Morgan Stanley’s Michael Wilson Throws In The Towel And Raises His S&P Price Target, But…

When we reported yesterday that Morgan Stanley had finally capitulated on its bearish bias, when its cross-asset strategist Andrew Sheets said that the bank was upgrading global stocks from Underweight to Neutral, we were not sure if the bank’s US equity strategist, and staunch market bear, Michael Wilson, would join the firmwide call reversing over a year of pessimism just as the S&P hit new all time highs.

Well, he did… but a close read of his report published this morning, in which he upgrades his base case target on the S&P from 2,750 to 3,000 after he too got a tap on the shoulder, suggests that every single pore of his body was oozing with disdain and disgust at being forced to reverse his bearish call, and not just because of the following Easter-egg sarcasm buried deep in the report: “history is clear that the market moves lower as well.“

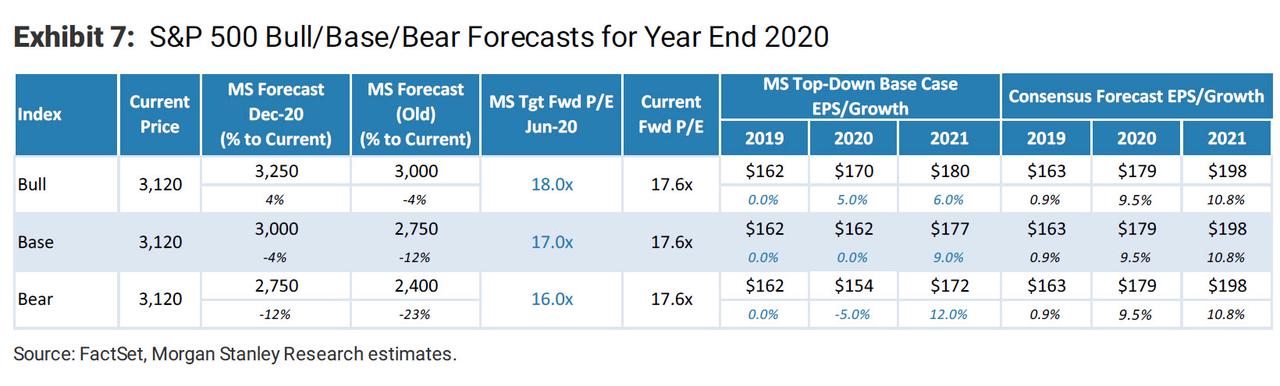

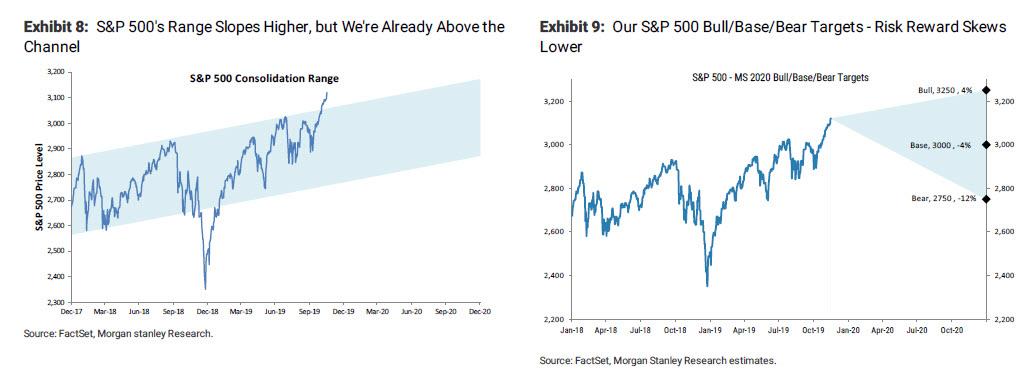

Speaking of getting the shoulder tap to reverse his bearishness, Wilson now says that at the index level he sees the S&P 500 “continuing to move within a modestly upward sloping channel and would look to trade off the highs and lows of that range.” And while Wilson has adjusted his S&P 500 bull/base/bear (3,250/3,000/2,750) targets higher by ~10% based on his “flattish earnings outlook and valuation support from lower rates”…

… and explains that there was just one catalyst for the reversal in the market, the same one that could also send the S&P even higher than 3,300 by year end, to wit:

… this year, the Fed elevated asset prices despite broadly slowing growth-something we identified well in 2018 but missed this year. As the Fed continues expanding its balance sheet by $60B/mo., the S&P 500 could overshoot the upper end of our year-end bull case of 3,250.”

