Boeing Suppliers Slide As 737 Max Production Halted

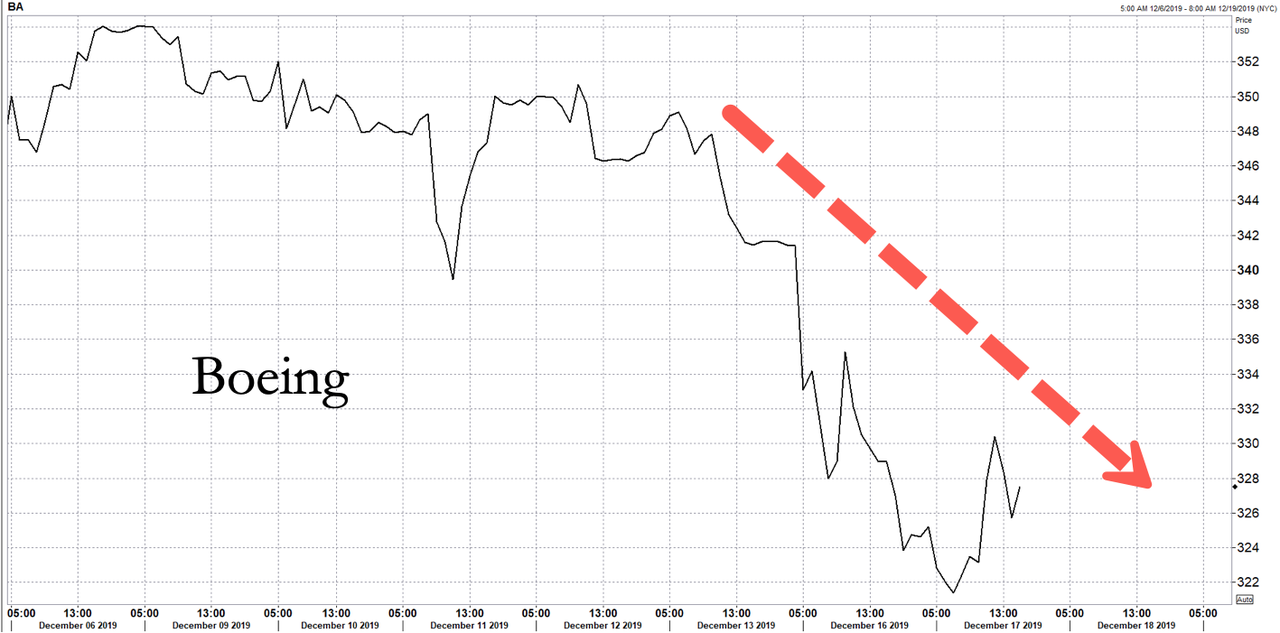

Shares in Boeing slid this week after the company announced on Monday afternoon that it would suspend production of its best selling plane, the 737 Max. The production halt has rippled down the supply chain, sent shares of some suppliers tumbling on Tuesday.

Analysts told Reuters this is one of the biggest assembly-line halts in several decades, could continue to cost Boeing $1 billion per month despite the production freeze.

“Each supplier will likely be missing about 200 deliveries versus original plans, with about 80% of the shortfall coming in 2020 and the remainder in 2021,” Melius Research analyst Carter Copeland wrote in a note.

