After Worst Quarter Ever, WTI Extends Losses On Massive Crude & Gasoline Build

After its worst quarter ever, as COVID-19 lockdowns crushed demand, raising fears about overflowing storage tanks amid a price war that has flooded the market with extra supply, all eyes are glued to new inventory data as Standard Chartered analysts, including Emily Ashford warned in a report, oil tanks around the world could fill in six weeks, a move that will likely force significant production shut-downs,

“Huge inventory builds, potentially exhausting spare storage capacity, will mean that market balance requires an unprecedented output shutdown by producers,” they wrote.

So, eyes down…

“There is the very real possibility that this week’s storage reports could be the energy patch version of last Thursday’s Weekly Jobless Claims,” Robert Yawger, Mizuho Securities USA’s director of energy said in a note.

“I would expect the numbers to be supersized and challenge multi-year highs/lows on multiple data points. Of course, I have been expecting big numbers for the past couple week, but the fireworks have not happened. That leads me to believe that the data explosion will likely happen this week … Exports will likely be down big, and refinery utilization will likely pull back dramatically. That will leave a lot of crude oil on the sidelines … EIA crude oil storage has been higher for nine weeks in a row. Storage will likely double up and increase at the rate of around 10 million for another nine weeks…at least.”

API

-

Crude +10.485mm (+4.6mm exp) – biggest build since Feb 2017

-

Cushing +2.926mm – biggest build since Feb 2019

-

Gasoline +6.058mm (+3.6mm exp) – biggest build since Jan 2020

-

Distillates -4.458mm (-600k exp)

While analysts expected the trend of crude builds to continues they unexpectedly saw a gasoline inventory build last week – bucking the 8-week trend of draws… and it with a huge crude and gasoline build last week

Source: Bloomberg

WTI was trading just above $20.20 ahead of the API data and extended losses after…

Goldman Sachs’s Jeff Currie said on Bloomberg TV that even Russia is “extremely vulnerable” to oil storage and infrastructure limits because its fields require thousands of miles of pipelines to get to buyers.

“The prices of the physical barrels are showing a lot more distress than the paper benchmarks,” said Roger Diwan, oil analyst at IHS Markit Ltd.

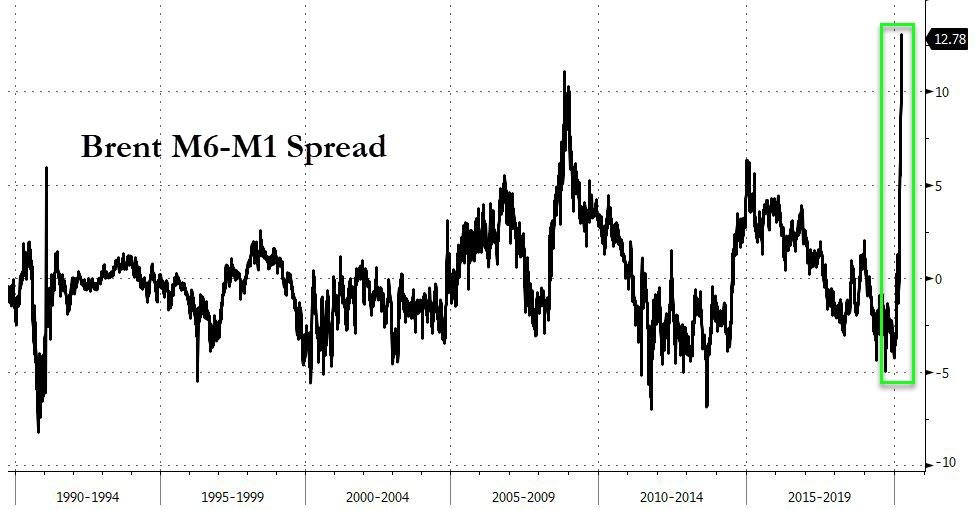

Finally, we note that Brent futures are signaling a historic glut is emerging.

The May contract traded at a discount of $13.66 a barrel to November, a more bearish super-contango than the market saw even in the depths of the 2008-09 global financial crisis.

Tyler Durden

Tue, 03/31/2020 – 16:35

via ZeroHedge News https://ift.tt/3bGRH5r Tyler Durden