However, things get tricky after Q1 when the Fed’s NOT QE is expected to shrink to nothing:

We expect that by April, the liquidity tailwind will fade and the market will focus more on fundamentals. Ironically, the outlook for the fundamentals is less certain for 2020 than for 2018/19 given more developed trade tensions, an election, and a weaker US economy.

Be that as it may, Wilson now extends his S&P 500 price target through 2020, raising his base case estimate to 3,000 from 2,750, which assumes a multiple of 17x forward 12-month earnings on our 2021 earnings forecast of $177.

Our bull and bear cases also shift higher, to 3,250 (from 3,000) and 2,750 (from 2,400), respectively (Exhibit 7). Our call for the last two years has been for a range-bound market and our changes today reflect the reality that, while the upper end of the range has held, the broader range has been in a gradually sloping upward channel (Exhibit 8). Rolling this channel forward shifts our range modestly higher, and we would look to add or reduce risk at the extreme ends of the channel over the course of the next year. Sitting above the upper end of the channel now, we think risk reward skews lower (Exhibit 9), and would prefer to be more opportunistic when adding risk at the index level.

Some more details on Wilson’s newly (upward) revised S&P price targets:

Base Case: 3,000

In our 3,000 base case, 2020 earnings growth comes in at 0% and rebounds by 9% in 2021. Forecasting earnings two years out is hard, so while we don’t necessarily believe the S&P 500 will grow earnings by the 9%, we pencil that in for 2021. We think that at year-end 2020, the market may be penciling in something like 9% growth (albeit off the lower base we feel more confident about in 2020) given that companies and analysts generally are slow to mark the next year’s number to more realistic levels. The tension between falling 2020 numbers and the look to 2021 will keep forward 12-month estimates flat over the course of the year, but the path may not be linear. We continue to believe there is potential for a material downward revision to 2020 numbers later this year or early next, which can pressure the market and open up downside risks in the short term, offset by the aforementioned Fed balance sheet expansion. Assuming a range-bound rates market and ultimately a focus on 2021, we use a multiple of 17, which is below today’s monetary policy induced levels. 17 x $177 = 3,000 base case target by year-end.

Bull Case: 3,250

In our 3,250 bull case, earnings growth falls from current consensus forecasts, but not to the 0% y/y we expect, growing about 5% y/y instead. Modest growth next year keeps the labor market capacity constrained meaning companies are likely to see continued pressure on margins as wage growth accelerates further, limiting earnings growth in 2021 to around 5%. Ultimately, the market gets to the same outlook for 2021 earnings as in our base case, but with greater optimism on the forward outlook given that earnings and the economy grow throughout 2020. Again, assuming a range-bound rates outlook, the equity risk premium falls toward 350 bps, and the S&P 500’s multiple rerates closer to 18x by year-end. As with much of this outlook, this outcome is contingent on a benign resolution to US-China trade and a US election that results in a government makeup that is unlikely to materially add to the corporate regulatory or tax burden. Our 18x multiple on $180 2021e earnings rounds to a bull case of 3,250. We see the potential for additional upside in a similar scenario but where the market also begins to discount a material infrastructure bill or legislation that lowers taxes.

Bear Case: 2,750

In our 2,750 bear case, our earnings recession turns into a modest economic one, which weighs on 2020 earnings as revenue slows more than expected and margin pressures become acute. We model an earnings growth rate of -5% for CY2020 giving us a full year number of $154. While this may seem like a rather benign earnings outcome in the event of an economic recession, but we highlight the fact that companies have already been cutting capex and opex for the past year and any recession would be accompanied by a head count reduction, which means margins would be protected and even rise. We would also expect any recession to be shallow and potentially met with fiscal stimulus, more rate cuts, and proper QE, allowing earnings to grow 12% in 2021, for a 12-month forward number of $172 at the end of next year. We envision that long end rates would see downward pressure in this scenario to new lows, while equity risk premium would increase toward 500, leading to a 16x multiple. A 16x multiple on $172 earnings rounds to 2,750.