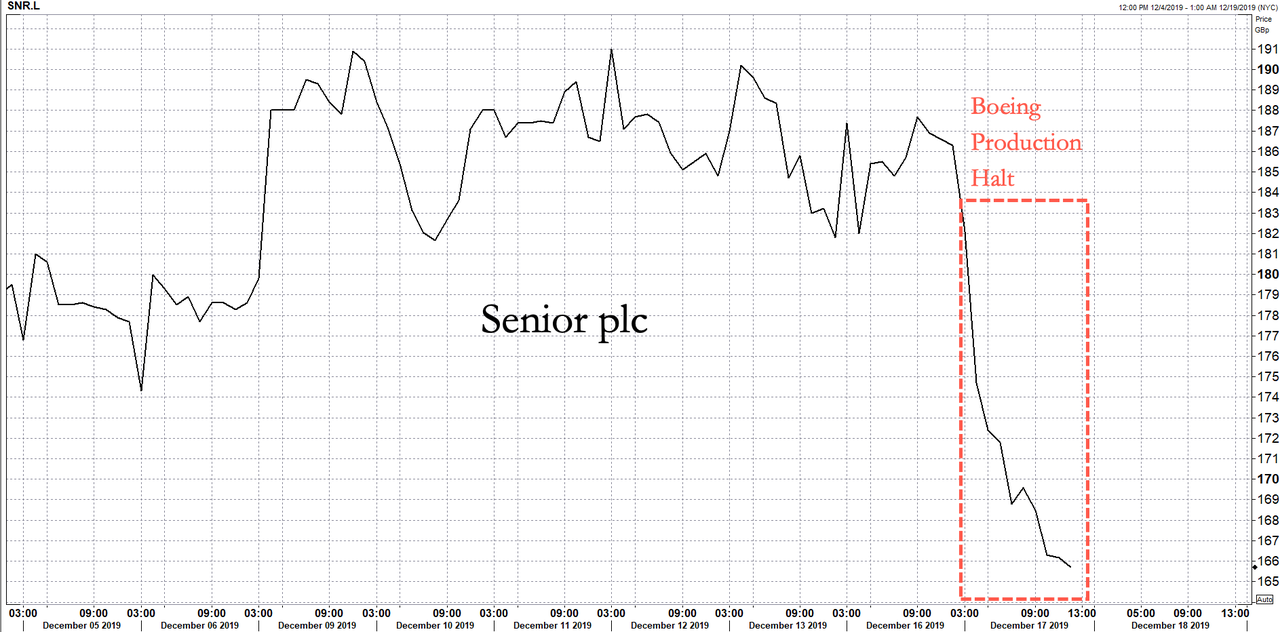

British engineering firm Senior Plc, whose biggest client is Boeing, saw shares plunge 11% on the production news.

