Stocks & Bonds Bid, Dollar Skids As Powell-Pontification Trumps Trade-Pessimism

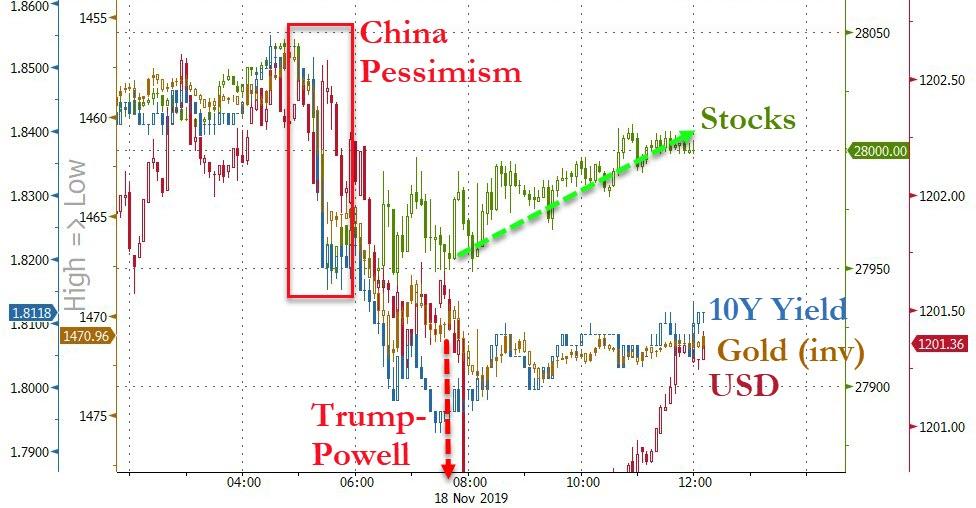

Chinese officials are reportedly “pessimistic” about a trade deal (the same trade deal that has enabled endless equity ramps on the back of spurious headlines proclaiming progress), but US equities refuse to go down (S&P down only twice in November) as speculation on what was discussed between Trump and Powell today levitated stocks (despite the dollar and bond yields sliding)…

Source: Bloomberg

Simply put America – all is well, so keep spending!!

Chinese markets were higher overnight, thanks to a late morning buying spree (NOTE, China closed before the “pessimism” comments)…

Source: Bloomberg

Europe was mostly lower with only UK’s FTSE holding gains (as cable continued to rally)…

Source: Bloomberg

US Stocks were mixed today, ending around unchanged but bid off early lows on Trump-Powell headlines (Small Caps ended red but record highs for S&P, Dow, and Nasdaq)…

Futures show the chaos overnight…

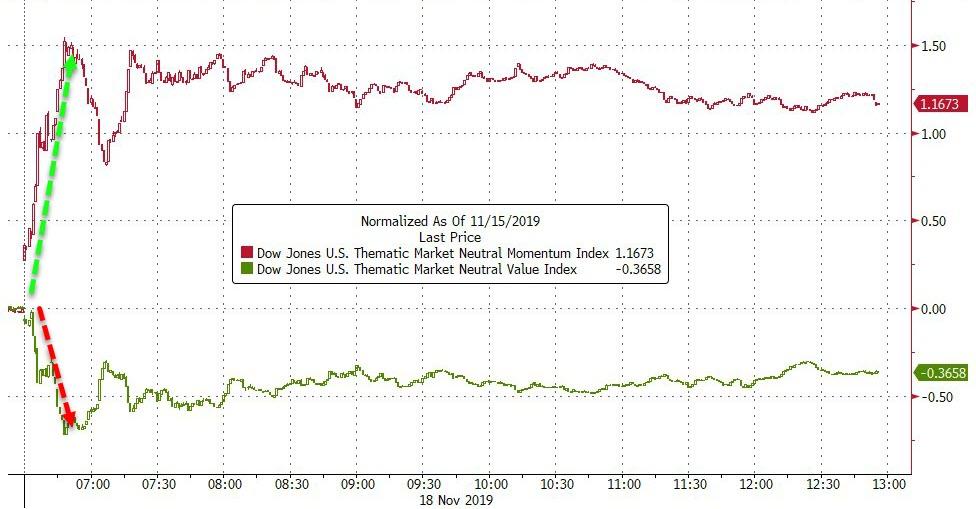

Momentum surged at the open but did nothing after that…

Source: Bloomberg

Shorts were dramatically squeezed after Trump-Powell headlines…

Source: Bloomberg

VIX briefly topped 13 but was quickly hammered back to a 12 handle…

Source: Bloomberg

Treasury yields plunged on the trade-deal pessimism comments, but as the US session continued, yields drifted higher again…

