Point 72 Relied On “Alternative Data” To Cash In On Two Short Bets

Point72 successfully shorted names like Weight Watchers and Dave and Busters this year based on “big data” it bought and combed through, according to Bloomberg.

Using geo-location data that was tied to anonymous credit card information, Point 72 discovered that when customers went to entertainment venue Topgolf that spending at a nearby Dave and Busters suffered. This helped Point 72 add to its conviction to short Dave and Busters in August, a position it has now covered. Dave and Busters shares fell about 5% in the first half of August, but have since recovered.

The trade exemplifies how hedge funds continue to use alternative data for Wall Street wagers. Point 72 continues to spend heavily on these types of data sets, in conjunction with quants, to improve their trading.

In January, the company took a “deep dive” into social sentiment surrounding dieting. It also looked at online search and credit card transaction data to round out a picture of Weight Watchers as a potential short. Point 72 saw declines in searching and social media at Weight Watchers, while offerings like the Keto Diet proved more popular.

As a result of its findings, Point 72 shorted the company in January. Its shares fell for the firs two months of the year, before also recovering. Point 72 has since covered the position.

Point 72 said it talks to about 1,200 ‘alternative data’ vendors a year, but only purchases data from about 30 or 40 of them. The company’s Chief Intelligence Officer, Matthew Granade, said: “There is a tremendous amount of data that has to get sorted through, and that’s huge part of challenge. The vast majority of people on our platform, our discretionary investors, are using this data. This was not true four or five years ago.”

Point 72 is up about 12.5% this year through August.

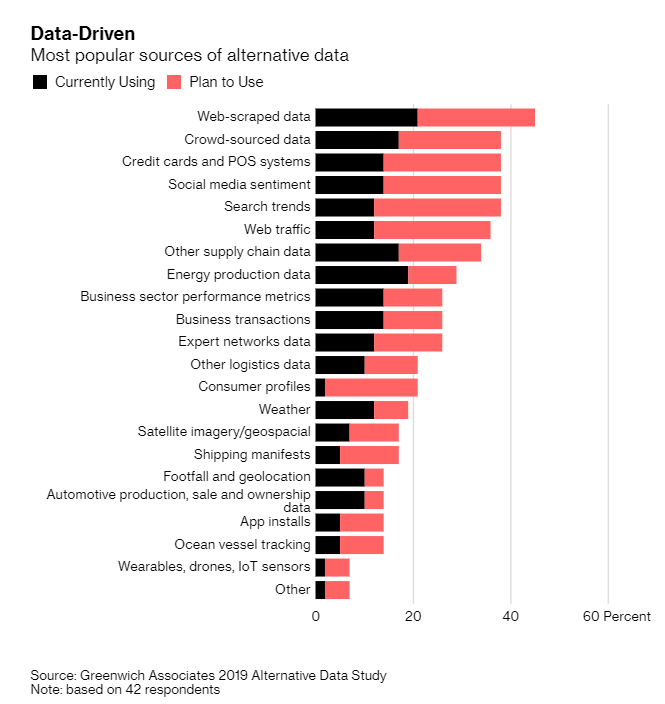

Back in July, we wrote about hedge funds mining all types of “alternative data” to try and gain trading edges. In that article, we reported that alternative data was being bought hand over fist by hedge funds like Point72 and Ken Griffith’s Citadel.

Michael Marrale, chief executive officer of M Science, said back in July:

“There is not one major hedge fund or asset manager that doesn’t have data initiatives underway or that are not using alternative data in some way.”

Tyler Durden

Mon, 09/23/2019 – 15:45

via ZeroHedge News https://ift.tt/2maA4GI Tyler Durden