Having gotten the S&P price target upgrade off his chest, Wilson reverts back to what he does best: providing a realistic assessment of the economy, one where the Fed’s intervention would be moot. His key expectation for 2020 – even more earnings weakness despite the US economy avoiding a recession in 2020, something Trump will make sure does not happen ahead of the November 2020 election even if it means daily unscheduled meetings with Jerome Powell:

We believe the US economy will muddle through in 2020, but expect EPS growth to disappoint. Our economists think the US will avoid a recession next year, thanks to swift action by the Fed and improving trade tensions. While that’s more optimistic than things looked just a few months ago, it does not change our forecast for little to no earnings growth, as overall growth remains slow and margin pressures persist. At this stage, we could see growth surprising to the upside or the downside, depending on a number of potential outcomes on trade and rates. After the recent rally, equity markets are now pricing a modest recovery, so upside is limited.

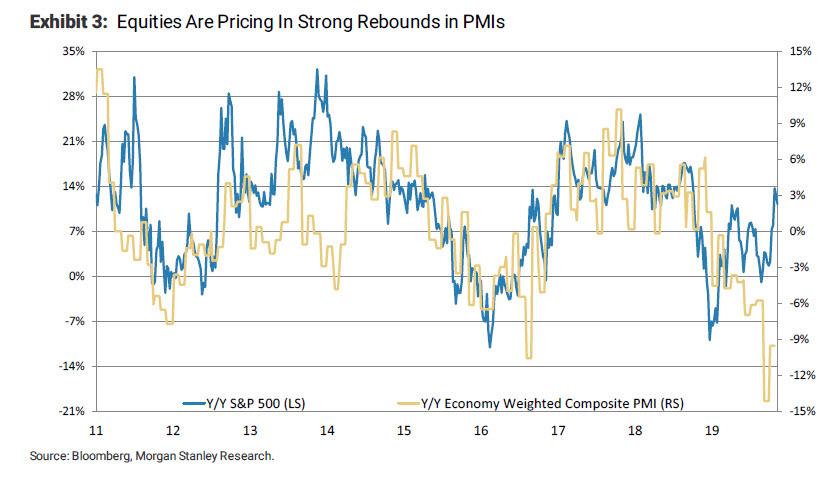

And speaking of what the market is pricing in, one can see that an economic recovery based on PMIs, one which as we noted earlier is unlikely absent a massive Chinese credit stimulus or monetary injection is unlikely, is already fully priced in by stocks as shown in the chart below.

As Wilson explains, “it appears to us that a modest rebound in economic data from monetary stimulus and a pause in trade tensions are priced in (Exhibit 3).” However, he warns next, such an assessment may be premature as “the turn in PMIs and economic data will be more elusive in the US than in international markets, which saw data weaken before the US in the latest slowdown, are arguably more levered to a relief from trade pressures, and have a more achievable earnings outlook than the US.”

Having recovered some of his bearish stride, Wilson then goes on to warn that “the base case for most investors, and indeed for our own economics team, is something of a muddle-through on growth … In this scenario, global growth and US growth improve modestly, with international economies showing more acceleration that the US. Consensus earnings for the US prove to be modestly too high, but no more so than usual, meaning forward 12-month numbers continue to rise through the year, even as 2020 numbers modestly fall.”

Meanwhile, covering his ass in case his bearish target was correct, but only off by a few months, Wilson then says doubles down on his cautious outlook, saying that weak growth year to date and low visibility around trade “creates higher uncertainty over whether this cycle is due for a mini-reset or its final act. If the base case is a muddle-through, then either of these alternate scenarios creates rotational risk.“

Wilson then lists two possible scenarios that may dominate once Fundamentals return to their rightful place of being the main drive of the market, once the Fed induced liquidity surge ends, some time around April:

- Rotation Scenario 1: Pro-Cyclical Rotation. In this scenario, trade tensions reach a positive resolution with possible rollbacks, growth improves faster than our economics team and we expect, and rates begin to back up more sharply. A better growth environment favors the underperformers of the last 18 months and Cyclicals/Lower Quality/Value all begin to lead the market, while richly valued Defensives and Growth lag behind. This scenario, which would be closest to our bull case, still sees capped upside on the market as a whole as cost pressures rise in tandem with top line growth and higher rates offset lower equity risk premiums. The relative performance of Cyclicals over Growth continues to weaken the momentum factor, negatively impacts many portfolios.