Source: Bloomberg

10Y briefly tested below 1.80%…

Source: Bloomberg

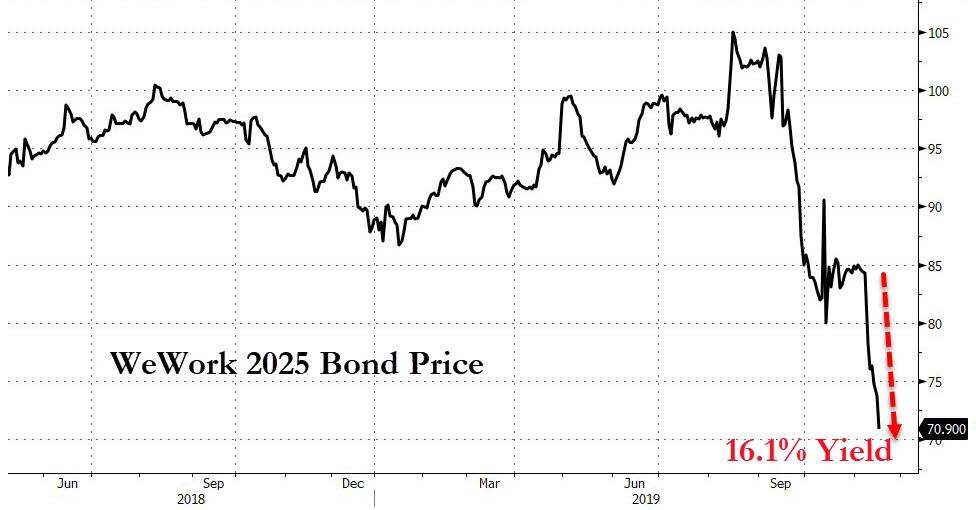

Meanwhile, WeWork bonds are collapsing, now yielding over 16%…

Source: Bloomberg

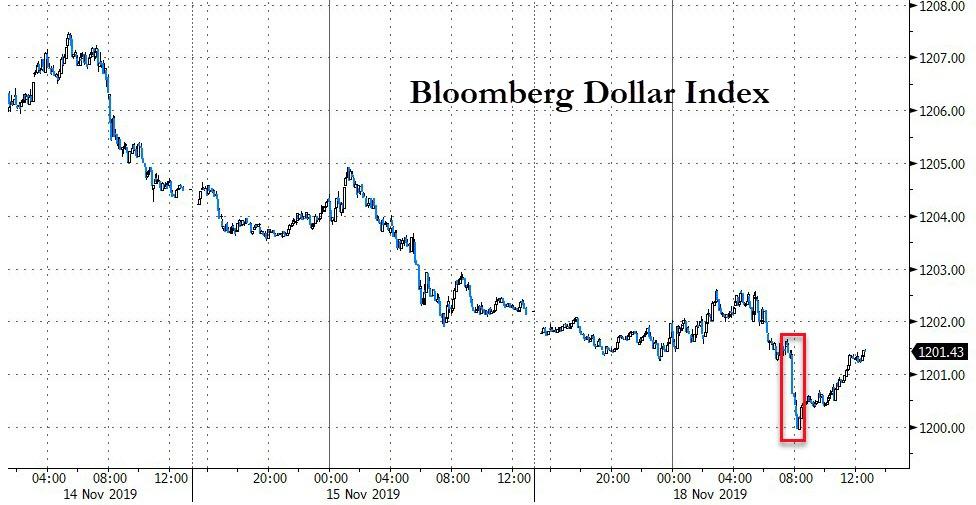

The Dollar fell for the 3rd day in a row, tumbling on reports that Trump and Powell discussed the dollar and NIRP…

