Used Heavy Duty Truck Prices Collapse As Much As 50% As Ugly Outlook To Continue

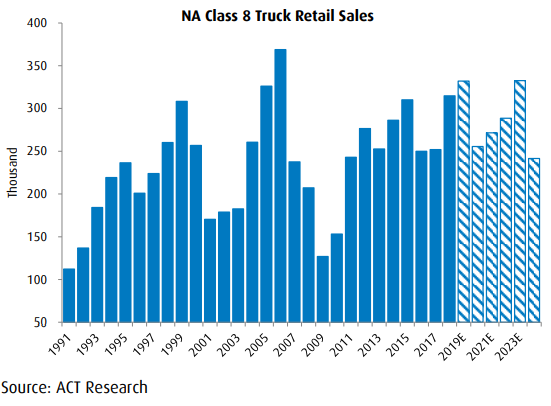

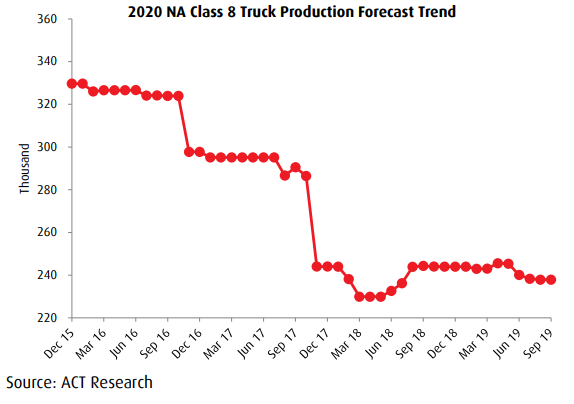

It isn’t just the automobile industry that, globally, has been mired in recession. We have also noted the stunning collapse in heavy duty trucking orders over the last 18 months, as the industry continues to deal the consequences of aggressive over-ordering in 2018 and a domestic economy that simply isn’t supporting growth Class 8 trucks like it once did. For instance, we reported just two weeks ago that trucking company Navistar had cut more than 1,300 jobs.

And after several months of “analysts” suggesting that trends could be improving and that the worst may be over, the reality for heavy duty trucking seems to remain that the industry is still grinding slower. Wells Fargo analyst Andrew Casey released a note on Thursday morning suggesting that truck demand conditions “remain weak” and that pricing is “deteriorating for used trucks”.

Casey believes that “most truckers [will] continue to avoid investing in new vehicles due to ‘transport overcapacity vs. relatively low freight demand’ and pressure on trade-in values”.

He also noted that Class 8 orders for December, which should be released over the next several business days, would come in around 17,500-20,500 vs November’s 17,512.

But don’t let the numbers fool you. “While this may be an optical positive, conditions behind that order number appear to be deteriorating,” Casey says in his note.

Meanwhile, dealers are reporting a collapse in used truck prices, which are down 20% to 50% y/y. Casey says this could lead to “discount programs and further pressure on manufacturer earnings”.

Steve Tam, Vice President at ACT Research commented in late December: “Dealers are reporting used truck sales are lagging, inventory is building, prices are falling, and the used truck market remains a buyer’s market.”

He continued: “While all of this is not welcome news for finance companies, truckers trading trucks, truck OEMs or dealers, it is good news for people who are buying trucks. Customers are finding that there are bargains available for all makes and models of used trucks, and there are some fantastic buys.”

November’s numbers were also sluggish. Class 8 same dealer sales volumes fell 35% month-to-month, according to the latest release of the State of the Industry: U.S. Classes 3-8 Used Trucks, published by ACT Research.

The American Trucking Associations (ATA) seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 3.5% in November after falling 0.7% in October.

ATA Chief Economist Bob Costello had said: “It’s tough to sugar coat November’s reading. It was the third decrease in the last four months and the index is down 7.2% since July. Additionally, November was the first month to see a year-over-year drop in the index since April 2017. While disappointing, it fits with the expected soft gross domestic product reading expected in the fourth quarter and reports of a soft fall freight season.”

Don Ake, FTR vice president of commercial vehicles commented last month: “The stalling of freight growth is causing fleets to exercise caution in placing orders for 2020. There will still be plenty of freight to haul, so we expect fleets will continue to be profitable and to replace older equipment. However, there won’t be a need for much additional equipment on the roads.”

“The industry thrives on stability, but we are now on a rocky road,” Ake concluded.

Tyler Durden

Thu, 01/02/2020 – 14:11

via ZeroHedge News https://ift.tt/39yutOJ Tyler Durden