- Rotation Scenario 2: Growth Scare. Whether due to trade escalation or margin pressures, growth disappoints, earnings cuts come faster and deeper than the market expects, the labor market begins to feel more pressure, rates fall, businesses defer/cancel more spending, and recession fears reignite. The market heads lower at the index level, but led lower by the growthier parts of the market not priced for any slowdown.

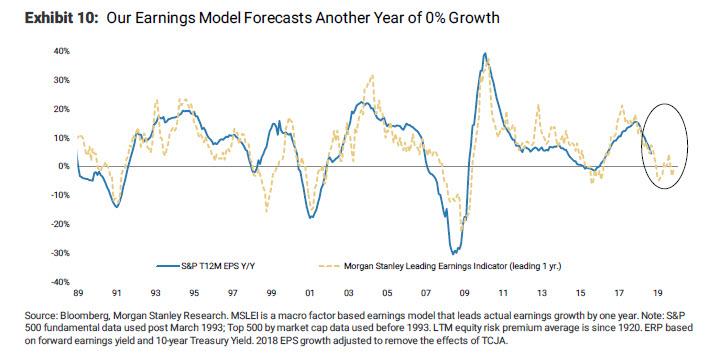

Having hinted at his earnings skepticism earlier, Wilson repeats that he remains bearish on the outlook for earnings relative to consensus as his model is indicating that earnings are likely to be flat to down next year (Exhibit 10), with the now evident margin pressures that have suppressed earnings growth this year set to continue.

Looking to the baseline forecast from the bank’s economics team of GDP growth that stabilizes below trend while labor costs accelerate, Wilson “struggles” to see material earnings upside. Similar to this year, he expects forward 12-month earnings

numbers to remain roughly flat form current levels ($177) as 2020 estimates that fall through the year, offset the natural upward drift of rolling 2021 estimates into forecasts.

So putting it all together, Wilson concludes that absent a recession – which his economist colleagues at MS no longer expect in 2020 – roughly stable interest rates and the relative safety of the S&P 500 among equity indices help keep the multiple near current levels, and “with stable earnings, this means the market ends the year near current levels.”

Then, looking at the appropriate multiple range, the MS strategist says that he views valuation through the lens of rates and the equity risk premium (ERP). On that basis, a forward Price/Earnings (PE) multiple of 17x (modestly below current) looks achievable. And since he vieww 17x as near the top end of a fair value range, he is not looking for multiple expansion but assumes that with the Fed on hold (and no longer excessively expanding the balance sheet), the US election, and US-China trade resolutions potentially resolved next year, and 2 years of easier comparisons for earnings growth, the market may not see material derating in the multiple either over the next 12 months either.

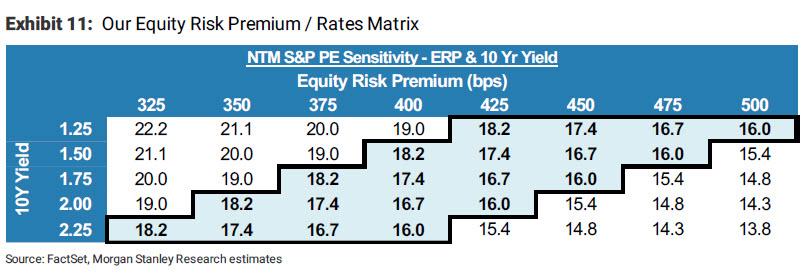

Then there is the question of what rising (or falling) rates on the 10Y TSY will do to stocks. Answering this question which gained prominence after JPMorgan’s Kolanovic last week said that even a 150bps increase in rates would not affect stocks, Wilson shows the following chart which illustrates a 10Y vs. ERP matrix, showing how corresponding pairs would affect the equity market PE. Wilson’s range has a diagonal tilt — as lower yields will likely be accompanied by higher uncertainty on growth and volatility leading to a higher ERP, while higher yields may reflect a more optimistic outlook on growth, allowing for ERP compression. While Wilson does not expect the Equity Risk Premium to ever rise above 5%, he sees 325 bps as a reasonable floor as much lower than this level would approximate levels seen in 2018 when visibility on the extension of the cycle and growth was notably higher and margins were still rising. With an ERP of roughly 380 bps and a 10Y Treasury yield of ~1.85% the S&P 500 multiple is now near the top end of his target range. It is also worth noting that Morgan Stanley does not see a credible scenario where the 10Y rises notably above 2.25%, some 125bps below the ceiling laid out by Kolanovic.