Source: Bloomberg

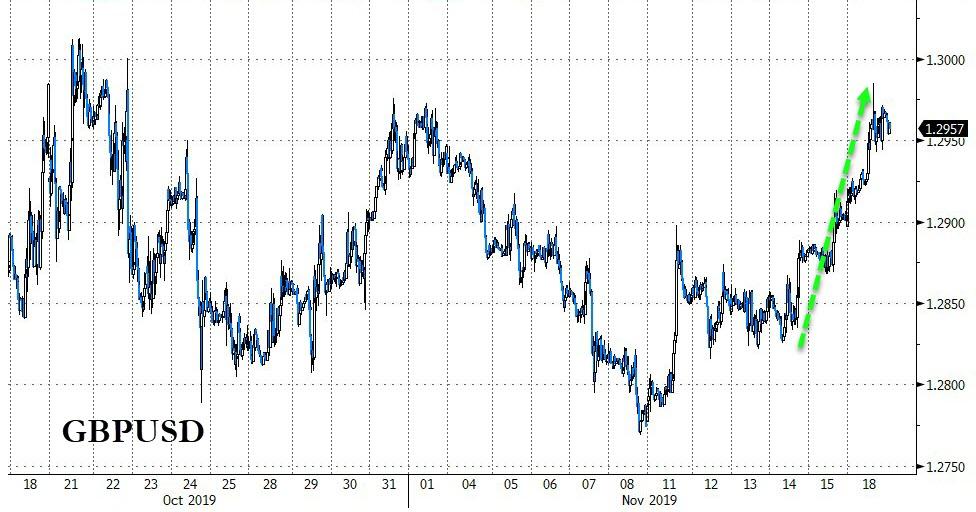

Cable pushed higher again today, back towards the key 1.30 level…

Source: Bloomberg

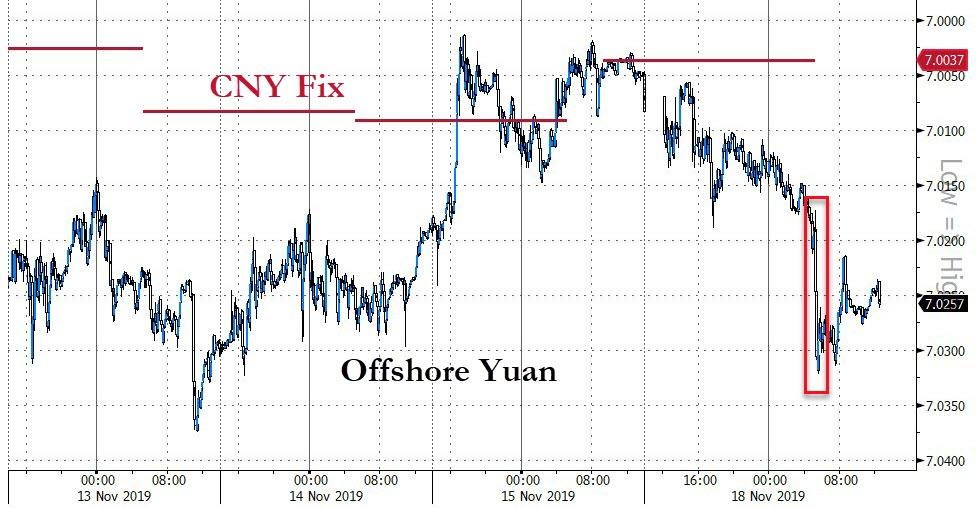

Yuan tumbled today on the trade-deal pessimism headlines…

Source: Bloomberg

Cryptos plunged suddenly this morning after a relatively stable weekend…

Source: Bloomberg

Precious metals gained on the day as trade deal hopes ebbed and copper and crude mirrored those gains for the same reasons…

Source: Bloomberg

Silver pushed back up to $17…

And WTI dropped from the upper rail of its recent range (once again)…

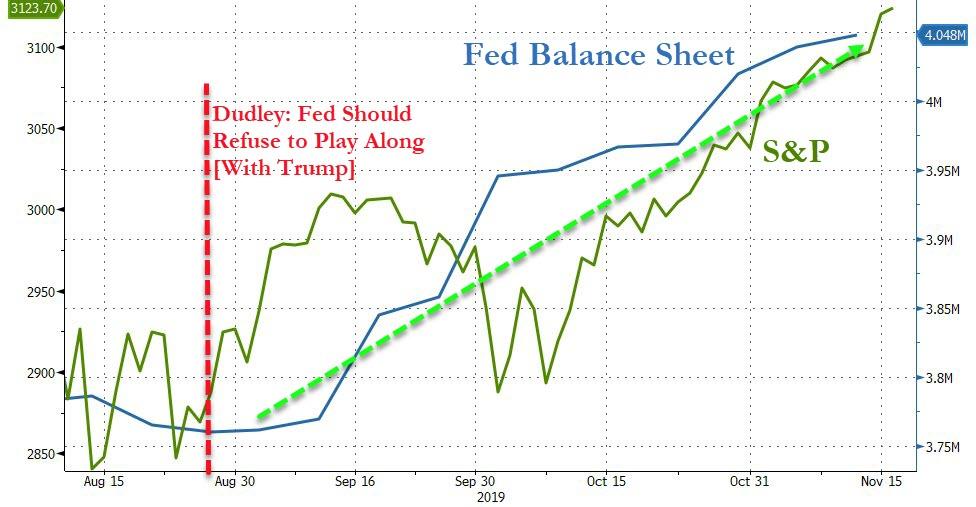

And, finally, Bill Dudley said (on August 27th) that The Fed can kill Trump’s reelection chances by tanking the market. So is The Fed now assuring Trump gets reelected?

Source: Bloomberg

Tyler Durden

Mon, 11/18/2019 – 16:01

via ZeroHedge News https://ift.tt/2O0MtIN Tyler Durden