’s remarks suggest he is comfortable with market pricing of an interest rate cut at the end of July. This was an opportunity to push back against those expectations if he wanted to, and he did just the opposite. July rate-cut odds are back at 100% (from 92.5% pre-remarks).

via ZeroHedge News https://ift.tt/2G3UCI8 Tyler Durden