Last but not least, we focus on what may be the real message in Wilson’s note, which as hinted above appears to have been written under “tap-on-the-shoulder” duress, and meant to goalseek a higher S&P price target. Fine, that’s done, but something surprising emerges on page 27 of the report – when discussing that key driver of the US economy, the US consumer, which accounts for 70% of US GDP growth, Wilson has once again turned quite pessimistic.

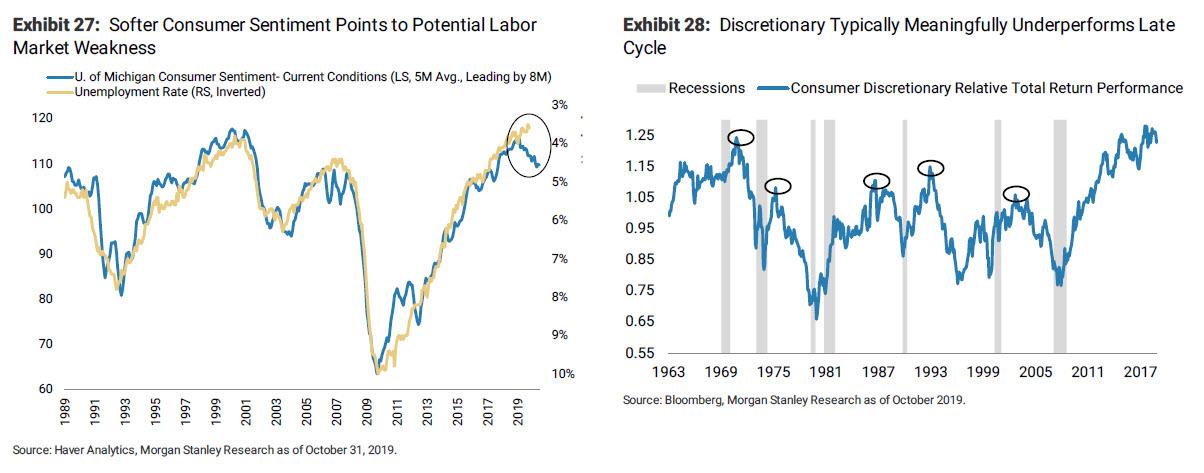

While he tries to avoid a compliance flag, noting that “the macro backdrop for the US consumer continues to remain healthy” and adding that the unemployment rate remains near historic lows, the personal savings rate (which was thoroughly and laughably revised twice in the past two years from 3% to roughly 8%) is elevated and wage growth remains solid, he then admits that he is “seeing some early signs of weakness” – companies are cutting employee hours worked and consumer sentiment has fallen off its highs. Further, relative earnings revisions breadth has begun to decline precipitously and relative performance has followed — Wilson then says that he believes this continues, sparking concerns not only about the consumer discretionary sector but the broader economy which is reliant on steady consumer optimism, not to mention spending.

Below is his full discussion of why the US consumer may soon be tapping out:

- Consumer is healthy, but cracks are starting to form: Early indications that consumer spending will slow are emerging — companies are cutting hours worked and consumer confidence has come off its highs (Exhibit 27). Still, there’s no evidence that the type of consumer slowdown typical of even a mild recession is imminent. That being said, Consumer Discretionary is typically an early cycle outperformer (Exhibit 28) and tends to price in a consumer slowdown well in advance. Thus, we see downside for the cohort ahead as we believe we are in a late cycle environment.