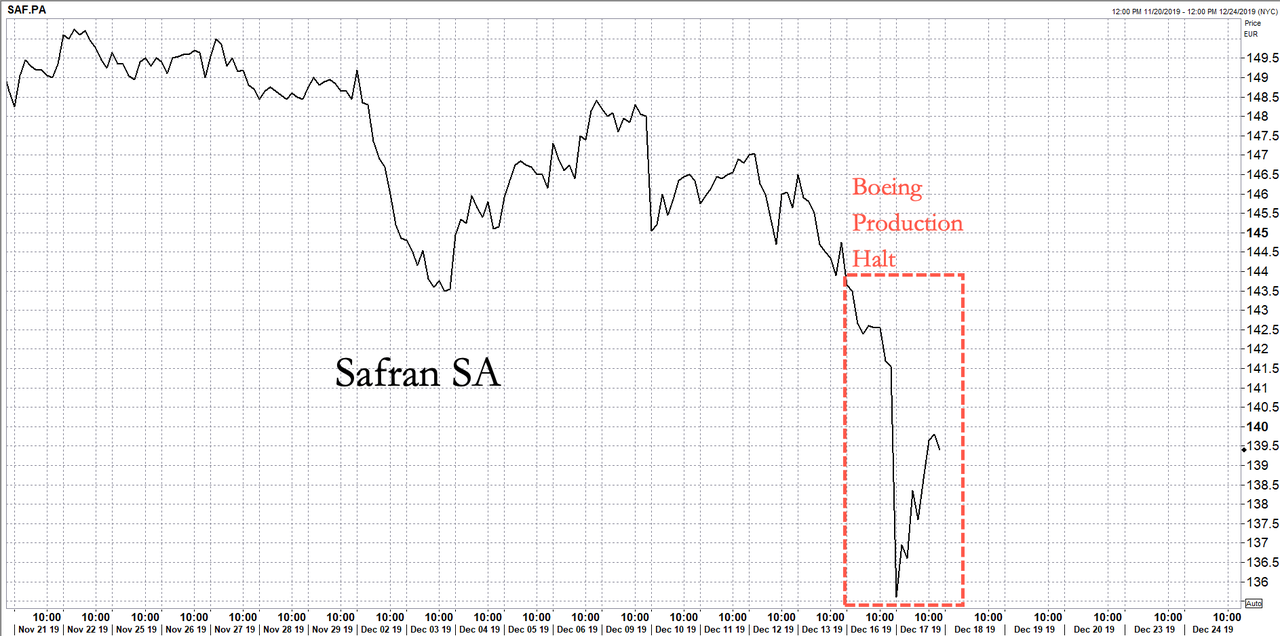

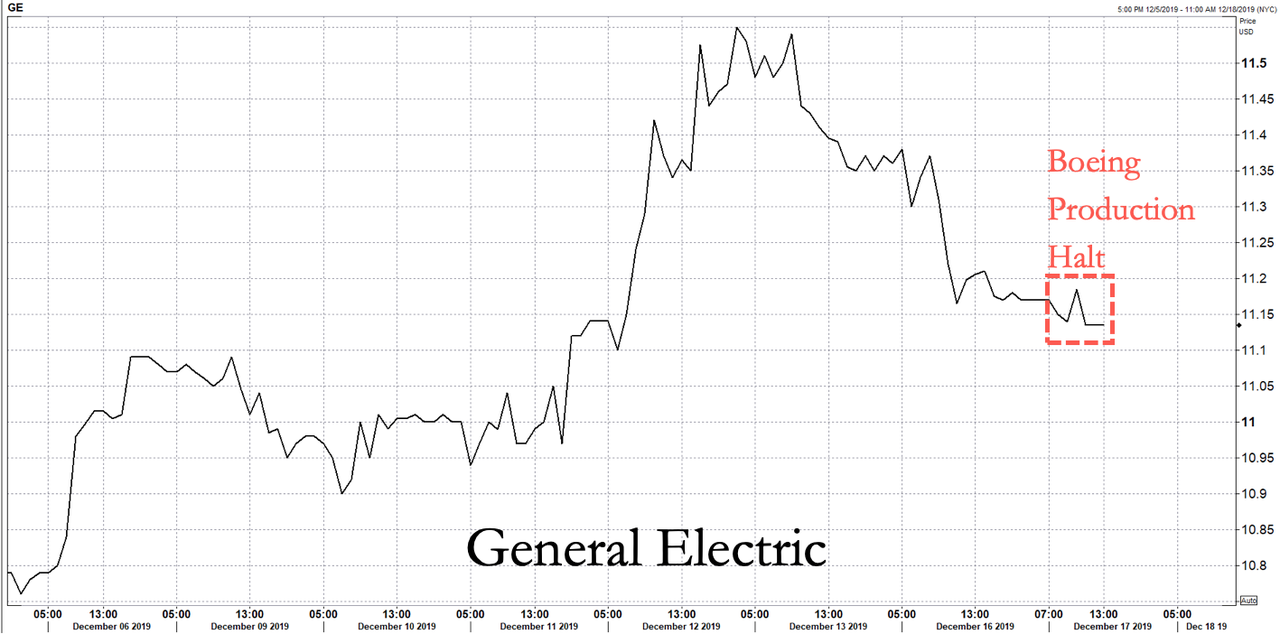

Shares in France’s Safran SA dipped 1.50%, while General Electric was flat, both companies are in a joint venture to produce engines for the 737 Max.

Copeland said U.S.-based Spirit, which manufactures the 737 Max’s fuselage, is one of the most exposed suppliers, deriving at least half of its sales from Boeing.

“We assume (Spirit) will elect to stop production and furlough employees at the cost of $0.40 (per share) per month of the stoppage,” Copeland said.

Safran warned that if 737 Max groundings lasted through 2020, its cash conversion rate could fall below its targeted 50 to 55% range of recurring operating income.

General Electric warned that extended groundings of the plane would reduce cash flow by $1.4 billion next year.

Canaccord Genuity analyst Ken Herbert said, “some step-down in production across the supply chain” will be seen as Boeing absorbs a lot of the financial impact to keep the chain together through the halt.

Other suppliers who’ve seen these shares fall on Tuesday include United Technologies Corp -.77%, Arconic Inc -1%, Ducommun Inc -1.50%, Hexcel Corp -3%, Astronics Corp -1.3%, Melrose Industries -1.1%, and Meggitt -1.5%.

Boeing employs more than 12,000 workers at its 737 assembly factory in Renton, Washington. There is no word on any layoffs as of yet.

Firms that have 10 to 20% of their annual sales exposed to 737 Max production could enact cost-cutting measures in 1Q20 — this would likely be in the form of furloughs.

As for the broader economy, the impact of the halt could be seen as a temporary headwind for GDP in the coming quarters.

Bloomberg Economics researcher Andrew Husby indicated that the 1Q20 impact of the halt could shave off one percentage point from 1Q20 GDP.

JPMorgan Chase & Co. chief U.S. economist Michael Feroli said Tuesday that the halt could subtract around .5 percentage point from 1Q20 GDP.

With manufacturing already in a recession, could the Boeing halt be a shock that ripples through the economy?

Tyler Durden

Tue, 12/17/2019 – 15:55

via ZeroHedge News https://ift.tt/2rV4YWI Tyler Durden