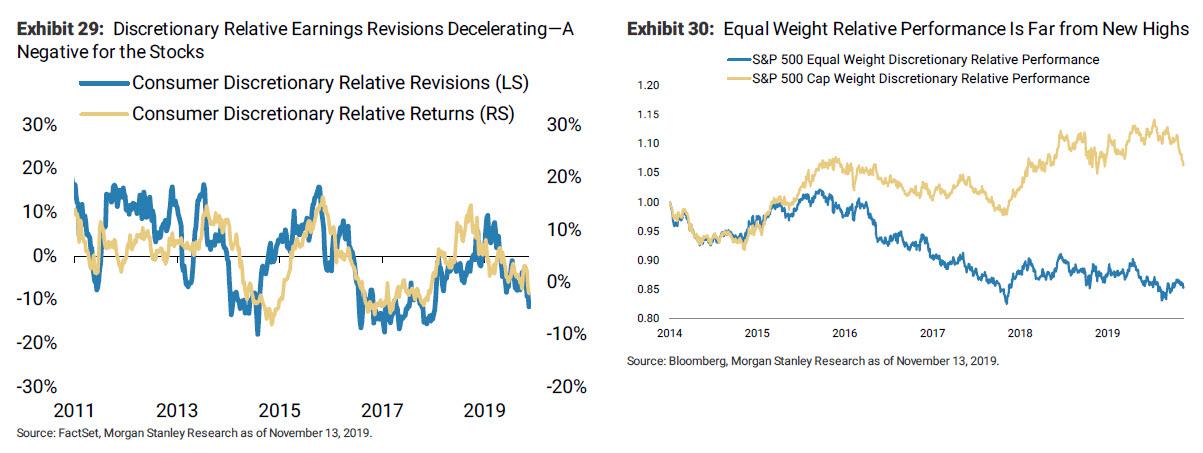

- Relative earnings revisions are decelerating: As Exhibit 29 shows, relative earnings revisions breadth for the Discretionary sector has been decelerating since January of 2019 — a negative for the stocks. At a sub industry level, this has been driven by Consumer Services (restaurants, hotels), Media, and Retailing. Consumer Services have seen a particularly steep decline. From a valuation standpoint, the sector is trading in the 55th percentile of relative price/sales levels over the last 10 years — slightly above median, but not as demanding as last year. Given the deterioration in relative revisions, that may be expensive.

- Performance breadth in Discretionary is poor: Exhibit 30 illustrates that performance breadth within the Discretionary sector has been poor since 2015. Specifically it shows relative performance of the sector on both a cap weighted and an equal weighted basis. There is a large gap between cap weighted and equal weighted performance. This is largely attributed to the massive outperformance of Internet Retail this cycle — this group has outperformed the S&P 500 by 2200% since 2009 driven in large part by secular tailwinds around e-commerce. We are constructive long term on these tailwinds, but still believe this group is exposed to cyclical headwinds. Interestingly, the correlation between Internet Retail’s relative performance and real personal spending growth has surged in recent years. As online retail has grown into a larger piece of overall retail spend, the group has become more exposed to changes in overall consumer activity, i.e., it can’t outgrow the sector anymore because it IS the sector. Its performance should, thus, be sensitive to a moderation in consumer spending and related earnings cuts/multiple compression when that plays out closer to a recession.

- Trade Tensions may be boosting demand in the channel: The push back of tariffs from September to December included many items consumers buy during the holidays. This may have led to some pre-stocking of inventories to beat those tariffs in December and perhaps even a little extra to carry into next year. This could lead to some excess inventory in 1Q which will further weigh on margins in 2020.

The bottom line is that while Michael Wilson tried to hold the line for as long as he could, perhaps buoyed by his immaculate 2018 call where the S&P closed just points away from his year-end target, in the end the Fed won (to see what happens when one refuses to yield to the Fed and keeps doubling down in a crusade against the money printer, see the earlier example of Horseman Global). Yet even when admitting he was wrong on where the S&P would end this year, a delta that was largely the result of the Fed’s sudden and unexpected decision to respond to the repo market turmoil in September with QE (something we predicted would happen in at the start of September), Wilson remains defiant, and instead of paraphrasing what he thinks will happen, we give him the final word to summarize what happens next:

When the Fed goes on hold, fundamentals will set the tone. Trade, the election, and a late cycle economy mean uncertainty is high & new leadership. We expect disappointing EPS & prefer value with a defensive bias & large caps. Growth is risky given rotations & crowding.

While we agree with all of the above, we are skeptical about one thing: it is a very bold assumption that the Fed will ever again go on hold. If Powell had to resort to QE4, expanding the Fed’s balance sheet by $285 billion in 6 weeks, faster than it did during QE1, QE2 or QE3 when the S&P was at all time highs, we dread to think what the Fed will do if and when there is another 20% correction. Assuming, of course, such a correction can happen ever again in a world in which the level of the stock market is the only thing that matters – from consumer confidence and spending, to collateral values on trillions in repoed securities, all the way to the president’s re-election chances.

Tyler Durden

Mon, 11/18/2019 – 15:45

via ZeroHedge News https://ift.tt/2OmpfMh Tyler Durden